In this blog, we will cover and discuss the mortgage guidelines Chapter 13 versus Chapter 7 Bankruptcy. Homebuyers qualifying for a mortgage after bankruptcies: Homebuyers can qualify for a mortgage after bankruptcies after they pass the waiting periods. There are separate types of qualification requirements depending on the types of bankruptcies.

Mortgage Guidelines Chapter 13 Versus Chapter 7 Bankruptcy is different depending on the loan program. In summary, Chapter 7 bankruptcy involves the potential discharge of your liability for mortgage debt.

In contrast, Chapter 13 bankruptcy allows you to create a repayment plan to catch up on missed payments and protect your home from foreclosure. The impact on your credit score and your ability to keep your home varies between the two chapters, so it’s crucial to consult a bankruptcy attorney to understand which option is best for your specific financial situation and goals. Additionally, mortgage guidelines vary between lenders, so it’s important to work with your mortgage servicer and bankruptcy attorney to navigate the process effectively.

What Are The Types of Bankruptcy

Chapter 13 and Chapter 7 bankruptcy are the two types of bankruptcy proceedings under the United States Bankruptcy Code. Each has its own set of guidelines and implications when it comes to mortgage-related matters. Chapter 7 bankruptcy is often called “liquidation bankruptcy” because it involves liquidating non-exempt assets to pay off creditors. The two types of consumer bankruptcies are the following:

- Chapter 7 Bankruptcy

- Chapter 13 Bankruptcy

Borrowers can qualify for a mortgage after bankruptcies and foreclosures. However, there are requirements, borrowers must meet. In a Chapter 7 bankruptcy, your mortgage debt is not eliminated, but your liability for the debt may be discharged. This means you are no longer personally responsible for repaying the mortgage debt. However, the lender can still foreclose on the property if you do not make the payments.

Speak With Our Loan Officer for chapter 7 bankruptcy

Reaffirming Debts in Bankruptcy

If you want to keep your home and continue making mortgage payments, you may have the option to reaffirm the mortgage debt. Reaffirmation means that you agree to remain legally responsible for the mortgage, and the lender allows you to keep the property as long as you continue making payments. The bankruptcy code provides for certain exemptions that protect a portion of your home’s equity from being used to repay creditors. The specific exemptions available vary by state. Chapter 7 bankruptcy significantly negatively impacts your credit score and stays on your credit report for up to ten years.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy is often called “reorganization bankruptcy” because it involves creating a repayment plan to pay off a portion of your debts over a specified period, typically three to five years. In a Chapter 13 bankruptcy, your mortgage debt is not discharged but can be included in your repayment plan.

While Chapter 13 bankruptcy also negatively impacts your credit score, it typically has less severe and shorter-lasting effects than Chapter 7.

Chapter 13 Bankruptcy means you can catch up on missed mortgage payments over time while continuing to make regular monthly payments. Chapter 13 bankruptcy allows you to address mortgage arrearages (missed payments) and keep your home if you can adhere to the repayment plan. It can also help you avoid foreclosure. Chapter 13 bankruptcy provides an automatic stay that halts foreclosure proceedings while you work on your repayment plan.

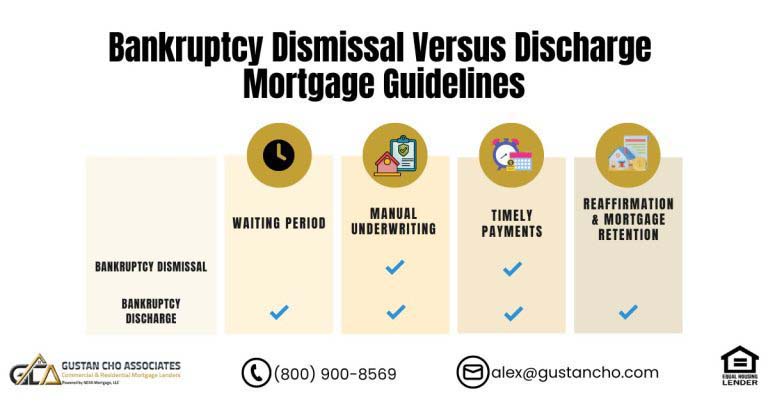

Chapter 13 Versus Chapter 7 Bankruptcy Waiting Period Mortgage Guidelines

All mortgage loan programs have a waiting period after bankruptcies. The waiting period depends on the type of bankruptcy and the type of loan program the borrower is trying to qualify for.

There are mandatory waiting period mortgage guidelines after Chapter 13 versus Chapter 7 Bankruptcy with regards to the loan program.

HUD requires a 2-year waiting period after a Chapter 7 Bankruptcy discharge date. USDA loans require a three-year waiting period after a Chapter 7 Bankruptcy discharged date. VA requires a 2 year waiting period after a Chapter 7 Bankruptcy discharge date as well. Fannie Mae and Freddie Mac require a four-year waiting period to qualify for a conventional loan after a Chapter 7 discharge date. Most Jumbo Lenders will require a 7 year wait period. However, there are lenders that will accept a Jumbo Borrower who has been 4 years out of Chapter 7.

Late Payments After Chapter 13 and Chapter 7 Bankruptcy Guidelines

No late payments after a bankruptcy or foreclosure. Gustan Cho Associates has Non-QM Jumbo Mortgages with no waiting period after housing events and bankruptcy. The underwriter will also look at the borrower’s credit profile before the event to see whether he or she established good payment history. However, the most important factor the underwriter will consider is the applicant’s housing payment record after the bankruptcy discharge; whether rental or mortgage, it must display perfect payment history. Talk to us about the late payments after chapter 13 and chapter 7 bankruptcy

Mortgage Loan After Chapter 13 Bankruptcy

Borrowers can qualify for an FHA loan while in Chapter 13 or after the Chapter 13 Bankruptcy discharged date. Those who are under a Chapter 13 bankruptcy repayment plan can qualify for FHA and VA loans 12 months into their Chapter 13 bankruptcy with the approval of the Chapter 13 bankruptcy trustee. For those who just had their Chapter 13 bankruptcy discharged, there is no mandatory waiting period to qualify for FHA and VA loans. However, it will need to be a manual underwrite. All manual underwriting mortgage loan applications require verification of rent, also known as VOR.

How Is Rental Verification Valid?

Rental Verification can only be provided by providing 12 months of canceled checks if renting from a private landlord. Renters renting from a registered property management company all is needed is the verification of rent form to be completed and signed by the property management manager.

How Do You Complete a VOR Form?

The VOR Form is provided by the lender. There is a two-year waiting period to qualify for conventional loans after Chapter 13 Bankruptcy discharged date. There is a four-year waiting period to qualify for conventional loans after the Chapter 13 dismissal date.

Mortgage Included In Bankruptcy Guidelines

For borrowers who had a mortgage as part of your bankruptcy, there is a four-year waiting period after the discharge date of bankruptcy to qualify for a conventional mortgage loan under Fannie Mae and Freddie Mac Guidelines. The foreclosure can be recorded after the Chapter 7 Bankruptcy discharged date and that does not matter. The four-year waiting period clock will start from the discharge date of the Chapter 7 Bankruptcy. The mortgage included in bankruptcy cannot be reaffirmed. In order for borrowers to qualify, the foreclosure needs to have been finalized and not be pending.

HUD Waiting Period Start Date After Foreclosure With Prior Mortgage Included in Bankruptcy

There is a three-year waiting period to qualify for an FHA loan after the recorded date of the foreclosure that is recorded on the county’s recorder of deeds office. If the borrower had a mortgage as part of their Chapter 7 Bankruptcy, the waiting period to qualify for an FHA loan starts from the recorded date of the foreclosure, deed in lieu, or short sale. Not the Chapter 7 Bankruptcy discharged date like Fannie Mae and/or Freddie Mac.

VA Waiting Period Start Date of Bankruptcy Discharged Date With Prior Mortgage Included in Bankruptcy

HUD Guidelines on mortgage part of Chapter 7 Bankruptcy are different than Fannie Mae and Freddie Mac. The same guidelines apply to VA loans. If borrowers had mortgages included in Chapter 7 Bankruptcy, the waiting period to qualify for VA loans starts from the recorded date of the housing event and not the discharged date of bankruptcy.