This Breaking News Article On The U.S. Unemployment Rate Falls To 50-Year Low

Great news this morning on the U.S. Employment Numbers and Unemployment Rate Falls To 50-Year Low:

- Right before the Dow Jones Industrial Averages opened this morning, the breaking news of the U.S. Unemployment Rate Falls To 50-Year Low For The United States came out over the wire

- The news of the Unemployment Rate Falls To 50-Year Low For The United States sent stocks soaring after the bell

- Investors were waiting for today and hoping for positive news

- The dow tanked the past two days after news of September ISM Non-manufacturing index slowed economic numbers

In this article, we will discuss and cover this breaking news on the U.S. Unemployment Rate Falls To 50-Year Low For The United States.

Stocks Soar After The News Broke

Consumer Confidence Levels Up After The News Of Unemployment Rate Fall To 50-Year Low For The United States:

- Once the news broke of the U.S. Unemployment Rate Falls To 50-Year Low, stocks took off. The news was announced and released by the Bureau of Labor Statistics (BLS)

- The BLS released its monthly Employment Situation Report

- The unemployment report is data that shows the employment numbers and growth for the month of September

- Investors were worried about the numbers of the BLS report all week

This report is very crucial and important due to the U.S. being in the middle of the longest economic recovery in U.S. history.

The Trump Economy

After President Donald Trump took office, the economy has been on fire.

- The U.S. economy has added over 6.4 million jobs

- This 6.4 million number surpasses the population of the state of Maryland

- Unemployment numbers have been declining month after month

- New job numbers remain strong far exceeding expectations

- The Dow Jones Industrial Averages are at historical highs which means more Americans are developing wealth through their 401k

- Low unemployment numbers mean higher wages due to the demand for higher-skilled workers

- It also means more spending by consumers due to more folks being in the workforce

- Many Americans who gave up looking for work due to the longest-lasting recession in American history now find the motivation to look for jobs, get hired, and enter the workforce

- Low unemployment numbers mean housing demand and home sales. Homeownership is increasing every quarter

There more first time home buyers today than ever in the history of the U.S.

Record-Breaking Numbers

Data suggests that the Unemployment Rate Falls To 50-Year Low For The United States to 3.5 percent for the month of September.

- The 3.5% unemployment rate marks the 19th consecutive month of decline

- Unemployment rates have been at under 4 percent for the past 19 months

- Today’s 3.5% unemployment rate is the lowest it has been since 1969

- This is over 50 years ago

- As more Americans are employed, this greatly benefits U.S. households and the economy

- The unemployment rate benefits Americans of all races plus those who are disabled and/or with health issues

The lowest unemployment record is for all Americans including Blacks, Hispanics, Indian Americans, Asians, and other nationalities.

What Experts Say About Record Unemployment Rate Data Released Today

Michael Gracz, the National Sales Manager and monetary policy expert at Gustan Cho Associates said the following:

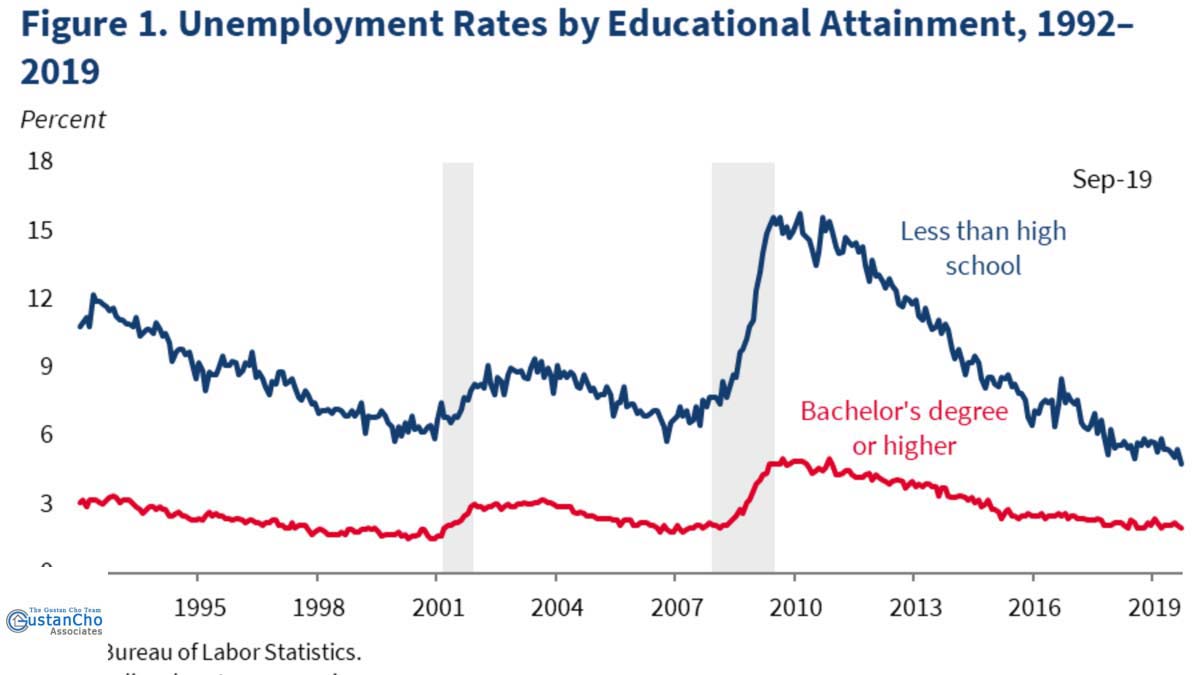

Additionally, the unemployment rate for people without a high school diploma fell to 4.8 percent, the lowest rate since the series began in 1992 and much lower than the 7.8 percent rate in November 2016 (figure 1). Since President Trump’s election, the unemployment rate for those without a high school degree has fallen at a faster rate than the unemployment rate for those with a bachelor’s degree or higher. The decrease has narrowed the gap between the unemployment rate for non-high school graduates and the unemployment rate for college graduates to 2.8 percentage points, matching the lowest gap ever seen in the series.

Education Versus Unemployment Chart:

Fears of a recession are diminishing as positive numbers are released.

- The Federal Reserve Board is expected to lower interest rates at the next FOMC meeting

- Mortgage rates are at a 36-month low and are expected to go lower

- Home prices are going up due to the great economy

Fears of inflation are at low levels. Wages are increasing in all job sectors.

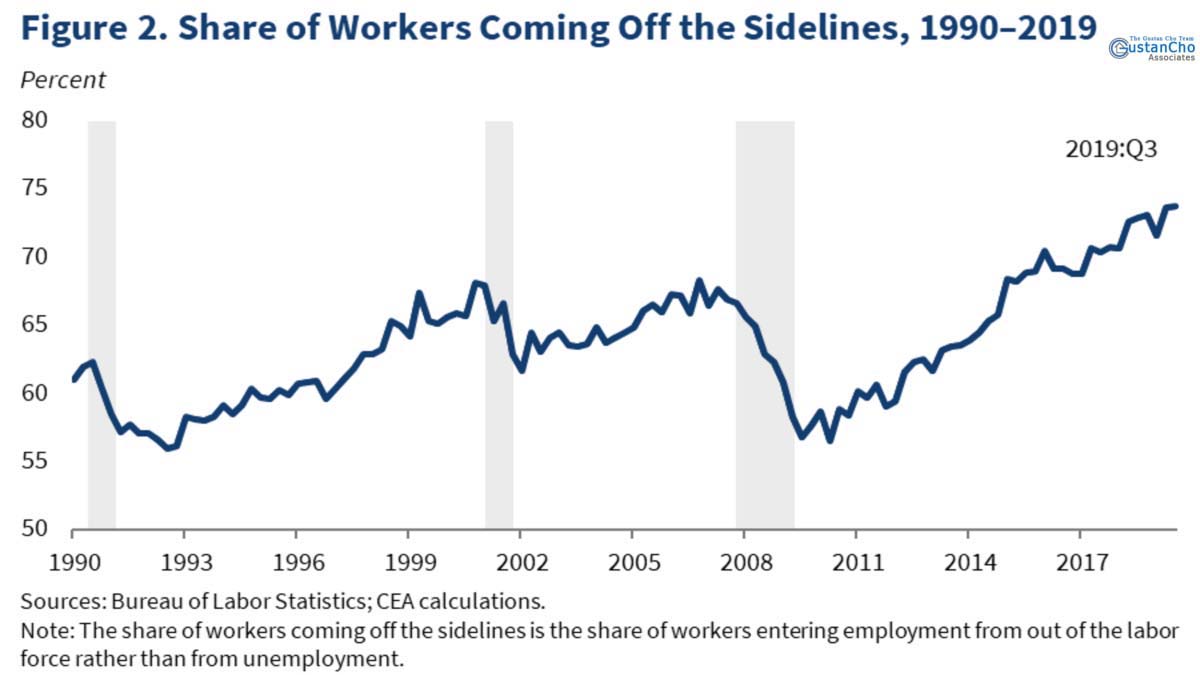

More Americans Sitting On The Sidelines Enter The Job Market Due To Unemployment Rate Falls To 50-Year Low

More and more workers sitting on the sidelines are re-entering the job market. See the chart below:

On another note, the U.S. Department of Labor released data earlier this week showing the initial Unemployment Insurance claims have remained at or below 300,000 for 239 consecutive weeks. This is another historic record since 1967. These numbers are beyond and above expected due to the labor force being over 100% since 1967. There are more jobs in the marketplace than the unemployment rate. Many workers who were underemployed can now gain employment in jobs where they are qualified. The economy seems to be very healthy with no signs of a recession or weakness in the economy. Gustan Cho Associates Mortgage News will keep our viewers update in the coming days and weeks with any changes in the economic data or other breaking news.