Chapter 13 Cash-Out Refinance Guidelines During Repayment

According to VA and HUD Chapter 13 cash-out refinance guidelines, homeowners may be eligible for a cash-out refinance on an…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

According to VA and HUD Chapter 13 cash-out refinance guidelines, homeowners may be eligible for a cash-out refinance on an…

Quick Answer: Documents Required for Mortgage Processing and Underwriting To avoid delays and get to closing on time, submit a…

Quick Answer Yes—you can still qualify for a mortgage with negative credit history, even with late payments, collections, or a…

Quick Answer: Credit Report Analysis by Mortgage Underwriters Credit report analysis by mortgage underwriters is when an underwriter reviews your…

Gustan Cho Associates works with many families in different areas of the country. However, our clients commonly ask similar questions….

12 Common Home Buying Mistakes and How to Avoid Them (2026 Guide) Buying a home is one of the biggest…

21 Day Fast Track TBD Loan Program: The Fastest Way to Close Your Mortgage Buying a home shouldn’t take months….

Kentucky’s economy is booming, especially the housing market. Many individual taxpayers and businesses are making Kentucky their home due to low state taxes and affordable housing and low property taxes. Homebuyers are finding home priced reasonably and home prices are beginning to creep up.

This guide covers why underwriters issue denials on mortgage loans. The mortgage process should not be a stressful process and…

Steps of the Home Mortgage Process: A Simple Guide to Get Approved Fast Are you thinking about buying a home…

In this blog, we will discuss and cover the bankruptcy mortgage guidelines on government and conventional loans. All mortgage loan…

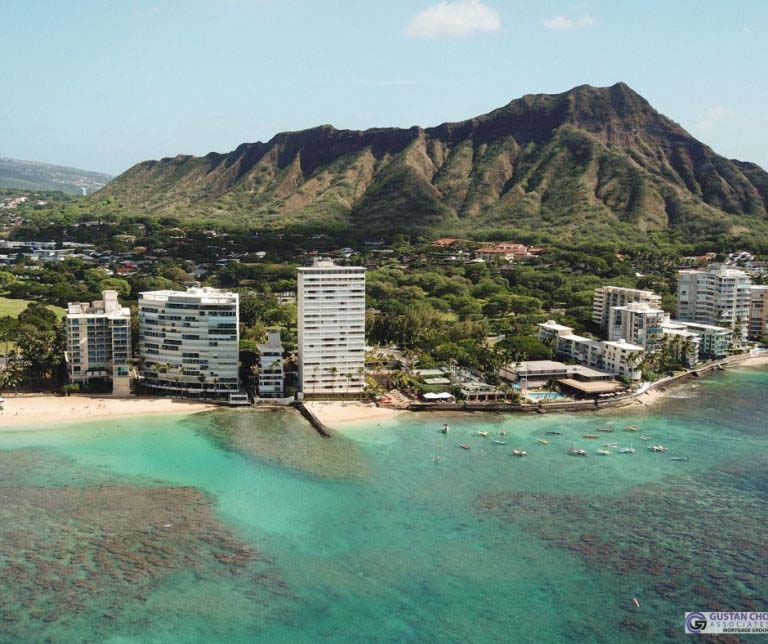

The latest data of the top 10 most expensive states to buy a house in 2026 has been released and…

In this blog, we will cover and discuss the steps in buying and selling a home and closing on time….

In this blog, we will discuss and cover how do underwriters approve mortgage loans when analyzing and processing borrowers. Mortgage…

The Mortgage Loan Underwriting Process: Simple, Step-by-Step Guide The mortgage loan underwriting process is the lender’s review of your income,…

Preparing for a Mortgage in Illinois: Step-by-Step Guide for Homebuyers Buying a home is one of the biggest financial decisions…

Why Choosing a Loan Officer Matters More Than You Think Buying a home is a big deal. It should feel…

How Credit Repair Affects the Mortgage Process: What Borrowers Need to Know Buying a home is one of the most…

Gustan Cho Associates are always expanding the mortgage programs we offer to our clients such as our new all-in-one mortgage…

This blog will discuss and cover HUD guidelines on student loans vs other mortgage programs. HUD, the Department of Housing…

What Lenders Look for in Bank Statements: 2025 Guide for Mortgage Approval Getting a mortgage can be stressful, especially when…

One Day Mortgage Loan Approval: Fast, No-Stress Approval with Gustan Cho Associates Buying a home is stressful—especially when time is…