This guide addresses common inquiries regarding the possibility of maintaining two FHA loans due to expanding family size. Typically, individuals are limited to one FHA loan per family. However, there are circumstances wherein you can retain your current home with an FHA loan while obtaining a second FHA loan for a new home purchase.

HUD agency guidelines permit having two FHA loans due to an expanding family size. Ordinarily, acquiring another FHA loan necessitates paying off the existing one. Yet, HUD, the overseeing body of FHA, may grant exceptions for multiple concurrent FHA loans.

In this article, we’ll delve into the exception of holding just one FHA loan versus having two FHA loans due to an expanding family size. We’ll outline securing a second FHA loan for a new home purchase while retaining the first as a rental property. HUD allows for this scenario, enabling individuals to have two FHA loans due to expanding family size without requiring the repayment of the initial FHA loan.

HUD Exceptions To Having More Than One FHA Loan At The Same Time

Exceptions to acquiring two FHA loans due to expanding family size are present. If borrowers relocate because of a job transfer exceeding 100 miles, they may be eligible for a second FHA loan. This arrangement allows borrowers to retain their current property, financed by an FHA loan, and utilize it as a rental property while obtaining a new FHA loan for their new residence.

The FHA permits borrowers to hold multiple loans concurrently under certain circumstances, such as a growing family. This article aims to provide insight into the process and considerations involved in obtaining two FHA loans due to expanding family size, helping borrowers navigate this aspect of homeownership with clarity and confidence.

Don’t Assume You Must Sell First When Your Family Grows

With the right documentation, HUD may allow you to keep your current FHA home and buy a larger one.About FHA Loans And Two FHA Loans Due To Expanding Family Size

FHA loans are renowned for their accessibility and flexibility, making them a premier loan program in the United States. They serve as a vital lifeline for borrowers facing challenges such as less-than-ideal credit histories or elevated debt-to-income ratios. With a credit score of 580 FICO or higher, borrowers can access loans with a minimal down payment requirement of just 3.5%, opening doors to homeownership that might have seemed unattainable previously.

Moreover, FHA loans simplify the approval process through automated underwriting systems, making them particularly attractive for individuals with prior credit issues or lower credit scores. Even for those with credit scores ranging from below 580 down to 500 FICO, FHA loans remain accessible, albeit with a slightly higher down payment requirement of 10%. This inclusivity underscores FHA loans’ commitment to providing homeownership opportunities for a diverse range of individuals, regardless of their financial background.

FHA loans provide more flexibility if a family needs to buy a larger home due to increased family size. Borrowers can simultaneously secure two FHA loans due to expanding family size, allowing them to accommodate their changing housing needs without undue financial strain. This unique feature further enhances the appeal of FHA loans as a practical and adaptable option for achieving homeownership goals amidst evolving life circumstances.

HUD Guidelines After Bankruptcy and Foreclosure

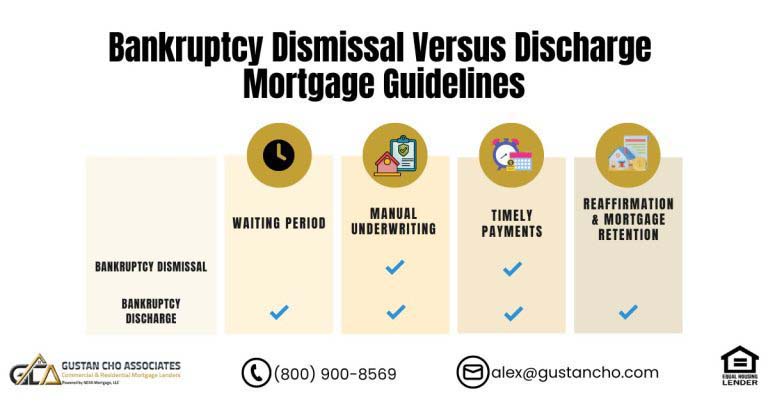

Homebuyers are eligible for FHA loans after experiencing bankruptcy or a housing event. Following a Chapter 7 Bankruptcy discharge, there’s a required two-year waiting period to qualify. For those dealing with foreclosure, deed-in-lieu of foreclosure, or short sale, a waiting period of three years is necessary.

Notably, outstanding collections and charged-off accounts are optional for repayment. To secure approval via the automated underwriting system (AUS), debt-to-income ratios can be restricted to 46.9%/56.9%.

Furthermore, manual underwriting is permissible for FHA loans. Borrowers in the first year of Chapter 13 Bankruptcy repayment can qualify with Trustee Approval through manual underwriting. Interestingly, there’s no waiting period following the Chapter 13 Bankruptcy discharge date with a manual underwrite. For manual underwrites, debt-to-income ratios can be capped at 40% front end and 50% back end, provided two compensating factors exist.

Need More Bedrooms But Still Have an FHA Loan?

New baby, blended family, or more kids at home—your current FHA house might be too small.Two FHA Loans Due To Expanding Family Size Lending Requirements

Under HUD Guidelines, homeowners with an FHA loan can acquire a larger home and hold two FHA loans due to expanding family size. To exemplify this scenario, consider a homeowner residing in a two-bedroom, one-bathroom townhouse with no children.

However, the space becomes insufficient upon meeting a partner with more than three chis needed. In such a situation, the homeowner can retain the townhouse with the existing FHA Loan and procure a larger residence, accommodating the sudden growth in family size.

This practice aligns with the provisions outlined in the HUD 4000.1 FHA handbook guidelines. Notably, the monthly expenses associated with the current property, including principal, interest, taxes, insurance (PITI), and HOA fees, will factor into the new mortgage debt-to-income ratio computations.

The HUD guidelines allow homeowners to maintain one FHA loan while acquiring another to accommodate an expanded family. A homeowner lives in a two-bedroom townhouse without children. Let’s consider this scenario to illustrate. However, the need for additional space arises upon entering a relationship with someone with three children and two dogs. If you need more space for your growing family, you can keep your current home with an FHA loan and buy a bigger one.

This approach adheres to the stipulations outlined in the HUD 4000.1 FHA handbook guidelines. It’s important to note that the financial obligations associated with the original property, such as PITI and HOA fees, will be factored into calculating the new mortgage debt-to-income ratio.

According to HUD Guidelines, homeowners with an FHA loan can hold two FHA loans concurrently, provided that expanding family size and acquiring a larger home is necessary. To illustrate, consider a homeowner residing in a two-bedroom townhouse with no children.

However, the existing space becomes inadequate upon entering into a relationship with someone with three children and two dogs, and it needs to be improved. In such circumstances, homeowners can retain their current property with the FHA loan and purchase a larger home to accommodate the growing family. This practice is explicitly permitted under the HUD 4000.1 FHA handbook guidelines.

Importantly, the financial commitments associated with the original property, including PITI and HOA expenses, will be considered when calculating the new mortgage debt-to-income ratio.

Getting Qualified and Pre-Approved For Two FHA Loans Due To Expanding Family Size

If you seek guidance regarding obtaining two FHA loans due to expanding family size, please contact us at Gustan Cho Associates. You can contact us at 800-900-8569 for a prompt response or text us for even quicker assistance. Alternatively, you can email us at alex@gustancho.com. Our team is dedicated and available to assist you seven days a week, including evenings, weekends, and holidays.

Did you know Gustan Cho Associates is a mortgage company operating in multiple states? We’re committed to providing transparent and reliable service, so you can trust us to help! We pride ourselves on having no lender overlays on government and conventional loans, ensuring a streamlined process for our clients.

Beyond this, we are recognized nationally as a comprehensive mortgage solution provider. In addition to our government and conventional loan offerings, we boast a wide range of non-QM and alternative lending programs to cater to diverse needs.

At Gustan Cho Associates, we understand the complexities of securing multiple FHA loans to accommodate a growing family. Our team has the expertise and resources to seamlessly guide you through the process. Whether you’re exploring conventional options or seeking alternative lending solutions, we’re here to support you every step of the way. If you are interested in achieving your homeownership goals, don’t hesitate to contact us today. We would happily assist you and provide more information about our services.

FAQ: Understanding Two FHA Loans Due To Expanding Family Size

1. Can individuals maintain two FHA loans due to an expanding family size? Typically, individuals are limited to one FHA loan per family. However, under certain circumstances outlined by the Department of Housing and Urban Development (HUD), borrowers can retain their current home with an FHA loan while obtaining a second FHA loan for a new home purchase. This exception is primarily applicable when there is a need for additional space due to a growing family.

2. What are the HUD guidelines regarding multiple FHA loans? HUD agency guidelines permit having two FHA loans due to expanding family size. While acquiring another FHA loan usually requires paying off the existing one, HUD may grant exceptions for multiple concurrent FHA loans. Borrowers must meet specific criteria, such as relocating due to a job transfer exceeding 100 miles, to be eligible for a second FHA loan.

3. How does obtaining two FHA loans due to expanding family size work? To secure two FHA loans due to expanding family size, borrowers can retain their current property financed by an FHA loan and utilize it as a rental property while obtaining a new FHA loan for their new residence. This allows borrowers to accommodate their changing housing needs without requiring repayment of the initial FHA loan, aligning with HUD guidelines.

4. Are there any specific lending requirements for holding two FHA loans? According to HUD guidelines, homeowners with an existing FHA loan can acquire a larger home and maintain two FHA loans due to expanding family size. Financial obligations associated with the original property, such as principal, interest, taxes, insurance (PITI), and HOA fees, will factor into the new mortgage debt-to-income ratio for the second FHA loan. This practice is explicitly permitted under the HUD 4000.1 FHA handbook guidelines.

This blog about Can I Have Two FHA Loans Due To Expanding Family Size was updated on February 26, 2024.