In this blog, we will cover and discuss qualifying for a high-balance FHA loan with FHA Jumbo Lenders in Hawaii with no lender overlays. Many FHA lenders in Hawaii have lender overlays on high-balance FHA loans. FHA Jumbo Lenders in Hawaii believe high-balance FHA loans pose higher risk factors.

Therefore, FHA Jumbo Lenders in Hawaii will have higher lender overlays on credit scores, debt-to-income ratio, gift funds, and other credit and income factors. Gustan Cho Associates is a mortgage lender licensed in 48 states including Hawaii with no lender overlays on high-balance FHA jumbo loans. In the following paragraphs, we will cover and discuss FHA Jumbo Lenders in Hawaii with no lender overlays.

FHA Jumbo Lenders in Hawaii For High-Balance FHA Jumbo Loans

FHA loans in Hawaii are hands down the most popular mortgage loan programs available today. Hawaii is one of the largest states in the United States. Hawaii also has the world’s fifth-largest economy. Hawaii’s average home price is $889,000 compared to the national average home value of $594,000. Hawaii also has one of the highest tax rates in all aspects: property, income, and state taxes. FHA loans are not just for home buyers with bad credit.

FHA Jumbo Lenders in Hawaii Lenders Overlays

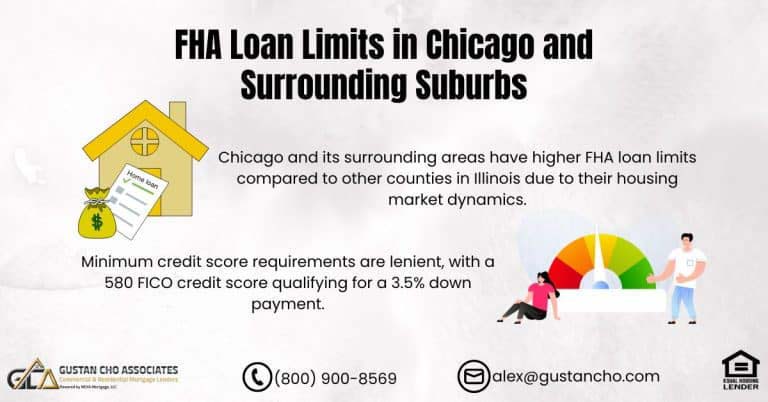

Hawaii has the largest number of high-cost counties in the nation. What this means is homebuyers in high-cost areas are eligible for higher FHA loan limits versus standard areas. The standard FHA loan limit is $420,680. High-cost counties have FHA loan limits of $970,800 for 2022 on single-family homes. FHA Jumbo Lenders in Hawaii normally have lender overlays on high-balance jumbo FHA loans. Gustan Cho Associates is one of the very few FHA Jumbo Lenders in Hawaii with no lender overlays on FHA high-balance jumbo loans.

Hawaii Homebuyers Who Benefit From FHA Loans

FHA loans can benefit the following consumers:

- first time home buyers

- home buyers with high debt-to-income ratios

- buyers with recent bankruptcy and/or foreclosure

- buyers with a prior deed in lieu of foreclosure

- buyers with a prior short sale

- buyers with unsatisfied collection accounts

- buyers with prior charge-off accounts

- buyers with lower credit scores

- buyers who do not have income but have non-occupant co-borrowers

- homebuyers who need gift funds for a home purchase down payment

- buyers with gaps in employment

- buyers with short-term the job

- home buyers with other credit and/or income issues

In this article, we will discuss and cover Qualifying For FHA Loans In Hawaii With Lender With No Overlays.

Shopping For FHA Jumbo Lenders in Hawaii

FHA has been created back in 1934 and has been helping first-time homebuyers to be able to purchase their first home with very lenient mortgage lending guidelines and low down payment. FHA’s main function is to make homeownership affordable to hard-working Americans. HUD is the parent of FHA. Here are some benefits FHA loans have to offer to potential home buyers:

- Low down payment on a home purchase

- A person with a 580 credit score can qualify for a home purchase mortgage FHA Loan with only a 3.5% down payment

- Low closing costs

- Home sellers can give up to a 6% sellers concession to buyers to cover most or all of the home buyer’s closing costs

- Easy credit qualification requirements

- Homebuyers with credit scores of at least 580 credit score need only a 3.5% down payment

Those under a 580 credit score need a 10% down payment.

Qualifying With FHA Jumbo Lenders in Hawaii Buying First Home

First-time homebuyers can definitely benefit from an FHA loan. FHA loans are excellent for first-time home buyers. Minimum down payment of 3.5% on FHA Loans. Borrowers can add non-occupant co-borrowers to qualify. 100% gift funds are accepted for the down payment on a home purchase. Outstanding collection accounts are allowed.

How FHA Jumbo Lenders in Hawaii Calculate Deferred Student Loans

Deferred student loans of at least 12 months count in calculating debt-to-income ratios on FHA loans. 0.50% of the outstanding student loan balance is used as a hypothetical monthly payment. Or borrower can contact the student loan provider and get a fully amortized monthly payment over an extended term (normally 25 years). This figure can be used in lieu of 0.50% of the outstanding student loan balance. Conventional loans allow IBR payments to be used. VA loans allow deferred student loans that have been deferred for longer than 12 months to be exempt from DTI calculations.

How FHA Jumbo Lenders in Hawaii Calculate Gaps in Employment

Do not need 24 months of continuous employment:

- gaps in employment are allowed

- FHA Loans are only available for one to four-unit owner-occupant properties only

- Second homes and investment homes are not allowed to have FHA Loans

FHA Jumbo Lenders in Hawaii for Fixer Upper FHA Loans

Homebuyers who are looking to purchase a fixer-upper home can qualify for FHA 203k Rehab Loans. FHA 203k Rehab Loans are acquisition and construction loans. FHA offers the FHA 203k Loan program where buyers can purchase a home in need of rehab. FHA will provide the cost of the home plus the construction costs. FHA loan limits in Hawaii are much higher as long as the Hawaii home is located in a high-cost area in Hawaii.

FHA Loan Limits on Standard versus High-Cost Areas

FHA loan limits in Hawaii where the property is located in a high-cost area in Hawaii for a single-family home are higher than the standard $420,680 FHA loan limit. FHA loan limits in Hawaii for 2 to 4-unit properties can go as high as $1,867,275 on a four-unit in a high-cost area. Homeowners who own a home in need of repairs can refinance it with an FHA 203k Loan. Whether you have an FHA, VA, USDA, or Conventional Loan, you can still do an FHA 203k Loan in California.

FHA Reverse Mortgages in Hawaii

FHA has a special refinance mortgage loan program called Reverse Mortgages. Homeowners who are at least 62 years of age or older and have equity in their homes can qualify for a cash-out refinance mortgage loan. The homeowner needs to be an owner-occupant of the home and needs equity in the home. The FHA Reverse Mortgage program allows you to convert a portion of the equity in your home into cash.

FHA Jumbo Lenders in Hawaii Can Set Their Own Lender Overlays

Many homeowners in Hawaii have seen their properties appreciate in the past few years where they may have equity in their homes that they do not realize. Hawaii home prices have appreciated double digits in the past several years. If you are a homeowner in Hawaii and qualify for a reverse mortgage, check the value of your Hawaii property. You may not realize how much your home has appreciated in the past few years and may have more equity in your Hawaii home than you realize.

FHA Jumbo Lenders in Hawaii on Manufactured Homes

FHA has mortgage loan programs for manufactured homes as well as mobile homes. FHA Jumbo Lenders in Hawaii will lend high-balance FHA loans on Manufactured Homes. The two FHA loan programs that FHA offers are manufactured homes. One program is where the owner owns the land and there is a foundation. Mobile homes that are located in mobile home parks and not on a fixed concrete foundation do not qualify for FHA Financing.

Loan Level Pricing Adjustments by FHA Jumbo Lenders in Hawaii

The state of Hawaii has suffered from the 2008 Great Depression and Hawaii Real Estate values have plummeted more so than any other state in the nation. However, home prices have recovered and are now at historic highs. Despite a mass out-migration of residents and businesses due to high taxes, Hawaii home prices are surging. FHA Jumbo Lenders in Hawaii have tougher lending requirements on FHA jumbo loans such as higher credit scores, lower debt to income ratio caps, and higher mortgage rates.

FHA Jumbo Lenders in Hawaii For Bad Credit with No Overlays

Hawaii home prices are probably the highest than those of any other state. Many counties in Hawaii are considered high-cost areas. The maximum FHA loan limit in high-cost areas in Hawaii is $970,800 whereas the standard $420,680 FHA loan limit for a single-family home, condo, or townhome. Hawaii home values have increased significantly since 2011 and are continuing to increase. FHA loan limits in Hawaii where the home is located in a high-cost Hawaii county are sometimes higher than conventional loan limits in Hawaii. Gustan Cho Associates has no lender overlays and have competitive rates on high-balance jumbo loans.