In this article, we will cover and discuss how homebuyers can qualify for a mortgage after bankruptcy in South Dakota. Consumers who have filed for bankruptcy can qualify for a mortgage after bankruptcy after meeting the waiting period after bankruptcy requirements in South Dakota. The waiting period to qualify for a mortgage after the bankruptcy discharge date depends on the particular mortgage loan program. The waiting period requirements depend on the type of loan program. However, homebuyers can definitely qualify for a mortgage after bankruptcy in South Dakota. In this article, we will discuss and cover the type of mortgage after bankruptcy in South Dakota that homebuyers can qualify for.

Buying a House After Bankruptcy in South Dakota

Homebuyers in South Dakota can qualify for a mortgage after bankruptcy. Gustan Cho Associates are experts in helping borrowers get approved for a mortgage after bankruptcy. Besides government and conventional loans, Gustan Cho Associates has hundreds of non-QM and non-prime mortgages for homebuyers with bankruptcy and/or foreclosure. FHA, VA, USDA, and conventional loans have waiting period requirements after bankruptcy. Non-QM mortgages one day out bankruptcy and/or foreclosure have no waiting period requirements but require a 30% down payment.

What Type of Mortgage Can You Get After Bankruptcy in South Dakota?

Homebuyers in South Dakota can qualify for government and conventional loans after bankruptcy after they meet the waiting period requirements. Non-QM loans and non-prime loans do not have any waiting period requirements after bankruptcy and/or a housing event. However, non-QM mortgages and non-prime loans require a 20% down payment on a home purchase.

FHA Waiting Period After Chapter 7 Bankruptcy Guidelines in South Dakota

There is a two-year waiting period after the Chapter 7 Bankruptcy discharge date to qualify for an FHA loan. Borrowers who recently got a Chapter 7 Bankruptcy discharge and waiting for the 2-year waiting period to qualify for an FHA loan should start the credit rebuilding process. Lenders expect borrowers to have re-established credit after bankruptcy with no late payments. The team at Gustan Cho Associates can coach and guide you on how to boost your credit scores and re-establish your credit after bankruptcy as soon as possible to prepare to qualify for a mortgage.

FHA Loans After Chapter 13 Bankruptcy in South Dakota

There is no waiting period after a Chapter 13 discharge date. Mortgage Loan Applicants who are applying for an FHA loan during or after a Chapter 13 Bankruptcy discharged date and the Chapter 13 discharge has been seasoned for less than two years, it needs to be a manual underwrite. All FHA manual underwriting mortgages need verification of rent by borrowers.

How Long After Filing Chapter 13 Bankruptcy Can I Apply For an FHA Loan?

Folks who have recently filed Chapter 13 Bankruptcy and entered a five-year repayment plan are eligible for an FHA loan one year into the repayment plan. First and foremost, mortgage loan applicants cannot be late on monthly debt payments after bankruptcy. Mortgage underwriters will want to see timely payment history after the bankruptcy discharge date. Just waiting out the two-year waiting period after the bankruptcy discharge date will not automatically qualify you for a mortgage loan.

VA Loans After Chapter 7 Bankruptcy in South Dakota

There is a mandatory waiting period of 2 years from the discharge date of a Chapter 7 bankruptcy to qualify for VA loans. Just waiting out the waiting period requirements is not a guarantee borrowers will qualify for VA loans. Lenders expect borrowers have re-established credit after bankruptcy with no late payments.

VA Loans During Chapter 13 Bankruptcy in South Dakota

Borrowers who filed a Chapter 13 Bankruptcy instead of a Chapter 7 can qualify for a VA loan in South Dakota one year after they filed Chapter 13 with Bankruptcy Trustee Approval. With a Chapter 13 bankruptcy, the home buyer needs the approval of the Trustee of their Chapter 13 Bankruptcy Courts. Timely payment history to all of their creditors under the Chapter 13 Bankruptcy Repayment agreement is required. Chapter 13 Bankruptcy does not have to be discharged.

Mortgage After Bankruptcy in South Dakota With Late Payments

No late payment history to qualify for a Mortgage After Bankruptcy in South Dakota is expected by lenders. One or two late payments may be acceptable but is really a negative factor. Consumers should also re-established credit after bankruptcy by getting several secured credit cards. Secured Credit Cards are the easiest and fastest way to re-establish credit and improve credit scores after bankruptcy.

Reestablishing Credit To Qualify For Mortgage After Bankruptcy in South Dakota

Consumers can get at least three secured credit cards with at least $500 credit limits, their credit scores will skyrocket in less than a year. Do not ever be late on secured credit card minimum monthly payments. Even though they are secured credit cards, they will report payment history to all three credit reporting agencies and late payments will be reported. One late payment can plummet credit scores by more than 50 points.

Is Verification Of Rent Required To Qualify For Mortgage After Bankruptcy in South Dakota

Verification of Rent is one of the most important factors for mortgage lenders in qualifying for a conventional mortgage after bankruptcy in South Dakota. Those who are renting, make sure to pay with a check because the only way verification of rent will count is by providing 12 months of canceled checks. Many renters pay their monthly rental payments with cash and think that a cash receipt from the landlord is sufficient. Cash payments for rents are worthless and even with a rental cash receipt, it will not count as verification of rent. Verification of Rent is not always required by mortgage lenders but providing verification of rent, is considered a strong compensating factor.

Fannie Mae Guidelines on Conventional Loans After Bankruptcy in South Dakota

We mentioned the waiting period to qualify for Mortgage After Bankruptcy in South Dakota with FHA loans above. The waiting period to qualify for a conventional mortgage after bankruptcy is 4 years from the discharge date of the Chapter 7 bankruptcy. Fannie Mae and Freddie Mac require a two-year waiting period after the Chapter 13 Bankruptcy discharge date on conventional loans. There is a four-year waiting period after the Chapter 13 Bankruptcy dismissal date to qualify for conventional loans. To get an approve/eligible per automated underwriting system (AUS), borrowers need re-established credit after bankruptcy with no late payments.

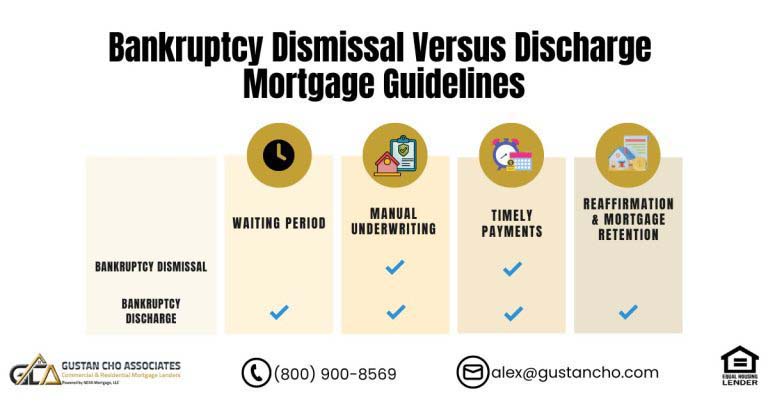

When Does Waiting Period Start For Borrowers Who Had a Mortgage Included in Bankruptcy

For those who have a mortgage part of Chapter 7 Bankruptcy, there is a four-year waiting period after the Chapter 7 Bankruptcy discharged date to qualify for a Conventional Loan. The foreclosure can be recorded at a later date after the Chapter 7 Bankruptcy discharged date and it does not matter. However, the foreclosure needs to be finalized in order for the borrower to qualify for Conventional Loans where a mortgage was part of the Chapter 7 Bankruptcy.

No Overlays In Qualifying For Mortgage After Bankruptcy in South Dakota

Gustan Cho Associates is a mortgage broker licensed in 48 states with a network of over 170 wholesale mortgage lenders with no overlays on government and conventional loans. We do not have any lender overlays on all mortgage loan programs unlike banks and other mortgage companies. With an approve/eligible per automated findings and as long borrowers can provide the conditions requested from the Automated Underwriting System, we can not just close on the loan but close it on time.

The Best South Dakota Mortgage Lenders For Bad Credit

Overlays are lender’s additional guidelines on top of the minimum federal lending guidelines by HUD and/or Fannie Mae or Freddie Mae. For example, the maximum debt to income ratio allowed on FHA Loans is 56.9% by HUD. Many banks and/or mortgage lenders may have lender overlays that cap the maximum debt to income ratios to no greater than 45%. Same with credit scores. The minimum credit score required to qualify for a 3.5% down payment FHA loan is 580 FICO. However, most banks and many mortgage lenders may have lender overlays requiring mortgage loan applicants a 640 credit score to qualify for an FHA loan.

How Long Til You Get a Home Loan After Bankruptcy

Gustan Cho Associates has traditional and non-prime mortgages after bankruptcy. We have non-QM loans one day out of bankruptcy with a 30% down payment. FHA and VA loans allow borrowers to qualify one year into Chapter 13 Bankruptcy repayment plan without having the bankruptcy discharged. There is no waiting period after Chapter 13 Bankruptcy discharged date to qualify for FHA and VA loans. Homebuyers who need to qualify for a mortgage after bankruptcy with a five-star national mortgage company licensed in multiple states with no lender overlays, please contact Gustan Cho Associates Mortgage Group at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We are available 7 days a week, on evenings, weekends, and holidays.

Gustan Cho Associates offers non qm loans where there is no waiting period after Chapter 7 Bankruptcy discharged date and no waiting period after foreclosure, deed in lieu of foreclosure and short sale

There is no waiting period after Chapter 13 Bankruptcy discharged date per HUD GUIDELINES.