This article will delve into the HUD guidelines for gift funds in the context of home purchase transactions involving Federal Housing Administration (FHA) loans. Our exploration will cover the fundamental HUD guidelines for gift funds and examine any potential modifications made to these guidelines concerning mortgage requirements.

It is essential to understand that the FHA, operating under HUD, plays a significant role in facilitating affordable housing options. Through this discussion, we aim to provide insights into the regulatory framework surrounding gift funds in FHA loan transactions, offering a comprehensive understanding of the HUD guidelines for gift funds.

HUD does not act as a lender and does not initiate or finance FHA loans. There is a common misconception among consumers that FHA is a government mortgage lender responsible for originating, processing, underwriting, funding, and servicing FHA loans. However, this is entirely inaccurate. The primary responsibility and role of HUD lie in providing insurance for mortgage loans to banks and lenders that have FHA approval and comply with all FHA mortgage lending requirements.

HUD guidelines for gift funds are implemented to regulate FHA loan applications, ensuring compliance with specified requirements for mortgage-related gift funds. HUD provides insurance in instances of borrower default on FHA loans, leading to lender losses during foreclosure.

Subsequently, HUD guarantees and offsets the losses suffered by the lender. Adherence to the HUD guidelines for gift funds is imperative for FHA loan applicants seeking HUD insurance, particularly if they have utilized such funds in their mortgage transactions.

HUD 4000.1 FHA Handbook For FHA Loans

On January 18, 2023, FHA came out with its newest lending guidelines, HUD’s FHA 4000.1 Handbook.

The HUD 4000.1 FHA Handbook outlines the comprehensive lending requirements that mortgage lenders must adhere to for HUD to provide insurance for the loans they originate and finance. The recently introduced HUD guidelines for gift funds in FHA loans are an integral component of the updated guidelines established by HUD.

Under HUD guidelines for gift funds, HUD allows homebuyers to get 100% gifted funds for the 3.5% down payment requirement on home purchases.

How Do HUD Guidelines For Gift Funds on FHA Loans Work?

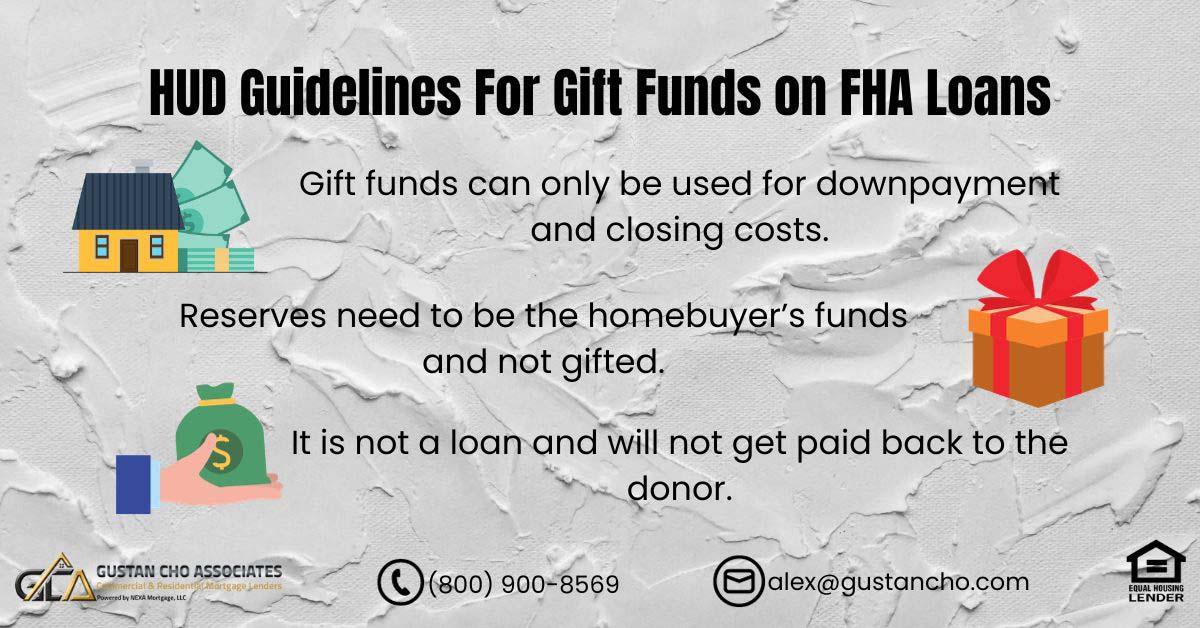

The HUD guidelines for gift funds specify that prospective homebuyers can utilize 100% gift funds for their home purchase. On FHA loans, adherence to stringent rules and regulations outlined by HUD is imperative. These guidelines stipulate that gift funds are exclusively permissible for covering down payments and closing costs.

Homebuyers are restricted from utilizing gift funds to cover the reserves mandated by lenders. Reserves encompass one month’s worth of principal, interest, taxes, and insurance, commonly known as P.I.T.I.

In instances where borrowers possess FICO credit scores below 600, mortgage lenders may require three months of reserves. It is essential to note that reserves must originate from the homebuyer’s own funds and cannot be received as a gift. Eligible asset accounts for reserves comprise I.R.A. retirement accounts, 401k retirement accounts, savings accounts, C.D.s, and investment securities accounts, as per H.U.D. guidelines for gift funds.

HUD guidelines for gist funds do not mandate the escrowing of reserves with the title company. Nevertheless, the verification of reserves will occur at the onset of the mortgage loan application process, and the underwriter will issue a clear-to-close based on this verification.

HUD Guidelines For Gift Fund On FHA Loans, click Here

How Do Lenders View Gift Funds

While HUD guidelines for gift funds permit using 100% gift funds for down payments and closing costs, lenders often hold a less favorable view of such funds, particularly when assessed through the Automated Underwriting System.

Numerous instances arise where individuals possessing low credit scores and less-than-ideal credit history, despite satisfying the obligatory minimum FHA guidelines, may not secure an automated underwriting system approval when relying entirely on gifted funds, as per HUD guidelines, for their down payment.

If the HUD GUIDELINES FOR GIFT FUNDS are excluded from the mortgage loan application, the Automated Underwriting System will generate an approve/eligibile status per its evaluation. In these instances, it is necessary to eliminate the gift funds and have the borrower generate them.

Strategies For Avoiding Gift Funds To Be Used For Down Payment

If borrowers face challenges in obtaining approval or eligibility via the automated underwriting system due to the utilization of gift funds for the down payment or closing costs, approval or eligibility will be conferred upon discontinuing the use of gift funds as per HUD guidelines for gift funds.

Specific approaches are available to circumvent the utilization of gift funds in compliance with the HUD guidelines for gift funds. One viable method involves incorporating the borrower into the donor’s bank account and establishing joint banking accounts.

By becoming a joint account holder, it becomes possible to obtain two-month bank statement printouts and subsequently validate those pages through the bank teller’s endorsement of signatures, dates, and stamps. This process ensures adherence to HUD guidelines for gift funds.

Borrowers must furnish a letter, signed and dated by the joint bank account holder(s), affirming their full authorization for 100% access to the shared bank account. As an alternative to utilizing gift funds directly, donors can deposit the gifts into the borrower’s bank account and permit a seasoning period of 60 days. This ensures compliance with HUD guidelines for gift funds.

Speak With Our Loan Officer for Getting Mortgage Loans

Understanding HUD Guidelines For Gift Funds Mortgage on FHA Loans

Prospective homebuyers are presented with the advantage of leveraging gift funds to alleviate the financial burden associated with the down payment when embarking on the journey to acquire a new home. This strategic approach allows individuals to seek assistance from generous donors willing to contribute to the initial costs of homeownership. In compliance with HUD guidelines for gift funds, the process involves the generous benefactor completing and signing a comprehensive gift letter.

This pivotal document, provided by lenders, confirms that the funds being gifted are expressly intended to cover the home purchase’s down payment and associated closing costs. The transparency inherent in this formal declaration ensures that the lending institution and the homebuyer are fully aware of the intended use of the gifted funds. By adhering to these HUD guidelines for gift funds, the entire transaction is characterized by clarity and accountability.

It is important to emphasize that the nature of this financial assistance is unequivocally a gift, not a loan. Unlike a loan, there is no expectation or obligation for the recipient to repay the gifted amount to the donor. This aspect adds a layer of financial flexibility and relief for the homebuyer, as they can embark on their homeownership journey without the burden of additional debt.

The HUD guidelines for gift funds create a structured and transparent framework that facilitates the seamless integration of external financial support into the homebuying process. By embracing this avenue, homebuyers can tap into the generosity of their network. At the same time, lenders can be assured that the financial assistance is aligned with established regulations, fostering a more secure and well-informed home purchase experience for all parties involved.

Compliance with HUD guidelines for gift funds is crucial, irrespective of whether the homebuyer reimburses the donor. The gift funds donation letter must explicitly articulate this and be duly signed and dated by the gift donor.

Additionally, the donoris required to furnish 30 days’ worth of bank statements, ensuring that the source of all funds in their bank account is documented. Detailed documentation of the transfer of gift funds from the donor’s account to the homebuyer’s account is also mandatory.

The homebuyer must provide a copy of the canceled check from both parties related to the gifted funds. Additionally, bank statements illustrating the withdrawal of the gift funds from the donor’s account and their subsequent transfer to the homebuyer’s account are required by HUD guidelines for gift funds.

If you have any questions about HUD guidelines for gift funds, don’t hesitate to contact us at Gustan Cho Associates at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

FAQ: Understanding HUD Guidelines for Gift Funds in FHA Loan Transactions

What are HUD guidelines for gift funds in the context of FHA loans? HUD guidelines for gift funds regulate the use of gifted funds in FHA loan transactions. They specify that homebuyers can utilize 100% gifted funds for their home purchase, covering down payments and closing costs.

How do these guidelines impact borrowers and lenders? For borrowers, adherence to HUD guidelines ensures compliance and eligibility for FHA loans. Lenders, however, may view reliance on gifted funds less favorably, particularly in automated underwriting assessments.

Can gift funds be used for reserves? No, according to HUD guidelines, gift funds are restricted from covering reserves required by lenders, which include one month’s worth of P.I.T.I. payments.

What strategies are available to avoid issues with gift funds during underwriting? Borrowers may avoid complications by discontinuing the use of gift funds if they hinder automated underwriting approval. Strategies include establishing joint bank accounts with donors or allowing a seasoning period for gifted funds in the borrower’s account.

What documentation is required to comply with HUD guidelines for gift funds? Documentation includes a comprehensive gift letter, signed and dated by the donor, along with 30 days’ worth of the donor’s bank statements. Additionally, records of fund transfer and canceled checks are necessary.

Is repayment of gifted funds required? No, gifted funds are not loans, and there is no expectation of repayment. However, compliance with HUD guidelines is essential regardless of repayment intentions.

you can use gift funds for reserves

Gift funds cannot be used for reserves. Gift funds can only be used for the down payment and closing costs on a home purchase. Reserves need to be borrower’s own money.