This guide covers common credit score questions from first-time homebuyers. What does a “good credit or good FICO” really mean One of the most important achievements in life (amongst many others) is to build a good credit history and thus achieve a respectable FICO score right? We all work very hard in life, day in and day out. And in doing so we pay our bills in a timely and responsible manner so we can ultimately be debt-free right? But what does that really mean to have good credit?…. Does it mean that once you’ve paid all your bills and have no more debt that you have good credit? It’s not really that simple. On the contrary, it’s actually quite interesting how credit is calculated and what it means to achieve a “good credit status”. In this article, we will discuss and cover common credit score questions from first-time homebuyers.

Frequently Asked Common Credit Score Questions For Mortgage Approval

Lenders will closely evaluate your credit scores and credit reports when applying for a mortgage. In the following paragraphs, we will cover common credit score questions and guidelines that lenders typically consider for mortgage approval.

What Are Frequently Asked Common Credit Score Questions For Mininimum Score Required For a Mortgage

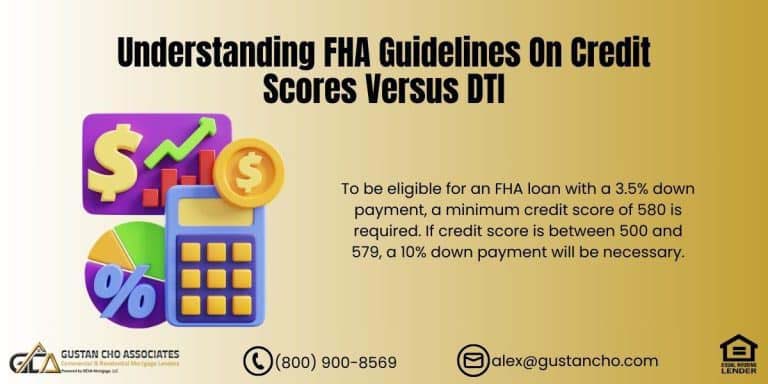

What are the minimum credit score requirements for a mortgage? For conventional loans, a credit score of 620 or higher is generally required. FHA loans allow credit scores as low as 500 with 10% down or 580 with 3.5% down. VA and USDA loans technically have no minimum credit score requirements, but most lenders prefer scores above 620.

Which of The Three Credit Scores Are Used By Mortgage Lenders?

Do you look at all three credit scores or just the middle one? Lenders usually take the middle score of the three major credit bureaus (Experian, Equifax, TransUnion). For multiple borrowers, they take the lowest middle score among them.

What Credit Score Model Is Used By Mortgage Lenders?

What credit score model do you use? Most mortgage lenders use FICO scores, not other scoring models like VantageScore. Specifically, they rely on FICO Scores 2, 4, and 5, which are tailored for the mortgage industry.

How Old Can a Credit Report Be To Be Valid For Mortgage Approval?

How old can the credit reports be? Credit reports generally can’t be older than 90-120 days at the time of the loan application. Do you consider credit score trends? Lenders may look at whether your scores have been increasing or decreasing over time. A positive credit score trend can help offset lower scores to some degree.

How Are Authorized User Account Treated on Credit Reports and Scoring Model

How do you treat authorized user accounts? Being an authorized user can help build credit history but may not always boost scores significantly. Do you manually review credit reports for derogatory items? Lenders review credit reports for bankruptcies, foreclosures, collections, charge-offs, etc. They may require letters of explanation for any major derogatory events.

Confused About Credit Scores as a First-Time Buyer?

Get clear answers to the most common credit score questions from first-time homebuyers

What Are FICO Credit Scores Used By Mortgage Lenders

Here’s how it’s broken down and how your FICO is determined: 35% of the score is based on the history of debt.

- In other words, the abilit and responsibility of paying debts on time (so long as you haven’t been in default and are current with all your payment obligations) demonstrates worthiness for credit over time.

30% of the score is based on the amount or level of debt:

- In other words, how much debt you accumulate over time how well you manage debt and are in too much debt as opposed to manageable debt etc…

15% of the score is calculated on the length of time you’ve been in debt:

- The longer you’ve been in debt with a good track record again demonstrated responsibility and worthiness

10% of your score is based on new debt:

10% of the score is based on the type of debt:

-

- credit cards

- auto loan

- student loans

- mortgage etc…

Maximizing Credit Scores To Qualify For Mortgage

Achieving a good FICO score and maintaining it essentially means to constantly be:

- in debt

- stay in debt

- maintain a good and consistent payment history on all your accounts throughout without any slip-ups

- all this without accumulating too much additional debt or not having enough debt

It’s like a fine balancing act all the time. One small slip up and it could take months to recover. Or a major setback could take years to recover and have to rebuild your credit all over again. The idea of not being in debt is the right one: However, only if you can afford it. You see, the fact is, we all need credit at one time or another. But how much and how well we manage that credit can make all the difference between walking over a very fine line or over a good tight rope.

Maintaining Good Credit

Good credit doesn’t care how much money you have in the bank, savings account, stocks, bonds, etc.. or how good your income is: It’s all about the ability to repay, maintain, show stability and consistency without overextending your reach. It’s kind of like having friends, too many friends. You find out they’re not all that they appear to be, too few friends and you could find yourself a little lonely at times. But having just enough and the right type of friends who bring positive influences in your life can be positive and prosperous when surrounding yourself with the right people.

First-Time Homebuyer and Nervous About Your Score?

Learn what lenders really look for—not just a magic number

Tips and Pointers in Keeping Good Credit

I suppose it all comes back to a full circle, we work our whole lives to build good credit (buy having just the right amount of debt as explained above): As we get older the goal is to be debt-free, no car payments, no credit card payments and hopefully one day, no house payment.

Which over a period of time of not having any credit activity your credit history becomes what’s called “indeterminable” . By this point in your life, you’ve taken no new loans for years, have no new credit cards and paid them all of the old cards off.

Hopefully, you have saved a good amount of money and really don’t need the credit any longer as you pay cash for everything, this is truly the way to end up. Unfortunately, this is not how many of us end up as we rely on our good credit to carry us on. Therefore the importance of maintaining good credit is critical. This holds true because you never know what tomorrow will bring.

Common Credit Score Questions: How Mortgage Lenders View Borrowers With Bad Credit

Common Credit Score Questions is how mortgage underwriters view borrowers with bad credit. Borrowers can qualify for a mortgage with prior bad credit. The keyword here is PRIOR. Lenders want borrowers have timely re-established credit after periods of bad credit for at least 12 months.

Borrowers do not have to pay outstanding collections and charged-off accounts off to qualify for home loans. However, borrowers do need to have timely payments after period of bad credit for at least the past 12 months.

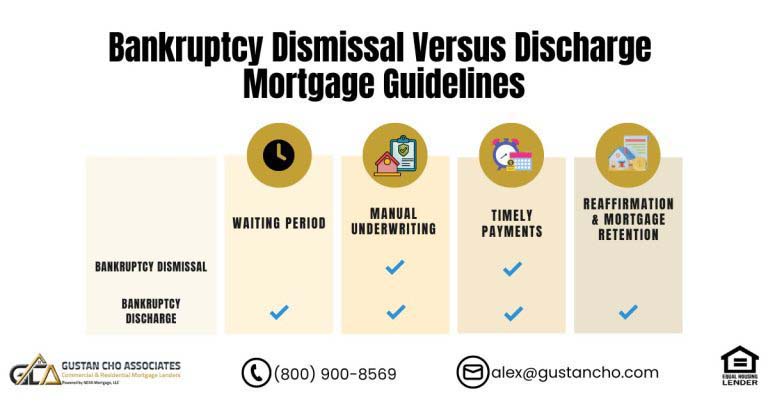

No late payments in the past 12 months. Same thing with a prior bankruptcy or a housing event. Borrowers can qualify for mortgage after a prior bankruptcy or foreclosure, deed in lieu or short sale. However, no late payments after a prior bankruptcy and/or prior housing event. One or two late payments after bankruptcy or housing event is not a deal killer. However, multiple late payments, collections, charge off accounts after bankruptcy or a housing event will be seen as a disregard for credit and approval is most not likely.

Frequently Asked Common Credit Score Questions

This blog on common credit score questions was was updated on March 19th, 2024 from the team at Gustan Cho Associates. The team at Gustan Cho Associates are experts in qualifying, approving, and closing mortgage loans for borrowers with bad credit and credit scores down to 500 FICO.

Gustan Cho Associates is apart from other lenders because over 80% of our borrowers are folks who could not qualify at other mortgage companies.

Gustan Cho Associates specializes in helping borrowers with less than perfect credit. GCA Mortgage Group is a national mortgage banking firm that has a national reputation of not having lender overlays. By understanding these common credit score questions covered in this comprehensive guide on common credit score questions, borrowers can better prepare themselves and work towards meeting mortgage credit requirements.

Want Simple Steps to Raise Your Credit Before You Apply?

Get a custom action plan built off your real credit data