In this blog, we will cover and discuss retirees fleeing high-taxed states to low-taxed states with affordable housing and low cost of living. The economy is hot. Housing prices have been appreciating throughout the United States except in certain states. Many Retirees Fleeing High Taxed States To Low Cost Of Living States.

Illinois Has The Highest State Tax Rates in the Nation

Illinois remains to be the highest taxed state in the country. There are more individual taxpayers and businesses fleeing Illinois than any other state. Besides having the second-highest property tax rate in the nation next to New Jersey, Illinois has record high taxes on everything you can think of from sales tax to state income tax, gas tax, and dozens of other taxable items.

Illinois Has The Second Highest Property Tax Rate in the Nation

Illinois has the second-highest property tax rate in the nation, right behind New Jersey. States that are in a financial crisis keep on raising taxes to solve their budget deficit. However, businesses and taxpayers are fighting back. Instead of swallowing the high taxes and higher cost of living in high taxed states, they had enough and are leaving.

High-Taxed States Facing Budget Deficit Due To Revenue Shortfall Due To Losing Taxpayers

Politicians who are raising taxes to solve their state’s budget deficit are getting back-fired due to taxpayers fleeing the state to other states with lower taxes and cost of living. Florida is raking in billions in revenues due to no state income taxes and low taxes on just about everything. Tennessee, another state with no state income taxes is seeing its population explode.

Reasons Why Retirees Fleeing High-Taxed States

Retirees Fleeing High-Taxed States To Tax-Friendly States With Affordable Housing

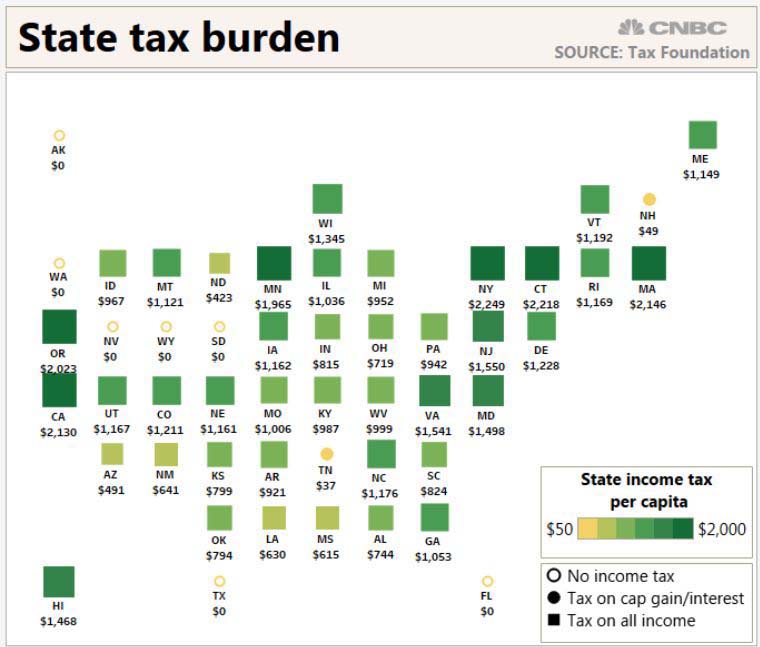

Retirees Fleeing High-Taxed States to tax-friendly states. California, the most populous state in the United States is seeing an exodus of its residents due to high taxes. California has the highest state income tax rate in the nation. The highest wage earners in the state are paying 13.3% of state taxes. Other high-taxed states include Oregon at 9.9%. Illinois is over 5.0%, Colorado is 4.63%, and Arizona is at 4.54% according to the Tax Foundation:

Please look at the data below of retirees fleeing high-taxed states:

Besides property taxes, states who are financially strapped are increasing sales taxes, gas taxes, and other taxes to raise revenue. Illinois recently doubled its gas tax.

Increasing Taxes Cause Of Retirees Fleeing High-Taxed States

New Jersey leads as the state with the highest property taxes. Illinois comes in a close second. New York is catching up fast in third place. Besides high property taxes, these states have the highest sales tax, state income taxes, and there seems like there is no cap in the nearing future. This is the main reason retirees fleeing high-taxed states. For many homeowners who have retired on a fixed income and no mortgage, rising property taxes are affecting their household income. Rising property taxes are also having an impact on property values. High-taxed states have depreciating home values. This affects homeowners’ equity positions in their homes. States like Florida, Texas, Tennessee have no state income taxes and are attracting countless retirees fleeing high-taxed states.