The best and easiest way to rebuild and re-establish credit to qualify for a mortgage is using secured credit cards to raise credit scores and have timely payments on all of your debt payments for the past 12 months.

The combination of these two tasks increases your chances greatly to get an approve/eligible per the automated underwriting system. Secured credit cards are the same as unsecured credit cards, except the creditor requires a deposit. The deposit amount is the credit limit the credit card company will issue.

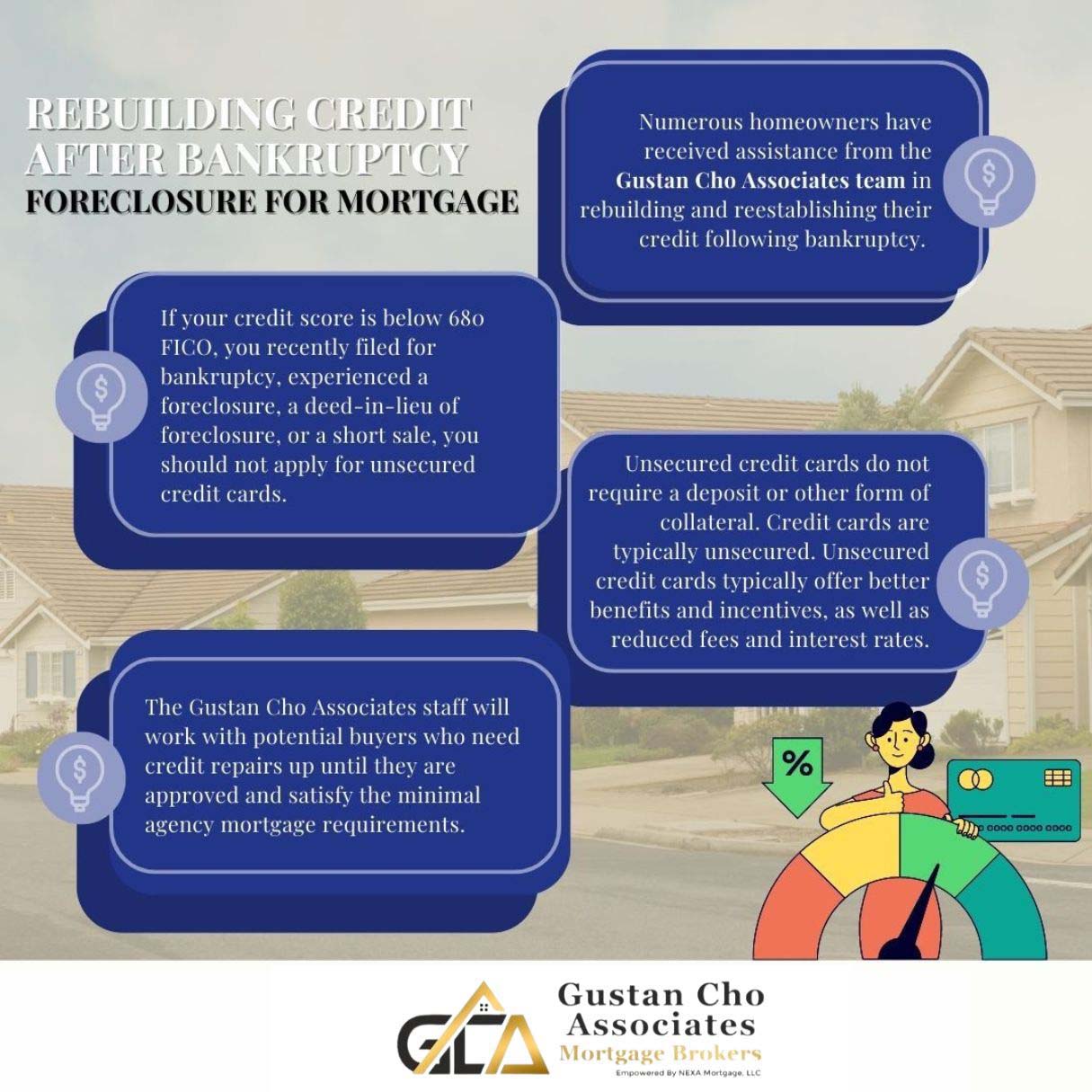

Rebuilding Credit After Bankruptcy and Foreclosure For Mortgage

The team at Gustan Cho Associates has helped thousands of homebuyers rebuild and re-establish their credit after bankruptcy. Most of our clients we helped raise their credit scores to over 700 FICO in less than one year after the bankruptcy discharge date. Do not apply for unsecured credit cards if your credit scores are under 680 FICO and if you recently filed for bankruptcy, had a recent foreclosure, deed-in-lieu of foreclosure, or short-sale.

A substantial number of our borrowers at Gustan Cho Associates may not be ready to qualify for a mortgage but can qualify after a few quick credit fixes in weeks or months. The team at Gustan Cho Associates will work with borrowers who need credit fixes until they qualify and meet the minimum agency mortgage guidelines.

The Difference Between Secured Versus Unsecured Credit Cards

Unsecured credit cards are very difficult to get approved if you do not have established credit with at least a 680 credit score. You cannot have late payments in the past 12 months and recent collection and charged-off accounts to get approved for an unsecured credit card. If you get three to five secured credit cards and make timely payments for six to 12 months, you will be eligible for unsecured credit cards.

In many instances, secured credit card companies will increase your credit limit after you make timely payments for six to 12 months. You would not get accepted for unsecured credit cards if you had late payments or recent derogatory credit tradelines in the past 12 months. We recommend at least three to five secured credit cards with at least a $500 credit limit on each card. There are other types of credit we recommend which we will cover later in this blog. This article will cover the best and easiest way to rebuild and re-establish your credit so you can qualify for a mortgage.

FHA Loan Requirements With Bad Credit

FHA loans are the best and most popular mortgage loan program for first-time homebuyers with credit scores down to 500 FICO and bad credit and borrowers with high debt-to-income ratios. HUD, the parent of FHA, has created and implemented lenient mortgage guidelines for hard-working Americans to purchase homes with a low down payment and less-than-perfect credit.

There are other home mortgage loan programs available for homebuyers with bad credit, but FHA loans, by far, are the most popular home loan program. The key to qualifying for a home loan with bad credit is to have been timely on all monthly payments for the past 12 months. FHA loan requirements with bad credit allow borrowers with outstanding collection and charged-off accounts to qualify for an FHA loan.

FHA Loan Requirements After Bankruptcy And Foreclosure

Homebuyers can qualify for an FHA loan after the Chapter 7 Bankruptcy discharge date by waiting a two-year mandatory waiting period after the Chapter 7 bankruptcy discharge date. However, just passing the waiting period does not automatically guarantee an FHA loan approval.

You cannot have any late payments after bankruptcy or foreclosure. You need timely payments after bankruptcy and re-established credit. There is a three-year waiting period after foreclosure, a deed-in-lieu of foreclosure, short sale. Rebuilt and re-established credit is required. No late payments after the housing event.

Rebuilding Credit After Bankruptcy And Foreclosure To Qualify For A Mortgage

For consumers who have bad credit and need to improve their credit scores to re-establish credit, secured credit cards are the best vehicle for good credit. Secured Cards are the easiest and fastest way of improving credit to qualify for mortgage loans. A bankruptcy or foreclosure can easily plummet credit scores by 150 points or more.

One 30-day late payment will drop scores by at least 40 points. A late mortgage payment will drop credit scores by at least 70 points. A recent collection account on the credit report will drop credit scores by 60 points or more. Each hard-pull credit inquiry will drop credit scores by 2 points or more. Consumers with bad credit or no credit should start re-establishing credit with secured cards. Getting secured cards is the easiest and fastest way to reestablish credit and boost credit scores.

Why Secured Credit Cards?

It will be difficult for consumers with under 700 credit scores to get unsecured credit cards. Secured Credit Cards are a great bridge to raise credit scores to get to 700 plus credit scores in a rather short period of time. Secured credit cards are just like any other unsecured credit card.

The only difference is that the secured credit card company will require a deposit from the consumer. Secured credit card companies will issue a credit limit equivalent to the deposit amount. If the secured credit card holder defaults on the payments, the secured credit card company will take the deposit. They will use that to offset the loss and close the credit card account. This article will discuss raising credit scores with secured credit cards to qualify for a mortgage.

Re-Establishing Credit With Secured Credit Cards

Secured credit cards are a great way to establish new credit. Consumers with bankruptcy, foreclosure, judgments, tax liens, and late payment histories will likely find it difficult to obtain new credit. They need to re-establish credit, and the chances of getting approved for unsecured credit with bad credit are slim to none.

By getting secured credit cards, consumers will be able to establish credit. The consumer credit profile will be stronger as time passes and the credit cards age. Secured credit cards report the cardholder’s payment history to all three major credit reporting agencies. The late payments will be reported to credit bureaus for consumers who are late with monthly secured credit card payments. Late payments will stay on consumer credit reports for seven years and drop credit scores.

Where Can I Get Secured Credit Cards?

Consumers can obtain secured credit cards online by searching various keywords such as secured credit cards for reestablishing credit. Many secured credit card options are available at your local bank or via an internet search. By researching the internet, consumers can apply for secured credit cards here at www.gustancho.com, another great place to get a selection of recommended secured credit cards. Secured credit cards are the best tool for establishing credit and improving credit scores.

Applying For Mortgage With Low Credit Scores

All mortgage loan programs have minimum credit score requirements. There are minimum mortgage guidelines on credit scores. FHA Loans are the most popular loan programs in the U.S. FHA loans benefit home buyers with lower credit scores, previous bad credit, higher debt-to-income ratios, and low down payment requirements.

FHA Credit Score Requirements

Here are the minimum HUD Mortgage Guidelines to qualify for FHA loans:

- For a 3.5% down payment home purchase FHA loan, HUD requires a 580 credit score

- Mortgage Loan Applicants can qualify for FHA Loans with outstanding collections and charge-off accounts without paying out the outstanding balances.

- HUD allows up to 46.9% DTI front end and 56.9% DTI back end

- HUD allows multiple non-occupant co-borrowers

- There is no maximum number of co-borrower the main borrower is allowed to add to the FHA loan.

- To qualify for a 3.5% down payment home purchase FHA loan with non-occupant co-borrowers, the non-occupant co-borrower needs to be related to the main borrower by blood, law, and marriage.

- HUD allows non-occupant co-borrowers not related to the main borrower by blood, law, or marriage but a 25% down payment is required

Cases Where Borrowers Do Not Meet Minimum FHA Credit Score Requirements

There are cases where FHA Loans borrowers or co-borrowers do not quite meet the 580 credit score requirements. Many borrowers do not understand why they have low credit scores when they have been paying all of their bills timely and making a good income. Low credit scores are usually due to not having active revolving credit tradelines.

The best and quickest method of increasing your credit scores to get mortgage approval is by getting secured credit cards. The recommended numbers get three secured cards with at least a $500 credit limit. Consumers can boost credit scores substantially. Secured Cards are the fastest and easiest tool for boosting credit scores to qualify for mortgage loans.

Home Buyers who want to qualify for a home loan with no lender overlays, please contact us at Gustan Cho Associates at 1-800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We are available seven days a week, evenings, weekends, and holidays. Gustan Cho Associates has a national reputation for its no-lender overlay business model on government and conventional loans.