In this blog, we will cover and discuss conventional loans versus government-backed mortgages and the differences. Conventional loans are the most popular loan program in the United States. Owner-occupant primary homes, second homes, and investment properties are eligible for conventional loan financing. Owner-occupant primary one to four-unit homes is eligible for government-backed loans. You cannot finance second homes or two to four-unit investment homes with government loans.

Government Versus Conventional Loans When Buying A House

Buying a house with a government or conventional loan is best recommended for first-time homebuyers due to the low down payment requirement and competitive rates. Government-backed mortgage loans are home loans insured by one of three government agencies. Three government agencies insure lenders if borrowers default on their home mortgage. Lenders can offer little to no down payment, and very low mortgage rates on government loans are due to this government guarantee to lenders. HUD, VA, and USDA do not originate mortgage loans. They act as federal mortgage insurers. Here are the three government agencies that insure home loans:

- HUD is the parent of FHA and insures FHA loans

- Department of Veterans Affairs (VA) insures VA mortgages

- U.S. Department of Agriculture (USDA) insures USDA loans

Conventional loans are also called conforming loans because they need to conform to Fannie Mae or Freddie Mac Guidelines. Conforming Loans are not guaranteed by any government agency. However, lenders require borrowers to conform to Fannie Mae or Freddie Mac Guidelines because these two agencies will not purchase conventional loans that do not meet their lending guidelines. FHA loans, because they are the most popular loans in the U.S. FHA loans, have the most lenient mortgage guidelines than any other loan program.

Conventional Loans Versus Government-Backed Mortgages: Types of Government Loans

There are three different types of government-backed mortgages:

- FHA loans backed by the United States Department of Housing and Urban Development

- VA loans backed by the U.S. Department of Veterans Affairs

- USDA loans backed by the U.S. Department of Agriculture Rural Development Program

Conventional loans are not guaranteed by any government agency. Therefore, it has stricter credit and income requirements and guidelines than government-backed mortgages. Borrowers have more options on conventional versus government-backed loans. Loan limits are generally higher on conventional loans. Borrowers can also qualify for warrantable condos with conventional loans where condos need to be agency-approved on government loans.

Contact US to Qualify For Conventional Loans Versus Government-Backed Mortgages

Conventional Loans Versus Government-Backed Mortgages: Second Home Financing

Conventional loans allow financing on second homes and one to four-unit residentially zoned investment homes. It is important to understand Fannie Mae and Freddie Mac Agency Guidelines versus lender overlays on conventional loans. We will cover what lender overlays on conventional loans extensively in the following paragraphs. Gustan Cho Associates has no lender overlays on conventional loans. In this article, we will discuss and cover the difference between Conventional Loans Versus Government-Backed Mortgages. We will also cover the benefits of Conventional Loans Versus Government-Backed Mortgages.

Why Are Conventional Loans Often Referred To As Conforming Loans

Conventional loans are home mortgages that are not backed by a government agency like FHA, VA, and USDA loans are. Fannie Mae and Freddie Mac is not a government agency. Fannie and Freddie are the two mortgage giants and are government-sponsored enterprises or commonly referred to as GSE. Fannie Mae and Freddie Mac are the GSE that sets the lending guidelines on conventional loans. Fannie and Freddie have minimum lending requirements which we will go over later in the following paragraphs.

Learn More on Conventional Loans Versus Government-Backed Mortgages

Fannie Mae and Freddie Mac GSE Agency Guidelines

Why do Conventional loans have strict guidelines such as minimum credit score requirements, debt to income ratio caps, waiting period after bankruptcy and/or foreclosure, and other requirements if they are not federally regulated? This is a great question. Conventional loans are often referred to as conforming loans. Why are they called conforming loans? Conventional loans are called conforming loans because they need to conform to Fannie Mae and/or Freddie Mac lending guidelines. Fannie Mae and Freddie Mac are the two mortgage giants in the United States. Both Fannie and Freddie are government-sponsored enterprises or GSE.

The Role of Fannie Mae and Freddie Mac

The role of Fannie Mae and Freddie Mac is to purchase mortgages and provide liquidity in the mortgage markets. Fannie and Freddie only purchase mortgages that conform to their lending standards and guidelines. Lenders use their warehouse lines of credit to fund conventional loans. However, lenders do not want to hold the loans they fund. Mortgage lenders will sell the loans they fund using their warehouse line of credit on the secondary mortgage market. They may sell it to larger mortgage bankers and/or correspondent lenders.

How Fannie Mae and Freddie Mac Stabilize The Housing Market By Buying Mortgages on the Secondary Market

Ultimately, the larger mortgage bankers and/or correspondent lenders will package these loans they purchase and sell them to Fannie and Freddie which are the largest buyers of mortgage loans on the secondary market. This is why lenders will make sure the conventional loans they originate and fund conform to Fannie Mae and/or Freddie Mac agency guidelines.

Borrowers Who Should Choose Conventional Versus Government Loans

Borrowers with stronger credit and income profiles should opt for conventional versus government loans. Homebuyers with higher credit scores and great credit will benefit from conventional versus government-backed loans. The minimum down payment required on conventional loans for first-time homebuyers is a 3% down payment. Fannie Mae and Freddie Mac define a first-time homebuyer as a buyer who did not have any ownership of a home in the past three years. Otherwise, the minimum down payment required on a home purchase with a conventional loan is a 5% down payment.

How Does Private Mortgage Insurance Work on Conventional Loans

Private mortgage insurance is required on all conventional loans if the loan to value is greater than 80% LTV. Mortgage Insurance on conventional loans is not a fixed rate like FHA loans. PMI rates depend on various factors such as the borrower’s credit scores, the LTV, the property type, and other factors.

Differences Between Conventional Loans Versus Government-Backed Mortgages

Differences Between Conventional Loans Versus Government-Backed Mortgages

As mentioned earlier, government loans are for owner-occupant primary home mortgages only. You cannot finance second homes, and/or investment homes with government loans. Borrowers can finance owner-occupant primary homes, second homes, and investment properties with conventional loans. There is no government guarantee and/or backing on conventional loans. Lenders need to count on private mortgage insurance on conventional loans. FHA, VA, USDA loans are backed with government-backed mortgage insurance which is paid by the borrower and is at a fixed rate. Premiums on private mortgage insurance are vary depending on the borrower’s credit/income profile and other risk factors.

Fannie Mae and Freddie Mac GSE Agency Guidelines on Conventional Mortgages

The list below is the minimum lending guidelines on conventional loans. There are conforming and non-conforming conventional loans. The maximum loan limit on conforming conventional loans for 2022 is $647,200 on single-family homes. Non-conforming conventional loans for single-family homes also referred to as high-balance conforming loans, are capped at $970,800 for 2022. There are many high-cost areas such as many counties in California, Alaska, and Hawaii falls into the high-balance conventional loan limits.

What Are The Eligibility Requirements for Conventional Loans

It is important borrowers get an approve/eligible per the automated underwriting system on conventional loans. The minimum credit score to qualify for conventional loans is 620 FICO. 3% down payment on a home purchase for first-time homebuyers and 5% down payment for seasoned homebuyers. Fannie Mae and Freddie Mac define first-time homebuyers as a buyer who had no interest in any homeownership in the past three years.

Mortgage After Bankruptcy and Foreclosure

Borrowers need to wait a four-year waiting period after the Chapter 7 Bankruptcy discharged date to qualify for a conventional loan. There is a two-year waiting period after the Chapter 13 Bankruptcy discharge date to qualify for a conventional loan. The waiting period is four years after the Chapter 13 Bankruptcy dismissal date to qualify for a conventional loan. There is a four-year waiting period after a deed in lieu of foreclosure and/or short sale to qualify for a conventional loan. The waiting period is seven years after a standard foreclosure to qualify for a conventional loan. For additional lending requirements on conventional loans, please feel free to contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays. Gustan Cho Associates has no lender overlays on conventional loans.

Understanding The Differences Between Conventional Loans Versus Government-Backed Mortgages

In this blog, we will cover and discuss comparing conventional versus government loans. There are times when homebuyers need to use Conventional Versus Government loans. Government loans are for primary residence financing only. You cannot purchase a second home and/or investment property using an FHA, VA, USDA loan. Government-backed loans are for those homebuyers who intend in using their home purchase as an owner-occupant primary home. Conventional loans are often called conforming loans. This is because conventional loans need to conform to Fannie Mae and/or Freddie Mac Agency mortgage guidelines. Aren’t conventional loans private loans and not backed by a government agency? Why do private home loans need to conform to Fannie Mae and/or Freddie Mac Agency Mortgage Guidelines if they are not government-backed loans?

What Are The Roles Of Fannie Mae And Freddie Mac

The reason for this is that Fannie Mae and Freddie Mac are the two giant mortgage companies that purchase mortgage bonds on the secondary market. Mortgage companies will use their warehouse line of credit obtained by banks to originate and fund conventional loans. After they fund home mortgages, lenders need to sell the loans they fund on the secondary mortgage bond market.

Fannie Mae and Freddie Mac Are The Largest Buyers of Mortgages on the Secondary Market

Fannie Mae and Freddie Mac are the two mortgage giants lenders that sell mortgages. However, Fannie Mae and Freddie Mac will not purchase mortgages from lenders if the loans do not conform to their agency guidelines. This is why conventional loans are called conforming loans. Gustan Cho Associates is a national mortgage company licensed in multiple states with no lender overlays on conventional and government loans.

Reasons Why Borrowers Need To Use Conventional Versus Government Loans

Conventional loans are the most popular loan program in the United States. Buyers can purchase primary homes, second homes, and investment properties with conventional loans. The minimum down payment on conventional loans is a 3% down payment for first-time homebuyers. A first-time homebuyer is defined as someone who did not have ownership in a home in the past three years. Otherwise, a 5% down payment is required on conventional loans. VA and USDA loans require no down payment. Lenders can finance borrowers with a 100% down payment on VA and USDA loans.

VA And USDA Loans Require Zero Down Payment On Home Purchase

VA and USDA loans are two specialty mortgage loan programs that do not require any down payment. VA loans are the best loan program in the nation. Zero down payment, no mortgage insurance, no maximum loan limit caps, and low mortgage rates than any other loan program. Only properties that are in a designated USDA Rural Development Area are eligible for USDA loans. USDA loans do not require any down payment. Plus, there are household income restrictions on USDA loans.

Conventional Loans Versus Government-Backed Mortgages on Types of Homes That Can Be Financed

Borrowers who need to finance a second home and/or investment property need to go with conventional loans. Borrowers with high student loan debts and are on an income-based repayment (IBR) may need to opt for conforming versus government loans. Fannie Mae and Freddie Mac will allow IBR payments on conforming loans. This holds true even if the IBR payment is a zero IBR Payment.

Student Loan Guidelines on Conventional Loans Versus Government-Backed Mortgages

Borrowers with high student loan balances often have difficulty qualifying for a home mortgage. FHA loans no longer exempt deferred student loans from debt to income ratio calculations. HUD, the parent of FHA require fully amortized monthly payments to be used as legitimate student loan debt when it comes to qualifying for FHA loans.

Conventional Loans Versus Government-Backed Mortgages on IBR Payments on Student Loans

HUD now allows accepts income-based repayment plans on student loan debts. If the student loan debt is on an income-based repayment and/or deferment, FHA requires 0.50% of the student loan balance to be used as a monthly hypothetical debt. Gustan Cho Associates will allow a letter from the student loan provider stating a monthly hypothetical monthly payment if the borrower is on a hypothetical fully amortized monthly payment plan on an extended-term. This written hypothetical monthly payment can be used in debt to income ratio calculations on FHA loans. Fannie Mae and Freddie Mac will allow income-based repayment plans in debt to income ratio calculations. This holds true even though the borrower has a zero IBR payment.

Conventional Loans Versus Government-Backed Mortgages: VA Loans

VA loans are the best home mortgage program in the nation. However, VA loans have certain guidelines versus conforming loans when it comes to student loan guidelines. One great aspect of VA loans is it exempts deferred student loans from debt to income ratio calculations as long as it has been deferred for longer than 12 months. Here is how the student loan guidelines on VA loans are stated:

- Deferred student loans that have been deferred longer than 12 months are exempt from debt to income ratio calculations

- Income-based repayment (IBR) does not count on VA loans

- If the loan is on an IBR repayment and/or non-deferred for longer than 12 months, then the VA requires mortgage underwriters to take 5% of the outstanding student loan balance and divide that figure by 12

- The resulting figure is used as a monthly hypothetical debt when calculating the borrower’s debt to income ratios

There are instances when borrowers with very high student loan balances need to use conventional versus VA loans. This holds true when the borrower has a zero IBR payment on their student loans.

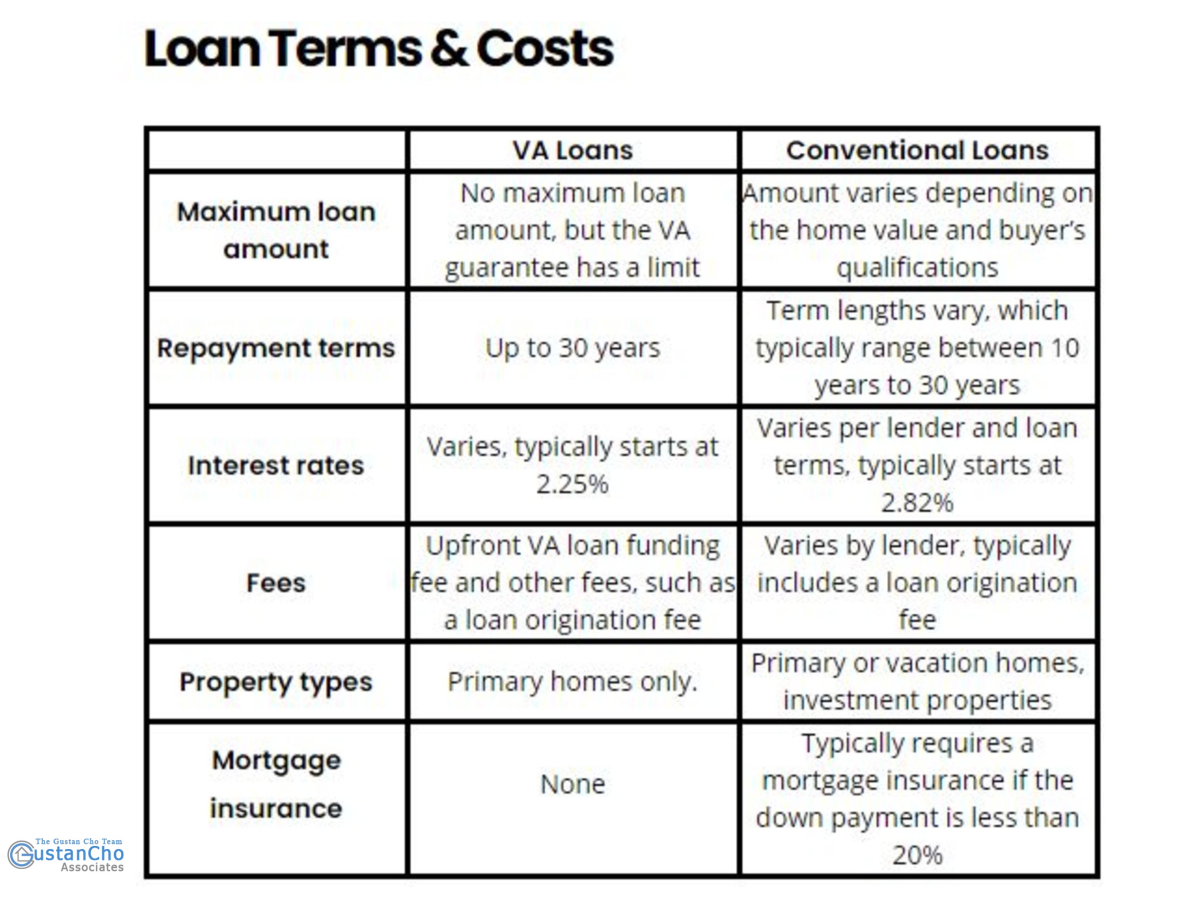

Below is a chart on a comparison between conventional versus VA loans on loan terms and costs:

There are many benefits of VA loans. There is no down payment required on VA loans. There is no monthly mortgage insurance and mortgage rates are lower than conventional loans. There are no maximum loan limits on VA mortgages. Due to the government guarantee, lenders are more than eager to offer 100% financing on VA loans at stellar low mortgage rates. To start the mortgage application process with a lender with no overlays on VA loans, please give us at Gustan Cho Associates a call at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.