Low Down Payment Mortgage: First-Time Homebuyer’s Guide to Homeownership

Can You Buy a Home With Little to No Down Payment? Yes!

If you think you need 20% down to buy a home, think again! Multiple low down payment mortgage options allow first-time homebuyers to secure a home with as little as 0% to 3.5% down. Many renters don’t even consider homeownership because they assume they don’t have enough savings. But the reality? You may qualify for a mortgage with a low down payment and start building wealth through homeownership today.

Best Low Down Payment Mortgage Options in 2025

Buying a Home with Little Money Down?

Apply Now And Get Pre-Approved for a Low Down Payment Mortgage Today

The good news? You have options! Here’s a breakdown of the best low down payment mortgage programs available in 2025:

1. FHA Loan: 3.5% Down Payment

A low down payment mortgage makes it easier for people to buy their first home. The FHA loan is a popular choice for a mortgage with a low down payment. Backed by the Federal Housing Administration, this loan requires just 3.5% of the home’s price as a down payment. This is helpful for first-time buyers because it has low credit score requirements and flexible rules. This way, more people can own a home even if they don’t have much money saved up..

Minimum Credit Score: 580 for 3.5% down (or 500 with 10% down)

Down Payment: 3.5%

Mortgage Insurance: Required (upfront and monthly premiums)

Loan Limit: $498,257 (varies by location in 2024)

Ideal For: Homebuyers with poor credit ratings or minimal savings.

Case Scneario: You want to buy a $300,000 home. With an FHA loan, your down payment would be just $10,500!

2. Conventional 97 Loan: 3% Down Payment

Fannie Mae and Freddie Mac have a low down payment mortgage called the Conventional 97 loan. This exceptional loan lets first-time homebuyers pay just 3% of the home price as a down payment. This means you don’t need a lot of money saved up to buy your first home!

Minimum Credit Score: 620+

Down Payment: 3%

Mortgage Insurance: Necessary when the down payment is below 20%.

Loan Limit: $766,550 in 2024 (higher in high-cost areas)

Best For: Buyers with good credit who want lower mortgage insurance costs over time

Case Scenario: If you are considering buying a home, you might be surprised to learn that with a low down payment mortgage, you can make it happen with very little money upfront. For example, if you want to buy a home that costs $300,000, you only need to put down $9,000 as your down payment. That’s a small amount compared to the total cost of the house. This makes it easier for more people to own their dream home without needing to save a lot of money first.

3. VA Loan: 0% Down Payment

If you’re a veteran, active-duty service member, or eligible spouse certificate of eligibility can qualify for VA loans. A VA loan offers the best low down payment mortgage with zero down and no PMI (private mortgage insurance).

Minimum Credit Score: No official minimum, but lenders prefer 580+

Down Payment: 0%

Mortgage Insurance: None

Loan Limit: No loan limits with full entitlement

Best For: Veterans and military families

Case Scenario: You can buy a $350,000 home with a low down payment mortgage. With a VA loan, you don’t have to pay any money upfront, making it easier to own a home. Plus, you won’t have to worry about paying for mortgage insurance. With this great deal, you can move into your dream home without extra costs.

4. USDA Loan: 0% Down Payment

For those buying in rural and suburban areas, the USDA loan offers 100% financing with no down payment.

Minimum Credit Score: 640 recommended

Down Payment: 0%

Mortgage Insurance: Yes, but lower than FHA

Income Limits: Must meet USDA’s household income guidelines

Best For: Buyers in rural or suburban areas

Case Scenario: If you qualify for a low down payment mortgage, you can buy a home without putting any money down. You get to keep more of your savings for important costs of owning a home, like repairs and bills. Moving into your new house makes it easier, and you start enjoying it immediately.

Own a Home Sooner! Explore the Best Low Down Payment Mortgage Options Now

Apply Now And Get recommendations From Loan Experts

Down Payment Assistance (DPA) Programs in 2025

Many states offer down payment assistance (DPA) to help first-time homebuyers cover their low down payment mortgage costs. These programs provide grants, forgivable loans, or second mortgages with little or no repayment.

- FHA Non-Recoverable DPA Program: Get 100% down payment assistance for an FHA loan and refinance later with no repayment.

- State & Local DPA Programs: Many states offer grants and low-interest loans.

- Employer & Nonprofit Programs: Some companies and organizations help with down payment funds.

Check if you qualify for DPA programs to reduce or eliminate out-of-pocket costs!

How to Qualify for a Low Down Payment Mortgage

If you want to get a low down payment mortgage, follow these steps:

- Check Your Credit Score – Your credit score holds significant value. Achieving a higher score can assist you in securing more favorable interest rates on loans. Strive for a minimum score of 580 for FHA loans and 620 for Conventional 97 loans.

- Save for a Down Payment – Even if you can get a loan with 0% down, like a VA or USDA loan, it’s wise to save money for closing costs and extra funds.

- Reduce Debt-to-Income Ratio (DTI) – Keep your monthly debt payments low. Aim to have a Debt-to-Income Ratio (DTI) under 50%. This will help you get approved for the loan.

- Get Pre-Approved – When you get pre-approved for a mortgage, it shows sellers that you’re serious about buying a home. It also lets you know how much money you can borrow.

- Work with a Lender Who Specializes in First-Time Buyers – Not all lenders are created equal! Work with Gustan Cho Associates to get the best mortgage for your needs.

Following these steps will give you a better chance of getting a low down payment mortgage.

Comparing Low Down Payment Mortgage Options

Next Steps: Buy a Home with a Low Down Payment

Ready to become a homeowner? Don’t let the down payment hold you back!

Contact Gustan Cho Associates today to explore your low down payment mortgage options and get pre-approved.

If you have any questions about low down payment mortgage options or borrowers who need to qualify for loans with a lender with no overlays, please contact us at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

FHA, VA, or Conventional? Learn Which Low Down Payment Mortgage Fits Your Budget

Apply Now And Get recommendations From Loan Experts

Frequently Asked Questions About Low Down Payment Mortgage:

Q: What Does a Low Down Payment Mortgage Mean?

A: A low down payment mortgage is a form of home financing that allows you to buy a house with a small upfront cost, usually demanding a down payment of around 3% to 3.5%, or in some cases, no down payment at all (as is the case with VA and USDA loans).

Q: Can I Buy a House with no Money Down?

A: Yes! VA loans (for eligible military members) and USDA loans (for homes in rural areas) offer 0% down payment, meaning you don’t need to put any money down to buy a house.

Q: What is the Lowest Down Payment I Can Get on an FHA Loan?

A: A down payment of at least 3.5% is necessary for an FHA loan if your credit score is 580 or higher. If your credit score falls within the range of 500 to 579, a down payment of 10% must be made.

Q: What Credit Score do I Need for a Low Down Payment Mortgage?

A: The credit scores needed are as follows:

- FHA loan: 580+ (3.5% down) or 500+ (10% down)

- Conventional loan: 620+ (3% down)

- VA loan: No official minimum, but most lenders prefer 580+

- USDA loan: 640+ recommended

Q: Do I Need Private Mortgage Insurance (PMI) if I Get a Low Down Payment Mortgage?

A: Yes, most low down payment mortgages require PMI unless you use a VA loan. FHA loans require mortgage insurance (MIP) for the life of the loan, while conventional loans cancel PMI once you reach 20% equity.

Q: How Can I Get Help with My Down Payment?

A: Numerous first-time homebuyers are eligible for down payment assistance (DPA) initiatives, which offer grants, forgivable loans, or secondary mortgages to support your down payment. Look into your state or local programs to determine your eligibility.

Q: Is a Low Down Payment Mortgage More Expensive in the Long Run?

A: Lower down payments result in larger loan amounts and potentially increased interest rates. Nevertheless, it enables you to purchase a home earlier and accumulate equity rather than spending money on rent.

Q: Can I Use Gift Funds for a Low Down Payment Mortgage?

A: Yes! Many loan programs, including FHA, VA, and conventional loans, allow gifts from family or friends to cover all or part of your down payment.

Q: How do I Qualify for a Low Down Payment Mortgage?

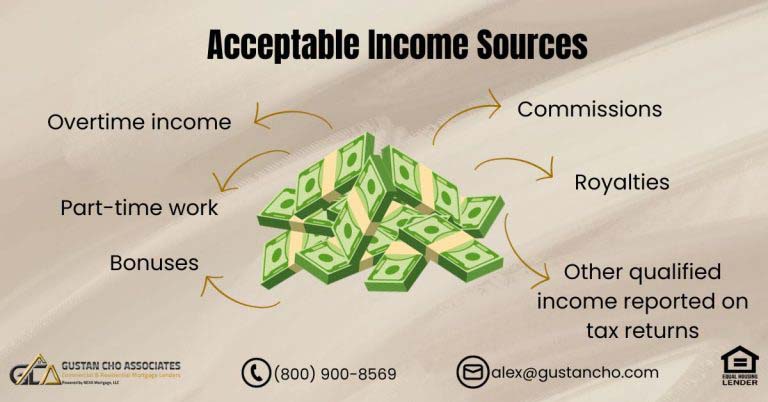

A: To qualify, you need to:

- Have a steady income and job history

- Meet the minimum credit score for the loan type

- Stay within the allowed debt-to-income (DTI) ratio

- Have enough savings for the down payment and closing costs (or qualify for DPA)

Q: How Can I Get Pre-Approved for a Low Down Payment Mortgage?

A: Getting pre-approved is easy! Contact Gustan Cho Associates to check your loan options. Call 800-900-8569, send a text for a quicker reply, or email alex@gustancho.com. We’re here every day of the week, including evenings and holidays!

This blog about “Low Down Payment Mortgage For First-Time Homebuyers” was updated on March 4th, 2025.

No Savings for a Large Down Payment? Discover Mortgage Programs That Require Less Money Upfront

Apply Now And Get recommendations From Loan Experts