This Article Is About Cook County Property Taxes Soaring To 20-Year Record High

Cook County Property Taxes Soaring at historic record pace since 2000.

- Cook County is the largest county in Illinois

- It is also the most populous out of any county in Illinois

- Cook County covers the city of Chicago

- Lake and Cook County has the highest property tax rate out of any county in Illinois

- Illinois has the second highest property tax rate in the nation

- Only New Jersey has a higher property tax rate than Illinois

- New Jersey leads the nation as having the highest property tax rate in the U.S.

- However, Illinois may outrank New Jersey in being the highest taxed state in the nation

- Illinois politicians keep on increasing property taxes whenever they have a budget deficit

- Chicago Mayor Lori Lightfoot is resorting to hike property taxes again to meet the $1.2 billion budget shortage the city is facing

Chicago has the highest property tax rate than any other major city in the United States. Chicago also has the highest tax rate out of any metropolitan city in the nation.

Cook County Property Taxes Soaring: Mayor Lori Lightfoot Resorting To Property Tax Increases To Bridge $1.2 Billion Budget Deficit

Everything in Chicago costs more money than other municipalities.

- Sales tax, gas tax, income tax, property tax, vehicle stickers, real estate transfer stamps, are higher in Chicago than any other city in Illinois

- Despite being ranked the highest taxed city in the U.S., Chicago faces large budget deficits every year

- The mayor and City Council cannot seem to balance its budget every year

- The only solution city politicians have in meeting its debt obligations is by increasing taxes

- The city has a broken pension system and needs pension reform

- However, Mayor Lightfoot and the Democrat controlled City Council do not have the stones to initiate pension reform

- The reason is because they are scared of being voted out of office

- City, county, state, and union workers make up a large percentage of Chicago and Cook County’s voter base

- With the coronavirus outbreak and recent riots, Cook County is hurting financially

- Chicago need funds to gap the $1.2 billion budget shortage

- Illinois Governor JB Pritzker was one of the first governors to shut down the state due to the COVID-19 outbreak and one of the last states to reopen

- Pritzker has still not reopened the state

JB Pritzker has actually put more restrictions on small businesses due to the recent spike in COVID cases.

JB Pritzker Shutting Down Illinois Again Due To Increase In COVID-19 Cases

As of Friday October 30th, Pritzker has issued his unconstitutional stay at home executive order and ordered all indoor dining and bars to be closed.

- Pritzker is trying to make a name for himself by branding himself as America’s Governor who cares for the lives and safety of Illinoisans

- Pritzker wants to be known as America’s Governor on Health and Safety

- JB Pritzker the U.S. Health Czar?

- Is this a joke?

- Illinois has a severely oversized overweight obese governor with most likely dozens of health problems and now wants to be known as America’s Health Czar

- He thinks the COVID pandemic is one and only ticket to the U.S. Presidency

- JB Pritzker is definitely politicizing the coronavirus pandemic for his dream of being on the 2024 Democratic Presidential ticket

Pritzker’s incompetence and power hunger is turning many Democrats against the first term political newcomer.

Pritzker’s Lockdown Order Ruled Unconstitutional By Clay County Judge Michael McHaney

JB Pritzker’s executive order locking down the state was only good for 30 days and expired April 28th, 2020 Clay County Judge Michael McHaney:

- However, Pritzker has defied Judge McHaney’s orders and kept on extending the judge’s ruling

- JB Pritzker and his administration had Illinois Attorney General Kwame Raoul file appeals on Judge McHaney’s ruling against him

- Dozens of lawsuits were filed against the 5’5′ 500 pound heavily overweight obese JB Pritzker

- Many local, county, and state Democrats are turning against Pritzker and are saying his power hunger and obesity has gotten out of control like a wild farm animal

- Due to rising COVID positive cases throughout the state, JB Pritzker issued another lockdown and restricted businesses on their operations

- Effective as of October 31st, 2020, all indoor dining and bars can no longer be open

- Pritzker’s lockdown will permanently shut down over 21,000 restaurants, bars, and cafes

- There is a public outrage against the first term rookie freshman heavy-set governor

- There is no doubt that Pritzker is politicizing the coronavirus outbreak in Illinois for his political aspirations for his dream of being on the 2024 Democratic Presidential ticket

- In the meantime, it is not just killing tens of thousands of Illinois business owners but is killing homeowners

- The lockdown is hurting homeowners due to property tax hikes from local and county governments due to shortage in revenues

Local, county, and state governments resort to property tax hikes when they face budget deficits.

Cook County Property Taxes Soaring Due To Loss Of Tax Revenues By Pritzker’s Second State Lockdown Order

Billions of dollars of tax revenues are lost from local, county, state government due to the lockdown.

- Businesses being locked down generate no tax revenues

- JB Pritzker’s incompetence, power hunger, and lack of concerns for the people of Illinois is driving tens of thousands of taxpayers and small business owners to flee Illinois to other low taxed states

- During the COVID economic crisis in Illinois, JB Pritzker is proposing a state tax increase by lobbying his FAIR TAX

- The FAIR TAX is changing the state’s flat-tax to a progressive tax system

- For the FAIR TAX to become law, voters need to vote YES on the FAIR TAX on November 3rd, 2020’s election

- If the majority of Illinoisans vote YES on the FAIR TAX amendment, lawmakers will amend the Illinois State Constitution in the spring where it then becomes state law

- This is a disastrous move by any politician and political suicide

- Nobody in their right minds will increase taxes on any taxpayer during a time of economic uncertainty and during a worldwide health pandemic

- However, the heavy-set overly overweight obese JB Pritzker says that there is no better time to increase taxes on the wealthy than now

Pritzker’s FAIR TAX ads says 97% of Illinoisans will not be affected by his FAIR TAX. However, studies and scholars say otherwise. Middle class and upper middle class wage earners will be highly impacted by Pritzker’s Fair Tax. Lower income wage earners will have little to no benefit from Pritzker’s FAIR TAX.

Pritzker’s Second Executive State Lockdown Order To Bankrupt Thousands Of Businesses

Pritzker’s restrictions on small businesses has devastated restaurants, bars, gyms, and other small businesses:

- Many small business owners have closed permanently while others have gone bankrupt

- The ones that have survived so far are hanging by a thread

- Now with Pritzker’s new restrictions on shutting down non-essential businesses, many restaurants, bars, gyms, and other businesses with restrictions will not be able to survive

- Many business owners intend in staying open despite Pritzker’s executive order shutting these businesses until the governor decides when they can open

However, JB Pritzker announced he will be deploying troopers from the Illinois State Police to enforce businesses are in compliance with his executive order.

Cook County Property Taxes Soaring Due To Pritzker’s Shutdown Order And Loss Of Tax Revenues

JB Pritzker said he will utilize his executive powers as the governor of Illinois which includes revoking business and liquor licenses.

- Pritzker instructed troopers to issue warnings, tickets, and go as far as arresting violators and locking them up

- Illinois’ extended executive stay at home order by the governor have been ruled unconstitutional by several circuit court judges throughout Illinois

- However, JB Pritzker has ignored them and filed countless appeals to higher courts

- Legal scholars say Pritzker’s executive orders is unconstitutional

- Pritzker is still proceeding with his restrictions in keeping Illinois shut down

- In the meantime, due to restrictions being placed on businesses, the state is only collecting a fraction of the revenues and is in a major financial crisis

Analysts and anonymous sources close to the governor’s office say Pritzker is politicizing the coronavirus to benefit his political aspirations to be the Democratic nominee for President of the United States for 2024.

Governor JB Pritzker Politicizing Coronavirus Outbreak To Get A Federal Bailout

Pritzker is banking on a federal bailout for Illinois so he can get credit for financial mess the state is in.

- Pritzker said Illinois had a financially balanced budget prior to the coronavirus outbreak in February 2020

- Pritzker blames the coronavirus pandemic for Illinois being in a financial crisis and demands a federal bailout for Illinois

- Not so fast “Fat Boy,” Senate Republicans fired back

- Senate Majority Leader Mitch O’Donnell and Senate Republicans said there is no way the federal government will be bailing out financially irresponsible states like Illinois

- Pritzker lied

- Illinois did not have a balanced budget prior to the coronavirus outbreak. Illinois was on the verge of bankruptcy and it still is

In the meantime. Pritzker and local and county politicians are resorting to increasing property taxes as well as other taxes to bridge the gap on its budget deficits.

Cook County Property Taxes Soaring: Treasurer’s Office Agrees

Cook County Treasurer Maria Pappas agrees Cook County Property Taxes Soaring and out of control.

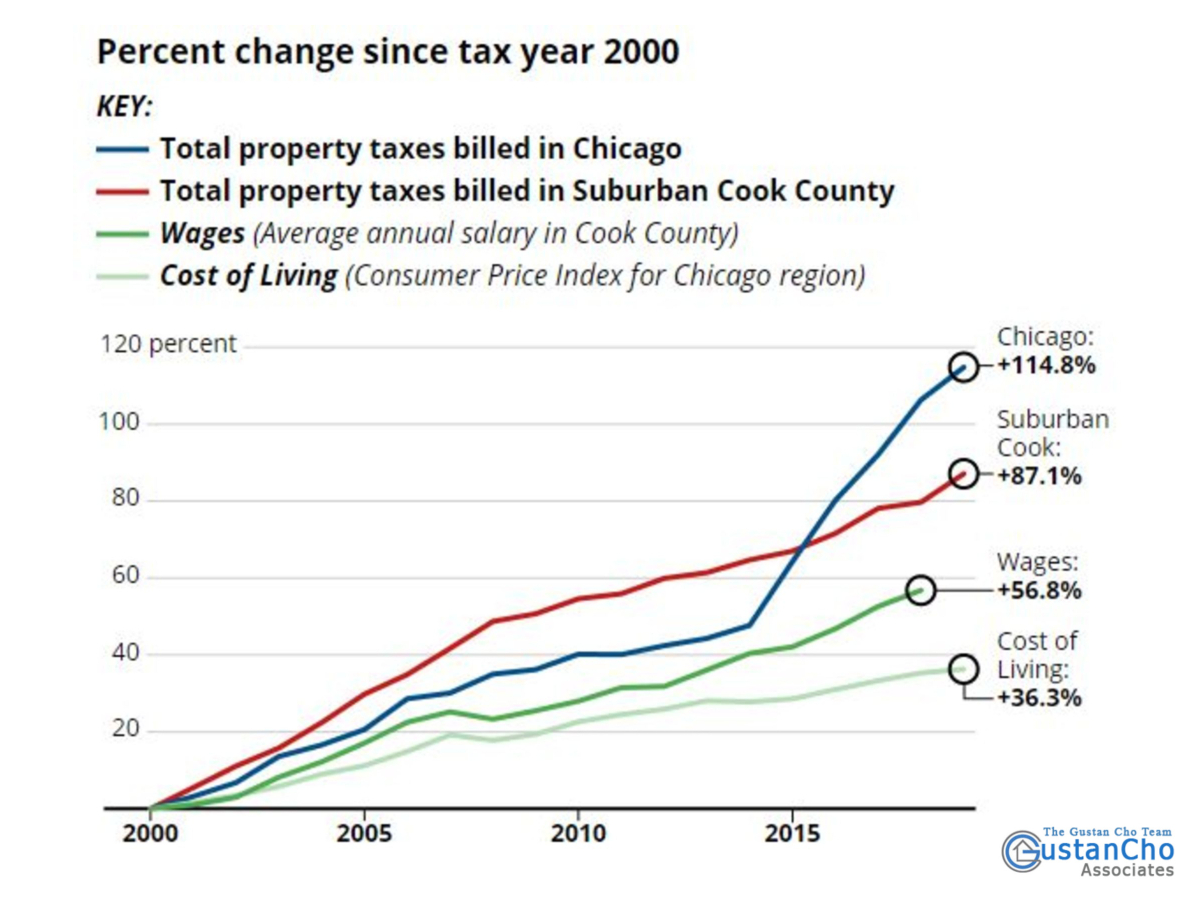

- Property taxes for Cook County residents are skyrocketing faster than any other bills a homeowner has

- Local and county government in Cook County has increased property taxes three time the rate of inflation

- Data was from a study conducted by Cook County Treasurer Maria Pappas office

See The Graph Below On The Percentage Change In Cook County Property Taxes Soaring Year After Year Since 2000:

The Cook County Treasurer has been elected to office since 1998.

- Pappas initiated the Pappas Study due to demand by Cook County taxpayers filing complaints because not being able to afford their increasing out of control property taxes

- Pappas’ study was released at the same time Mayor Lori Lightfoot announced a property tax increase for 2021

- To make matters worse, Lightfoot proposed property tax hikes year after year matching the inflation rate

- There are many instances where a single family home in Chicago’s North Side went from an average of $3,000 in 2000 to $16,000 today

JB Pritzker And MK Pritzker Under Federal Criminal Investigation For Tax Fraud

It did not take long for JB Pritzker to be under federal criminal investigation for property tax fraud.

- Four months into his term as governor, JB Pritzker and MK Pritzker were under federal criminal investigation for their alleged criminal tax fraud scheme

- JB and MK Pritzker are under federal criminal investigation for ripping out toilets on a home they owned next their primary residence in Chicago’s Gold Coast

- The property was assessed at $6 million

- By removing all the toilets, the house was deemed not habitable and the assessed value dropped to $1 million

- JB Pritzker and MK Pritzker saved $331,000 in property taxes just by having their plumbing contractor remove the toilets and making the house uninhabitable

When JB and MK Pritzker got caught from this property tax fraud scheme, Governor Pritzker immediately wrote a personal check to Cook County Assessor Joe Berrios office and denied any wrongdoing.

JB And MK Pritzker Property Tax Fraud Investigation Is Ongoing

Cook County Property Taxes Soaring that even Gov. JB Pritzker and his wife MK Pritzker appealed their home assessment trying to lower their property taxes on a home they owned next to their Gold Coast Chicago primary home. However, JB and MK Pritzker did it in an illegal way and allegedly committed property tax fraud trying to do so:

- The federal criminal fraud investigation of the Pritzker’s property tax fraud scheme is still ongoing as of today

- Federal criminal investigators recently subpoenaed documents pertaining JB and MK Pritzker’s ongoing federal criminal property tax fraud scheme from former Cook County Assessor Joe Berrios and the Cook County Assessor’s Office

- JB Pritzker downplayed him getting caught after trying to commit the property tax fraud scheme

- On his press conference after getting caught of his property tax fraud scheme, he said he did nothing wrong and denies being under federal criminal investigation

- Illinois is ranked as the most corrupt state in the nation

- Six Illinois governors were indicted for public corruption

- Of the six governors, four Illinois governors were convicted and sent federal prison terms

Can JB Pritzker be the next Illinois governor arrested, indicted, and sent to federal prison for corruption and fraud? Looks like he is sure headed in that direction.

Cook County Property Taxes Soaring Also Due To New Cook County Assessor Fritz Kaegi Increasing Valuations

Businesses in Cook County are in a financial crisis due to JB Pritzker’s heavy restrictions and lockdown orders.

- To top off the financial crisis facing business owners, many business owners own their commercial property

- Current Cook County Assessor Fritz Kaegi, who took office in 2018, have been increasing property valuations and assessments at a faster pace than former Assessor Joe Berrios

- This is putting another major financial burden to small business owners in Cook County

- It is not just residential homeowners that are hurting from the record increasing property taxes in Cook County but commercial property owners as well

Gustan Cho Associates is an Illinois licensed real estate agent and an expert in property tax appeals.They said the following:

High property taxes is not breaking news for Cook County property owners. Former Chicago Mayor Rahm Emanuel increased property taxes back in 2015 due to the city’s pension fund shortage. Emanuel’s plan included a tax increase of $543 million over four years. The city’s property taxes under Emanuel’s property tax hike increased from $1 billion to $1.7 billion. Even with this historic tax hike on Chicago property owners, Lightfoot is now increasing property taxes by $94 million for 2021. Lightfoot is also proposing property tax hikes every year and for all future years by the rate of inflation. However, politicians from the governor on down the food chain always turn to increasing property taxes as the first source of solution whenever they need to turn to revenue. Illinoisans need to put their heads together and need to research candidates for political office prior to voting for incompetent politicians like Pritzker, Lightfoot, and countless others who are not qualified to be in a public leadership position. Something has to give. Illinois needs a competent governor, and local, county politicians. Why are other Republican low taxed states like neighboring Indiana thriving and Illinois is in a financial crisis? It is due to leadership. Illinois leaders and lawmakers run their state like a business. You do not spend money you do not have. You cannot spend more than what you take in. Indiana politicians lower taxes to attract new taxpayers and businesses to Indiana. Illinois keeps on raising taxes and are losing countless taxpayers and small business owners to other lower taxed states.