This guide covers how inflation affects the housing and mortgage markets. Whenever you turn on the news, you hear “inflation.” In this article, we will review the current inflation rate throughout the country and break it down by sector. We will also go one step further and discuss inflation’s effects on the mortgage market.

The inflation news seems contradictory, and it is tough to understand who you can trust. Gustan Cho Associates are mortgage lending experts and offer many loan programs for our borrowers without lender overlays.

Inflation is affecting everybody, especially those attempting to buy a home. This article will include many pieces of information, some of which are opinions, as real numbers can be speculative. The following paragraphs will discuss how inflation affects the housing and mortgage markets.

What Does Inflation Mean

First, we must understand what inflation means. It is a term used in economics that refers to the rising prices of goods and services within a particular economy. A general rule states that as prices rise, consumers’ purchasing power decreases. As the cost of a certain good or service goes up, a person can buy less of that item. You may have heard news outlets attempt to tell you that the rising food costs are good. That is not true, in my opinion. Since prices for goods or services increase over time, the money you owe for goods or services will increase. This can be horrible if your wages are fixed. You feel the maximum price burden if you are on a fixed income.

Skyrocketing Price of Goods and Services

According to our government, the year-over-year number through December 2022 was 7.9% (some reports show 9.2%). In my personal opinion, I think it’s much higher than that. But even at 7.9%, this is the highest rate in 31 years. The last time Americans felt this inflation level was in 1990 when things were quite a bit different. The median age in the United States is 38, so many of us cannot fully understand the consequences. According to the Washington Post, here are a few sectors with the highest price increase. The figures below are year-over-year data:

- Fuel oil is up 59%

- Gas up 50%

- Utilities is up 28%

- Used cars of 26%

- Hotels up 26%

- Washing machines up 15%

- Furniture of 12%

- Televisions up 10%

The Sudden Increase in Food Costs Is Alarming

The sector hitting most Americans the hardest is our food costs. When headed to the grocery store, you can expect to pay quite a bit more for most items on your list. According to the same Washington Post article, prices are up as follows:

- Steaks are 24%

- Bacon is up 20%

- Pork is up 16%

- Eggs are up 12%

- Fish is up 11%

- Chicken is up 9%

- Milk is up 6%

In my experience, grocery store trips have been incredibly expensive. Not to mention many items are not even available. I have seen a low inventory of many products, such as pork and beef. Items such as cheese and pizza dough have also been unavailable for a few weeks. This is due to the current supply chain issues plaguing the country. The costs at the grocery store are quite a bit higher than Americans are used to. When speaking with my next-door neighbor, who is currently retired, he said the costs at the grocery store are changing his lifestyle.

While the Social Security Administration is raising his Social Security income by 5.9% for 2022, that is not enough for average Americans to keep up with this pace of inflation. According to my neighbor, when he does receive the 7.9%, that amount (in January 2023) will be spent with just a trip to the grocery store. Not to mention factoring in the cost of gasoline. This will put many individuals on a fixed income in a bind.

Also, suppose you are a salaried or hourly employee and have not received at least a 5.9% raise in 2023. In that case, you are theoretically experiencing a pay cut due to rising costs and virtually every sector of the economy. While someone like my neighbor is not in the market for a used or new car, everyday products such as food and gasoline are necessary for life. His personal story includes a lifestyle change. He is no longer going out to eat at restaurants which also puts a bind on the local economy. Some argue that high prices will result in higher wages (nobody has complained about higher wages), but when those gains are spent instantly on maintaining your current lifestyle, can you even consider it a raise? Last week I bought a quart of paint that cost $6.00! This was your everyday paint, not specialty paint. A printed sign on the register stated a 7% increase in prices across-the-board due to supply chain issues. If you have been paying attention, I’m sure you are seeing similar and many help-wanted signs in your area.

How Skyrocketing Prices of Goods and Services Negatively Affects The Housing Markets

How high prices harm mortgage borrowers attempting to enter the housing market: Saving for a down payment to buy a house is difficult enough without sky-high costs of goods and services. If you are forced to pay more for virtually everything you buy, saving money will be near impossible.

Many borrowers had trouble saving for a down payment even before the excessive inflation. Investment mogul Warren Buffett has given some tips to prepare for skyrocketing prices according to a recent article featured on MoneyWise. He urges Americans to increase their earning power by finding a side hustle with their time off work or a job with higher pay.

He then encourages you to play the stock market, as stocks have historically outperformed inflation. This is a way to hedge your money against flying high prices. He also encourages you to invest in precious metals such as gold, which has risen by 52% in the past five years. If you can, bring down your consumer debt.

Consumers With Substantial Debts

If you are carrying significant debt, this can hurt during times of inflation. It is important to cut your costs as much as possible. He strongly encourages individuals to stay away from adjustable-rate loans. When inflation heats up, interest rates usually follow. If you are carrying debt with adjustable rates, like a credit card or home equity line of credit, as inflation ticks up, the amount of interest you will pay will also tick up.

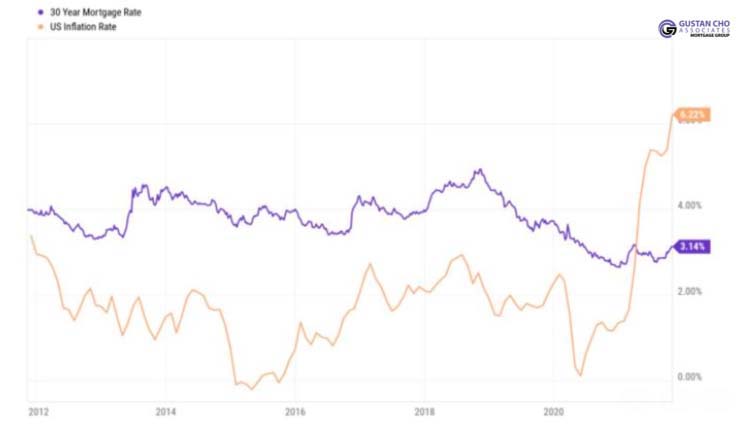

The main takeaway from this article was that he encouraged Americans to capitalize on the current real estate market. Real estate has proven to be one of the most reliable long-term investments. If you’re ready to buy at home, capitalizing on these historically low-interest rates is key. Entering a low-rate 30-year fixed mortgage can be a great tool for financial success.

As demand for goods and services rises, the cost of everything seems to go up, including real estate. So, if you can get into the real estate market in lock in the historically low 30-year fixed mortgage interest rate, this can be a great tool against increasing prices. When buying a house, you get locked into your principal and interest payments, so you will not have to worry about rising rent costs in the future. Also, you build equity as you pay your loan, and your home appreciates. This is how you can turn your housing expense into future equity.

How Inflation Affects The Rental Housing Market

Has the rental market been hit with raging price increases? Yes, the rental market is also feeling the squeeze of inflation—bad news for renters. Rents have skyrocketed along with everything else in this country. Newly released data shows an increase in rents has increased by an average of 10.2% nationwide.

Single-family detached homes had an average rental increase of 12.5% compared to September 2020. Certain parts of the country, such as Miami, have had a rent increase of 25%.

According to recent reports from core logic, Miami saw the largest rent increase, followed by Phoenix and Las Vegas. On the bottom line of rental increases, we see cities like Chicago, Philadelphia, Washington DC, New York City, and Boston. The growth in these cities was under 5%.

How Inflation Impacts Mortgage Lenders and Borrowers

One question we often get is, does inflation favor a lender or a borrower? The short answer to this question is both. The current inflation and the bargaining power have led to a rise in average wages across the country. Inflation could help a borrower if the borrower were already paying off the debt before inflation occurred—especially with a low fixed rate.

Because you still owe the same amount of principal before the inflation occurred, any increased wages due to inflation will allow you to pay less of your total paycheck towards your debt. This only is a factor if your wages truly increase during inflation. Otherwise, this argument does not hold.

Inflation can help a lender as well. When extending new financing or offering new loans, higher prices mean people need more credit to buy the item. So increased housing prices will allow the lender to collect interest on the total money. Since borrowers need more money, they may pay interest for a longer period creating more profit for the lender. Demand for goods and services will typically raise interest rates for lenders so their profits can remain steady.

When Will The Biden Administration Financial Crisis End

When will it end? Normally consumers will not notice a slight uptick in inflation rates. However, the skyrocketing inflation of 2021 is noticeable to most consumers. It is not a secret that many Americans have lost all faith in the federal reserve banking system and the Biden Administration. They are currently blaming the inflation numbers on the COVID-19 pandemic. While the COVID-19 pandemic has been an inflation factor, it is not the end all be all. If anything, in my opinion, it’s more of an excuse. For months the Federal Reserve has told us that inflation is transitory (temporary). I think they used this term to justify keeping rates low and helping with public perception. But Americans have caught on to this excuse. Going through their everyday life, they have come to the conclusion that this inflation seems to be sticky. Meaning we will have this inflation for the time to come. Until the supply chain and Covid are rectified, inflation is here to stay. Elected economists like to use certain measurements, such as the consumer price index (CPI) to measure inflation.

According to the Bureau of Labor Statistics, this can be a play on words such as inflation, which excludes the costs of food, shelter, and energy to skew their numbers favorably. The media will use terms most Americans do not understand, such as easing, demand-pull / cost-push, CPI, and WPI. I wish the issues of shutdowns, mandates, and labor force were used to describe the current inflation issues. Since companies are needed to charge more to stay profitable due to factors like shipping costs, this cost is passed down to the consumer. Even when shipping costs back down, businesses will likely keep higher prices to compensate for lost profits.

The team at Gustan Cho Associates is here to answer any questions you have about the current mortgage market. The world of mortgage information is vast, so please get in touch with the experts for specific advice. You can reach Alex Carlucci via phone at (800) 900-8569 or email at alex@gustancho.com. Our team is here to help you qualify without lender overlays. Even if your lender has turned you down in the past, we encourage you to reach out to our team. If, for any reason, you cannot qualify for a mortgage today, our team will work with you to qualify in the future. We are available seven days a week and after business hours to accommodate your busy lives. We want you to take advantage of these historically low-interest rates before they climb. If you or any of your friends have mortgage-related questions, please get in touch with our team today.