This ARTICLE On Purple Heart Veterans Updated Mortgage Guidelines was PUBLISHED On December 12th, 2019

Many loyal Gustan Cho Associate’s readers are veterans.

- We are thankful for our veterans and offer VA mortgage loans without any LENDER OVERLAYS

- A VA mortgage is a great tool to help those who have served our country achieve homeownership and help build a financially secure future

- We are experts in all aspects of VA mortgage financing

- In this blog, we will detail the recent change with the VA funding fee as well as the new change for our Purple Heart veterans

In this article, we will cover and discuss the changes in VA Loans to benefit the Purple Heart Veterans.

Changes In VA Funding Fee To Benefit Purple Heart Veterans

Purple Heart Veterans Updated Mortgage VA funding fee for the calendar year of 2020:

- As of January 1, 2020, they will no longer be a loan limit for a VA mortgage eligible for 100% financing

- Since the loan limit is extinguished, the Department of Veteran Affairs along with the U.S. Department of Housing and Urban Development has raised the VA funding fee

- In efforts to ensure all these VA mortgages without a loan limit, the Department of Veteran Affairs has decided to temporarily raise the VA funding fee

The new Purple Heart Veterans funding fee will affect all mortgage loans closed on or after January 1st, 2020.

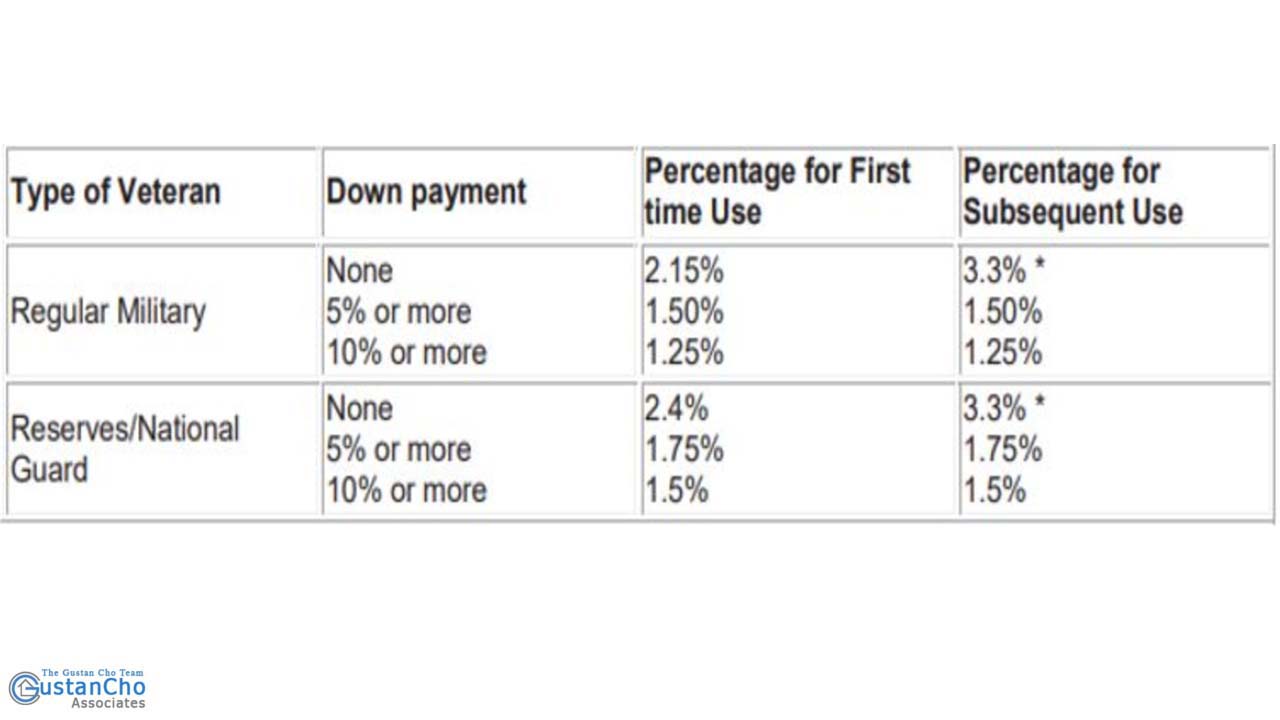

2019 Funding Fee Table On VA Loans

- For loans closing in 2019, a regular military veteran will pay a funding fee of 2.15% for first-time use and 3.3% for subsequent use when buying a home without a down payment

- You may reduce the funding fee with a 5% or 10% (or more) down payment

Please see the chart below:

Purple Heart Veterans 2020 VA Funding Fee Table

- The new rule starting January 1st, 2020 raises the funding fee for first-time use as well as subsequent use

- The new funding fee will be 2.3% for first use and 3.6% for subsequent use without a down payment

- Once again you may lower the funding fee when putting down a 5% or 10% (or more) down payment

NOTE.

The funding fee for manufactured homes (NOT permanently affixed), loan assumptions, and IRRRLs have not changed with the new changes.

- The funding fee for cash out and regular refinance mortgages have also increased

- The old funding fee was 3.3% (subsequent use) and is now 3.6% (subsequent use)

Reason For The Purple Heart Veterans New VA Guidelines

What prompted this change?

- The BLUE WATER NAVY VIETNAM VETERANS ACT OF 2019 provides disability benefits to Veterans who served in the offshore waters of Vietnam, and in some cases, their surviving spouses

- This change was added as many of our Vietnam veterans were exposed to herbicides off the coast of Vietnam during the war

This act promoted a few changes.

Purple Heart Veterans Changes For 2020 On New VA Guidelines

The increase in VA funding fee:

- Which we already went over above

- As of today, this increase funding fee is set to be in practice for two years

- Then the rule will be revisited

Removal of conforming loan limits:

- The removal of a loan limit for a VA mortgage will give greater access to our veterans for no down payment home loans

- There will no longer a down payment requirement for “JUMBO” VA mortgages

- After January 1st, 2020, a no down payment VA back mortgage is available throughout the entire country, regardless of the cost of the home

Native American direct loan:

- Part of the Blue Water Navy Vietnam Veterans Act of 2019 also removes the loan limit for veterans using their entitlement for a VA Native American direct loan

- The elimination of this loan limit enhances access or Native American veterans to purchase a home on federal trust land

Purple Heart Veterans Defined

Purple Heart veterans:

- A PURPLE HEART Medal is awarded to service members who have been killed or wounded as a result of enemy action while serving for the US Military

- The award was created in 1782 and over 1.8 million purple hearts have been awarded since

- An important change for Purple Heart recipients includes your funding fee can be waived if you close on a mortgage while still on active duty

While an increase in funding may sound like a bad thing for our veterans, there are scenarios where this does help Veterans.

VA Lender With No Overlays On VA Loans

As you can see, Gustan Cho Associates are experts in VA mortgage financing. We make it a priority to stay on top of the ever-changing mortgage guidelines. We have the ability to underwrite your file before you put an offer in on a property, see our TBD UNDERWRITING blog. We have seen every credit profile from an 800+ credit score all the way down to scores in the 400s. A VA mortgage does not have a minimum qualifying credit score but does have payment history requirements. We offer VA MANUAL UNDERWRITING, which many banks do not offer. If you are having trouble or have had trouble qualifying for a VA mortgage in the past, please give us a phone call. Call Mike Gracz on (800) 900-8569. You may also send an email to gcho@gustancho.com. You’re available seven days a week for your mortgage questions. We hope to hear from you.