In this blog, we will cover the mortgage due-on-sale clause when you inherit a house with a lien. If you are inheriting a property with a mortgage, you may wonder if the mortgage due-on-sale clause is relevant to you. The mortgage due-on-sale clause is a provision in mortgage loans that gives the lending company the ability to demand full payment of the loan if the property is sold.

Mortgage-Due-on-Sale Clause For Lenders

The due-on-sale clause is essential for lenders because it enables them to control the disposition of the collateral on the loan. If the borrower is able to sell the property, the lender can demand full repayment of the loan. This makes sure that the lender will not be stuck holding a loan secured by property the borrower no longer owns.

Most mortgages have a mortgage due-on-sale clause provision, which allows the lender to demand payment in full if the owner sells the property without paying off their loan. The lender holds the right to call in the loan at any time if it believes that doing so is in its best interests unless prohibited by federal law.

Mortgage Due-on-Clause For Borrowers

The due-on-sale clause is also crucial for borrowers because it adds an incentive to not fall behind on their payments. If the borrower defaults on the loan, the lender has the right to demand the total cost of the loan, which will likely put the borrower in a difficult financial position.

If you’re considering a cash-out refinance, understand the terms and conditions, including the due-on-sale clause. This assists you in making the best decision for your financial situation and protecting your interests.

Can Reverse Mortgages Have a Due-on-Cause Clause

A reverse mortgage is called due when the borrower moves or dies. If the homeowner of a reverse mortgage dies, the heir has one year to either sell the property or pay the outstanding loan balance of the reverse mortgage.

Checking If Inherited Properties Have a Mortgage

When you purchase a property with an existing mortgage, you will assume responsibility for that mortgage. You need to review the deed and any other relevant documentation to determine if the inherited property has a mortgage. If you find a mortgage on the property, you will need to work with the lender to decide what options are best for you. It is critical to remember that taking on an existing mortgage is a big responsibility and should not be done lightly.

If you are considering buying a home that has been inherited, you’ll want to know if a mortgage exists on the property. If so, this will have an impact on your ability to get financing and may impact your decision to acquire the home. There are a few ways to determine if there is a pre-existing mortgage on an inherited property.

Checking Documents on The Property

The first step is checking all documents attached to the home. You may find utility bills or new mortgage details in the mail. Look for the balance due, debt, and account/loan number. Your loan number will help you determine if your loan is FHA insured or any other loan.

- Contact a County Recorder

- Contact a Title Company

- Contact a Lender/Servicer

Remember that if there is a mortgage on the property, you’ll need to factor this into your decision to purchase the home. You’ll also need to ensure that you have the financial resources to cover the mortgage payments if you decide to buy.

Inheriting Property Process Timeline

Like most people, you probably possess some property – a home, a vehicle, or maybe some land. And, if you’re planning, you’re probably thinking about what will happen to that property when you die. Will it go to your spouse? Your children? A charity?

Sometimes, lenders are prohibited from repaying a total amount because of the court settlement or a borrower’s death. Inheriting property can be complicated, especially if multiple heirs are involved.

Intestate Succession VS Testamentary Disposition

First, it is essential to understand the difference between intestate succession and testamentary disposition. Intestate Secession is the process by which property is distributed in the event of the owner dying without a will. The property will be distributed according to the laws of the state if the owner has no relatives. This is known as “intestate succession” or “intestacy.”

What Is Testamentary Disposition

Testamentary Disposition is the process where a property is distributed if the owner dies with a will. If you die without a will, your property will be distributed according to your state’s laws of intestate succession. These laws change from state to state, but generally, the property is distributed to a surviving spouse or children first and then to other relatives if there are no surviving spouses or children.

What Happens To Your Property When You Die?

If you die with a will, your property will be distributed according to the terms of your choice. You have the ability to leave your property to whomever you want and stipulate how and when it will be distributed.

For example, you could choose to leave your home to your spouse with the provision that it will be sold and the proceeds are divided equally between your children. When you inherit property, you also inherit any of the debts associated with that property. For example, if you acquire a house from a late relative, you will also inherit any mortgage or other debts on the home.

Who’s Responsibilities Are Debts Prior To Death

You are not responsible for any debts of the deceased before their death, but you are liable for any debts after their death. If you’re inheriting property, there are a few things to remember.

- Consult with an attorney to understand your rights and responsibilities.

- Be aware of any deadlines for taking possession of or selling the property.

- Make sure you’re prepared to take on any debts associated with the property.

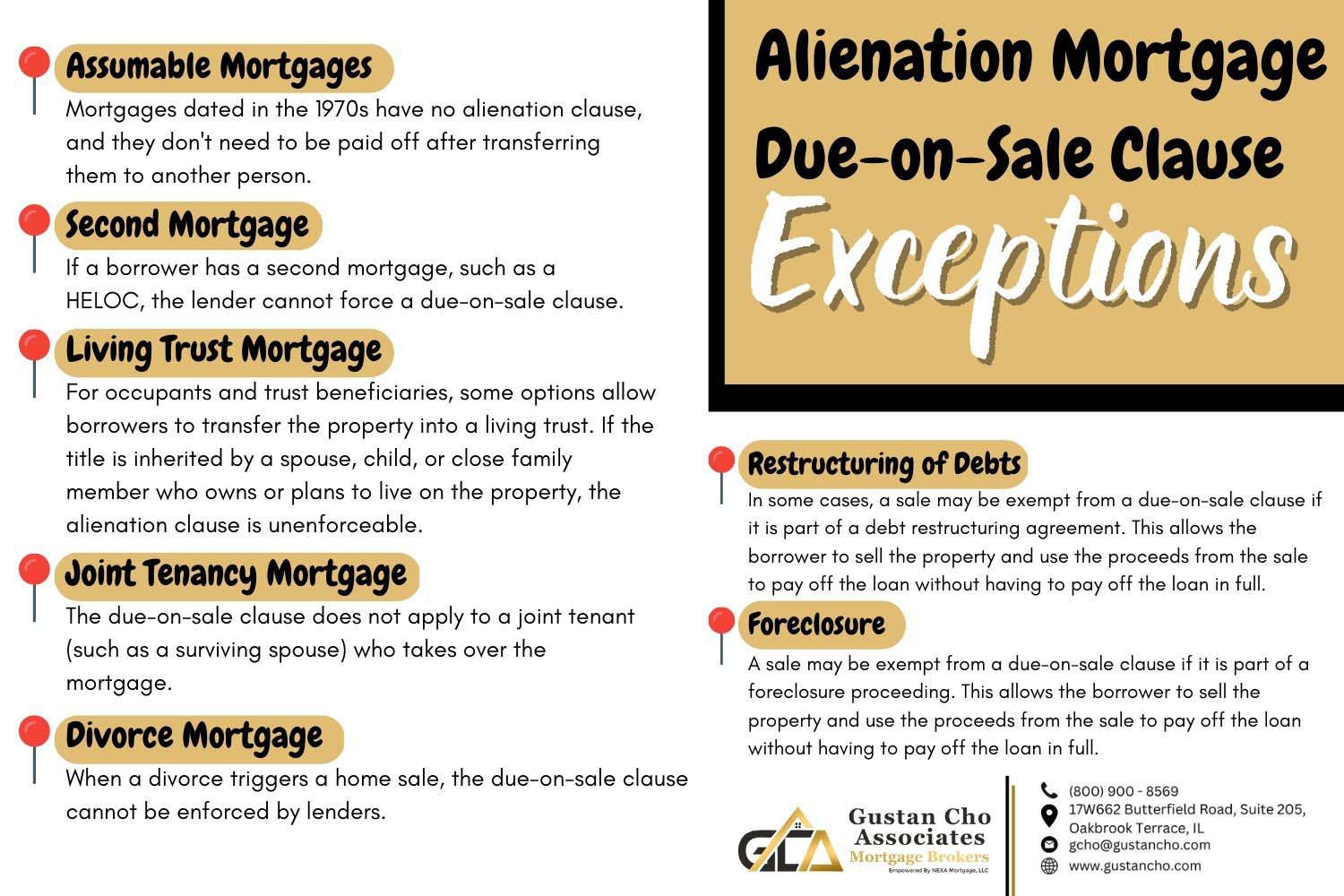

Alienation Mortgage Due-on-Sale Clause Exceptions

A due-on-sale clause is not always enforceable. People should be aware of the exceptions to this rule to determine whether or not the property sale will trigger the clause. Here are a few exceptions where it may be used:

Assumable Mortgages

Assumable mortgages – Mortgages dated in the 1970s have no alienation clause, and they don’t need to be paid off after transferring them to another person.

Second Mortgage Due-on-Sale Clause

Second Mortgage – If a borrower has a second mortgage, such as a HELOC, the lender cannot force a due-on-sale clause.

What Is a Living Trust Mortgage Due-on-Sale Clause

Living trust: For occupants and trust beneficiaries, some options allow borrowers to transfer the property into a living trust. Death: If the title is inherited by a spouse, child, or close family member who owns or plans to live on the property, the alienation clause is unenforceable.

Joint Tenancy Mortgage Due-on-Sale Clause

Joint tenancy: The due-on-sale clause does not apply to a joint tenant (such as a surviving spouse) who takes over the mortgage.

Divorce Mortgage Due-on-Sale Clause

Divorce: When a divorce triggers a home sale, the due-on-sale clause cannot be enforced by lenders.

Restructuring of Debts Mortgage Due-on-Sale Clause

Debt restructuring: In some cases, a sale may be exempt from a due-on-sale clause if it is part of a debt restructuring agreement. This allows the borrower to sell the property and use the proceeds from the sale to pay off the loan without having to pay off the loan in full.

Foreclosure Mortgage Due-on-Sale Clause

Foreclosure: A sale may be exempt from a due-on-sale clause if it is part of a foreclosure proceeding. This allows the borrower to sell the property and use the proceeds from the sale to pay off the loan without having to pay off the loan in full.