This guide covers rebuilding credit during Chapter 13 Bankruptcy repayment plan. Rebuilding credit during Chapter 13 Bankruptcy is highly recommended for those who want to purchase or refinance their current home. Consumers do not have to wait until Chapter 13 Bankruptcy has been discharged to re-establish their credit. To qualify for a mortgage with an FHA or VA loan while in Chapter 13 Bankruptcy, you need to meet the minimum agency mortgage guidelines of HUD for FHA and VA for VA loans.

HUD requires a minimum credit score of 500 FICO to qualify for an FHA loan with a 10% down payment. To qualify for an FHA loan with a 3.5% down payment, you need a 3.5% down payment. The Veterans Administration does not have a minimum credit score requirement to qualify for VA loans.

Lower credit scores mean high mortgage rates and possible discount points. It is best to boost your credit to the maximum potential before applying for a mortgage loan to get the best rates and not pay discount points.

Can You Rebuild Your Credit After Chapter 13?

With patience and commitment to sound financial habits, it is possible to rebuild your credit after filing for Chapter 13 bankruptcy. While Chapter 13 bankruptcy remains on your credit report for up to ten years from the filing date, its impact diminishes over time. To start the process, review your credit report from all major bureaus to ensure its accuracy.

Establishing a realistic budget that allows for timely bill payments is crucial. If you handle them responsibly, secured credit cards can help rebuild your credit. You can manage your spending by providing a deposit that becomes your credit limit while gradually improving your credit score. Maintaining low credit utilization ratios and timely payments on all accounts are key steps.

Credit-builder loans or becoming an authorized user on someone else’s credit account can also help establish a positive credit history. Monitoring your credit score regularly is essential to track progress and promptly address any errors or discrepancies. While rebuilding credit post-Chapter 13 bankruptcy may take time, consistency in financial management will gradually improve your creditworthiness.

Rebuild Your Credit While in Chapter 13

You don’t have to wait until discharge to improve your credit or qualify for a mortgage. Start rebuilding now and prepare for homeownership sooner.

Can Credit Repair Fix Bankruptcy?

With patience and commitment to sound financial habits, it is possible to rebuild your credit after filing for Chapter 13 bankruptcy. While Chapter 13 bankruptcy remains on your credit report for up to ten years from the filing date, its impact diminishes over time. To start the process, review your credit report from all major bureaus to ensure its accuracy.

Establishing a realistic budget that allows for timely bill payments is crucial. If you handle them responsibly, secured credit cards can help rebuild your credit. You can manage your spending by providing a deposit that becomes your credit limit while gradually improving your credit score. Maintaining low credit utilization ratios and timely payments on all accounts are key steps.

Credit-builder loans or becoming an authorized user on someone else’s credit account can also help establish a positive credit history. Monitoring your credit score regularly is essential to track progress and promptly address errors or discrepancies. While rebuilding credit post-Chapter 13 bankruptcy may take time, consistency in financial management will gradually improve your creditworthiness.

How Do I Recover From Chapter 13?

Recovering from Chapter 13 bankruptcy requires diligent financial planning and strategic credit rebuilding. To effectively manage your income and expenses, begin by assessing your financial standing and creating a budget. Prioritize essential expenditures while also setting aside funds for savings and emergencies.

To rebuild credit, consider obtaining a secured credit card and making timely payments to demonstrate creditworthiness. Additionally, explore options such as becoming an authorized user on another credit card or applying for a small loan to diversify your credit mix.

Consistent, on-time payments and low credit utilization are crucial for improving your credit score. While recovery may take patience and persistence, each positive financial decision contributes to rebuilding your financial health and paving the way for a more secure future. Consulting a financial advisor or credit counselor can help you create a customized plan for your financial recovery after bankruptcy.

Can You Have Good Credit With Bankruptcies?

Yes, it is possible to have good credit despite having a bankruptcy on your record. While bankruptcy can significantly negatively impact your credit score, it’s not necessarily a permanent barrier to achieving good credit. You can gradually improve your creditworthiness with responsible financial management and strategic credit-rebuilding efforts.

If you have filed for bankruptcy, shifting your focus toward rebuilding your credit score is important. To achieve this, you should make timely payments, keep your credit card balances low, and diversify your credit mix. Developing healthy credit practices, like timely bill payments and maintaining low credit utilization, can greatly mitigate the adverse effects of bankruptcy on your credit score.

It is important to consider these habits as they can go a long way in mitigating the consequences of bankruptcy. Additionally, demonstrating financial stability and responsibility over time can outweigh the negative effects of bankruptcy in the eyes of lenders.

It’s important to note that rebuilding credit after bankruptcy takes time and patience. However, consistently practicing good financial habits and making informed credit decisions can eventually achieve good credit despite past bankruptcy filings.

The Fastest Way of Rebuilding Credit During Chapter 13 Bankruptcy

The best way of re-establishing credit during Chapter 13 Bankruptcy is by getting new credit and having the payment history report on credit reports. Many consumers are told they cannot get new credit during the Chapter 13 Bankruptcy repayment plan. This is not the case. Don’t apply for unsecured credit cards for rebuilding credit during Chapter 13 Bankruptcy.

You can have family members with great payment histories and low credit card balances to add you on as authorized users or get three to five secured credit cards:

Re-established credit, high credit scores, and a strong credit profile mean lower mortgage rates, insurance premiums, and better job opportunities or promotion opportunities.

Consumers can get secured credit cards and a credit rebuilder loan during the Chapter 13 Bankruptcy repayment plan. Bankruptcy Trustees will approve secured credit cards with at least $500 credit limits and a credit rebuilder loan program while in the Chapter 13 Bankruptcy repayment period.

Gustan Cho Associates are experts in helping homebuyers qualify for a home mortgage while in Chapter 13 Bankruptcy. The team at Gustan Associates can help borrowers rebuilding credit during Chapter 13 Bankruptcy Repayment and after Chapter 13 discharge without any waiting period.

Yes, You Can Qualify for a Mortgage in Chapter 13

Many lenders say no. We say yes. Our team helps borrowers in active bankruptcy get approved—while rebuilding their credit.

Rebuilding Credit During Chapter 13 Bankruptcy To Qualify For a Mortgage

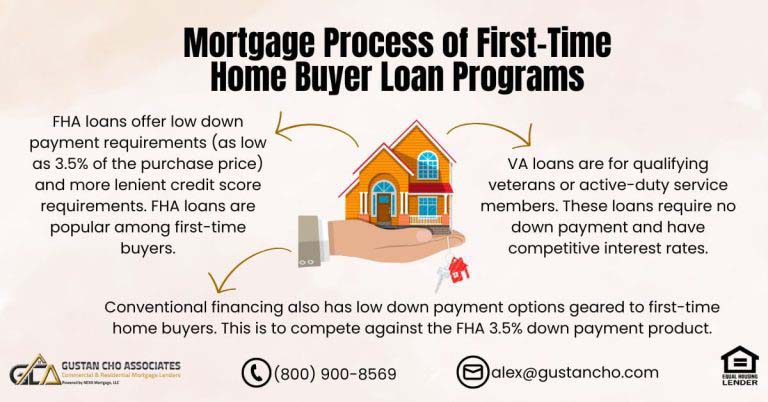

FHA and VA loans allow homebuyers to qualify for a home mortgage during a Chapter 13 bankruptcy repayment plan with Trustee Approval via manual underwriting. Chapter 13 Bankruptcy does not have to be discharged.

There is no waiting period after the Chapter 13 Bankruptcy discharge date. Homebuyers can only qualify for an FHA or VA loan during and after Chapter 13 Bankruptcy if they need to go through manual underwriting. FHA and VA loans are the only two mortgage loan programs that allow manual underwriting.

People can qualify for a mortgage during the Chapter 13 Bankruptcy repayment period. Bankruptcy trustee approval is required. As long as it is a modest home and the homebuyer can afford the new mortgage payments, 100% of the bankruptcy trustees will approve a new home purchase during the Chapter 13 Bankruptcy repayment period.

The loan must be manually underwritten if the Chapter 13 Bankruptcy discharge has not been seasoned for two years. The borrower’s credit scores determine mortgage rates. Chapter 13 Bankruptcy repayment plans are normally 60 months. Homebuyers and homeowners expecting to apply for a mortgage during the Chapter 13 Bankruptcy repayment plan should start re-establishing their credit.

Do The Courts Allow Rebuilding Credit During Chapter 13 Bankruptcy

Generally, most bankruptcy attorneys will tell you you cannot take on new credit or a new loan during the Chapter 13 Bankruptcy Repayment period. Most Chapter 13 repayment plans are for a term of 60 months. Most Trustees frown on consumers taking on unnecessary new debt during the Chapter 13 repayment period.

Small secured credit cards and a small credit rebuilder loan program are normally not problematic for most bankruptcy trustees. This only holds true if the consumer makes timely payments on their repayment plan.

Most Trustees will approve an auto loan if you need to trade in your junk car for a new car. You need a car these days to use for transportation. It is more of a necessity than a luxury. Any debt that is greater than $5,000 needs bankruptcy trustee approval. A new car falls in the category of needing trustee approval. However, most trustees will not approve an RV. RVs are a luxury unless the person will use them as housing.

Getting New Credit During Chapter 13 Bankruptcy To Re-Establish Credit For a Mortgage

Most bankruptcy trustees will not have a problem for consumers to get a couple of secured credit cards to re-establish their credit during the Chapter 13 Bankruptcy repayment plan. The ideal amount of secured credit cards for maximum credit optimization is 3. Get three secured credit cards with at least a $300 to $500 credit limit. Borrowers should start rebuilding credit during Chapter 13 Bankruptcy as soon as they file.

Adding secured credit cards and credit rebuilder cards while in Chapter 13 Bankruptcy will skyrocket your credit scores. Each secured credit card will boost your credit by 20 to 50 points. Besides the three secured credit cards, get at least one installment loan. The best credit rebuilder program is www.self.inc. You are making a $25 to $50 monthly payment.

Self Credit Rebuilder will deposit that monthly payment towards your 12-month FDIC CD account. The monthly payments will report to all three credit bureaus. After your fourth payment, Self Credit Rebuilder Installment Account will issue a $150 secured credit card without you needing to deposit.

If you follow the above steps, you will have a credit score of over 700 FICO in just 12 months after starting the credit rebuilding program after filing Chapter 13 Bankruptcy. As mentioned above, the easiest and fastest way rebuilding credit during Chapter 13 Bankruptcy repayment plan so you can qualify for a mortgage with the lowest rates is by getting three to five secured credit cards and one to three credit rebuilder accounts such as the Self Credit Rebuilder or a credit rebuilder account from a credit union or bank.

If you have about Rebuilding Credit During Chapter 13 Bankruptcy For a Mortgage or you need to qualify for loans with a lender with no overlays on government or conforming loans, please contact us at Gustan Cho Associates at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com . The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

FAQ: Rebuilding Credit During Chapter 13 Bankruptcy For a Mortgage

- 1. Can I rebuild credit during Chapter 13 bankruptcy repayment? Yes, you can. It’s highly recommended, especially when considering purchasing or refinancing a home. You can start re-establishing credit before your Chapter 13 bankruptcy is discharged.

- 2. What are the credit score requirements for FHA and VA loans during Chapter 13 bankruptcy? A credit score of at least 500 FICO is mandatory for FHA loans if you plan to make a down payment of 10%. However, if you plan to make a down payment of 3.5%, you need a minimum credit score of 580 FICO. On the other hand, VA loans do not have a minimum credit score requirement.

- 3. How can I get the best mortgage rates during Chapter 13 bankruptcy? To secure the best rates, boosting your credit score as much as possible before applying for a mortgage is essential. Lower credit scores may result in higher mortgage rates and potential discount points.

- 4. Is it possible to have good credit despite bankruptcy? Yes, it is possible. With responsible financial management and strategic credit rebuilding efforts, you can gradually improve your creditworthiness over time, even with a bankruptcy on your record.

- 5. How can I qualify for a mortgage during Chapter 13 bankruptcy? Borrowers can qualify for a mortgage while repaying their Chapter 13 bankruptcy with the help of FHA and VA loans, provided that their bankruptcy trustee approves. Manual underwriting is required, and borrowers must meet agency mortgage guidelines.

- 6. Does the bankruptcy court allow rebuilding credit during Chapter 13 bankruptcy? Generally, small secured credit cards and credit rebuilder loans are acceptable for rebuilding credit during Chapter 13 bankruptcy, provided that timely payments are made on the repayment plan and any new debts are approved by the bankruptcy trustee.

- 7. What’s the fastest way to rebuild credit during Chapter 13 bankruptcy? The fastest way is to obtain secured credit cards and credit rebuilder loans. These can significantly boost credit scores, allowing you to qualify for a mortgage with the lowest rates once your bankruptcy is discharged.

This blog about Rebuilding Credit During Chapter 13 Bankruptcy For a Mortgage was updated on April 3rd, 2024.

Credit Score Low? Let’s Fix That

Start working on your credit and loan pre-approval now—so you’re ready to buy the moment you’re eligible.