This guide covers no tax returns mortgages. We will discuss W2 income mortgages and no-doc mortgage loans for self-employed borrowers. Income is the most important factor in qualifying for a mortgage. Borrowers can have the most perfect in the world, but with no qualified income documentation or declared low income, borrowers may not qualify. Mortgage Underwriters require the following:

- Two years of tax returns

- 2-year W-2s

- 2-year 1099’s if applicable

- 60 days of bank statements to see verified funds for the down payment or closing costs

- The above docs are required to see whether or not they meet the required debt-to-income ratios in qualifying for a mortgage

Do Lenders Want to Give You a Mortgage?

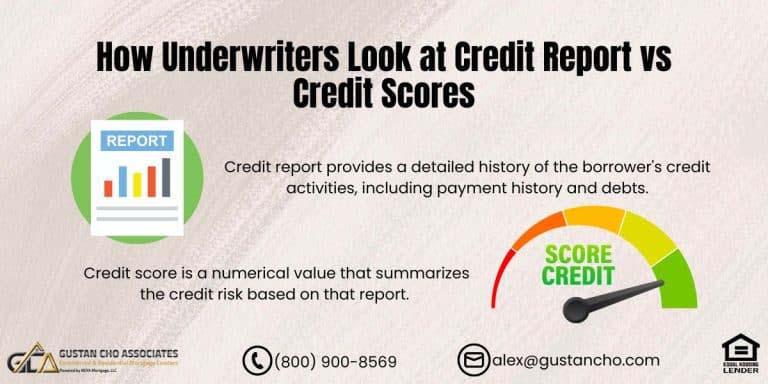

The idea behind giving mortgages to lenders is to get money from the interest you pay. Nevertheless, they are very cautious about whom they lend it to as they don’t want to lose their money. Some of the things that mortgage lenders look at include: A good credit score gives an impression of someone who can be trusted.

Income and Job History: When looking at your income history it should be evident that you have a regular salary.

Debt-to-Income Ratio: This compares how much you owe each month to how much you earn. You will always want it lower.

Down Payment: Paying extra cash upfront can make you appear more attractive in their eyes.

Property Value: They must ensure that the house is worth the amount one borrows on it. When self-employed or do not have proof of traditional income, one may consider No Tax Returns Mortgages. If you have unconventional sources of income this type of loan allows for qualification without displaying your tax returns, which is vastly beneficial for most people who have unconventional incomes.

Adjusted Gross Income As Qualified Income

Unreimbursed expenses can be deal killers. Lenders go by adjusted gross income on the borrower’s tax returns. Self-employed borrowers need to provide 2-years of tax returns. Self Employed Borrowers who are business owners or 1099 wage earners must provide the lender with two years’ tax returns and 2-year 1099 income. Tax returns are required for self-employed borrowers. This is because most self-employed borrowers write off expenses on their tax returns.

Mortgage underwriters calculate income by adjusting gross income after all deductions. They take the 24-month average of the adjusted gross income of self-employed borrowers.

However, the average of the two years is only averaged if the adjusted gross income is the same or is higher in the most recent year. If the adjusted gross income is lower than the most recent year, the income of the lower year will be used. The two-year adjusted gross income average will not be used in cases of declining income.

No Tax Returns? You Can Still Buy a Home with the Right Mortgage Option!

Contact us today to find out how you can qualify for a no-tax-returns mortgage.

How Mortgage Underwriters View Declining Income

If the underwriter sees that the adjusted gross income has been declining and the likelihood is likely to decline, then the income cannot be used. The borrower would need to go to FHA and get a non-occupant co-borrower to qualify for the mortgage loan. Or they may be eligible for our bank statement loan program for self-employed borrowers. Tax Returns are not required with our bank statement mortgage loan program for self-employed borrowers.

1099 Wage Earners Versus W2 Income Only No Tax Returns Mortgage

Mortgage borrowers who are 1099 wage earners, such as car salesmen, realtors, or other sales workers lenders, will require two years of 1099’s and two years of tax returns. Tax returns are required to see how much the borrower has written off on their tax returns. The gross adjusted income will be used to calculate income. If the two years’ 1099’s are similar, a 24-month average will be used to calculate monthly gross income.

If AUS does not condition tax returns, mortgage underwriters do not want loan officers to provide income tax returns. W2 Income Wage earners do not normally have to provide income tax returns. Self-employed borrowers or borrowers with income properties DO have to provide income tax returns.

Type Of Wage Earners Determine Tax Return Requirements

Self-employed borrowers and 1099 wage earners must provide lenders two years of income tax returns. Mortgage Underwriters will also verify the income tax returns of borrowers with the Internal Revenue Service using IRS Form 4506-T. Borrowers utilizing many income deductions from their tax returns will have difficulty qualifying for a mortgage. This is due to tax filer’s gross income being decreased by tax filers deductions. This lowers the number of money borrowers can qualify for a loan.

Bank Statement Loans With No Income Tax Returns Required For Self-Employed Borrowers

Self-employed people and business owners always had issues qualifying for a mortgage. If you are not a W2 wage earner and are a 1099 wage earner, self-employed, or own a business, you are able to take substantial unreimbursed expense deductions from your income tax returns. Lenders will go with adjusted gross income which is the net income after deductions.

There are many instances where self-employed folks can have zero or negative income after deductions. Borrowers with little to no adjusted gross income cannot qualify for a mortgage. Non-QM bank statement loans for self-employed borrowers solve this problem. If you are self-employed or own a business, you will be eligible for a 12 or 24 months bank statement loan. Only deposits on bank statements are used to calculate income. Withdrawals do not matter. Gustan Cho Associates Mortgage Group offers Bank Statement Mortgage Loans For Self Employed Borrowers where no tax returns are required.

Eligibility Requirements On Non-QM Bank Statement Loans For Self-Employed Borrowers

Below are the general eligibility guidelines and requirements on the 12 and/or 24 months bank statement loan program for self-employed borrowers with no income tax returns required.

- Self-employed borrowers can qualify without providing income tax returns. Income is derived from 24 months’ personal or business bank statements.

- Deposits over 24 months are averaged and that is how monthly gross income is derived.

- If borrowers provide 24 months of personal bank statements, 24 months of bank deposits are averaged.

- If borrowers provide 24 months’ business bank statements, then 50% of deposits are averaged over 24 months.

- Needs to be the same bank.

- Cannot have overdrafts.

- Verification of rent and/or verification of mortgage is required.

- Withdrawals do not count.

- There are no loan limits on bank statement mortgage loans.

- There is no private mortgage insurance required on bank statement mortgages.

- A 10% to 30% down payment is required.

- Mortgage rates depend on borrowers’ credit scores and down payment.

- The more down payment, the less the mortgage interest rates.

The higher credit scores, the lower the interest rates.

Looking to Buy a Home Without Tax Returns? We’ve Got Mortgage Solutions for You!

Reach out now to explore your options for a no-tax-returns mortgage and get pre-approved today.

Qualifying For A Mortgages With No Tax Returns With A National Lender With No Overlays

The team at Gustan Cho Associates are experts in helping borrowers who have been denied at other lenders due to their lender overlays. Over 75% of our borrowers are folks who could not qualify at other lenders. Gustan Cho Associates Mortgage Group does not have any lender overlays on government and conventional loans. One of the main roles of all of our experienced loan officers is educating police officers, firefighters, and other first responders throughout the country in real estate investments and credit.

All of our licensed loan officers work closely with our support and operations team at Gustan Cho Associates Mortgage Group in setting up seminars with real estate agents and at arranged group conferences.

Topics include the following:

- qualifying for home loans after bankruptcy

- foreclosure

- short sale

- qualifying for home loans with less than perfect credit and high debt to income ratios

Is it Normal for Mortgage Lenders to Ask for More Information?

This is typical of mortgage lenders during their application process. To determine your eligibility for the loan and the terms to offer, they must have a clear picture of your financial condition. They could need more details about your earnings especially if you are multiple employers, self-employed or with non-regular earnings.

Also, they want to make sure that you are employed and stable hence may ask for other papers if you recently changed jobs. Some concerns or inconsistencies present in your credit record will require clarification or experience supporting documents.

They must look at your savings, investments, or any other assets that can be used to cover for down payment and closing costs. Lenders will be able to calculate borrowers’ debt-to-income ratios correctly by obtaining more information on debts owed by them. If one is applying for No Tax Returns Mortgage one might also submit alternative income proof such as bank statements in case he/she works independently or gets paid without conventional proof of salary/wages. By giving accurate and fast responses to the demands put forth; this could speed up the approval procedure.

Every American’s dream is to own a home. Crime and Safety are every homeowner’s concerns. Most of our loan officers are experts in giving basic tips in all areas of homeownership. Our number one goal at Gustan Cho Associates is to help others. Our true passion at Gustan Cho Associates is helping first-time homebuyers make their dream of homeownership become a reality.

Over 75% of our borrowers at Gustan Cho Associates are folks who could not qualify at other lenders. Gustan Cho Associates has a national reputation for being able to approve and close loans other lenders cannot. If you are a borrower needing a lender licensed in multiple states with no lender overlays on government and conventional loans, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Borrowers can email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays.

FAQs: No Tax Returns Mortgage Only For Homebuyers

- 1.What is a Mortgage with No Tax Returns? This mortgage allows you to qualify for a loan without having to submit your tax returns. Those who work for themselves or get income from non-standard sources can benefit from this.

- 2. What effect does my income have on my mortgage application? Income is a significant determining factor in qualifying for a mortgage. Even with an exceptional credit rating, one would still be required to show enough income documentation or make lower income statements in order to be eligible. It is normal for lenders to request proof of regular income such as W-2s, 1099s and bank statements.

- 3. What are typical documents requested by the underwriters of mortgages? When mortgage underwriters evaluate an application, they typically request a series of documents from the borrower. These include two years of tax returns, two years of W-2s, and, if applicable, two years of 1099s. Additionally, they often ask for 60 days’ worth of bank statements, which should show the funds set aside for the down payment or closing costs.

- 4. Do mortgage lenders fear giving out loans? Yes, mortgage lenders are cautious because they want to minimize their risk. They evaluate several things including your credit score, job history and incomes, debt-to-income ratio, down payment and property value among others before approving your loan.

- 5. What if I am self-employed but need traditional-income proof? If you are self-employed or do not earn standard wages then think about applying for this No Tax Returns Mortgage option. For such types of loans, these lenders may ask alternative documents like bank statements instead of tax returns.

- 6. How do declining incomes affect the decision-making process used by mortgage underwriters? In situations where there have been changes in adjusted gross income underwriters may not rely on it for qualification purposes. When that occurs, you might need a non-occupant co-borrower or be able to qualify for a bank statement loan program where one does not require filing any tax returns.

- 7. What are the requirements for a No Tax Returns Mortgage for self-employed borrowers? For self-employed borrowers looking into a No Tax Returns Mortgage, the general qualifications for a 12 or 24-month bank statement loan program do not require the filing of income tax returns. Instead, income is verified through personal or business bank statements over a 24-month period, along with a demonstration of regular deposits throughout this time. It’s important that the bank statements show no overdrafts. Applicants must also provide proof of rent or mortgage payment history. The down payment required ranges from 10% to 30%, and the mortgage rates are determined by credit scores and the amount of the down payment.

- 8. How can I speed up the mortgage approval process? Be accurate and prompt with information provided. Take your bank statements and other alternative documents if you are applying for a No-Tax-Returns Mortgage to justify your income.

- 9. Can mortgage lenders ask for more information during the application process? Yes, it is common for lenders to ask more in-depth questions so that they get a complete understanding of what your financial picture is like. More papers may be requested so as to verify your earnings, employment, assets, and liabilities.

- 10. What should I do if other lenders deny me a mortgage? If other lending institutions decline giving you loans try contacting companies like Gustan Cho Associates that specifically help those who have unusual financial problems. They offer programs such as No Tax Returns Mortgages which many times get approved where others cannot approve them.

If you have any questions about No Tax Returns Mortgage or you need to qualify for loans with a lender with no overlays, please contact us at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

This blog about No Tax Returns Mortgage Only For Homebuyers was updated on June 26th, 2024.

No Tax Returns? You Can Still Qualify for a Mortgage!

Contact us today to learn about no-tax-returns loan options and how we can help you secure financing for your home.