Exploring Solutions to High Debt to Income Ratios for Home Purchases

This article discusses the solutions to high debt to income ratios, a critical aspect for individuals aiming to buy a home. Both government and conventional loan programs impose certain limits on DTI ratios. However, VA loans stand out as they do not have a strict maximum DTI cap as long as the automated underwriting system issues an approve/eligible decision. VA loans can accommodate borrowers with DTI ratios up to 65%, especially if they have strong residual income.

Gustan Cho Associates has a history of approving many VA loan applicants with DTI ratios over 60%. Additionally, they have introduced a new 90% LTV jumbo loan program that allows for a maximum DTI ratio of 50%. For those dealing with high DTI ratios, Non-QM loans also present a feasible option, typically permitting DTI ratios ranging from 50% to 55%.

The following sections will cover the significance of DTI ratios for lenders, updated DTI ratio guidelines for mortgage loan programs at Gustan Cho Associates, the advantages of adding non-occupant co-borrowers, and other alternative solutions to high debt-to-income ratios.

At Gustan Cho Associates, we adhere to the philosophy that where there is a will, there is always a way. We have successfully helped thousands of borrowers with high DTI ratios qualify for mortgages, underscoring our dedication to providing solutions to high debt-to-income ratios that facilitate home ownership despite financial challenges.

The Importance of Debt to Income Ratio on Government and Conventional Loans

Debt-to-income (DTI) ratios are critical in assessing eligibility for home loans, as they measure a borrower’s capacity to manage and repay a new loan. The allowable DTI varies across different loan programs and is determined by dividing the total of all minimum monthly debt payments by the borrower’s gross monthly income.

For mortgage applicants with high DTI ratios, FHA loans are often the more feasible option compared to conventional loans due to their more forgiving guidelines concerning high debt levels. Conventional loan programs typically limit DTI to between 45% and 50%.

To qualify for a conventional loan with a DTI higher than 45%, applicants generally need a credit score of at least 720 or to make a down payment of 20% or more since private mortgage insurance providers are reluctant to insure loans exceeding these DTI limits without these compensating factors. Consequently, borrowers with solid credit scores but elevated DTI ratios may find FHA loans offer better solutions to high debt to income ratios, as they are structured to accommodate higher debt levels more readily.

Struggling with High DTI? We Can Help You Qualify for a Home Loan!

Contact us today to learn how we can help you secure financing and navigate the approval process.

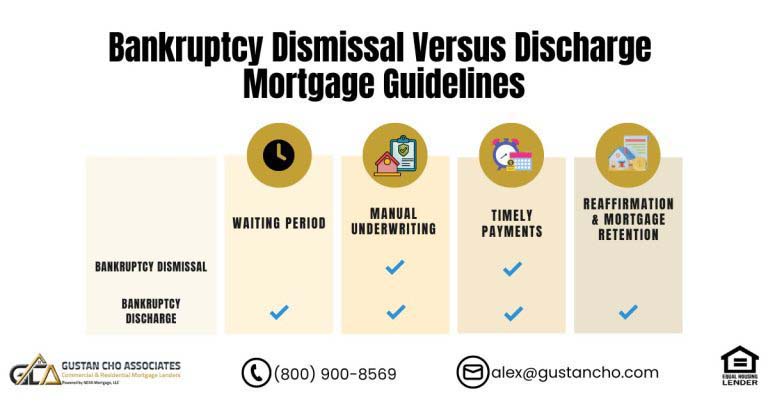

Debt To Income Ratio Caps On Manual Underwriting

Manual underwriting is a unique feature offered by only FHA and VA loan programs, providing flexibility in handling high debt-to-income (DTI) ratios. Manual underwriting for FHA loans allows a maximum DTI ratio of 40% on the front end and 50% on the back end, provided two compensating factors exist. VA loans permit a slightly higher DTI cap, ranging from 50% to 55%.

Gustan Cho Associates can extend this limit to 65% DTI for VA loans if the borrower demonstrates strong residual income and multiple compensating factors, showcasing mortgage underwriters’ significant discretion with manual underwriting. Borrowers with marginal profiles approve/eligible per Automated Underwriting System (AUS) may also shift their files to manual underwriting.

Regarding specific caps for FHA loans, the back-end DTI is limited to 56.9%, while the front-end DTI should not exceed 46.9%. These parameters ensure that FHA loans remain accessible yet responsible, providing solutions to high debt to income ratios for borrowers who need them.

Can You Buy a House with a High Debt-To-Income Ratio?

Purchasing a home with a high debt-to-income (DTI) ratio presents challenges. Still, viable solutions to high debt to income ratios can facilitate this process under specific conditions. Most lenders prefer a standard DTI ratio of 36% or lower, with a maximum of 28% allocated specifically for mortgage expenses.

Solutions to high debt to income ratios include accessing government-backed loans such as FHA, VA, and USDA. These mortgage programs are less strict, allowing for higher DTI ratios of up to 43-50%, and they also offer added perks such as lower down payments and more adaptable credit score prerequisites.

Suppose your DTI ratio is above these thresholds. In that case, you might still qualify for a mortgage by presenting compensating factors to lenders, such as a strong credit score, substantial savings, or a large down payment. Another solution includes enlisting a co-signer with good financial standing. Furthermore, some lenders provide manual underwriting, which involves a more personalized review of your financial situation, potentially leading to loan approval despite a high DTI.

Addressing your DTI ratio by increasing your income or decreasing your debts can increase your likelihood of purchasing a home.

Risks With Closing With High Debt To Income Ratio

It is important for borrowers with high debt-to-income ratios who are about to qualify for a mortgage to understand the potential risks associated with closing on a mortgage loan. Those at the upper limit of the allowable 56.9% debt-to-income ratio need to understand that even small increases in monthly debt obligations can jeopardize their mortgage approval.

For instance, if the monthly payment for homeowner’s insurance ends up being higher than the amount initially used for qualification, this could push their debt-to-income ratio beyond acceptable limits.

Additionally, borrowers must be cautious if certain expenses are overlooked during the loan approval process. If a borrower requires flood insurance but this was not accounted for by the loan officer, they could exceed the maximum debt-to-income ratio allowed. Similarly, if property taxes or homeowners association dues are higher than initially estimated, these could also be potential deal-breakers.

These scenarios underscore the importance of careful planning and consideration of all possible expenses when calculating debt obligations to find solutions to high debt to income ratios.

Worried About High DTI on Your Mortgage? We’ve Got Solutions!

Contact us now to discuss your options and get pre-approved for your mortgage.

Solutions To High Debt To Income Ratios When Qualifying For Loan

In some cases, mortgage applicants who initially qualify and meet the debt-to-income (DTI) requirements may find themselves non-compliant due to increased monthly expenses, a reduction in income from employment verification, or tax write-offs. Here are several effective solutions to high debt-to-income ratios that can help address this issue:

Adding a Non-Occupant Co-Borrower

The Federal Housing Administration (FHA) permits primary borrowers to add family members or relatives as non-occupant co-borrowers who are not listed on the title but share the responsibility of the loan. These co-borrowers must be related by blood, marriage, or law. However, HUD allows exceptions for non-relatives with a higher down payment requirement—25% compared to 3.5%. Similarly, Fannie Mae and Freddie Mac programs allow non-related co-borrowers to join the primary borrower with a minimum of 3% or 5% down payment on conventional loans.

Buying Down the Mortgage Rate

Lowering your mortgage rate by buying points can significantly reduce monthly payments and address high DTI issues. Borrowers considering this option should negotiate a substantial seller’s concession to cover buyer closing costs. The FHA permits up to 6% in seller concessions. In comparison, VA loans allow up to 4%. Conventional loans offer up to 3% for owner-occupied homes and 2% for investment properties.

Paying Down Debts

Reducing DTI can also be achieved by paying off or down revolving credit accounts and other debts. Installment debts like car loans, alimony, and child support payments with 10 months or fewer remaining can often be excluded from DTI calculations, further improving the borrower’s financial profile.

These strategies provide viable solutions to managin high debt to income ratios, enabling borrowers to align with lender requirements and facilitating successful mortgage applications.

Can I Refinance My Home with a High Debt-To-Income Ratio?

Refinancing your home with a high debt-to-income (DTI) ratio can be difficult. Still, certain options are available that help you succeed.

Government-backed loans such as FHA Streamline Refinance, VA Interest Rate Reduction Refinance Loan (IRL), and USDA Streamline Refinance provide a smoother pathway for those with stricter DTI ratios. These programs often do not require extensive credit checks or appraisals, and they can provide more lenient terms for homeowners looking to refinance.

Suppose you don’t qualify for government-backed refinancing. In that case, you might still find flexibility with conventional lenders if you present compensating factors such as a high credit score, substantial home equity, or a strong payment history. Alternatively, a cash-out refinance could allow you to pay off other debts, thus lowering your DTI ratio and improving your overall financial profile. Adding a co-signer with a better financial standing can also enhance your application.

It’s wise to compare different lenders, as terms and thresholds for DTI ratios vary. Getting advice from a mortgage broker or a financial advisor can also prove helpful. They can provide customized recommendations and assist you in exploring the refinancing alternatives that are best suited for your financial requirements.

Lender With No Overlays On Debt To Income Ratios

Most lenders have overlays on debt-to-income ratios. Borrowers with higher debt to income ratios who cannot qualify for a mortgage at other lenders due to their lender overlays can contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. Gustan Cho Associates has ZERO OVERLAYS on FHA, VA, USDA, and Conventional Loans.

FAQ: Solutions To High Debt To Income Ratios On Home Purchase

- What is the importance of the debt-to-income (DTI) ratio for lenders? The borrower’s DTI ratio is essential as it reflects their capability to handle and pay off the new loan. Various loan programs have specific DTI limits. Typically, conventional loans restrict DTI between 45% and 50%, while FHA loans may allow higher ratios due to their more relaxed guidelines.

- Can you buy a house with a high DTI ratio? Yes, it is possible, especially through programs like FHA, VA, and USDA loans, which accept DTI ratios as high as 43-50%. To increase their likelihood of approval, applicants can highlight compensating factors such as a high credit score, substantial savings, or a substantial down payment.

- What are some solutions for high DTI ratios when qualifying for a loan? Options include adding a non-occupant co-borrower, buying down the mortgage rate, or paying off existing debts to lower the DTI ratio. Each solution can help align a borrower’s financial profile with lender requirements.

- Can I refinance my home with a high DTI ratio? Some programs, like the FHA Streamline Refinance or VA Interest Rate Reduction Refinance Loan, are less strict about DTI ratios and can make refinancing with a high DTI ratio possible. Other solutions include adding a co-signer or a cash-out refinance to consolidate and pay down debts.

- What risks are associated with closing with a high DTI ratio? Risks include potential deal breakers such as increases in homeowners insurance, property taxes, or homeowners association dues that can push DTI beyond acceptable limits. Borrowers at high DTI caps need to be aware of these risks.

- What does Gustan Cho Associates offer for borrowers with high DTI ratios? Gustan Cho Associates provides solutions like manual underwriting up to 65% DTI for VA loans and a special 90% LTV jumbo loan program with a 50% DTI cap. They operate with zero overlays on FHA, VA, USDA, and Conventional loans, facilitating approvals for borrowers with higher DTIs.

This blog about the Solutions To High Debt To Income Ratios On Home Purchase was updated on April 25th, 2024.

Ready to Buy a Home Despite High DTI? Let Us Help You Navigate the Process!

Contact us today to get expert advice and explore your options for financing.