Best Mortgage Lenders for Bad Credit in Hawaii: Get Approved in 2025

If you have bad credit and want to buy a home in Hawaii, you might be wondering: Can I get a mortgage? Are there lenders that will approve me? The answer is YES! Many lenders offer mortgage loans for bad credit in Hawaii, and some specialize in working with borrowers like you.

In this guide, we’ll walk you through how to find the best mortgage lenders for bad credit in Hawaii, what loan programs are available, and how to increase your chances of getting approved—even with a low credit score.

What Is the Minimum Credit Score to Buy a House in Hawaii?

Your credit rating is an important factor in getting a home loan in Hawaii, but you don’t need perfect credit to qualify. Here are the minimum scores required for different mortgage programs:

- FHA Loans: A credit score of 500 or higher is required, with a 10% down payment. Alternatively, a score of 580 or more is necessary for a 3.5% down payment.

- VA Loans: No minimum set by the VA, but most lenders prefer 580+

- USDA Loans: Typically 640+, but some lenders allow lower scores

- Conventional Loans: 620+ (but higher scores get better rates)

- Non-QM Loans: As low as 500 (varies by lender)

Even if your score is below 500, you still have options! Some of the best mortgage lenders for bad credit in Hawaii offer alternative loan programs that don’t rely on traditional credit scores.

Loan Limits in Hawaii

In 2025, new limits are established for mortgage amounts, which can be considered the minimum and maximum lenders can offer. The floor is $524,255, meaning that this is the least amount you can borrow for a mortgage. The ceiling, on the other hand, is at $1,209,750, representing the highest loan limit available. In Hilo, Hawaii, which is known for being one of the more affordable locations, the minimum loan amount is increased to $571,550.

Suppose you find yourself in a situation where you’re worried about your credit score. In that case, you might be searching for the best mortgage lenders for bad credit in Hawaii. It’s important to know that there are lenders out there who specialize in helping people with less-than-perfect credit. Don’t hesitate to explore all your options with these lenders.

Dreaming of a Home in Hawaii? See If Your Credit Score Qualifies

Apply For A Mortgage Loan Today!

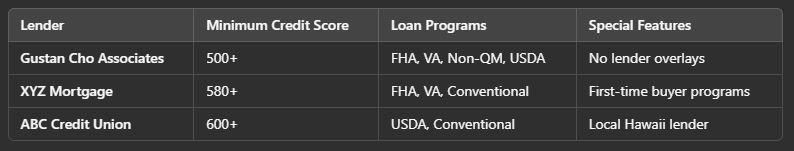

Which Mortgage Lenders in Hawaii Are Best for Bad Credit?

Not all lenders in Hawaii work with bad credit borrowers. Some have stricter guidelines (lender overlays), while others follow only federal mortgage rules. Here are the best mortgage lenders for bad credit in Hawaii:

Why Choose Gustan Cho Associates?

When looking for the best mortgage lenders for bad credit in Hawaii, consider Gustan Cho Associates.

- No lender overlays (we follow only FHA, VA, and USDA guidelines).

- Approvals for credit scores as low as 500.

- Specializing in high-balance FHA and VA jumbo loans (perfect for Hawaii’s high-cost homes).

- Fast closings with competitive rates for bad credit borrowers.

Is It Possible to Buy a Home in Hawaii With No Down Payment?

Yes! Here are three ways to buy a home with no or low down payment:

- VA Loans (0% Down) – If you are a veteran, active-duty service member, or a qualified spouse, you may be eligible for a VA loan that requires no down payment.

- USDA Loans (0% Down) – If you’re buying in a rural area of Hawaii, you may qualify for a USDA loan with 100% financing.

- Down Payment Assistance (DPA) Programs—Hawaii has state and local programs that help with down payments and closing costs.

💡 Pro Tip: Even if you don’t qualify for zero-down financing, you can still buy with just 3.5% down using an FHA loan with the best mortgage lenders for bad credit in Hawaii.

Don’t Let Credit Hold You Back! Find Out Your Loan Options in Hawaii

Apply For A Mortgage Loan Today!

How to Get a Mortgage With Bad Credit in Hawaii

Suppose you have bad credit and are aiming to boost your chances of mortgage approval. In that case, the best mortgage lenders for bad credit in Hawaii recommend the following steps:

1. Check Your Credit Score

Before you apply for a mortgage, get a free credit report and check for errors. If you find mistakes, dispute them to improve your score.

2. Improve Your Credit Score (Even a Little Bit Helps!)

- Pay all bills on time (late payments hurt scores the most).

- Pay down credit card balances below 30% of your limit.

- Get secured credit cards or credit builder loans to establish new positive credit.

3. Work With a Mortgage Broker Specializing in Bad Credit

A mortgage broker like Gustan Cho Associates helps clients connect with different lenders. They find the right mortgage options for people with bad credit in Hawaii, making sure to meet their specific needs.

4. Save for a Down Payment

Having more money for a down payment can offset a low credit score and help you get approved faster.

3. Consider a Non-QM Loan

If you don’t qualify for FHA, VA, or USDA loans, consider a non-QM loan, which allows:

- No tax returns (bank statement loans for self-employed borrowers)

- Low credit scores (500-579 OK)

- No waiting period after bankruptcy or foreclosure

Are you unsure about what to do? Contact us today for a free chat! We can help you find the best mortgage lenders for bad credit in Hawaii.

How Much Do You Need to Buy a House in Hawaii?

Hawaii has some of the highest home prices in the U.S., so budgeting is important. Here’s what you need to consider:

- Average Home Price (2024-2025): $835,000+ (varies by island)

- Minimum Down Payment: $0 (VA/USDA) or 3.5% (FHA)

- Closing Costs: 2-5% of the loan amount

- Mortgage Payment: $3,500+/month (depends on loan size and rate)

💡 Tip: If you’re looking to buy an expensive home, finding a lender who knows a lot about high-balance FHA and VA jumbo loans is a good idea. Check out the best mortgage lenders for bad credit in Hawaii if you have bad credit. They can guide you through the process and help you find the right loan.

Get Pre-Approved for a Mortgage in Hawaii Today!

You can make your dream of owning a home in beautiful Hawaii a reality, even with credit challenges. Just find a lender who understands your situation and is eager to help. Gustan Cho Associates is one of the best mortgage lenders for bad credit in Hawaii, offering:

- FHA loans down to 500 credit score

- No lender overlays (we follow only agency guidelines!)

- Fast closings & competitive rates

- Expert loan officers available 7 days a week

📞 Call or text us today at 800-900-8569 or email alex@gustancho.com to see what you qualify for! 🚀

Credit Score Matters! Check Your Eligibility for a Hawaii Home Loan Today!

Apply For A Mortgage Loan Today!

Frequently Asked Questions About the Best Mortgage Lenders for Bad Credit in Hawaii:

Q: Can I Buy a Home in Hawaii with Bad Credit?

A: Yes! The leading mortgage providers in Hawaii offer FHA, VA, USDA, and non-QM loans. These options allow homebuyers with low credit scores to qualify for financing.

Q: What is the Lowest Credit Score I Need to Get a Mortgage in Hawaii?

A: FHA loans are accessible for individuals with credit scores starting at 500 if they provide a 10% down payment. Alternatively, a score of 580 will enable borrowers to qualify with only a 3.5% down payment. In comparison, VA and USDA loans generally have a higher requirement, with scores ranging from 580 to 640. Furthermore, non-QM loans can accommodate credit scores of 500 or even lower.

Q: Which Mortgage Lenders in Hawaii are Best for Bad Credit?

A: The best mortgage lenders for bad credit in Hawaii are those with no lender overlays, such as Gustan Cho Associates, which follows only FHA, VA, and USDA guidelines and approves borrowers with scores as low as 500.

Q: Can I Get a Mortgage in Hawaii with no Down Payment?

A: Yes! If you qualify for a VA loan designed for veterans or a USDA loan aimed at rural areas, they can secure 100% financing without needing a down payment. Additionally, various down payment assistance (DPA) programs are accessible in Hawaii to help potential homebuyers.

Q: How Much Money do I Need to Buy a Home in Hawaii?

A: Home prices in Hawaii are very high, averaging over $835,000 in 2024-2025. The amount you need for a down payment depends on the type of loan. It can be as low as 0% for VA and USDA loans or 3.5% for FHA loans. The costs associated with closing typically lie between 2% and 5% of the total loan amount.

Q: What Steps Can I Take to Boost My Credit Score and be Eligible for a Mortgage in Hawaii?

A: The best mortgage lenders for bad credit in Hawaii recommend:

- Paying bills on time

- Maintaining credit card balances at under 30% of the credit limit.

- Disputing errors on your credit report

- Exploring options like credit builder loans or secured credit cards can be beneficial for improving credit scores.

Q: Are There Special Home Loan Programs for First-Time Buyers in Hawaii?

A: Yes! First-time homebuyers in Hawaii can access FHA loans, USDA loans, and state-specific down payment assistance programs to help with closing costs and affordability.

Q: What if I have a Foreclosure or Bankruptcy? Can I Still Get a Mortgage?

A: Yes! FHA loans allow borrowers 2 years after Chapter 7 bankruptcy and 3 years after foreclosure. VA and USDA loans have similar waiting periods, while non-QM loans have no waiting period after bankruptcy or foreclosure.

Q: Is Working with a Mortgage Broker for Bad Credit Home Loans Better?

A: Yes! Mortgage brokers like Gustan Cho Associates can help you find the best mortgage lenders for bad credit in Hawaii. This connection can increase your chances of getting approved and receiving better interest rates.

Q: How do I Get Pre-Approved with the Best Mortgage Lenders for Bad Credit in Hawaii?

A: First, check your credit score. Next, save money for a down payment. Finally, work with a broker. You can apply online or call Gustan Cho Associates at (800) 900-8569 for a free consultation.

This blog about the “Best Mortgage Lenders for Bad Credit in Hawaii” was updated on February 10th, 2025.

Get Closer to Homeownership in Hawaii! Find Out If Your Credit Score Qualifies

Apply Online And Get recommendations From Loan Experts