This Article Is About Private Money Loans With Bad Credit For Real Estate Investors

Qualifying for Private Money Loans With Bad Credit. Is it possible?

- What if my credit is bad?

- Can I still get a Private or Hard Money Loan on my Investment Property?

- Do private money lenders require a minimum credit score to qualify with bad credit?

- Do private money lenders require income documentation like traditional lenders?

- Are there rules and regulations in private money lending like there are in traditional conforming loans?

These are frequently asked questions by real estate investors who inquire about hard money and private money loans with bad credit.

Private Money Versus Traditional Commercial Loans

Hard Money and Private Money Lenders are focused more on the asset than the borrower.

- Banks and traditional commercial lenders are concerned about the borrower and the property

- Will not lend if the borrower has bad credit

Private and Hard Money Lenders do care about borrowers credit scores and credit payment history:

- But still lend to real estate investors with bad credit

- Bad credit borrowers may get charged more in points and get higher interest rates due to their poor credit but they can still qualify for private money loans

Underwriting And Focusing More On Collateral Versus Borrower

The answer to Qualifying for Private Money Loans With Bad Credit is simple:

- Most of the time yes

- Private and Hard Money Lenders weigh most of their credit decisions more than equity than the borrower

- If a real estate investor has a lot of Equity or putting a large amount of down payment on their investment property purchase, the less risk the private money lender has

- Most private and hard money lenders are not too much concerned with the credit, credit scores, and income of borrowers

- More focused on the particular property and down payment/equity

However, private money lenders will review the borrowers’ credit reports:

- Will take the borrower’s credit and credit scores into consideration

The higher the credit score, the less risk the borrower has.

Here is what is most likely to happen if the borrower’s credit is horrible:

- The lender is probably going to reduce the LTV or loan to value they will lend on the property

- This means the more down payment to have a lower loan to value

The lender may charge more points and charge a higher rate if the borrower’s credit scores are lower.

Getting Denied By Bank

Just so you completely understand here is a good example:

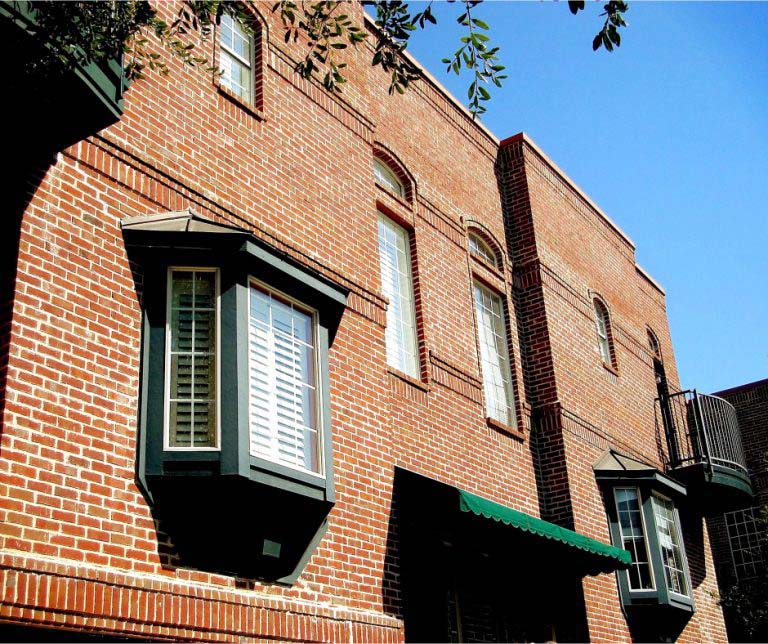

- Joe the borrower has a mixed-use commercial property on the south side of Chicago

- It is free and clear

- He has not had a mortgage on it for 10 years

- Now he has an opportunity to buy the building next door really cheap

- Joe was laid off from his job for 6 months last year

- Is behind on every bill except his Harley Davidson

- Plus, he has 5 medical charge off credit accounts, and a judgment for $15,000 from his ex-wife’s divorce lawyer

- He went to his bank; he got a free pen because he forgot to return it

- He didn’t get any cash

- No mortgage for Joe…

Getting Approved With Private Money Lender

Many people who get denied by banks and traditional commercial lenders, turn to private money lenders:

- His Private Money Lender Dan at Gustan Cho Associates Commercial Lending Division this time gave him a loan for 50% of what his building was worth

- His building was worth $200,000

- Dan issued an LOI or letter of intent for $100,000

- He had to pay off the judgment

- This is because it was recorded on the title of his building:

- But Joe walked away with roughly $85,000 minus costs

- Joe bought the building and had enough money to fix it up

- He sold it 60 days after he fixed, and for $200,000 and paid off his Private Money Loan

A Private Money or Hard Money Lender might have issued an LOI for more money. However, this is a good example of a real-life situation. I did protect the borrower’s name, but there really is a Dan.

Case Scenario On Private Money Loans With Bad Credit

Here is another quick example:

- Jan the borrower really needs cash to catch up on her real estate taxes

- Needs to fix up the single-family house she inherited from her mother

- The mortgage is only $20,000, and the house is worth around $100,000 as is

- She has a contractor bid for $30,000

- So she needs at least $50,000

- But she also has a car payment that is $600 a month

- She only needs $10,000 to pay that car off

- Her credit isn’t that bad

- She has paid all her bills on time for the last year

- But she just got out of bankruptcy 3 weeks ago

- Ironically, she has a good credit score

- Good for a Private or Hard Money lender is 580 FICO

- For your bank, that score is good for the free pen

- She really needs about 60% of what her house is worth

- Well that’s possible

- She plans on fixing up and selling the house anyway

- The Hard Money Lender looks at this client and thinks she has a lot of equity, and she can’t file bankruptcy again for 7 years

- What is the risk?

- The risk is she doesn’t make payment

- She is selling the property anyway

- The Private Money Lender looks at this:

- Simply assumes the client might not make all the payment

- However, she has demonstrated some ability to repay

- They make the loan

What is important to remember here is the loan has to make sense. You are going to pay a higher rate of 12-18%. Is it going to be worth it to you, and worth the risk to the Private or Hard Money Lender?

Even if your Credit is Horrible, you can get a Private or Hard Money Mortgage and the cash you need out of your investment single family, 1-4 unit, or commercial property.

Qualifying For Private Money Loans With Bad Credit And No Income Documentation Required

Gustan Cho Associates are experts in the following areas of lending:

- Hard Money Loans

- Commercial Loans

- Fix And Flip Rehab Loans

- Rental Property Financing And Investment Property Loans

- FHA, VA, USDA, Conventional Loans with no lender overlays

- Jumbo Loans

- Alternative Financing For Jumbo Loans

For more information on Private Money Loans with bad credit or Hard Money Loans, please contact Gustan Cho Associates at 800-900-8569. Or email us at gcho@gustancho.com.