This guide covers factors influencing credit scores when applying for a mortgage. There are five Factors Influencing credit scores. The following line items are factors influencing credit scores:

- Payment history

- Credit balances outstanding

- Credit history longevity

- Types of credit types

- Credit Inquiries

In this article, we will cover and discuss the factors Influencing credit scores when applying for a mortgage.

Factors Influencing Credit Scores When Applying for a Mortgage: A Comprehensive Guide

Your credit score steps into the spotlight as soon as you ask a lender for a mortgage. That single number will help decide whether you get the loan, how much money you can borrow, and what monthly interest rate you pay. Boosting the score even a few points can translate into savings worth thousands of dollars over the life of the mortgage. Because of its importance, anyone hoping to buy a house should know exactly what makes the score go up or down. In the sections that follow, we break down the main drivers of credit, explain how each one touches your mortgage request, and offer simple, smart steps you can take to strengthen the number before you apply.

Know What Affects Your Credit Score Before You Apply

From payment history to credit utilization, small changes can impact your mortgage approval.

Factors Influencing Credit Scores-Why Credit Scores Matter for Mortgages

Credit scores usually fall between 300 and 850, and the number puts a quick value on how trustworthy you are as a borrower. Lenders pull the score in seconds and use it and other details from your credit report to judge the risk of lending you money for a home. Dale Elenteny, a senior mortgage loan originator at Gustan Cho Associates says the following about factors impacting credit scores for a mortgage:

If the road record looks good and the score is high, lenders see you as a reliable borrower and follow with lower interest rates and easier terms. On the other hand, a weak score raises questions; lenders might charge a steeper rate, ask for a bigger down payment, or, in rare cases, turn down the loan request altogether.

When you apply for a mortgage, the lender will always look at your FICO Score. Some may peek at VantageScore, too, but that is less common. Usually, the lender checks your score with all three big credit agencies-Equifax, Experian, and TransUnion- and then takes the middle number.

Factors Influencing Credit Scores-Minimum Credit Score Requirements For a Mortgage

- Conventional Loans: Usually, you need a score of 620 or higher.

- FHA Loans: A score as low as 580 lets you put down 3.5%; with a score between 500 and 579, you can still qualify if you put down 10%.

- VA Loans: There is no set floor, but most lenders like to see 620 or better.

- USDA Loans: A score around 640 is generally expected.

Learning how credit scores are built can help you hit these marks and get a better deal on your mortgage.

Key Factors Influencing Credit Scores

The FICO Score most lenders use has five parts, each of which matters in a different way. Below, we list those parts, how much weight each carries, and what they mean for your loan.

- Payment History (35%): Payment history carries the biggest weight, 35 percent. This part shows whether you pay your credit cards, loans, and other bills on time, and even one late payment can lower your score.

- Payment History (35%): Your payment history shows lenders how responsibly you handle bills. Always paying on time boosts your score and proves you can be trusted with a loan. However, late payments, accounts sent to collections, or bankruptcy raise warning flags.

Factors Influencing Credit Scores For a Mortgage-Examples:

- A single 30-day late payment can knock 60 to 100 points off your score.

- A foreclosure or bankruptcy stays on the report for seven years, making getting a mortgage harder.

Factors Influencing Credit Scores-Tips to Improve:

- Set up automated payments so bills are paid even if you forget to pay them.

- Always pay at least the minimum on every account to keep them current.

- Deal with overdue balances or talk to creditors about wiping negative marks.

- Credit Utilization (30%): Credit utilization shows what portion of your total credit you’re using. To find it, divide your total card balances by your credit limit.

- Impact on Mortgage: Lenders like a utilization rate below 30 percent because anything higher signals money stress.

Factors Influencing Credit Scores-Example:

If your cards add up to a $10,000 limit and you owe $4,000, your ratio is 40 percent, which can weigh down your score.

Factors Influencing Credit Scores-Tips to Improve:

- Pay down balances so utilization sits below 30 percent.

- Ask for a credit-limit increase to nudge the ratio lower, but don’t spend the extra room.

- Letting an old credit card sit unused is better than closing it.

- Closing cards shrinks your total credit limit, nudging your utilization ratio in the wrong direction.

- Length of Credit History (15%): This part of your score looks at how old your oldest account is, the average age of all your accounts, and how new your newest account happens to be.

- A longer history gives lenders more data to trust when applying for a mortgage, so your score will likely improve.

- Borrowers with short or thin records usually score lower, giving lenders a reason to be careful.

Picture this: a borrower with one ten-year-old credit card and several others averaging seven years will still outscore someone who started everything just two years ago.

Tips to Improve:

- Keep those dusty, old accounts open, even if they rarely see a purchase, so your history can grow.

- Opening many new cards or loans in a few months lowers the average age of all your accounts, which hurts your score.

- If your file is thin, ask a trusted friend or relative if you can be an authorized user on their long-standing account.

- That can quickly add age.

- Types of Credit (10%): Your credit mix shows how well you manage different kinds of loans: credit cards, mortgages, auto loans, and student loans all count.

Impact of Credit Mix on Your Mortgage

A mix of credit accounts, even a little variety, can nudge your score because it proves you handle more than one kind of debt. Still, lenders mostly look at your payment record and how much of your available credit you use before caring about the mix.

Example:

A borrower with a credit card, an auto loan, and a student loan usually scores slightly higher than a borrower with only credit cards.

Tips to Improve:

- Don’t open new accounts just for variety.

- Applying can knock a few points off your score.

- Put most of your energy into using and paying your current accounts on time.

- New Credit Inquiries (10%): This part of your score counts the times you ask for new credit and wind up with hard inquiries on your report. Each new hard pull can take a small toll on your score that fades in a few months.

- Impact on Mortgage: If you submit lots of applications in a hurry, almost at once, it can look like you are in trouble, which dents your score and makes lenders pause. The good news is that all the mortgage pulls within a 14-to-45-day stretch are bundled together, so they count as one hit.

Example:

If you go to three mortgage shops in two weeks, you will see just one hard inquiry, but if you ask for a credit card and an auto loan at the same time, those pulls will pile up separately.

Tips to Improve:

- Keep new loan and credit-card requests minimum in the few months before applying for your mortgage.

- Shop for mortgage rates quickly to cut the impact of credit inquiries.

- Monitor your credit report for surprise inquiries and dispute any mistakes.

Extra Factors Mortgage Lenders Check

Beyond the main FICO score, lenders look at other pieces that might affect your score or decide whether to approve your loan.

Debt-to-Income Ratio (DTI)

DTI isn’t part of your score but shows how much of your income goes to debt. Divide all monthly debt payments by gross monthly income for the number. A high DTI can cancel out a great score because you have little room for new bills.

- Guideline: Most lenders want DTI below 43 percent for conventional loans and between 41 and 50 percent for FHA or VA options.

- Tip: Trim high-interest balances or boost income to lower that DTI.

Employment and Income Stability

Lenders usually check two years of steady work and enough pay to cover a new mortgage. Breaks in employment or income that change month to month can worry them, even if your score shines.

- Tip: Bring clear documents, especially if you are self-employed or just switched jobs.

- Cash Reserves: Many mortgage lenders ask for cash reserves, which usually means setting aside the equivalent of one to six months’ worth of your mortgage payment in a separate account.

- They want this cushion so you can still cover your bill if life throws you a curveball.

- Even though reserves don’t appear on your credit report, having very little available makes underwriters look harder at the rest of your profile.

- Quick Tip: Start saving before you fill out your loan application, so you meet the reserve guideline when the time comes.

- Lender Overlays: Because every lender has its risk appetite, many tinker with an overlay.

- These are extra hoops on top of the standard rules for a given loan program, like FHA or VA. For instance, FHA may say a 580 score is okay, yet a specific lender could still demand you come in at 640.

- So even if your score looks decent on paper, those extra hurdles can still knock the wind out of your approval hopes.

Quick Tip:

Talk to three or four lenders to find the one with the lightest set of overlays.

Credit Score Too Low for a Mortgage? Let’s Fix That

Understand what drives your score—and how to raise it quickly for better rates.

How to Improve Your Credit Score Before Applying for a Mortgage

Boosting your credit score will not happen overnight, but daily habits can make a difference in weeks. Follow this simple roadmap to achieve a healthier number.

Check Your Credit Reports

Snag a free copy from each bureau at [AnnualCreditReport.com](http://AnnualCreditReport.com

- Look for mistakes, like wrong balances or accounts that aren’t yours, and file a dispute right there.

- Give the bureaus 30 to 60 days; once fixes settle in, you’ll likely see a small score bump.

Pay Down Debt

- Zero in on high-interest credit cards first; less debt means lower utilization, which helps your number.

- If you can, chip away at more than the minimum payment to shorten the balance’s life span.

Make All Payments on Time

Set up calendar reminders or use autopay so bills never slip your mind. If you’ve already missed a payment, catch up fast to limit the damage.

Avoid New Credit Applications

Don’t open new credit cards or make big purchases in the six months before you apply for a mortgage.

Work with a Credit Counselor

If your score is still low, contact a nonprofit credit counselor who can build a step-by-step plan with you.

Consider Rapid Rescoring

Many lenders offer rapid rescoring, letting your credit report refresh days after you pay off a debt or fix a mistake.

How Long Does It Take to Improve Your Credit Score

It depends on what’s holding you back:

- Minor Issues (like high credit use): Pay down balances, and you may see a lift in 1 to 2 months.

- Late Payments: A recent missed payment lingers for 6 to 12 months before its sting fades.

Major Derogatories (like bankruptcy):

These stay for up to 10 years, but good habits soften the blow after 2 to 3 years.

- Focus on these steps at least six months before you plan to get a mortgage, and you’ll give your score its best shot.

- Your credit score, often seen as the gatekeeper of lending, can make or break your dream mortgage.

- It shapes everything from whether you get approved to the interest rate that lingers on your monthly bill.

- When you know the five main pieces-payment history, credit use, how long you’ve had credit, the mix of accounts, and recent inquiries-you can work on each part and boost your score.

- So, check your score early, watch it, and talk with different lenders to lock in the best deal.

- If you’d rather have a pro behind the wheel, contact a mortgage broker or friendly lender; they’ll review your credit, show you options, and steer you toward a loan that fits.

How Mortgage Underwriters Analyze Borrowers Credit Reports

The types of credit the consumer has in his or her profile, and credit inquiries is looked at by mortgage underwriters. Underwriters are concerned by past timely credit history. Past performance is a good indication of how consumers pay their bills. Special emphasis will be placed on timely payment history in the past 12 months. It is alright to have gone through financial hardship. However, underwriters will look at credit history prior to and after hardship. Late payments after bankruptcy and/or foreclosure is really frowned upon.

First Factors Influencing Credit Scores: Consumer Credit Payment History

The first type of Factors Influencing credit scores is the overall consumer overall payment history on their credit report. This accounts for 35% of the overall credit score of the consumer. A consumer paying their monthly bills on time and/or in full has the best impact on their overall credit scores with the credit bureaus credit scoring model. Any late payments, collections, judgments, and charge off accounts will have an extremely negative impact on a consumer’s credit scores. John Strange, a senior loan officer at Gustan Cho Associates says the following about factors Influencing credit scores when applying for a mortgage.

A consumer being late on a high monthly credit payment will have more severe consequences on his or her credit scores than being late or missing a lower monthly credit payment. Credit delinquencies in the most recent two years will have more of a negative impact on consumer credit scores.

This will carry more of a negative weight than older derogatory credit items. All negative payment history such as late payments and other derogatory credit items with the exception of credit inquiries will remain on consumer credit reports for a period of seven years from the date of the last activity.

Second Factors Influencing Credit Scores: Outstanding Credit Card Balances

The second Factors Influencing Credit Scores is outstanding balances on revolving credit accounts. This accounts for 30% of credit scores. The consumer’s outstanding credit balances is actually the available credit to the available credit limit ratio. This ratio is the ratio between the current outstanding revolving account balance and the total available credit limit. Maxing out a credit card will yield a high ratio. This will have a very negative impact on the consumer’s credit scores and credit scores will drop significantly. This factor marks the ratio between the outstanding balance and available credit. Consumers should have a ratio of less than 10% where the credit balances are under 10% of the available credit limit. The good thing about maxed out credit cards is that by paying down the credit card balances, the consumer credit scores will instantly go up the next update period.

Overall Credit Payment History On Credit Report

The overall credit payment history is the third Factors Influencing Credit Scores. This accounts for 15% of the overall credit scores. A consumer’s overall credit history is the longevity on how long the consumer has had a particular credit or credit accounts. The start date in judging longevity starts from the date the credit account was opened. Never close out an open credit account even though you are not using the credit account even though consumers do not use the revolving credit account. Open tradelines are priceless and add strength to the credit profile of the consumer.

Improve Your Score, Improve Your Mortgage Terms

The better your credit, the better your rates and options. Start your improvement plan now.

Having Different Types Of Credit On Credit Report

10% of a consumer’s credit profile is from having different types of credit on the credit reports. A consumer’s mix of credit and types of credit he or she has in their credit profile has a 10% impact of their overall credit scores. The mix of credit and types of credits include revolving credit accounts such as the following:

- Credit card accounts

- Automobile loans

- Student loans

- Mortgage loans

Have a variety of different types of credit is an advantage of maximizing overall credit scores than just having one type of credit such as credit card credit. Having a variety of different type of credit tradelines creates a stronger credit profile.

Credit Inquiries On Credit Report

There are two types of credit inquiries:

- Hard Pull

- Soft Pull

Credit Inquiries on a consumer credit report have a 10% impact on consumer credit scores.

- The number of inquiries a consumer has on his or her credit report will have a 10% impact on their credits scores

- This is credit inquiries in a six month period window

- Every hard credit inquiry will negatively impact a consumer’s credit score

- The maximum number of credit inquiries that will reduce the consumer’s credit score is 10

- For example, 11 or more credit inquiries within a six month window period will have the same negative results as the 10 inquiries

- Each credit inquiry can drop a consumer’s credit scores by two to five points for a maximum of 25 points for ten or more inquiries

If consumer runs their own credit reports or has a mortgage company run a soft pull, that will have no negative impact on credit scores.

How To Raise Credit Scores To Qualify For Mortgage

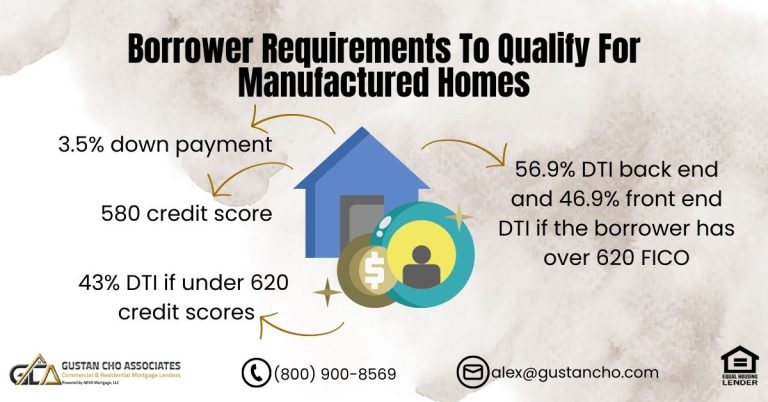

Every mortgage loan program has a minimum credit score requirement. Here are the minimum credit score requirements to qualify for home loans:

- To Qualify For 3.5% down payment FHA Loans, HUD, the parent of FHA, requires 580

- There are no minimum credit score requirements for VA Loans

- However, to get an approve/eligible per Automated Underwriting System Findings on VA Loans, borrowers should have at least a 580 credit score

- To qualify for USDA Loans, borrowers should have at least a 640 credit score

- To qualify for NON-QM Loans, borrowers should have at least a 640 credit score:

- 680 credit scores will require less of a down payment versus lower credit scores

- Fannie Mae and/or Freddie Mac require a 620 credit score on conventional loans

- Jumbo Mortgages require a 700 credit score with 20% down payment

- Jumbo Mortgage Loans with 10% down payment requires a 740 credit score

- Condotel and Non-Warrantable portfolio loans require a 680 credit score

Please click on this BLOG ON HOW TO RAISE YOUR CREDIT SCORES TO QUALIFY FOR MORTGAGE for tips on how to boost your credit scores to qualify for home loans.

Not Sure What’s Hurting Your Credit Score?

We’ll analyze your report, identify red flags, and guide you toward loan approval.