Mortgage Loan after Foreclosure and Short Sale Guidelines

Quick Answer: Mortgage Loan After Foreclosure Yes—you can get a mortgage loan after foreclosure, often sooner than you think. Eligibility…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Quick Answer: Mortgage Loan After Foreclosure Yes—you can get a mortgage loan after foreclosure, often sooner than you think. Eligibility…

Fannie Mae Guidelines on Mortgage After Foreclosure in 2026: How to Qualify Again Fast If you’ve been through a foreclosure,…

Quick Answer: Jumbo Loans After Foreclosure Yes—you can get a jumbo loan after foreclosure, primarily through non-QM/portfolio jumbo lenders that…

Quick Answer Yes—getting a home loan after multiple foreclosures is still possible. The key is the most recent foreclosure date…

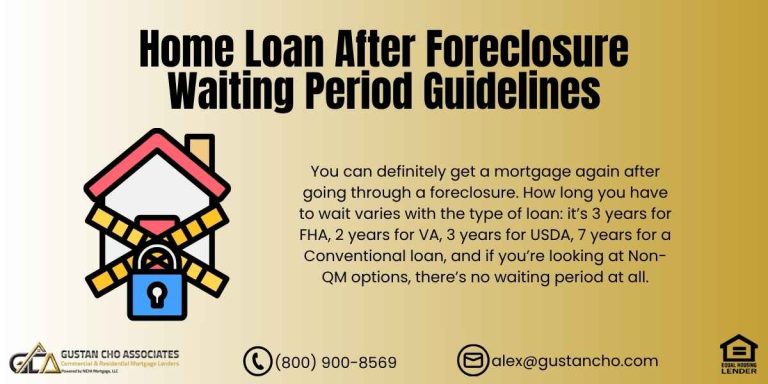

Home Loan After Foreclosure: 2026 Waiting Period Guidelines and Options Losing a home to foreclosure can feel like the end…

In this blog, we will cover and discuss FNMA waiting period guidelines after foreclosure for 2025. Conventional loans are often…

In this guide, we will explain the difference between a short sale and foreclosure, as many viewers often get confused…

This guide covers foreclosure in mortgage qualification lending guidelines. We will thoroughly discuss the waiting period requirements when there is…

This guide covers the ill-fated HUD’s FHA Back to Work Mortgage. The FHA Back to Work Mortgage no longer exists….

This guide covers the waiting period mortgage guidelines after housing events and bankruptcy. Homebuyers with prior bankruptcy, foreclosure, deed-in-lieu of…

Qualifying for FHA loan after foreclosure is now possible for homebuyers who meet the mandatory waiting period after foreclosure. Fannie…

This guide covers the frequently asked question is a 120-day mortgage late payment considered foreclosure. One of the biggest fears…

This article will discuss the FHA Waiting Period After Bankruptcy and Foreclosure. The FHA mandates waiting periods after bankruptcy, foreclosure,…

In this blog, we will discuss and cover mortgage after foreclosure with no waiting period with non-QM loans. Non-QM loans…

This guide cover the waiting period to qualify for a mortgage loan after foreclosure. Homeowners who had a prior foreclosure…

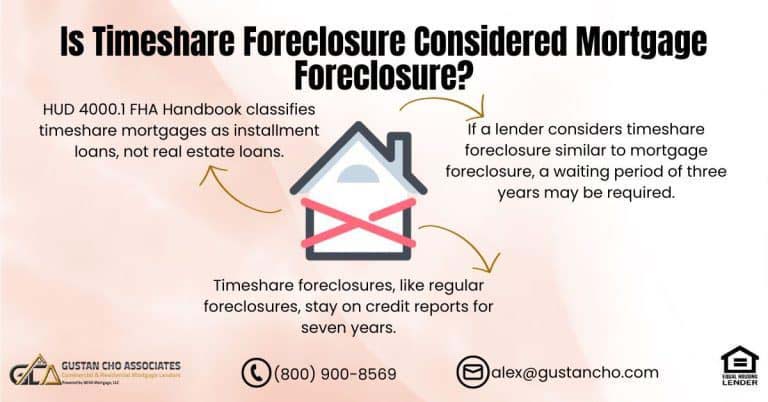

Is Timeshare Foreclosure Considered Mortgage Foreclosure? It’s important to understand that timeshare foreclosure is different from mortgage foreclosure. Agencies like…

The conventional loan waiting period after deed-in-lieu of foreclosure and short sale of four years is shorter than the 7-year…

In this blog, we will discuss and cover the recorded date in foreclosure versus the surrender date of the home….

This Article Is About Homeowners Who Bailed On Mortgage During Mortgage Collapse Residential home sales have been steadily increased and…

This article covers Freddie Mac Housing Event Guidelines On Conventional Loans Fannie Mae and Freddie Mac are the two mortgage…

This BLOG On What Are The Foreclosure Procedures And Process Was UPDATED And PUBLISHED On July 2nd, 2020 The government’s…