This guide covers the waiting period mortgage guidelines after housing events and bankruptcy. Homebuyers with prior bankruptcy, foreclosure, deed-in-lieu of foreclosure, or short sale have a mandatory waiting period to qualify for a mortgage. FHA, VA, and USDA loan programs have a waiting period of 2 years after Chapter 7 bankruptcy. Waiting period mortgage guidelines start date after a housing event is the date when the deed of the property has transferred out of the homeowner’s name into the name of the lender or the new property owner, says Ronda Butts, a dually licensed realtor and loan officer:

The waiting period time clock starts from the discharge date of Chapter 7 bankruptcy. There is a three-year waiting period after the recorded foreclosure date or deed-in-lieu of foreclosure to qualify for FHA and USDA loans.

There is a three-year waiting period to qualify after a short sale for an FHA and USDA loan after the short sale date, which is reflected on the settlement statement. The U.S. Department Of Veteran Affairs (VA) has a two-year waiting period after Chapter 7 Bankruptcy, short sale, deed in lieu, and foreclosure to qualify for VA home loans. Fannie Mae and Freddie Mac have a special rule. If you have a mortgage included in the bankruptcy, the waiting period start date is the discharge date and not the date of the housing event.

Conforming Waiting Period Mortgage Guidelines

Conventional loans have a four-year waiting period after Chapter 7 bankruptcy, deed-in-lieu of foreclosure, and short sale to qualify for a conventional loan. The minimum down payment required is 5% on home purchases. Fannie Mae and Freddie Mac have a 3% down payment conforming loan programs for first-time home buyers. Homebuyers who have a mortgage included in a bankruptcy, Fannie Mae and Freddie Mac will base the waiting period mortgage guidelines start date on the date of the bankruptcy discharge date and not the date of the housing event, says Dale Elenteny of Gustan Cho Associates:

First-time home buyers are those who have had no ownership of a home for the past three years. There is a 7-year period after standard foreclosure to qualify for conventional loans. However, if borrowers had mortgages included in Chapter 7 bankruptcy, here are the Waiting Period Mortgage Guidelines. Suppose the deed to the property did not transfer out of the homeowner’s name until after the discharge date. Conforming waiting period mortgage guidelines state that the four-year waiting period starts from the discharge date of Chapter 7 Bankruptcy.

The housing event needs to have been finalized as foreclosure, deed-in-lieu of foreclosure, or short sale. The date of the housing event does not matter, and only the discharge date of Chapter 7 is what counts. Mortgage included in Chapter 7 Bankruptcy cannot have been reaffirmed. This is a brand new Fannie Mae Guideline that just launched on August 15th, 2014.

Alternatives To Home Purchase Waiting Period Mortgage Guidelines

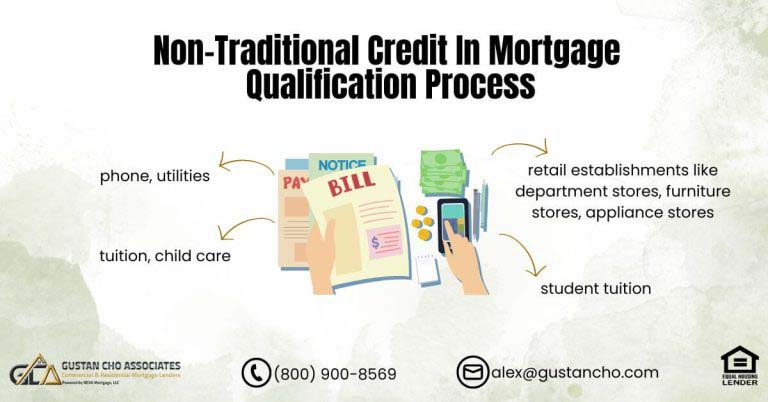

There are options for consumers who recently have gone through bankruptcy, foreclosure, deed-in-lieu of foreclosure, or short sale, are ready to purchase a home, and do not want to wait until the waiting period is over. Non-QM loans often offer no waiting period mortgage guidelines after a housing event or bankruptcy. However, non-QM wholesale lenders can change their guidelines from time to time and may require a one-year waiting period after a housing event and bankruptcy, says Alex Carlucci.

Gustan Cho Associates Mortgage Group offers non-QM loans. There are no waiting period mortgage guidelines after a housing event or bankruptcy.

A 10 to 20% down payment is required on a home purchase. The amount of down payment on a home purchase required depends on borrowers’ credit scores. There is no private mortgage insurance required on non-QM loans. There are no loan limits on non-QM loans.

Apply For Buying Home After Bankruptcy And Foreclosure

Apply Online And Get recommendations From Loan Experts

Waiting Period Mortgage Guidelines On Chapter 13 Bankruptcy

Home Buyers in a current Chapter 13 Bankruptcy Repayment Plan can qualify for FHA and VA home loans one year into their repayment plan. Trustee approval is required. Most Chapter 13 Bankruptcy Trustees will sign off on a home purchase during Chapter 13 Bankruptcy Repayment Periods.

There is no waiting period to qualify for FHA and VA loans after the Chapter 13 Bankruptcy discharge date. Most lenders will require two years after the Chapter 13 Bankruptcy discharge date.

There is no waiting period requirement after the discharge date after Chapter 13 Bankruptcy. Lenders require a waiting period after Chapter 13 because their lending requirements are called mortgage guidelines. There is a two-year period to qualify for conventional loans after the Chapter 13 Bankruptcy discharge date. There is a four-year waiting period to qualify for Conforming loans after the Chapter 13 Bankruptcy dismissal date.

Owner Financing on Home Purchase

There are other alternatives home buyers can purchase or refinance a home after bankruptcy, foreclosure, deed-in-lieu of foreclosure, or short sale without meeting the waiting period mortgage guidelines. Seller financing is a great option. Many home sellers that are selling a fixer-upper can get prime dollars for their homes selling it by seller financing, says Alex Carlucci of Gustan Cho Associates:

The first and most favorable option is owner or seller financing. This is where the home sellers act as the lender. Owner financing is when buyers give the home seller a down payment. Monthly housing payment is made to the home seller.

Seller financing is short-term bridge loans until they can get regular traditional financing. Most sellers will want to balloon the note in three to five years, if not earlier. After meeting the traditional waiting period mortgage guidelines, homeowners would refinance the home with a government or traditional home loan.

Buying a Home After Bankruptcy and Foreclosure

The waiting period after bankruptcy and foreclosure does not prohibit buyers from owning a property. Waiting period mortgage guidelines prohibit buyers from qualifying for government or conforming loans until the waiting period requirements are met.

Home sellers who sell their homes via seller financing make positive cash flow from the monthly payments. They can make interest income. Home sellers can sell their homes at higher than market interest rates. A home seller does not need to have the property free and clear to sell their home via owner financing. Make sure both parties have attorneys representing them so both parties are protected.

Married Homebuyers With Spouse on Title But Not on Note

Another option is if the spouse was on the title but not on the mortgage loan note, homebuyers can purchase a new home. Have the mortgage under the spouse’s name. As long as they qualify with debt-to-income ratios, both husband and wife do not need to be on the mortgage.

Married folks do not always have both folks file bankruptcy and have a housing event. If the other spouse was not on the title and had a bankruptcy, foreclosure, deed-on-lieu of foreclosure, or short sale, that spouse can be on the mortgage loan as the other spouse can go on title.

Same with bankruptcy. If one spouse had a bankruptcy and the other spouse did not, the spouse is not under the waiting period mortgage guidelines requirement. If a spouse does not have income, the spouse can have a non-occupant co-borrower. Non-occupant co-borrowers can be added to FHA Loans. The non-occupant co-borrower will go on the mortgage note but not the title.

What Are Straw Buyers

Homebuyers with a relative willing to purchase the home for them as an investment property can be an option. Straw Buyers are illegal, but there are ways of making it legal if a family member is willing to purchase property as an investment property. Do not lie on mortgage loan applications.

It is illegal for a non-occupant home buyer to state they will be an owner-occupant to buy a home for another person. Stating they will be an owner-occupant occupying the property as their main residence is illegal if they have no intention to.

It is considered a straw buyer. Straw buyer, home purchase strategies are considered mortgage fraud. It is classified as a felony punishable by up to 30 years in federal prison. However, a relative or family member can purchase the property as an investment property. The resident can go on the title and make the mortgage payments. After the waiting period, you can qualify for a refinance mortgage loan. Refinance family members or relatives off.

Non-QM Portfolio Loans

Portfolio loans are loan programs where the mortgage lender will hold the note and not re-sell it to Fannie Mae or Freddie Mac. Portfolio lenders are banks, credit unions, and mortgage companies that offer adjustable-rate mortgages. The mortgage is amortized over 30 years. Do not need to follow HUD or Conventional waiting period mortgage guidelines.

Gustan Cho Associates Mortgage Group offers non-QM loans for homebuyers who cannot meet the waiting period mortgage guidelines after housing events or bankruptcy. There is no waiting period to qualify for non-QM mortgages after housing events and bankruptcy.

A 10% to 20% down payment is required to qualify for non-QM loans. Down payment requirements depend on the borrowers’ credit scores—no maximum loan limit. There are no private mortgage insurance requirements. Contact us at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com.

Frequently Asked Questions About Waiting Period Mortgage Guidelines:

Q: What are Waiting Period Mortgage Guidelines?

A: Waiting period mortgage guidelines require a certain amount of time to pass after events like bankruptcy, foreclosure, or a short sale before you can qualify for a new mortgage.

Q: How Long Must I Wait After Chapter 7 Bankruptcy to Get a Mortgage?

A: The waiting period for FHA, VA, and USDA loans is 2 years from the discharge date. Conventional loans require a 4-year waiting period.

Q: What is the Waiting Period After a Foreclosure?

A: The waiting period starts from the date the foreclosure is recorded. It’s 3 years for FHA and USDA loans and 7 years for conventional loans.

Q: Does a Short Sale Have the Same Waiting Period as a Foreclosure?

A: Yes, FHA and USDA loans have a 3-year waiting period after a short sale, while conventional loans require 4 years.

Q: What if My Mortgage was Included in Chapter 7 Bankruptcy?

A: If your mortgage was included in a Chapter 7 bankruptcy, the waiting period for conventional loans starts from the bankruptcy discharge date, not the foreclosure date.

Q: Are There Options to Buy a Home Without Waiting for the Required Time?

A: Yes, non-QM loans don’t have a waiting period mortgage guideline. They may require a higher down payment, usually between 10% and 20%.

Q: Can I Qualify for a Mortgage in a Chapter 13 Bankruptcy Repayment Plan?

A: Yes, FHA and VA loans allow you to qualify after 1 year in a Chapter 13 repayment plan with trustee approval.

Q: What is the Waiting Period for Conventional Loans After Chapter 13 Bankruptcy?

A: It’s 2 years after the discharge date or 4 years after the dismissal date.

Q: What Happens if My Spouse Went Through Bankruptcy but I Didn’t?

A: You can apply for a mortgage using only your name, provided you meet the guidelines and debt-to-income ratio requirements.

Q: What are the Advantages of Non-QM Loans for Buyers Who Can’t Wait?

A: Non-QM loans don’t follow waiting period mortgage guidelines, require no private mortgage insurance, and have flexible qualification terms, though they require a larger down payment.

This blog about “Waiting Period Mortgage Guidelines After Housing Events” was updated on December 4th, 2024.

Take First Step Toward Making Your Dream A Reality

Apply Online And Get recommendations From Loan Experts