In this guide, we address underwriters conditions to pave the way for a clear-to-close submission. Whether individuals seek approval for a home purchase mortgage loan or aim to refinance, the approval procedures remain consistent. Please submit all the required underwriting conditions to avoid delays during the mortgage loan closing process.

The focal point of this guide is navigating through the steps necessary to clear underwriters’ conditions, which is crucial for achieving a clear-to-close status. Regardless of whether applicants are pursuing a mortgage loan for a home purchase or refinance, the approval process follows a uniform path. It is emphasized that the timely and complete submission of underwriting conditions is essential to avoid setbacks and ensure a smooth closing process for the mortgage loan.

When individuals applying for a mortgage receive a pre-approval, it is granted based on the details they have supplied in their mortgage application. The mortgage application, often called Form 1003, seeks crucial information such as income, debts, and assets. The pre-approval process is a preliminary step in securing a mortgage, offering an initial assessment of the applicant’s financial standing.

It indicates from the lender that, based on the provided information, the applicant meets the preliminary criteria for a mortgage loan. It’s important to note that a pre-approval is subject to the fulfillment of underwriters’ conditions, ensuring that the applicant’s financial profile aligns with the lender’s requirements.

The pre-approval serves as an initial confirmation of an applicant’s eligibility for a mortgage loan and is contingent upon meeting specific underwriters’ conditions. These conditions act as criteria set by the underwriter to assess the applicant’s financial stability and ability to fulfill mortgage obligations. The information gathered in the mortgage application, encompassing details on income, debts, and assets, forms the basis for this preliminary evaluation.

Applicants must understand that while pre-approval is a positive step, final approval and the issuance of a mortgage loan are contingent upon successfully satisfying the underwriters conditions. Therefore, applicants must diligently provide accurate and comprehensive information to ensure a smooth progression through the mortgage approval process.

The request for additional information encompasses disclosures related to the borrower’s historical financial events, including but not limited to bankruptcy filings, foreclosures, short sales, deeds-in-lieu of foreclosure, prior judgments, tax liens, and other pertinent details. Loan officers will meticulously evaluate credit reports and scores as part of the assessment process. Typically, the mortgage application undergoes input into Fannie Mae’s Automated Underwriting System (AUS), yielding automated findings.

The ultimate objective is to secure an approved/eligible status based on the AUS Findings. This status implies a conditional approval contingent upon satisfying specified underwriters’ conditions. It is imperative to meticulously validate all information borrowers provide in the mortgage application to ensure accuracy and compliance with the identified conditions. This thorough scrutiny is essential for a smooth and successful mortgage approval process. Click here to get approve for mortgage loan.

How Does The Mortgage Process Work

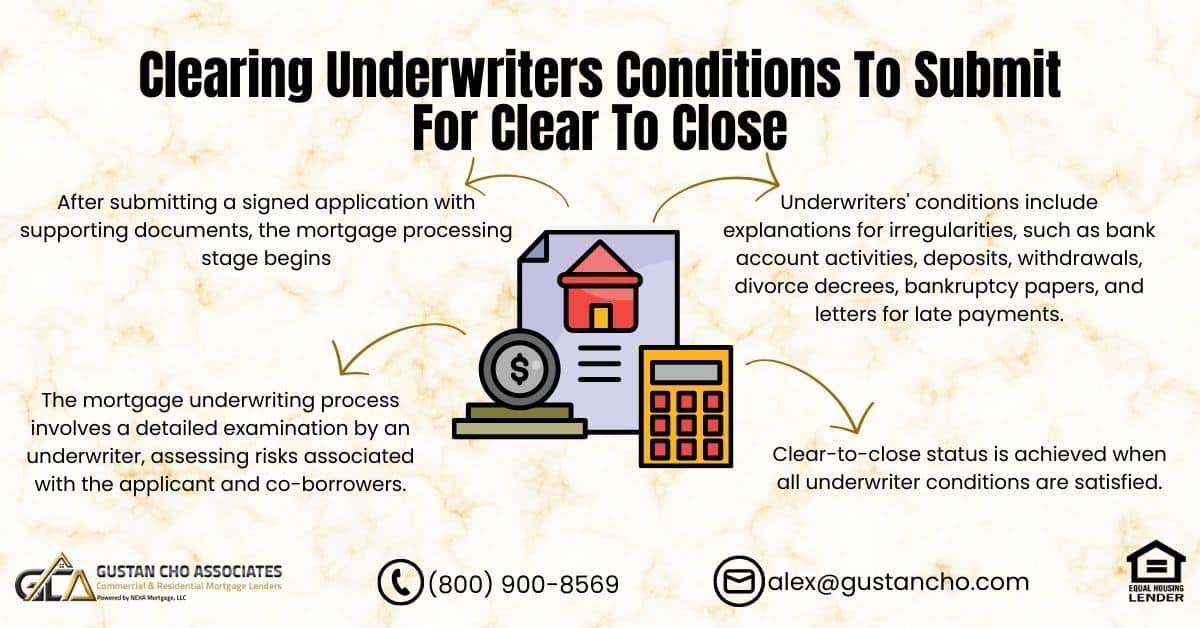

After borrowers submit a fully signed mortgage application along with supporting documents, such as two years’ tax returns, W2s, and two months’ bank statements, as well as any additional documents requested by the loan processor or mortgage loan originator, the mortgage application advances to the processing stage within the overall loan process.

A mortgage processor ensures that every item is cross-checked on the mortgage application. They make sure that all pages of documents are complete such as tax returns, bank statements, copies of driver’s licenses, and social security cards.

During mortgage processing, the focus is on verifying the currency of all submitted documents. The role of the processor is vital in securing the integrity of the mortgage file, with the goal of avoiding its rejection by the underwriter. It’s important to note that delays in the mortgage process often stem from incomplete files and missing documents. The primary goal of the processor is to minimize the underwriters’ conditions, thereby streamlining the approval process and facilitating a smoother progression of the mortgage application.

Speak With Our Loan Officer for mortgage process for your mortgage loans

What Is a Conditional Mortgage Approval

Once the mortgage processor has compiled and submitted the mortgage loan application file along with the necessary documents for underwriting, the mortgage file is subsequently assigned to a mortgage underwriter. In detailing the responsibilities of a mortgage underwriter within the mortgage loan process, Dale Elenteny, a senior loan officer at Gustan Cho Associates, provides insights into their crucial role. The focus is on navigating through the underwriting phase, which involves meticulously examining the submitted documents and application to ensure compliance with the Underwriters Conditions.

During the mortgage loan process, the underwriter plays a pivotal role in evaluating the submitted application files, meticulously examining documents, and ensuring adherence to the Underwriters Conditions. Dale Elenteny, a senior loan officer at Gustan Cho Associates, explains the importance of the role of the mortgage underwriter following the completion and submission of the mortgage loan application file by the processor.

This underscores the importance of a thorough underwriting process in verifying the application’s compliance with the conditions set by the underwriters, ensuring a comprehensive and accurate assessment of the mortgage file.

The mortgage loan package is assigned to an underwriter responsible for either approving the mortgage loan or denying the mortgage loan.

In evaluating a mortgage loan application, the underwriter plays a crucial role in meticulously scrutinizing the provided documentation to ensure the accuracy of all information. This comprehensive examination encompasses various financial aspects, such as tax returns, W2s, bank statements, debts, and other assets. The underwriters responsibility extends to addressing and seeking clarification on any instances of late payments, bankruptcy, foreclosure, charge-offs, judgments, tax liens, and overdrafts that may be present in the applicant’s financial history.

The underwriter’s multifaceted verification process covers crucial elements like income, debt, and assets. Through this meticulous review, the underwriter aims to determine whether the mortgage applicants align with the stipulated guidelines. The underwriter must assess the overall financial health of the borrowers, ensuring that the mortgage loan adheres to the underwriters conditions and meets the necessary criteria for approval.

This detailed examination of the mortgage application package underscores the underwriters commitment to maintaining the integrity of the lending process by making informed decisions based on accurate and verified financial information.

Mortgage Underwriting Process

The mortgage underwriter will examine the appraisal to assess the risk associated with the mortgage loan applicant and their co-borrowers. Subsequently, the mortgage underwriter will provide a conditional loan approval, specifying the underwriters conditions. Dustin Dumestre, who serves as a senior loan officer at Gustan Cho Associates and holds the position of Editor in Chief at F-1 Mortgage Group, illustrates underwriters’ conditions in the following manner:

Mortgage underwriters will almost always have underwriters’ conditions on conditional loan approvals. The mortgage processor will submit the underwriters conditions for the underwriter to issue a clear to close.

The underwriter can re-issue the conditional loan approval with new underwriters conditions that were not on the prior conditional loan approval. The underwriter can issue new underwriter conditions repeatedly until she is satisfied. Once all underwriters conditions has been satisfied, the underwriter will issue a clear to close.

What Are Underwriters Conditions

Once borrowers have been issued a conditional mortgage approval by an underwriter, there will most likely be the underwriters’ conditions. Some examples of underwriters’ conditions include letters of explanation of irregular activities in a bank account. The underwriter might want explanations for deposits or funds over $200 withdrawals.

Other underwriters conditions might be that they might want to see a divorce decree if divorced. For borrowers who have filed for bankruptcy, the mortgage underwriter might want to see bankruptcy papers or a letter explaining to file for bankruptcy. For borrowers with late payments, the underwriter might want to see a letter of explanation on why they were late.

Contact For Getting Mortgage Loans

What Is a Clear To Close

Dealing with conditions set by other underwriters can be both tiresome and occasionally confusing. Nevertheless, it’s impossible to circumvent a request for underwriters’ conditions. To secure a clear-to-close status on a mortgage loan, collaboration and compliance from borrowers and the entire mortgage team are essential. Sonny Walton, a realtor and loan officer with dual licenses, provides insights into the process of obtaining a clear-to-close from mortgage underwriters:

Once satisfied with all underwrite conditions, the borrower will be issued a clear to close. Clear To Close is when the lender is ready to prep docs and fund the mortgage loan.

For more information on the contents of this article or other mortgage-related topics, please get in touch with us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The Gustan Cho Associates Mortgage Group team is available seven days a week, evenings, weekends, and holidays.

FAQs: Clearing Underwriters Conditions To Submit For Clear To Close

- Q.1 What is a pre-approval in the context of a mortgage application? Ans: A pre-approval is an initial confirmation of an applicant’s eligibility for a mortgage loan based on the information provided in their mortgage application (Form 1003). It indicates that the applicant meets the preliminary criteria for a mortgage, but it is subject to the fulfillment of underwriters conditions to secure final approval.

- Q.2 What are underwriters’ conditions, and why are they essential? Ans: Underwriters conditions are criteria set by mortgage underwriters to evaluate an applicant’s financial stability and ability to meet mortgage obligations. Fulfilling these conditions is crucial for obtaining final approval for a mortgage loan. These conditions include providing additional information about the borrower’s financial history, credit reports, and other relevant documents.

- Q.3 What is the role of a mortgage processor in the application process? Ans: A mortgage processor plays a crucial role in verifying the completeness and accuracy of all submitted documents and application details. Their goal is to minimize underwriters’ conditions, reduce delays, and ensure a smooth progression of the mortgage application.

- Q.4 Who is responsible for evaluating and approving or denying a mortgage loan application? Ans: Mortgage underwriters are responsible for evaluating and making informed decisions about mortgage loan applications. They meticulously examine documents, assess the applicant’s financial health, and determine if the application meets underwriters conditions and approval criteria.

- Q.5 What is a conditional loan approval, and how does it relate to underwriters conditions? Ans: Underwriters grant conditional loan approval, but is contingent on the fulfillment of specific underwriters conditions. Underwriters may issue new conditions until they are satisfied. Once all conditions are met, a “clear-to-close” status can be achieved.

- Q.6 What are some common examples of underwriters conditions? Ans: Examples of underwriters conditions include providing explanations for irregular activities in a bank account, explaining deposits or withdrawals over a certain amount, providing divorce decrees for divorced borrowers, or explaining late payments for borrowers with such history.

- Q.7 What does “clear-to-close” mean in the context of mortgage approval? Ans: A “clear-to-close” status indicates that the lender is ready to prepare the necessary documents and fund the mortgage loan. It signifies that all underwriters conditions have been satisfied, and the loan is moving towards final approval.

- Q.8 How can borrowers and the mortgage team work together to obtain a “clear-to-close” status? Ans: Collaboration and compliance from borrowers and the entire mortgage team are essential to secure a “clear-to-close” status. This involves promptly providing requested documents, addressing underwriters conditions, and ensuring a smooth mortgage approval process.

This blog about Clearing Underwriters Conditions To Submit For Clear To Close was updated on February 6, 2024.