In this blog, we will cover choosing the right lender for a mortgage loan approval. Choosing The Right Lender with no overlays is extremely important for mortgage borrowers with prior credit issues. Examples of prior credit issues include the following:

- prior bankruptcy

- prior foreclosure

- prior short sale

- prior deed in-lieu-of foreclosure

- outstanding collections

- charge off accounts

- higher debt-to-income ratios

- do not have verification of rent

- lower credit scores

- late payments after bankruptcy and foreclosure

- recent late payments

- just had a Chapter 13 Bankruptcy discharge

- are in a current Chapter 13 Repayment Plan

- have judgments

- have tax liens

- or have other credit and income issues

Not All Lenders Have the Same Mortgage Guidelines on Government and Conforming Loans

Just because one lender says you do not qualify for a home loan does not mean that you do not qualify for a mortgage loan with another mortgage lender. The first place borrowers think about when they need a home loan is to visit their local bank and apply for a home loan there. Unfortunately, banks are one of the toughest places to qualify for home loans. Requirements at banks are much tougher than mortgage lenders with no lender overlays.

Is It Better To Get a Mortgage Approval Through a Broker or Bank?

Most banks have mortgage lender overlays. Overlays are additional mortgage lending requirements in addition to the minimum mortgage lending requirements that FHA requires, VA, USDA, Fannie Mae, and Freddie Mac.

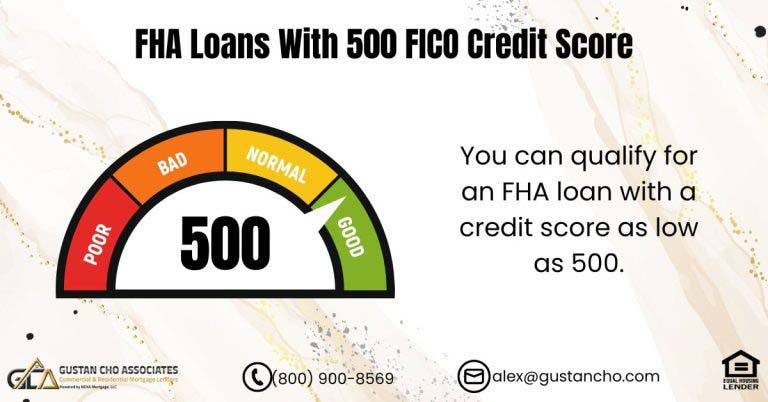

For example, here is a case scenario. The minimum credit score required to qualify for an FHA loan by HUD, HUD is the parent of FHA, is 580 FICO. However, most banks will not touch anyone who does not have a credit score of at least 640 FICO. The bank has lender overlays on credit scores.

Typical Overlays By Mortgage Lenders

There are other lender overlays that banks and lenders have. Here are examples of typical lender overlays imposed by lenders:

- lender overlays on debt-to-income ratios

- overlays on collection accounts

- charge off accounts

- lender overlays on verification of rent

- overlays on credit tradelines

- manual underwriting

- gift funds: some lenders do not allow gift funds even though HUD Guidelines allow it

Choosing The Right Lender With High Debt To Income Ratios

There are many borrowers who do not qualify for a mortgage loan because their debt-to-income ratios are too high. Many lenders have overlays on debt-to-income ratios, especially with FHA loans.

Under FHA Guidelines on Debt To Income Ratios, the maximum debt-to-income ratio permitted is 56.9% DTI for Borrowers with credit scores of at least 620. However, most banks and lenders will cap the debt-to-income ratio limits to 45% DTI.

Is It Easier To Get a Mortgage Approved Through a Broker?

Some mortgage companies will go to debt-to-income ratio caps of 50% DTI. This exception may be made as long as Borrower has credit scores of at least 680 FICO. This creates a problem for borrowers with a debt-to-income ratio of 56.9% DTI and lower credit scores. Choosing The Right Lender with no lender overlays on debt-to-income ratios, like myself, is crucial in securing an FHA loan.

Gustan Cho Associates has no lender overlays on FHA loans. Whatever the HUD Guidelines on debt-to-income ratios are what we go by. The team at Gustan Cho Associates goes by and can approve and close any borrower who meets the minimum HUD Lending Guidelines. HUD allows as many non-occupant co-borrowers to be added to the main borrower for borrowers with higher debt-to-income ratios.

Choosing The Right Lender With Outstanding Collection and Charge-Off Accounts

Under FHA Guidelines on Collection Accounts, outstanding collection and charge-off accounts do not have to be paid to qualify for FHA loans. However, most banks and lenders will require that all outstanding collection and charge-off accounts be paid in full. As part of their own overlays, these lenders require zero balances to be recorded on the borrower’s credit report before proceeding with the mortgage process. This is not necessary if borrowers choose the right mortgage lender.

Choosing The Right Lender With No Overlays

Choosing the right lender with no lender overlays is crucial for borrowers with many collections and charge-off accounts. Many borrowers contacted me and were told they did not qualify for multiple other lenders because they had outstanding collection and charge-off accounts.

The team at Gustan Cho Associates has helped thousands of borrowers get approved and closed on their FHA loans without needing to pay their outstanding collection and charge-off accounts. Borrowers who are told they do not qualify for an FHA loan unless they pay off their outstanding unpaid collection and charge-off accounts. Please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com, and I will be able to help you get your FHA loan approved and closed promptly.

Choosing The Right Lender With Outstanding Judgments and Tax Liens

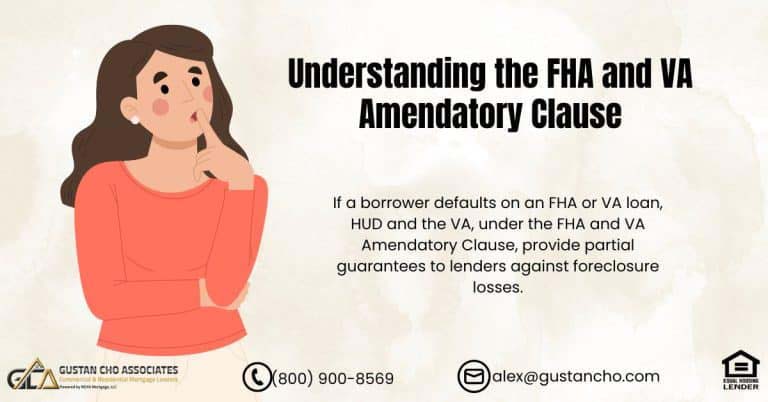

Many mortgage companies will not take your mortgage loan file submitted into processing and underwriting if you have an outstanding judgment or tax lien on your credit report unless you have paid off the judgment and tax liens and the zero balance is reported on your credit report. There are two solutions to having judgments and tax liens where you can still have outstanding judgments and tax liens and qualify for FHA loans.

Getting Approved For an FHA Loan With Outstanding Judgments

HUD, the parent of FHA, will allow borrowers with outstanding judgments or tax liens to qualify for FHA loans if they have a written payment agreement with the judgment creditor and the Internal Revenue Service and have made at least three monthly payments. The borrower must provide the mortgage lender with three months of canceled checks. Once a written payment agreement has been made with the judgment creditor and the IRS, you cannot pre-pay the three payments upfront and need to make at least three months’ worth of payments.

Getting Approved For a Mortgage With Written Payment Agreement on Tax Lien and Judgment

The second choice is borrowers can pay off judgment and tax lien at or prior to the closing of home loan. Borrowers will need a payoff letter from the judgment creditor and/or IRS and pay the funds to the title company. The title officer will record the payment in full. Consumers can pay a negotiated amount of the judgment as long as the judgment creditor will release the judgment.

Borrowers are told they do not qualify by other lenders due to their overlays or got a mortgage loan denial. Please give us a shout at 800-900-8569 or text for a faster response. Or email us at gcho@gustancho.com. Let me evaluate your situation and see if we can make it work. The team at Gustan Cho Associates is seven days a week, evenings, weekends, and holidays to take your calls and answer any questions you may have.

Get Mortgage Quotes

Mortgage lenders do not all charge the same interest rate. Some are very efficient and do so many loans that they can afford to make less on each transaction. Others are cheaper because they only work with perfect borrowers. And some charge less because they are understaffed and take all year to close loans.

Rates are important, but bad service can cost you a lot more than a small difference in interest rate.

That’s why you have to look further.

Lender Guidelines Vary

Not all mortgage lenders have the same underwriting guidelines. All lenders need to meet the minimum guidelines by FHA, VA, USDA, Fannie Mae, and/or Freddie Mac. But most also impose additional requirements called overlays.

Lenders add overlays to reduce the chance of having bad loans. Too many defaults or foreclosures, even if the lender follows the program rules to the letter, can cost a lender its approval to fund loans from agencies like FHA or corporations like Fannie Mae.

The FHA allows lenders to approve 96.5% loans to borrowers with FICO credit scores as low as 580, for instance. But many lenders set their minimum credit score at 600, 620, or even higher. That’s an overlay, and if you’re concerned about getting caught by one you need to find a lender with no overlays.

Lenders With No Overlays

Gustan Cho Associates adds no overlays to government and/or conventional loan underwriting. As long as the file gets a passing grade from the automated underwriting system (AUS) of the agency or corporation, Gustan Cho Associates will approve it.

Word of Mouth

There are many sources of mortgage funding. A mortgage lender can be a mortgage banker or mortgage broker. They work in credit unions, banks, investment firms, insurance companies, mortgage companies, savings and loans, and mortgage brokerages.

It’s smart to ask for referrals from friends, Realtors, attorneys, insurance agents, or anyone who you trust to make a thoughtful referral.

Not all mortgage lenders can suit every borrower’s needs. For example, borrowers with credit issues may need to seek a mortgage lender who specializes in bad credit mortgage loans.

Check Licensing

It’s smart to check a lender’s status with its licensing board. The Nationwide Mortgage Licensing System (NMLS) is a database of licensed mortgage loan officers and lending companies that consumers can search to make sure their lender is in good standing.

You can put a lender into the NMLS search box and get its licensing information. Speak With Our Loan Officer for Getting Mortgage Loans

Signs of a Great Mortgage Lender

Great mortgage lenders can make the home buying experience a pleasure, and bad ones can make it an expensive nightmare. Here’s what to look for in a mortgage lender.

They ask questions

It is impossible for mortgage lenders to provide an accurate mortgage quote without some information from you.

Expect questions concerning your credit rating, how long you expect to own the home, home use (vacation, rental, primary residence), and property type (condo, duplex, single-family home, etc.).

A great lender takes your answers and offers mortgage options that make sense for your needs.

They have knowledge

Knowledgeable mortgage pros know their industry and their products well enough to explain them in plain English. A great lender wants you to understand what you’re signing.

But a loan officer who hides behind a load of jargon may not actually understand the terms he or she is throwing at you. Even licensed loan officers don’t know everything about all programs. You need one who is an expert in helping borrowers like you.

Great mortgage lenders know that their biggest asset is their reputation, and each will go the extra mile to make you happy as the customer.

Pre-qualify for Mortgage Loans, Click Here

They solve problems for you

Experienced mortgage bankers and brokers expect the unexpected. They have experience dealing with glitches and monkey wrenches. Glitches are not uncommon so this is important.

The mortgage program you need was discontinued? An underwriter wants you to explain recent credit inquiries? Are there mistakes on your credit report?

A great mortgage lender will find a new program, help you write an letter of explanation or order a rapid rescore to fix your credit. Don’t risk getting a loser who falls apart when the going gets tough.

They communicate

Great mortgage lenders communicate in the style that you prefer. Whether that’s email, a text, or a call to your home, cell or office.

They keep you informed as much as you want them to, but don’t drown you in updates if you don’t want them. They return your calls, your emails, and your texts promptly.

Bad mortgage lenders, by contrast, make chasing new clients a higher priority over serving the clients they already have. And they evaporate if there is bad news to deliver.

They honor your comfort zone

Just because you can get approved for a specific loan amount doesn’t mean that you should.

If you can technically afford a $600,000 mortgage, but the payment makes you dizzy with fear, a great lender won’t push you. He or she can help you with a smaller loan size, a different mortgage program, or perhaps some budgeting help.

When you work with a great lender, the priority your comfort and financial wellbeing. Abd future business, of course.

Speak With Our Loan Officer for Getting Mortgage Loans

Specialty Mortgage Lenders

Not every mortgage lender can meet your individual needs.

Many lenders have their own internal overlays and don’t deal with certain credit profiles, products or loan amounts.

In addition to traditional lenders offering Fannie Mae and Freddie Mac loans, FHA and VA products, there are portfolio lenders who create their own loan products and guidelines. You might find products like these:

- Bank statement loans for self-employed

- One day out of bankruptcy or foreclose loans

- Super jumbo loans for very expensive homes

- Loans against your investment portfolio at a brokerage

- Loans for farms or unusual properties

- No income verification loans for investment properties

These non-QM loans or non-prime loans don’t work for everyone but they are helpful to people with specific sets of circumstances.

Ask an Expert

Gustan Cho Associates has ZERO OVERLAYS on government and conventional loans.

Home Buyers who need to qualify for a mortgage with a national five-star direct lender with no mortgage lender overlays on FHA, VA, USDA, Conventional Loans, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.

All of our pre-approvals at Gustan Cho Associates are full credit approvals that have been fully underwritten and signed off by our mortgage underwriters. This is why we close all of our pre-approved borrowers. We are available 7 days a week, evenings, weekends, and holidays.