This guide covers EPM Empowered down payment assistance mortgage programs. There are several types of down payment assistance mortgage programs for homebuyers. We have some very exciting news at Gustan Cho Associates. The team at Gustan Cho Associates offers two different types of down payment assistance mortgage program: Forgivable and non-forgivable DPAs. We offer the EPM DPM Program with non-forgivable down payment assistance mortgage! We will discuss the types of down payment assistance mortgage options and their lending requirements:

We are excited to say you can purchase a house with as little as a 0% down payment and no closing costs.

We are excited to announce we can offer down payment assistance mortgage programs in most of the states we operate in. This guide covers various types of down payment assistance mortgage options for homebuyers. There are forgivable and non-forgivable down payment assistance mortgage options for homebuyers.

Empowered DPA Program: 3.5% Down Payment Assistance Mortgage Grant

In this section, we will cover the Empowered DPA program. Unlike other down payment assistance mortgage programs, the Empowered Down Payment Assistance Mortgage Program has lenient guidelines.

Some down payment assistance mortgage programs require a certain credit score, income level, and debt-to-income ratio or are certain state-specific.

The Empowered DPA program is offered by Equity Prime Mortgage (EPM). The EPM down payment assistance mortgage program comes with a forgivable grant equal to 3.5% of the purchase price. The minimum credit score is 620 FICO. The EPM Empowered DPA program covers FHA loans’ minimum 3.5% down payment requirement. Must have an automated AUS Approval (no manual underwriting).

Buy a Home with Little or No Down Payment

The EPM Empowered Program offers down payment assistance to help you move into your new home sooner—without breaking the bank.How Does The EPM Empowered DPA Program Work

Empowered DPA down payment assistance mortgage program gives homebuyers up to 3.5% of the purchase price of a home, which is the down payment requirement on FHA loans.

The EPM Empowered down payment assistance mortgage program comes as a forgivable grant.

The down payment assistance does not need to be paid back after six months. A forgivable grant means the 3.5% down payment assistance mortgage does not have to be paid back after the borrower has made the initial six monthly mortgage payments.

Eligibility Requirements For EPM’s Empowered DPA Program

Three different classes of homebuyers can qualify for the EPM Empowered DPA FHA mortgage program. First-time homebuyers are eligible for the Empowered DPA program. A first-time homebuyer is a buyer who has not had ownership of a home in the past three years.

Even though Gustan Cho Associates has no lender overlays on government and conventional loans, most down payment assistance mortgage programs have lender overlays.

If you are a first responder, do volunteer work, or are an active or retired member of the U.S. Armed Services, medical professional, school teacher, or city, county, state, or federal employee, you qualify for the Empowered DPA program.

DPA Mortgage For Low To Moderate Income Families

Homebuyers of underserved census areas can qualify for the Empowered DPA mortgage program. Other borrowers who qualify are folks whose income exceeds 140% of the state or county median income. The income for borrowers on the application cannot be higher than 140% of the state or county median Income. This holds regardless of family size.

Borrowers need to take a HUD-approved homeowner education course offered by Framework Homeownership or from a HUD-approved counselor.

Certain down payment assistance mortgage programs require completing a homebuyer education course or counseling before applying for assistance. The course or session can help you learn about the home-buying process, budgeting, credit, mortgage options, and homeownership responsibilities. The course or session can be online or in-person and may have a fee or be free.

What Are The Empowered DPA Mortgage Guidelines and Requirements

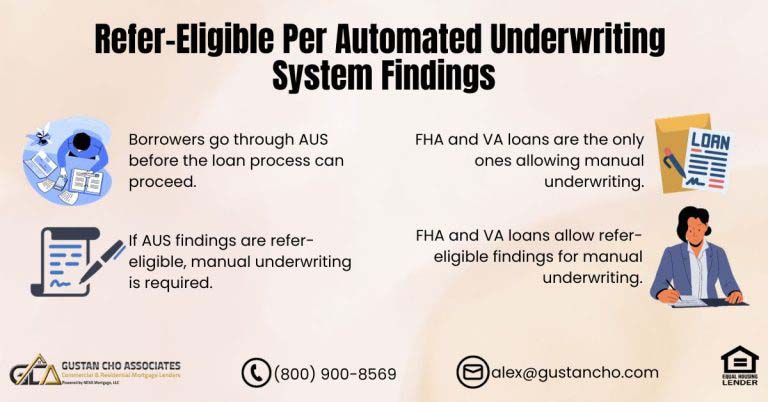

To qualify for the EPM Empowered DPA mortgage program, borrowers need to have a minimum 620 credit score and be buying a primary owner-occupant residence. You need to meet the minimum HUD guidelines for FHA loans. You need an automated underwriting system approval.

The Equity Prime Mortgage Empowered DPA Program is available in all states, except for Washington state. Most down payment assistance mortgage programs are only available in one or a few states.

The standard maximum front-end debt-to-income ratio is 46.9%, and the back-end debt-to-income ratio is 56.9% on standard FHA loans. The maximum front-end and back-end debt-to-income ratio cannot exceed 48.99% for the Empowered DPA mortgage program. The maximum loan-to-value is capped at 96.5%.

Occupancy Guidelines on Empowered DPA

Some programs require that you live in the home as your primary residence for a certain period, such as one year, five years, or the loan duration. You cannot rent or sell the home during this period without paying back the assistance or facing penalties. Some programs may also allow you to buy a home as a second home or an investment property but with different terms and conditions.

What Type of Properties Is Eligible For Empowered DPA Mortgage

Some programs are only available for certain properties, such as single-family homes, condos, townhomes, or manufactured homes. You need to buy a home that meets the property standards and specifications of the program. Some programs may also limit the purchase price or value of the home.

Single-family homes, townhomes, duplexes, single and double-wide manufactured homes, HUD-approved condominiums, and PUDs.

Down payment assistance can be a great way to help you buy a home with less money upfront. However, down payment assistance is not free and has pros and cons. Do your research and weigh your options carefully before applying for any program. You should also consult with a mortgage professional and a financial advisor to ensure you can afford the mortgage payments and the long-term costs of homeownership. There will be an official announcement once we officially roll out this program!

Get Help with Your Down Payment Through EPM

Struggling to save for a home? You may qualify for down payment assistance through the Empowered Mortgage Program.Frequently Asked Questions (FAQs)

- What is the EPM Empowered Down Payment Assistance Mortgage Program?

The EPM Empowered Down Payment Assistance Mortgage Program is designed to help homebuyers afford their down payment when purchasing a home. - How does the program work?

The program provides eligible homebuyers with financial assistance for their down payment, typically in the form of a grant or loan that does not require repayment or a low-interest loan. - Who is eligible for the program?

Eligibility criteria vary depending on the program’s specific requirements but typically include income limits, credit score requirements, and the property’s location. - What are the benefits of the EPM Empowered Down Payment Assistance Mortgage Program?

The program can make homeownership more accessible by providing financial assistance for the down payment, reducing the upfront costs of buying a home. - Are there any restrictions on the types of properties that qualify for assistance?

Property eligibility requirements may vary depending on the program, but generally, assistance is available for primary residences, and there may be restrictions on the property’s purchase price and condition. - How do I apply for the program?

Homebuyers interested in the program must apply through a participating lender or housing agency. The application process may involve providing income, assets, and other relevant information documentation. - Is there a limit to the amount of assistance I can receive?

Assistance amounts vary depending on the homebuyer’s financial need, funding availability, and program-specific limits or guidelines. - Do I need to repay the assistance provided by the program?

The repayment terms for the program’s assistance depend on the specific program and type of assistance received. Some programs offer grants or forgivable loans that do not require repayment. In contrast, others may offer low-interest loans that must be repaid over time. - Can I use the assistance for closing costs and the down payment?

Some programs may allow assistance for closing costs in addition to the down payment. In contrast, others may restrict how the assistance funds can be used. - Are there any risks or drawbacks to participating in the program?

It’s crucial to thoroughly examine the program’s terms and conditions and understand any potential risks or obligations associated with accepting assistance. This may include restrictions on the resale of the property or repayment requirements if certain conditions are not met.

For more information about EPM empowered down payment assistance, you can contact at GCA Mortgage Group by calling 800-900-8569 or text us for a faster response. You can also email us at alex@gustancho.com. Our expert Loan Officers are available even during weekends and holidays!