This guide covers lender overlays on government mortgages versus lender overlays. Not all lenders have the same mortgage lending requirements on FHA, VA, USDA, and Conventional loans. Ronda Butts, a dually licensed realtor and loan officer, explains the difference between lender overlays on government mortgages versus lender overlays as follows:

Mortgage companies can have higher lending requirements above and beyond the minimum agency lending guidelines by HUD, VA, USDA, Fannie Mae, and Freddie Mac. These higher lending requirements are called lender overlays.

Not all mortgage companies have the same lending requirements. Just because a borrower may not qualify for a mortgage with one lender does not mean they cannot qualify for a mortgage with a different lender. Over 80% of our borrowers at Gustan Cho Associates could not qualify at mortgage lenders due to their lender overlays.

Government Mortgage Loans

Government Loans are home loans that guarantee lenders if borrowers default on their home loans. Government agencies do not originate nor fund loans. It is due to the government guarantee private lenders can originate and fund loans at great rates and low or no down payment. Lenders can offer low to no down payment on government-backed loans at low mortgage rates due to the government guarantee. If borrowers default on government loans, the government agency will insure part of the loss lenders takes. For FHA, VA, and USDA to insure the loan, lenders must meet and follow the minimum agency guidelines of the loan program.

Types of Government Loans

There are three types of government loans:

- FHA loans

- VA loans

- USDA loans

Government Loans are for owner-occupant borrowers only. Borrowers cannot qualify for second home or investment property mortgages with government loans. Each government loan program has credit/income agency guidelines that lenders must meet. All mortgage lenders need to meet agency lending guidelines on government loans. However, lenders can have Lender Overlays On Government Mortgages. Lender Overlays On Government Mortgages are additional mortgage guidelines set by individual lenders.

Example of Lender Overlays on Government Mortgages

Examples of lender overlays on government mortgages are higher credit scores than agency guidelines. Higher debt-to-income ratio requirements than government mortgage guidelines. Agency guidelines do not require outstanding collections and charged-off accounts to be paid.

Many mortgage companies have lender overlays on government mortgages on collections and charge-off accounts. Collection and Charge offs may be required to be paid off by the lenders as part of their overlays when agency guidelines do not require them to.

Common lender overlays on government mortgage lenders may disqualify late payments in the past 12 months when borrowers got an AUS approval with late payments in the past 12 months. Gustan Cho Associates has no overlays on government and conventional loans. Gustan Cho Associates is a mortgage company licensed in multiple states with zero lender overlays. We go off minimum agency guidelines and do not impose any other lending requirements above and beyond AUS Approval.

Case Scenarios of Overlays Required by Lenders

Not all lenders originating and funding FHA, VA, and USDA loans have the same mortgage guidelines. All lenders must meet FHA, VA, and USDA agency guidelines. But not all lenders have the same FHA, VA, and USDA requirements.

HUD, the parent of FHA requires a 580 credit score for home buyers purchasing a home with a 3.5% down payment. These are the bare bones minimum FHA guidelines. However, most banks require 640 credit scores from borrowers.

Why do banks require a 640 minimum credit score requirement when FHA requires a 580 FICO? The reason is that most banks have lender overlays on credit scores. It is perfectly legal for a bank and or lender to have higher credit/income standards (lender overlays).

Lender Overlays on VA Loans

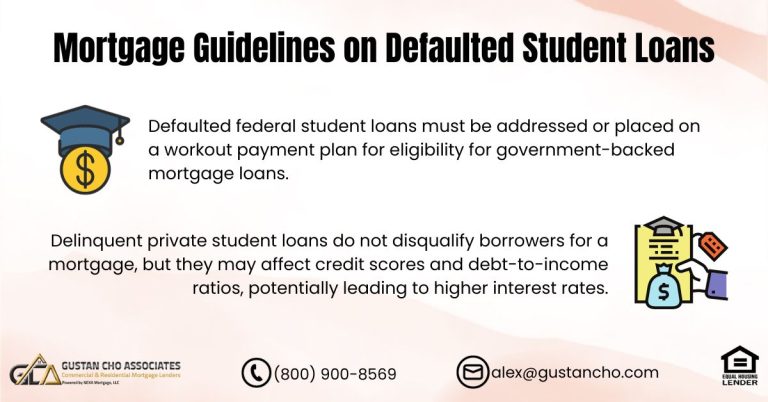

Lender Overlays Scenarios On VA Loan With Over $40,000 Of Medical Collections

Recently we had a client who was involved in back-to-back major car accidents with many unexpected bills (medical bills and other accident-related bills). New medical collections kept popping up and popping up on her credit report. These medical collections caused the credit score to drop all the way down to 552 from 715.

We were able to close the VA mortgage with 100% financing even though the credit score was low. There were over $60,000 in medical collections that showed up in just the past few months. They were many NON-MEDICAL collections older than 12 months. We were able to utilize the new credit supplement rule and verify that no payment plan was put in place for the non-medical collections. Of course, medical collections use a zero-dollar payment per VA guidelines.

Please see our blog on VA COLLECTION GUIDELINES for more information.

This client was turned down by two other lenders due to their credit score and medical collection balance is being too high. However, the decision from the other lender was based on overlays and the HUD guidelines. Per HUD guidelines, there is no minimum credit score requirement for VA loans. Our client was incredibly happy we were able to close this loan for her in a short amount of time.

Lender Overlays Scenarios On FHA Loan With Active Current Chapter 13 Bankruptcy

We close FHA mortgages with an active chapter 13 bankruptcy all the time at Gustan Cho Associates. We are experts in manual underwriting FHA loans when currently in a chapter 13 bankruptcy OR less than two years from the chapter 13 discharge. This example is being written about due to the issues during the trustee’s approval.

If you are in an active chapter 13 bankruptcy, your trustee must sign off on your loan terms before the underwriter can approve the FHA loan. This trustee was located in Cook County, Illinois. After a review of our pre-approval and mortgage fees, the trustee told the client they would need to extend their chapter 13 bankruptcy in order to be approved for this new mortgage debt. Our client had to make a decision based on the very specific rules from the trustee. In this particular case, our client had about 2 years left on chapter 13 repayment.

At the time of this trustee review, the trustee learns about a substantial raise the client received from his work. In order to sign off on the new mortgage debt, the trustee extended the bankruptcy repayment 12 more months due to this raise.

Finding Lenders With No Overlays on Government and Conventional Loans

Our business model at Gustan Cho Associates is a mortgage company licensed in multiple states with no lender overlays on government and conventional loans. Over 80% of our borrowers could not qualify at other lenders due to their overlays. Borrowers who need to qualify for a mortgage with a mortgage company licensed in multiple states with no lender overlays, please get in touch with us at 800-900-8569. For a faster response, you can text us at the same number 800-900-8569. Or email us at gcho@gustancho.com.

Gustan Cho Associates are mortgage lenders licensed in 48 states, including DC, Puerto Rico, and the United States Virgin Islands. Gustan Cho Associates is one of the few national mortgage companies with no lender overlay on government and conventional loans. In this article, we will discuss and cover agency mortgage guidelines versus lender overlays.

Gustan Cho Associates are experts in non-QM and alternative loan programs on primary, second homes, and investment properties. We have dozens of relationships with non-QM wholesale lenders. Some of our popular non-QM loan programs include bank statement loans, asset-depletion loan programs, non-QM mortgages one day out of bankruptcy and foreclosure, fix and flip loans, mortgage programs for real estate investors, portfolio loan programs, and dozens of other alternative loan programs. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.

Qualifying With A 5-Star National Direct Lender With No Overlays On Government And Conforming Loans

Periodically we like to share success stories of recently closed mortgages and Lender Overlays Scenarios. Many of our readers are facing similar situations and we want to show them there is light at the end of the tunnel.

Every mortgage borrower has different qualifications and no two mortgage loans are the same. Thousands of Americans get denied due to LENDER OVERLAYS and simply give up. We hope they find our website and reach out directly to Gustan Cho Associates. Our highly skilled mortgage team is here to assist seven days a week, mornings or evenings. Even if you do not qualify today, we will come up with a financial plan to qualify for your dream home as soon as possible.