This guide covers unexpected home buyers expenses payment shock for borrowers. The American Dream is still owning your own home. More millennials are getting qualified for a mortgage and are shopping for their first home. Rent prices are soaring nationwide. In some areas, a mortgage payment is less than the market rents.

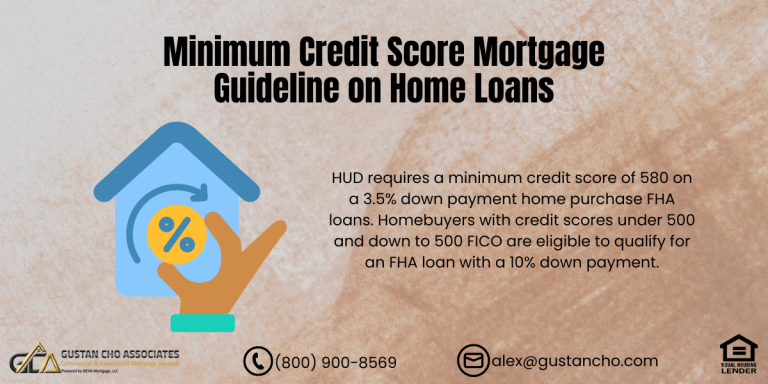

VA and USDA loans allow home buyers to get 100% financing. HUD, the parent of FHA requires a 3.5% down payment on a home purchase. First-time homebuyers require a 3% down payment on conventional loans.

A first-time homebuyer is defined as a buyer who did not have an interest in homeownership in the past three years. Seasoned home buyers require a 5% down payment on conventional loans. Non-QM loans require a 10% to 30% down payment. Gustan Cho Associates offers non-QM jumbo mortgages for self-employee borrowers with no income tax returns required.

Down Payment and Closing Costs on Home Purchase

Traditional jumbo loans require 720 FICO and a 25% down payment with a debt-to-income ratio not greater than 41%. Gustan Cho Associates has multiple traditional and non-QM jumbo loan programs. Gustan Cho Associates offers a 10% down payment jumbo loan program with credit scores as low as 660 and a debt-to-income ratio as high as 50%.

Gustan Cho Associates offer non-QM jumbo mortgages with credit scores down to 500 FICO and no waiting period after bankruptcy or foreclosure. Seller concessions can be used for closing costs.

Homes have been appreciating year after year since 2012. Due to increased home prices, both HUD and the Federal Housing Finance Agency (FHFA) have increased FHA and Conventional Loan Limits for 2024. FHA Loan Limits for 2024 is $498,255. Conventional Loan Limits for 2024 is capped at $766,550. The Department of Veterans Affairs (The VA) recently eliminated the maximum loan limit on VA Loans. There are unexpected home buyers expenses when buying a new home. In this article, we will cover and discuss unexpected home buyers expenses for new home buyers.

Worried About Unexpected Homebuyer Expenses and Payment Shock? We’re Here to Help!

Contact us today to explore mortgage options that fit your budget and avoid payment shock.

Closing Costs

When buying a home, several unexpected expenses can lead to what is known as “payment shock,” where home buyers find their new financial obligations significantly higher than anticipated. Here’s a look at some of these unexpected costs: These can include various fees, such as loan origination fees, appraisal fees, title searches, title insurance, surveys, taxes, deed-recording fees, and credit report charges. Closing costs typically range from 2% to 5% of the home purchase price and can be a surprise if not planned for in advance.

Unexpected Home Buyers Expenses Home Inspection and Repairs

Home inspections are crucial and can reveal the need for repairs that might not be visible during your initial visits. The repair costs can add up quickly if significant issues are found, such as structural problems or old plumbing.

Property Taxes

Property taxes can be higher than expected, especially if there was a recent reassessment or if you need to be fully aware of local tax rates. Sometimes, taxes can increase immediately after a purchase if the property is reassessed at the new price.

Unexpected Home Buyers Expenses on Homeowners Insurance and PMI

Homeowners insurance costs can vary based on location, coverage levels, and the home’s value. If you put down less than 20%, you might also need to pay for Private Mortgage Insurance (PMI), which can add to the monthly expense.

Unexpected Home Buyers Expenses on Maintenance and Utility Costs

New homeowners might anticipate a partial home maintenance cost, including routine upkeep and emergency repairs. Utility costs can also be higher than expected, especially if the home is larger than previous residences or less energy efficient.

Homeowners Association (HOA) Fees

If your new home is in a community with a homeowners association, you may be required to pay monthly or annual HOA fees. These fees can be significant and used to maintain common areas and services. Moving into a new home often involves buying new furniture or paying for renovations and decor to suit your taste, which can become a substantial financial burden. If you have an adjustable-rate mortgage (ARM), rising interest rates can unexpectedly increase your monthly mortgage payments.

Feeling the Pressure of Unexpected Homebuyer Expenses? We Have Solutions to Help You Manage!

Contact us now to explore ways to manage your mortgage and expenses effectively.

Preventing Payment Shock

Calculate all potential expenses before purchasing a home, not just the mortgage payment. Ensure you have an emergency fund covering unexpected home repairs and other non-regular expenses. Conduct a thorough inspection to identify potential repair costs before buying. Consider a fixed-rate mortgage to protect against rising interest rates. Understanding and preparing for these expenses can mitigate the impact of payment shock. It’s always wise to consult with real estate professionals, financial advisors, and possibly even current homeowners in the area to get a realistic perspective on total home ownership costs.

Costs and Unexpected Home Buyers Expenses of Homebuyers

As a new homeowner, you will not have the luxury of calling your landlord for the following:

- Repairs required such as furnace and air conditioning breakdowns

- Appliance repairs

- Landscaping

- General maintenance

There will also be unexpected home buyers expenses that first-time home buyers need to be aware of. There are predictable costs such as the new mortgage. Home buyers can incur additional costs associated with homeownership such as property taxes, homeowners insurance, utilities, water bill, scavenger services, and others. Maintenance and repairs can become expensive. Things taken for granted such as landscaping and snow plowing are a new homeowner’s responsibility.

Maintenance and Repairs For New Homeowners

Alex Carlucci, the National Sales Manager at Gustan Cho Associates and an expert in homeowners insurance, advice the following: You’re best off buying a replacement cost policy which will cover the cost of replacing the items that get stolen or damaged in a fire, rather than one that gives you the depreciated value of the items lost. According to the Insurance Information Institute, the average annual premium is $1,132. But you can save yourself a significant amount by shopping around, both online and off.

Ask about what discounts you can get, including discounts for security systems, working from home, and bundling coverage for your home with your auto insurance policy.

Be aware of the limitations of homeowners insurance Policies tend to only protect home and possessions within, but if you’re buying a condominium, the co-op might require a liability rider for accidents on the property. And if you’re in a flood zone, you’ll need flood insurance as well. For more information about the contents of this topic and/or other mortgage-related topics, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We are available 7 days a week, evenings, weekends, and holidays.

Struggling with Unexpected Expenses and Payment Shock? We Can Help You Find a Solution!

Contact us today to find solutions that keep you on track with your mortgage.