In this guide, we will cover what down payment assistance is and how it works. We will discuss how down payment assistance works and how homebuyers can get $10,000 or more for home purchases.

There are many different types of down payment assistance programs. Each down payment assistance program is different and has its separate lending requirements.

If you’ve researched buying a home, you’ve probably already realized there can be a high upfront cost. You might need significant savings between the down payment, closing costs, moving costs, and more. Down payment assistance programs can help you reduce the upfront cash outlay. Some programs offer $10,000, $20,000, or more. Here’s how these programs work.

How Does The Down Payment Assistance Work?

Down payment assistance, or DPA, is offered to encourage homeownership among those who cannot buy a home otherwise. These programs are usually supplied by government agencies, non-profits, and organizations that want to help first-time homebuyers. These agencies issue funds to the closing agent (called “escrow”) at the final step of buying a home, known as “closing.” Here is the definition of closing costs on a real estate transaction:

Closing is when you have to come up with cash to close the transaction. The cash covers your down payment for the loan, closing costs like title insurance, property taxes that must be paid in advance, and other costs. For instance, say you’re buying a home for $250,000. Your down payment is 3.5%, or $8,750.

You may also have closing costs of around $5,000 for $13,750. It’s quite a high number. But because you applied for and received a down payment assistance program, the agency issues $12,000 toward that closing cost. You only have to pay $1,750 from personal funds. You can now see why DPA is such a game-changer for new buyers.

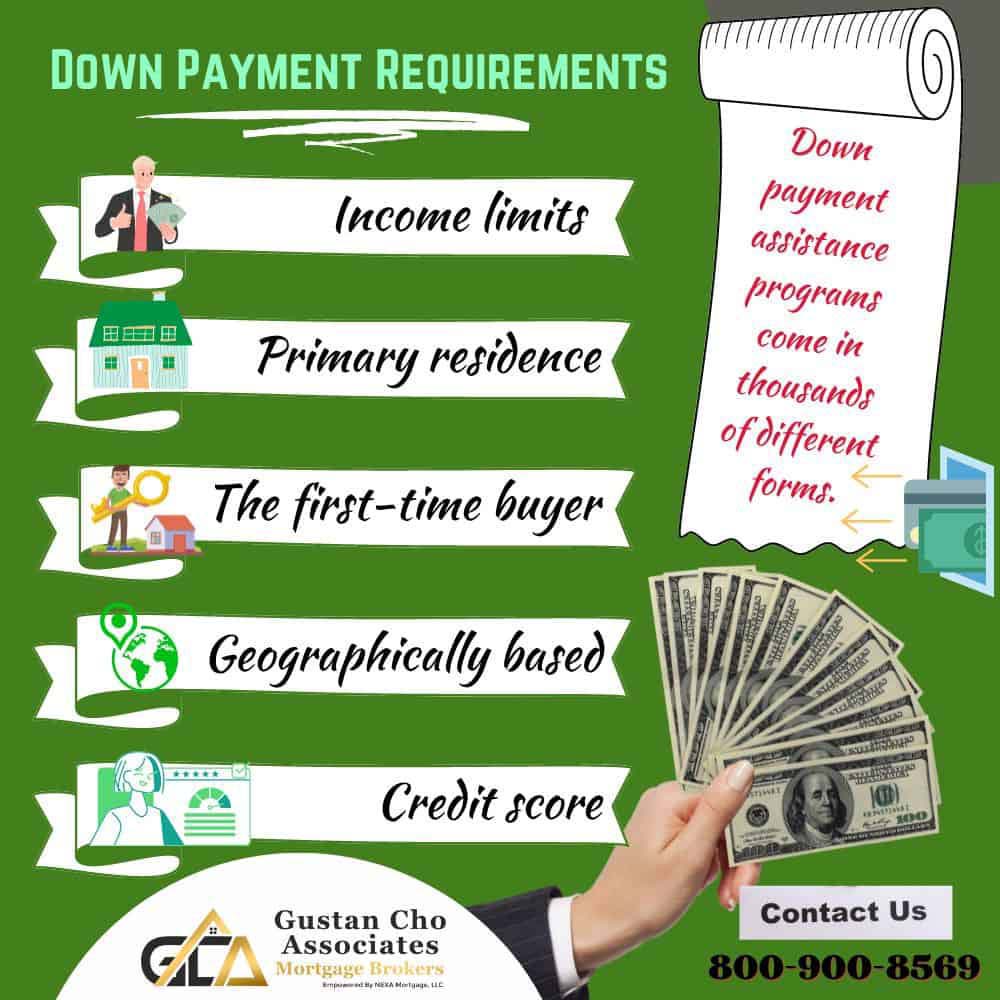

Down Payment Requirements

DPA is not like mortgage programs such as FHA, conventional, and USDA loans, which come with similar guidelines nationwide. Down payment assistance programs come in thousands of different forms. For example, the State of Washington offers at least ten programs with different requirements. Multiply this by 50 states, plus various nationwide non-profit DPA programs, and you can see how varied the requirements are. However, this is a big advantage to first-time buyers. If you don’t qualify for one program, many more are likely available in your area. Many of the programs come with similar guidelines, however.

Income limits: Most DPA programs limit the amount you can make since agencies want to reserve funds for those who need it most. However, making enough to qualify for the primary mortgage would be best.

Primary residence: DPA is only for a home you plan to live in, not a vacation home or rental.

The first-time buyer: Most programs are reserved for those who haven’t owned a home in the past three years.

Geographically based: Most state, city, and county agencies only offer DPA to homebuyers purchasing within certain geographic areas.

Credit score: Since DPA must be layered on top of a standard loan program, you must meet credit score requirements for the base mortgage.

How To Get Down Payment Assistance

The typical process to get a down payment program is as follows.

- Search for a program that you may qualify for

- Apply with the agency directly or a lender that administers the program

- Submit your income documentation and bank statements, and have the lender pull your credit

- Get a pre-approval for a certain home price

- Make an offer on a home

- The lender orders an appraisal

- Supply any additional requirements to the lender or DPA provider

- The DPA agency issues funds to the closing agent

- You sign the final paperwork and supply any additional funds needed

- Close on the loan and get the keys to your home

The DPA process is not very different from any homebuyer, except that you can drastically reduce the amount of cash needed to close.

Types of Down Payment Assistance Mortgage Loan Program

DPA comes in many different forms. Most come with some payback procedure, although the terms are quite generous.

Grants: Assistance that never has to be repaid. However, they often come with a requirement that you stay in the home for a number of years.

Second mortgage: Some agencies will place a second mortgage on your home in the amount of your down payment funds. Sometimes you pay on a monthly loan; however, no payment is usually due until you refinance, sell, or move out of the home.

Forgivable Down Payment Assistance Mortgage Loan Programs: Your DPA could be forgivable. It’s technically a loan, but if you meet certain requirements, the lender “forgives” it, meaning they cancel the debt, and it does not have to be repaid. No matter what kind of DPA you get, make sure to read the fine print and can meet the requirements.

Popular Down Payment Assistance Programs

Because DPA programs are highly localized, it’s best to do a Google search with the following query, filling in the brackets with your criteria.

down payment assistance [city] [state] [county]

There are, however, a few nationwide (or near nationwide) programs.

Empower Down Payment Assistance

Empower DPA: Receive 2-3.5% of the home’s price as a forgivable grant. Available to first-time buyers, military personnel, first responders, educators, medical personnel, or civil servant.

Freddie Mac BorrowerSM Down Payment Assistance Program

Freddie Mac BorrowSmartSM: Up to $2,500 in down payment assistance for those who earn less than 100% of their area’s median income and use one of Freddie Mac’s first-time programs, such as HomeOne or Home Possible program.

National Homebuyers Fund Down Payment Assistance Program

National Homebuyers Fund: Up to 5% of the loan amount towards the down payment and closing costs.

Chenoa Fund Down Payment Assistance Program

Chenoa Fund: 3.5%-5% down payment assistance available in every state except New York. Open to applicants with credit scores of at least 600 and who meet other qualifications.

Is DPA right for you?

Even if you have given up on homebuying due to large upfront costs, it’s time to consider it again. With the right DPA, you could be a homeowner faster than you think. It’s always worth searching for your area’s programs and contacting a reputable lender who can help determine your eligibility.