Is Timeshare Foreclosure Considered Mortgage Foreclosure?

It’s important to understand that timeshare foreclosure is different from mortgage foreclosure. Agencies like HUD, VA, USDA, Fannie Mae, and Freddie Mac do not classify them similarly. This causes confusion for many people, including homebuyers, sellers, realtors, loan officers, and underwriters. At Gustan Cho Associates, we often get questions about this topic and are here to help clarify any concerns.

This blog will discuss whether timeshare foreclosure is considered mortgage foreclosure. Timeshares were once very popular in the United States. A timeshare allows investors to share property ownership in a resort area. Each investor has a specific time each year to use the property exclusively with their family.

What Are Timeshares?

Timeshares are similar to traditional homeownership, and owning a timeshare comes with financial responsibilities. Owners must pay their share of the costs of maintaining the property. These costs include association dues, homeowners’ insurance, and maintenance fees, all necessary for the timeshare’s upkeep.

Timeshare owners must meet these financial obligations to keep the property running smoothly. Failing to make these payments can result in foreclosure, similar to what happens with a conventional mortgage. Not paying dues and maintenance fees can start timeshare foreclosure proceedings. This shows the importance of fulfilling financial responsibilities to avoid serious legal issues in timeshare ownership.

Confused About Timeshare Foreclosure vs. Mortgage Foreclosure?

Contact us today to understand the differences and how it affects your homeownership options.

Can a Timeshare Go Into Foreclosure?

Borrowers often wonder about the waiting period required for home mortgage eligibility following a timeshare foreclosure. Even though timeshares are not officially recognized as real estate mortgages by entities like HUD, VA, USDA, Fannie Mae, and Freddie Mac, borrowers are puzzled by the foreclosure potential of timeshares, given their classification as installment loans. It raises questions about why timeshares, considered installment loans, can be subject to foreclosure.

It’s crucial to note that a timeshare foreclosure differs significantly from a house foreclosure since timeshares are not categorized as real estate. In essence, defaulting on a timeshare unit is akin to defaulting on other installment loans, such as those associated with automobiles or appliances.

Why Do So Many Underwriters Deny Home Loans Due To Timeshare Foreclosure Considered Mortgage Foreclosure

Many underwriters have trouble with home loan applications because they mistakenly think that timeshare foreclosure is the same as mortgage foreclosure. Like regular homes, owners can lose their timeshares if they don’t pay their mortgage. When an owner fails to pay their monthly fees, the timeshare lender or management company starts foreclosure.

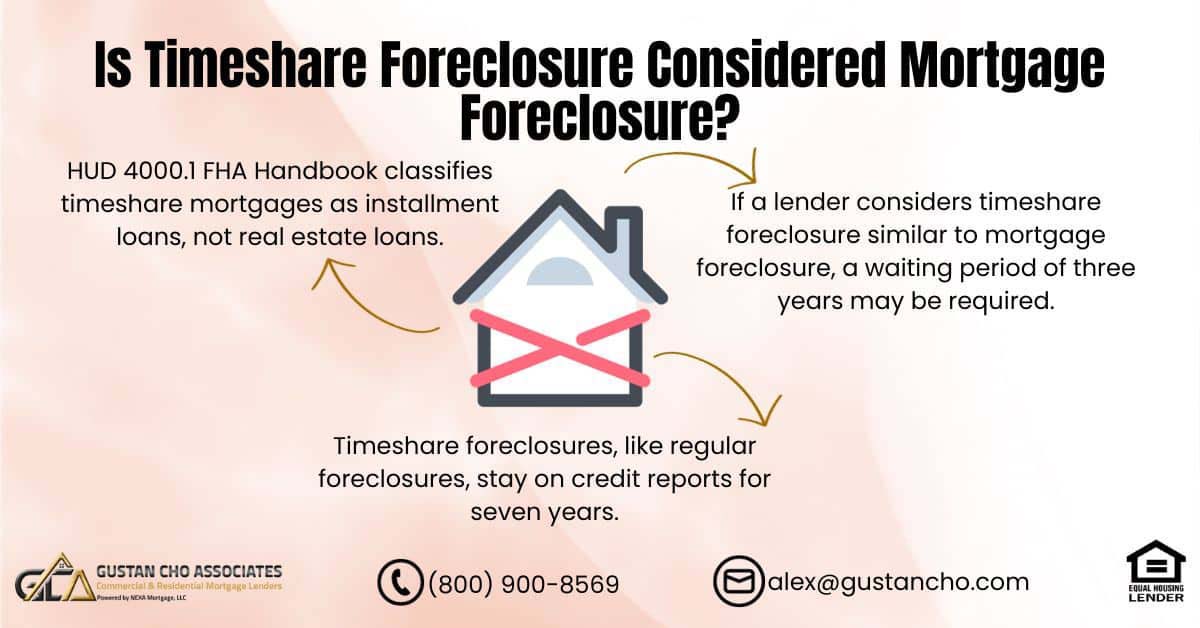

The US Department of Housing and Urban Development FHA Handbook states that timeshare mortgages are installment loans, not real estate loans. Despite this, many underwriters wrongly assume that timeshare foreclosure is the same as mortgage foreclosure.

To avoid this mistake, mortgage underwriters should thoroughly review agency mortgage guidelines before denying a loan to a qualified homebuyer. This careful approach ensures a better understanding of timeshare issues. It helps prevent wrongful denials based on misunderstandings of timeshare foreclosures.

Getting Mortgage Denial By Underwriters Due To Timeshare Foreclosure Considered Mortgage Foreclosure

Timeshare owners are responsible for paying their mortgage if they have one. Although a timeshare is often seen as a second home, its cost is usually lower because owners only have rights to the property for a few weeks each year. If timeshare owners fail to pay their financial dues, the management company can start foreclosure proceedings.

Owners with a mortgage must keep up with their payments. Even though timeshares are considered secondary homes, they remain affordable because ownership includes specific usage rights. If owners do not meet their costs and fees, the management company can also begin foreclosure actions related to the timeshare.

Is There a Waiting Period After Timeshare Foreclosure?

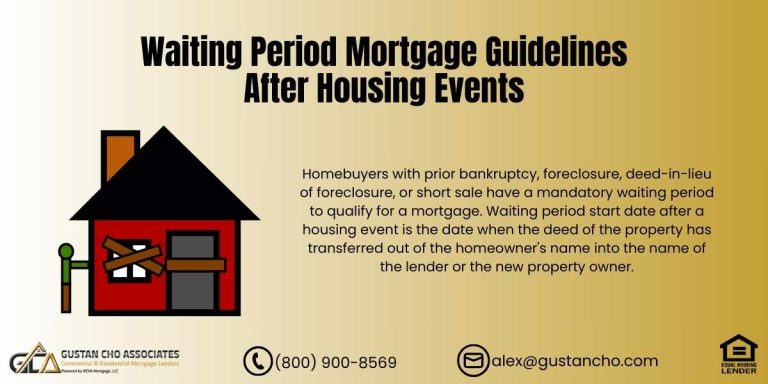

It’s important to understand their similarities and differences when comparing timeshare foreclosures to mortgage foreclosures. Like traditional home foreclosures, timeshare foreclosures are recorded on your credit report, adversely affecting your credit score. This impact persists for seven years, just like other types of foreclosure.

However, despite the timeshare foreclosures being labeled as mortgage foreclosures on credit reports, not all mortgage lenders view them the same way. In recent years, particularly after the 2008 real estate and banking crisis, many lenders have started treating timeshare foreclosures more like traditional mortgage foreclosures. This trend shows that perceptions around timeshare foreclosures are changing within the financial world, highlighting the importance of how they are recognized and their consequences in real estate and financial transactions.

HUD Waiting Period on FHA Loans of Timeshare Versus Home Foreclosure

Previously, many homebuyers were unable to purchase a new home following the guidance of HUD that falsely stated timeshare and home foreclosures were identical. Some underwriters believed that timeshare foreclosure was equivalent to a mortgage foreclosure. Timeshares were quite popular in the 2000s as a luxurious vacation option. Essentially, a timeshare is a vacation home that a family can use during a specific time each year. When a buyer purchases a deeded timeshare property, they acquire a portion of the property rights. This article will explore why timeshare foreclosure is not considered the same as real estate foreclosure.

Is Timeshare Foreclosure Considered Mortgage Foreclosure By Lenders?

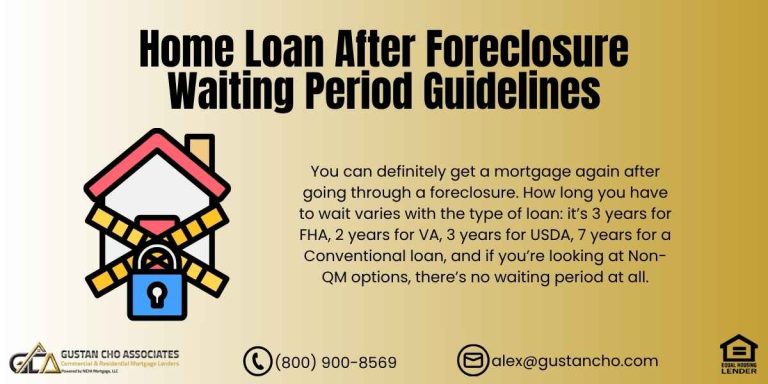

If a lender considers a timeshare foreclosure to be the same as a mortgage foreclosure, they will typically require a waiting period of three years. Borrowers who have a foreclosure on their record must wait three years from the recorded date of the foreclosure in order to be eligible for FHA loans. While some lenders treat timeshare foreclosures as regular foreclosures, HUD mortgage lending guidelines classify timeshares as consumer debt rather than real estate foreclosures. At Gustan Cho Associates, we do not categorize timeshare foreclosures as real estate foreclosures, and therefore, we do not impose any waiting period following a timeshare foreclosure.

Are There Waiting Period To Get a Mortgage With Timeshare Foreclosure?

Are you a timeshare owner who has faced a previous foreclosure on a timeshare or a real estate property and needs to qualify for FHA loans? Feel free to reach out to Gustan Cho Associates by phone at 800-900-8569 or via text for a faster response. You can also email us at alex@gustancho.com. Gustan Cho Associates is a reputable mortgage company that is licensed in multiple states and has no mortgage overlays on government and conventional loans. The company also boasts dozens of lending partnerships with non-QM wholesale lenders. We also provide more information on why many underwriters consider timeshare foreclosures to be the same as mortgage foreclosures.

Wondering if Timeshare Foreclosure Affects Your Mortgage?

Reach out now to get expert guidance on how timeshare foreclosure impacts your financial situation.

Qualifying For FHA Loans With Timeshare Foreclosure

Among all mortgage agencies, FHA loans have the most flexible guidelines for getting approved after a recent timeshare foreclosure. While all agencies allow borrowers to qualify for a mortgage with a timeshare foreclosure, FHA loans are known for being the easiest and fastest loan program to obtain approval. The automated underwriting system is more likely to provide an approved/eligible result for FHA loans compared to other government and conventional loan programs. This is because FHA loans are backed by HUD and have a more lenient algorithm in their programming.

How To Get Approved For an FHA Loan After Being Denied Due To Timeshare Foreclosure Considered Mortgage Foreclosure?

Here at Gustan Cho Associates, our mortgage services go beyond providing no lender overlays on government and conventional loans. We also offer non-QM and alternative financing loan programs for owner-occupants, second homes, and investment properties. Over 75% of our clientele consists of individuals who were unable to qualify for a mortgage elsewhere. Our dedicated team is available to assist you seven days a week, including evenings, weekends, and holidays. If you are a homebuyer or homeowner seeking the expertise of a top-rated mortgage broker, licensed in 48 states, including Washington DC and Puerto Rico, and with zero lender overlays, please don’t hesitate to reach out to Gustan Cho Associates at alex@gustancho.com.

Are the best mortgage lenders for FHA loans after being denied due to a timeshare foreclosure considered mortgage foreclosure?

Prospective homebuyers seeking pre-approval can reach out to us by calling or texting at 800-900-8569. The Gustan Cho Associates team is accessible every day of the week, even during late evenings, weekends, and holidays. Our seasoned loan officers, many of whom are veterans, specialize in assisting borrowers to qualify for mortgages, even in situations where other lenders may struggle. Gustan Cho Associates holds a national reputation for successfully securing home mortgages in cases where other lenders have faced challenges.

FAQ: Is Timeshare Foreclosure Considered Mortgage Foreclosure?

Q: How were Timeshares Commonly Perceived in the 2000s, and Why Did They Lead to Confusion Regarding Foreclosure?

A: Timeshares were popular as luxurious vacation options in the 2000s, where investors invested in a property for a specific time each year. The confusion arose because some guidelines erroneously equated timeshare foreclosures with mortgage foreclosures, affecting homebuyers’ ability to purchase new homes.

Q: How are Timeshares Defined in Terms of Responsibilities and Payments?

A: Similar to homeowners, timeshare unit owners are responsible for fees related to maintaining their timeshare, including association dues, homeowners’ insurance, and property maintenance fees. Additionally, timeshare owners may have a mortgage on their timeshare, and failure to meet obligations can lead to foreclosure initiated by the timeshare management company.

Q: How does HUD Classify Timeshare Mortgages, and Why do Underwriters Sometimes Mistake Timeshare Foreclosure for Mortgage Foreclosure?

A: According to HUD 4000.1 FHA Handbook, timeshare mortgages are considered installment loans rather than real estate loans. Despite this classification, some underwriters mistakenly treat timeshare foreclosure as equivalent to mortgage foreclosure, emphasizing the importance of researching agency guidelines before making loan decisions.

Q: Is There a Waiting Period After a Timeshare Foreclosure, and How is it Recorded on Credit Reports?

A: Timeshare foreclosures are recorded on credit reports similar to regular residential home foreclosures, impacting credit scores for seven years. While timeshare foreclosures may be considered mortgage foreclosures on credit reports, lenders may have varying perspectives. Some lenders may impose a waiting period of three years if they consider timeshare foreclosure equivalent to mortgage foreclosure.

Q: Are There Flexible Options for Obtaining a Mortgage After a Timeshare Foreclosure, and which Agency Offers the Most Lenient Guidelines?

A: FHA loans are highlighted as having the most flexible guidelines for approval after a timeshare foreclosure. FHA loans are backed by HUD and are known for their lenient automated underwriting system, making them more accessible than other government and conventional loan programs.

Q: How can Borrowers Seek Assistance and Guidance from Gustan Cho Associates Regarding Timeshare Foreclosures and Mortgage Approval?

A: Borrowers facing challenges or seeking information on timeshare foreclosures and mortgage approval can contact Gustan Cho Associates via phone, text, or email. The company is reputed for assisting without imposing additional mortgage overlays and offers various loan programs, including non-QM options.

This Blog on Is Timeshare Foreclosure Considered Mortgage Foreclosure was published on April 25th, 2025.

Need Help Understanding Timeshare Foreclosure vs. Mortgage Foreclosure?

Reach out now for expert advice on how this affects your mortgage options.

Superb information

I let a Wyndham Timeshare go into foreclosure and was able to purchase a home within a year of it foreclosing. Luckily it didn’t count as a mortgage foreclosure or else I would have had to wait the 7 years.

How did it report on your credit report and did it significantly drop your credit score?

I want to sell and/or resell timeshares.Which is less regulated?

Timeshares are not regulated by mortgage regulators. Timeshares are not mortgages. They are installment loans.

I have a TimeShare and it’s showing as a Conventional Mortgage on my Credit Report and it’s causing major issues for me! Tried disputing it to have it changed to installment loan and was unsuccessful. Not sure what to do at this point! (Diamond Resorts)

I am in the same situation currently!