This guide covers how your credit impacts your homebuying process. If you are in the market to buy or refinance a home, you know the importance of your credit score. Gustan Cho Associates are experts in all areas of mortgage lending and cannot stress enough the importance of a credit score. Dale Elenteny says the following about how your credit impacts your homebuying process:

In this blog, we will discuss how your credit score will affect your mortgage qualifications and, most importantly, how much down payment is required for you to buy a home.

Most buyers want to make the smallest down payment possible with mortgage rates as low as they are today. The following paragraphs will cover how your credit impacts your homebuying process.

How Your Credit Impacts Your Homebuying Process

Your credit score shapes your homebuying process in 2025. Know its effects on mortgage approval and interest costs, and find easy steps to boost your score before you buy.

Lenders raise rates to offset the risk of lower credit. However, the score is not the only factor at work. Your down payment and how much debt you already carry can also move the rate arrow one way or the other.

Track your progress with a free credit-monitoring tool, and remember, big changes can take a few months to show up. Adding just one new credit app, even by mistake, can delay your goal, so stay patient and keep improving your credit score month by month.

See How Your Credit Affects Your Mortgage Approval

Your credit score plays a big role in qualifying for a home loan. At Gustan Cho Associates, we help borrowers with perfect or challenged credit achieve homeownership.

Introduction: How Your Credit Impacts Your Homebuying Process

Buying your first home marks a huge financial step. Age and experience matter, but in 2025, your credit score is even more important. With 30-year fixed mortgage rates near 6.4% thanks to market changes, a smart score can help you secure the house you want without blowing your budget. Your credit will determine whether you get a loan in the first place, the rates you pay, and even how much you can borrow. Let’s break down the score’s role in the mortgage process and explore easy, practical steps to improve your credit before you buy.

Understanding Credit Scores

Your credit score helps lenders decide if you will repay your borrowed money. Please consider the score a single, quick grade to show your trust in them. It’s a three-digit number usually between 300 and 850 and comes from the history you build every month. While mortgage lenders mostly use the FICO score, many also consider the VantageScore, so either can matter. The higher the number, the safer lenders feel.

Components That Make Up Borrower’s Credit Scores

The score stands on five legs, each with a different weight. The biggest chunk—35 percent—comes from your payment history, so paying bills on time wins the most points. Next, credit utilization makes up 30 percent. This means the total balances on your credit cards should stay under 30 percent of their limits.

For a typical $400,000 mortgage, the math becomes clearer. Suppose your score is 760 or above. Your monthly payment is about $2,437, and you’ll pay around $477,289 in interest over 30 years. The same mortgage with a 620 to 639 score costs about $2,581 monthly, and total interest leaps to nearly $529,200. That’s a monthly difference of $144 and a difference of over $51,000 across the life of the loan.

The age of your accounts—15 percent—will rise each time you keep an old account open. Going for too many accounts simultaneously sends the 10 percent for new credit downward. Finally, the same 10 percent want you to have a good credit mix, like loans and cards. Dear binder of credit grades, it takes steady, smart money habits to make your score strong and keep it that way.

Credit Score Requirements For Mortgage Approval

When applying for a mortgage, knowing the minimum credit score you need is crucial; these numbers will depend on your loan type. Conventional mortgages usually need at least a 620 score. However, if you hit 720 or higher, you’ll likely see better interest rates, lower fees, and friendlier loan terms. Some programs let you make a down payment as low as 3%, and higher credit scores can even trim the cost of private mortgage insurance, or PMI.

The Federal Housing Administration, or FHA, offers more wiggle room. A score of 580 gets you in with a 3.5% down payment. If you’re in the 500 to 579 range, you still qualify, but you’ll need to come to the table with a 10% down payment.

That’s why this loan is a strong choice for first-time buyers and anyone working to improve their credit. Veterans and sometimes active-duty service members can consider VA loans, which set no official minimum score. That said, most lenders will want you above 620. The USDA home loan rules tend to expect at least a 640 score for those eyeing a rural home.

How Credit Affects Mortgage Interest Rates

When shopping for a mortgage, your credit score is one of the biggest pieces of the puzzle. A small change in the score can change your interest rate, which means real money saved—or spent—over the life of the loan. Let’s look at how it shakes out for a 30-year mortgage in 2025.

Some lenders may approve lower numbers if the rest of your financial picture is solid. However, 2025 could see even stricter criteria in the mortgage market, so the smartest move is to aim for scores well above the floor.

Doing that not only boosts your chances of approval, but it can also spare you higher rates, costs, and hassle. If your credit score sits in the elite range of 760 to 850, you’ll likely see an annual percentage rate (APR) of about 6.15%. Drop into the 700 to 759 range, and that rate can jump to 6.35%. Going lower, the score of 680 to 699 averages 6.45%, 660 to 679 gets 6.50%, 640 to 659 is 6.60%, and the 620 to 639 bracket thumps you with approximately 6.70%. Rates can also shift based on where you live and the loan’s size.

The Role of Credit in Loan Amounts and Qualification

Your credit score is like a financial report card — it doesn’t just decide if you get a yes, it also tells the bank how much money you can borrow and the rules that come with it. Banks look at that score next to what you earn, how long you’ve been with your job, and your debt-to-income ratio, which is best kept below 36 percent.

If your score is high, it can offset a slight dip in another area, making it more likely that you’ll get pre-approved.

Strong credit often opens the door to larger loans, which says to lenders that you’re someone who pays bills on time. If your score is low, the bank might offer you a smaller loan or ask you to add more cash. For instance, if the number is below a certain point, you may have to buy private mortgage insurance if your down payment is less than 20 percent, which adds to your monthly payment.

Quick Steps to Boost Your Credit for a Mortgage

Want a better mortgage rate? Start working on your credit score 6 to 12 months before you apply. Begin by getting your free copy of the credit report from Equifax, Experian, and TransUnion.

Look for mistakes—fixing just one error can lift your score now. You get one free report from each agency every 12 months.

After you have the reports, focus on lowering your debt. Pay the highest-interest cards first to keep your credit cards below 30 percent of the max limit. This move lowers your credit utilization and debt-to-income ratio, two factors lenders watch closely. Next, build strong habits: pay every bill on time, avoid opening new credit lines, and keep a mix of accounts, like a credit card and an installment loan. Check out credit-builder loans or a secured card if your credit file is thin.

Common Credit Mistakes to Avoid When You’re Buying a Home

Please don’t mess up your mortgage before you even get it. Shutting your credit account for a car, student loan, or furniture deal seems harmless, but a new inquiry record makes your score dip a few points. When your score drops, lenders think you’re taking on risky new debt even if you never purchased a thing.

On the other hand, putting a big charge on one or two credit cards bumps your credit-utilization ratio up. That move drags your score even lower.

A forgotten minimum payment for any card, medical bill, or subscription could ruin the mortgage deal you’ve waited for. And if you co-sign on a new student loan, boost a car payment, or pile on any other charge before the deed goes through, the extra debt makes your back-end ratio sky-high—loan denied! No big financial move is ever harmless, from when your realtor hands you the first digital pre-approval to the moment the pen hits the closing disclosure. Stay calm and stay on the plan.

How Higher Credit Scores Yields Lower Mortgage Rates

In 2025 and beyond, your credit score still makes or breaks the whole homebuying deal, deciding what rates you see, how big a loan the bank writes, and how much of a payment you can afford. John Strange, a senior mortgage loan originator says the following about how borrowers can save tens of thousands of dollars over the course of the loan if they have higher credit scores.

When you know what makes the score tick and what breaks it, you can fix, boost, and protect the one number that decides your mortgage every step of the process.

Listen, even a few extra clicks to get that extra discount on furniture or clothes can cost you hundreds of dollars a month in interest and thousands of dollars over a decade. Whether buying your first home or changing your loan, getting your credit score to shine is the smartest first investment step. Money and mortgage strategies aren’t one-size-fits-all, so talk with your loan officer or credit union rep for the boost that fits your money style.

Bad Credit? We Can Still Help

Even with collections, late payments, or low scores, we offer mortgage programs with no lender overlays.

How Your Credit Impacts Your Homebuying Process: Factors Determining The Qualification Of Borrowers

There are three main areas of concern when getting preapproved for a mortgage.

- Credit score

Debt-to-income - Down payment (and reserves).

How Your Credit Impacts Your Homebuying Process: How Mortgage Underwriters Analyze Debt-to-Income Ratios

Your debt-to-income ratio will dictate how much home you can afford. An underwriter must assess your ability to repay your mortgage loan. Your total qualified income must be approximately double your expenses, including your future housing payment (with taxes, insurance, and any homeowners association dues). Many lenders have overlays regarding the debt-to-income ratio, which will limit the number of homes you can afford. The good news is that Gustan Cho Associates has no lender overlays on their mortgage programs.

How Your Credit Impacts Your Homebuying Process: Debt-to-Income Requirements Depend on The Loan Programs

Each mortgage loan program has its own debt-to-income ratio requirements. In many cases, we can go up to 56.9% back in the debt-to-income ratio for FHA mortgage lending. We can go even higher on some VA lending products. Conventional mortgage lending will have a strict cap of a 49.99% debt-to-income ratio.

USDA loans have a 31% front-end and 43% back-end debt-to-income ratio. If you are trying to calculate your debt-to-income ratio independently, we strongly encourage you to contact our team.

The amount of income that can be used to qualify for a mortgage will vary dramatically based on your sources of income. The income you receive, and the amount allowed per mortgage guidelines, can vary dramatically. Please leave it up to the experts, so you know the correct price range for the homes you should be shopping for.

How Your Credit Impacts Your Homebuying Process and Down Payment

The next main pillar when qualifying for a mortgage is your credit score. But just because you may have a qualifying credit score does not mean you qualify for a mortgage loan.

Your credit score will be the main factor determining the interest rate you qualify for, but other factors, such as payment history and account seasoning, will also play a role.

For example, you could have a 660 credit score (which will qualify you for virtually every mortgage program) but have a collection account that is only nine months old. This may hinder your mortgage qualifications because most loan programs do not allow recent collection accounts. Having the highest credit score possible will save you thousands of dollars on your mortgage loan.

How Your Credit Impacts Your Homebuying Process and Mortgage Rates

The interest you pay is determined based on your credit score and your credit score only. This eliminates the possibility of discrimination. Mortgage rates are based on credit score thresholds. The amount of interest will be broken down into 20-point buckets. Below is an example AND not factual, REACH OUT TO A LICENSED LOAN OFFICER FOR AN EXACT QUOTE.

- 620-639 – 7.75%

- 640-659 – 7.50%

- 660-679 – 7.25%

- 680 -699 – 7.0%

- 700 – 719 – 6.75%

- 720-739 – 6.50%

- 740-759 – 6.25%

- 760 and above – 6.0%

In the (hypothetical) example above, your rate could be 1.75% lower based on a higher credit score. Based on a loan amount of $300,000, the savings will add up quickly:

How Your Credit Impacts Your Homebuying Process and Interest Expense Over The Term of The Loan

The total interest paid on a 30-year fixed mortgage at 5.25% is $296,380, and the total interest paid on a 30-year fixed mortgage at 4% is $215,608. A higher credit score in this example could save you $80,772! We hope you now see your credit score’s impact on your mortgage loan. Borrowers with higher credit scores will get lower interest rates. Lower interest means tens of thousands of dollars in savings over the loan’s term.

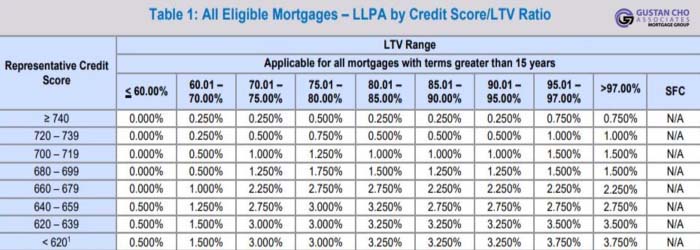

How Your Credit Impacts Your Homebuying Process on Loan Level Pricing Adjustments

LLPA stands for loan level pricing adjustment. This is a term used by Fannie Mae and Freddie Mac. These are adjustments to your interest rate based on certain eligibility factors such as credit score, loan purpose, occupancy, number of units, product type, and more. These loan-level pricing adjustments are cumulative, and each adjustment will affect the interest rate you qualify for. These interest rate pricing adjustments are universal for every mortgage lender participating in conventional mortgage lending. As you can see from the chart below, the credit score is a major driving factor in the amount of the loan level pricing adjustments added to your rate.

The third aspect of qualifying for a mortgage is down payment and/or available assets. The larger down payment you have available will increase your chances of qualifying for a mortgage.

Your credit score will also dictate what mortgage products are available to you. For example, very few mortgage programs are available if your credit score is below 580.

Credit scores below 620 will require VA or FHA mortgage lending. For our veterans, no down payment is required regardless of credit score. Depending on the underwriting qualifications, they may ask you to have reserves available.

How Your Credit Impacts Your Homebuying Process: FHA Loans Under 580 Credit Scores Versus Over 580 FICO

FHA loans require a 10% down payment if your credit score is below 580. If your credit score is 580 or above, only a 3.5% down payment is required. Conventional mortgage lending requires a minimum of a 620 credit score and a minimum of 3% down.

Putting down 3% is only available to first-time homebuyers. A first-time homebuyer has not owned a property in the previous three years (36 months before the application date).

If you have owned a property in the past three years, your minimum down payment for a primary residence is 5% with conventional mortgage lending. The automated underwriting system for conventional mortgage lending can be tricky. With a credit score below 640, you may not get an automated conventional approval. Therefore, a credit score is important.

Don’t Let Credit Challenges Stop You

Whether you’re rebuilding or improving, we’ll guide you through the process so you can buy your dream home with confidence.

How Your Credit Impacts Your Homebuying Process: Importance of Maximizing Credit Scores Before Applying For a Mortgage

Gustan Cho Associates cannot stress enough the importance of your credit score. Since we are experts in lower credit score mortgage lending, we have seen virtually every credit profile.

We help clients with credit scores in the 800s and down to the 500s. It is very easy to damage your credit score. As you may know, repairing your credit score can be difficult and time-consuming.

If your credit profile is imperfect, we encourage you to contact our mortgage experts. While we don’t recommend a credit repair agency, we may be able to point you in the right direction to raise your credit score in a reasonable timeframe. We have helped numerous clients raise their credit scores to qualify for the mortgage program that suits them best.

How Your Credit Impacts Your Homebuying Process FAQs

What’s The Minimum Credit Score to Buy a House in 2025?

- It depends on the loan: conventional loans typically need a score of 620

- FHA loans allow 580 with 3.5% down or 500 to 579 with 10% down.

- VA loans also need a 620.

- USDA loans usually ask for a score of 580.

- Lenders may raise these cutoffs based on the market.

How Will a Low Score Change My Mortgage Interest Rate?

- A lower score usually means a higher rate.

- For example, a borrower with a score between 620 and 639 could see a 6.70% APR, while someone with a score of 760 or higher might get 6.15% for the same 30-year loan.

- That’s more money over the life of the mortgage.

Can I Get a Mortgage With Bad Credit?

- Yes, FHA loans can be approved with a score of 500, but expect higher interest and a bigger down payment.

- It’s smarter to boost your score first if you can.

How Long Can I Boost My Credit Score for Buying?

- You might see small gains in 3 to 6 months, but for a more significant increase, aim for at least 12 months.

- Start by reviewing your three credit reports and cutting down on existing debt.

Will My Credit Score Drop After Getting a Mortgage?

- You might see a small, temporary drop due to a credit inquiry and the new loan, but your score can get stronger over time if you make mortgage payments on time.

Starting The Mortgage Process With a Mortgage Company Licensed In Multiple States With No Overlays

Gustan Cho Associates are made up of mortgage professionals who take pride in their work. Our team is committed to offering fast and reliable service. You must have a trustworthy mortgage team in today’s competitive housing market. Our seasoned loan officers are available seven days a week to help you with your qualifications. Any mortgage-related questions can be directed to Mike Gracz at (800) 900-8569 or email mike@gustancho.com. We would love the opportunity to help you and your family realize the dream of homeownership and make it a reality.

Take Control of Your Credit and Your Future

Your homebuying journey starts with understanding your credit. With our flexible programs, the path to approval is closer than you think.