Everything You Need to Know About 85% LTV Jumbo Loans: Your Guide to Financing a High-End Home in 2024

Are you looking to buy a high-end home or refinance your luxury property? If so, an 85% LTV Jumbo Loan could be your perfect option. Jumbo loans are a specialized form of financing designed for high-value homes that exceed the limits set by conventional loan programs. However, not all jumbo loans are created equal. With an 85% LTV Jumbo Loan, you can secure more favorable terms, including lower interest rates and better flexibility in your home purchase or refinance.

In this updated guide, we’ll explain everything you need about 85% LTV Jumbo Loans, how they compare to other loan options, and how you can qualify for one in 2024. Whether you’re a first-time jumbo loan borrower or a seasoned homeowner looking for a better deal, this article covers you.

What is an 85% LTV Jumbo Loan?

Before discussing the specifics of an 85% LTV Jumbo Loan, let’s define jumbo loans and explain why the loan-to-value (LTV) ratio is important.

A jumbo loan is a type of mortgage that surpasses the conforming loan limits established by Fannie Mae and Freddie Mac. These two government-sponsored organizations establish guidelines for the majority of conventional loans. In 2024, the maximum conforming loan limit for a single-family residence is $726,200 in most regions. However, this limit can be as high as $1 million or more in higher-cost areas.

When you apply for a jumbo loan, the amount you borrow exceeds these conforming loan limits. Because of this, jumbo loans are considered “non-conforming” loans. They typically come with stricter requirements and can have higher interest rates than conventional loans. However, 85% of LTV Jumbo Loans offer a balance of favorable rates and access to financing for those purchasing luxury homes.

Looking for a Jumbo Loan? Compare 85% LTV vs 90% LTV Non-QM Mortgages Today!

Contact us today to explore the differences and determine which loan suits you best.

What Does 85% LTV Mean?

The LTV ratio is the percentage of the property’s value you borrow through the loan. An 85% LTV Jumbo Loan means you’re borrowing 85% of the property’s value, while your down payment must cover the remaining 15%.

For example, if you purchase a home valued at $1 million, an 85% LTV Jumbo Loan would allow you to borrow up to $850,000, with the remaining $150,000 coming from your down payment.

Why Choose an 85% LTV Jumbo Loan?

There are several benefits to choosing an 85% LTV Jumbo Loan, especially in 2024:

- Lower Down Payment: You don’t need to come up with the full 20% down payment required by many traditional jumbo loans. With just a 15% down payment, you can access financing for your dream home.

- Competitive Interest Rates: While jumbo loans can sometimes have higher interest rates, 85% LTV Jumbo Loans can offer more competitive rates than loans with higher LTV ratios, like 90% or 95%. This is because lenders typically consider loans with lower LTV ratios less risky.

- No Private Mortgage Insurance (PMI): By utilizing an 85% LTV Jumbo Loan, you eliminate the expense of Private Mortgage Insurance (PMI), which is frequently necessary for loans with elevated LTV ratios. Since PMI can increase your monthly mortgage payment by hundreds of dollars, the absence of this cost is a significant advantage.

- Higher Loan Amounts: 85% LTV Jumbo Loans are designed for high-value homes, meaning you can borrow larger amounts to finance more expensive properties. This makes it an ideal option for buyers in competitive luxury home markets.

How to Qualify for an 85% LTV Jumbo Loan in 2024

Qualifying for an 85% LTV Jumbo Loan differs from qualifying for a conventional or government-backed FHA or VA loan. Here are the key qualifications you’ll need to meet in 2024:

1. Credit Score Requirements

You usually need a higher credit score to be eligible for an 85% LTV Jumbo Loan. The minimum credit score requirement is generally 740. Lenders require a strong credit history to ensure that you can handle the responsibility of a larger loan. If your credit score is below 740, you may still be able to qualify, but your options might be limited, and the interest rate could be higher.

2. Debt-to-Income (DTI) Ratio

Your debt-to-income ratio (DTI) represents how much of your monthly income is used to pay off existing debt. For a Jumbo Loan with an 85% loan-to-value (LTV) ratio, it is generally expected that your DTI should not exceed 41%. Your monthly debt obligations (including the new mortgage payment) should remain below 41% of your gross monthly income. Nevertheless, in certain situations, factors such as a larger down payment or greater reserves may allow you to qualify even with a slightly elevated DTI ratio.

3. Reserves Requirements

Lenders want to make sure you have enough savings to pay your mortgage if you face financial trouble. For an 85% LTV Jumbo Loan, you’ll typically need at least four months of reserves. These reserves include cash, securities, retirement accounts, or other liquid assets.

4. Property Type

An 85% LTV Jumbo Loan is generally available for primary residences, but if you’re purchasing a second home or investment property, the terms and qualifications may differ. Most lenders favor providing loans for primary residences; however, you can still be eligible for a jumbo loan on a secondary property if you fulfill the other criteria.

5. No Recent Late Payments

You should have a strong payment history to be eligible for an 85% LTV Jumbo Loan. Most lenders require that you have no late mortgage payments in the past 12 months and no late payments on other credit accounts in the past six months.

85% LTV Jumbo Loans vs. 90% LTV Non-QM Jumbo Loans

While 85% LTV Jumbo Loans are a great option for many borrowers, other choices are available. Another popular option is the 90% LTV Non-QM Jumbo Loan, which offers a higher LTV but has some differences in terms and qualification criteria.

90% LTV Non-QM Jumbo Loans

A 90% LTV Non-QM Jumbo Loan lets you borrow up to 90% of the property’s value, which means you need to make a 10% down payment. This option is great if you want to keep your down payment low. However, there are some trade-offs to think about.

- Credit Score: You may qualify for a 90% LTV Non-QM Jumbo Loan with a lower credit score. Some non-QM loans accept scores as low as 500. At the same time, traditional 85% LTV Jumbo Loans typically require a minimum credit score 740.

- Debt-to-Income Ratio: Non-QM loans are generally more flexible regarding DTI ratios, with some lenders allowing ratios as high as 50%.

- Private Mortgage Insurance (PMI): While 85% LTV Jumbo Loans typically avoid PMI, 90% LTV Non-QM Jumbo Loans may not require it, which is a significant benefit.

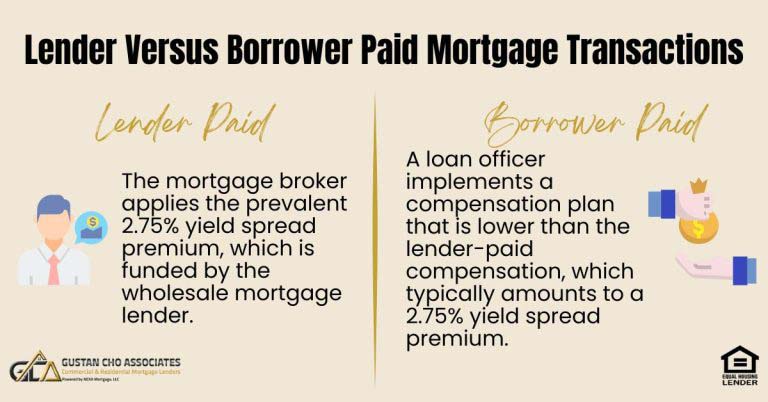

However, non-QM loans can sometimes have higher interest rates than traditional jumbo loans, and the qualification process may involve alternative methods of verifying income, such as bank statements instead of tax returns.

Confused About 85% LTV Jumbo Loans vs. 90% LTV Non-QM Mortgages? Let Us Help!

Contact us today to discuss the best option for your home purchase or refinance.

Which Loan is Right for You?

If you’re comfortable with a larger down payment and have strong credit, an 85% LTV Jumbo Loan is likely the better option, offering more favorable rates and terms.

If you are open to obtaining a larger loan with a reduced down payment and have some leeway in your qualifications (like a lower credit score or elevated DTI ratio), a 90% LTV Non-QM Jumbo Loan might be a suitable option.

85% LTV Jumbo loans Jumbo Bank Statement Loans For Self-Employed Borrowers Without Tax Returns

Self-Employed Borrowers with many unreimbursed expenses can now qualify for our Jumbo Non-QM Bank Statement Mortgage without the income tax returns required. 12 months of bank deposit averages determine the borrower’s monthly income. Withdrawals do not matter. Credit scores down to 500 FICO. The amount of down payment is dependent on the borrower’s credit scores. High-end homebuyers opting for non-QM jumbo loans with no maximum loan cap have no PMI.

How to Get Approved for an 85% LTV Jumbo Loan

Getting approved for an 85% LTV Jumbo Loan isn’t as difficult as it might seem if you follow these steps:

- Check Your Credit Score: Begin by verifying your credit score to confirm that it meets the minimum threshold of 740. If your score falls short, consider enhancing it before applying for a jumbo loan.

- Review Your Debt-to-Income Ratio: Calculate your DTI ratio to ensure it’s under the required 41%. If it’s too high, consider paying down some debt before applying for the loan.

- Prepare Your Documentation: Gather relevant financial documents such as tax returns, bank statements, proof of income, and details of your assets. Lenders will want to see that you have the necessary reserves and income to support the loan.

- Shop Around for Lenders: Various lenders can present varying terms and interest rates for Jumbo Loans with an 85% loan-to-value ratio. Evaluate multiple offers to identify the most advantageous option for your circumstances.

- Get Pre-Approved: Getting pre-approved for your 85% LTV Jumbo Loan will give you a clear understanding of what you can afford and help you move quickly once you find your dream home.

Conclusion: Get Your Dream Home with an 85% LTV Jumbo Loan

An 85% LTV Jumbo Loan is an excellent choice for those looking to buy a high-end home without breaking the bank on a huge down payment. With reduced down payment needs, appealing interest rates, and no private mortgage insurance, this is an enticing choice for numerous luxury homebuyers in 2024. Whether you are refinancing a current jumbo loan or purchasing a new property, an 85% loan-to-value Jumbo Loan can assist you in obtaining the necessary financing.

Ready to take the next step? Contact us today to learn more about 85% LTV Jumbo Loans and how they can help you achieve your homeownership goals. We’re here to make the process as smooth and simple as possible.

Feel free to contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com for more information on jumbo loans or other mortgage-related topics.

Frequently Asked Questions About 85% LTV Jumbo Loans:

Q: What is an 85% LTV Jumbo Loan?

A: A Jumbo Loan with an 85% loan-to-value ratio permits you to finance 85% of a high-value property’s worth, which means you’ll need to contribute just 15% as your down payment. These types of loans cater to more costly properties than standard home loans.

Q: How is an 85% LTV Jumbo Loan Different From a Regular Mortgage?

A: A regular mortgage follows Fannie Mae and Freddie Mac’s limits, while an 85% LTV Jumbo Loan exceeds these limits. Jumbo loans are used for more expensive homes and typically have higher requirements, such as better credit scores and lower debt-to-income ratios.

Q: Why Should I Choose an 85% LTV Jumbo Loan Over a 90% LTV Loan?

A: Choosing an 85% LTV Jumbo Loan means you’ll make a smaller down payment (15% instead of 10%) but may get better interest rates and avoid Private Mortgage Insurance (PMI), which can save you money in the long run.

Q: What is the Minimum Credit Score for an 85% LTV Jumbo Loan?

A: To qualify for an 85% LTV Jumbo Loan, you generally need a credit score of at least 740. A better score indicates that you are more inclined to repay the loan responsibly, which is crucial for lenders.

Q: What is Private Mortgage Insurance (PMI), and Do I Need it for an 85% LTV Jumbo Loan?

A: PMI is a type of insurance that protects the lender in the event that you are unable to repay the loan. With a Jumbo Loan at an 85% LTV, there is no requirement for PMI, which can lead to significant monthly savings compared to loans with higher LTV ratios.

Q: How do I Qualify for an 85% LTV Jumbo Loan?

A: To qualify for an 85% LTV Jumbo Loan, you need a strong credit score (at least 740), a low debt-to-income ratio (usually under 41%), and enough savings to cover at least four months of mortgage payments in reserves.

Q: Can I Use an 85% LTV Jumbo Loan for a Second Home or Investment Property?

A: You can use an 85% LTV Jumbo Loan for a second home, but the terms may vary. Lenders typically prefer primary residences for these loans, so you’ll need to meet additional requirements if you’re buying a second home or investment property.

Q: What Happens if My Credit Score is Below 740?

A: If your credit score is below 740, you may still qualify for an 85% LTV Jumbo Loan, but your interest rates could be higher, or you might need a larger down payment or other compensating factors to qualify.

Q: How Much Down Payment Do I Need for an 85% LTV Jumbo Loan?

A: With an 85% LTV Jumbo Loan, you only need a 15% down payment, which is lower than the 20% down payment required by many other Jumbo loans. This makes it easier to finance a high-value home without a large upfront cost.

Q: How Long Does it Take to Get Approved for an 85% LTV Jumbo Loan?

A: The approval process for an 85% LTV Jumbo Loan typically takes longer than conventional loans, as lenders must thoroughly verify your financial details. However, you can expect a quicker process if you have all your documentation in order. It’s a good idea to get pre-approved first to speed things up.

Related> Non-Qm Jumbo Mortgages

Related> Jumbo Mortgage With 10% Down Payment

This blog about “85% LTV Jumbo Loans Versus 90% LTV Non-QM Mortgages” was updated on November 26th, 2024.

Choosing Between a Jumbo Loan and Non-QM Mortgage? Let’s Find the Right Fit!

Contact us now to learn about the advantages of both loan types and how you can get approved.