This ARTICLE On Illinois Home Values Versus Property Taxes On Residential Homes Was PUBLISHED On October 20th, 2019

Home values in Illinois is very reasonable throughout the whole state.

- Illinois is one of the very few states where home values did not appreciate much since the 2008 Great Recession and Credit Meltdown

- There is a direct relation between Illinois Home Values Versus Property Taxes On Residential Homes

- Increasing and high property taxes mean lower home values

- Homes in high property tax states do not have much appreciation in home values

- Illinois has the second highest property taxes in the U.S.

- New Jersey leads the nation with the highest property taxes

In this article, we will cover and discuss Illinois Home Values Versus Property Taxes On Residential Homes.

Illinois Property Taxes Increase While Home Values Drop

Illinois is in a financial crisis.

- The state has been increasing taxes to meet its budget deficit

- The state has a $241 billion pension debt shortage

- The city is in worst financial shape after the election of Mayor Lori Lightfoot

- Both Governor J.B. Pritzker and Chicago Mayor Lori Lightfoot cannot seem to get the debt of the city and state under control despite increasing existing and creating new taxes

- Chicago is now rated as the highest taxed U.S. City in the nation

Pritzker recently doubled the state gas tax. Many taxpayers are livid because Pritzker recently approved wage increases to state lawmakers.

Changing To Progressive Tax System

He is also proposing in changing the state’s flat tax system to a progressive income tax plan.

- Progressive income taxes hurt higher income wage earners

- Experts are against this

- They think it will expedite wealthy Illinoisans leaving the state

- Countless of Illinoisans are already fleeing Illinois to other lower-taxed states

- What good is having the highest tax rates when you are losing taxpayers

- The governor does not agree with critics on Illinoisans fleeing the state

J.B. Pritzker thinks Illinoisans will stay in the state due to the great amenities the state has to offer such as top universities, places to visit, and landscape.

Raising Taxes Is Not The Solution To Solving Budget Deficit

Pritzker does not seem to realize that raising taxes is not the solution to balance the budget:

- It is two-fold

- Increasing taxes and cutting spending need to go hand in hand

- However, Pritzker is increasing spending

- He recently approved wage increases to state lawmakers

- Property taxes has been increasing in the state for years

- Not just property taxes, but other taxes in Illinois have been skyrocketing

- J.B. Pritzker recently has doubled its gas tax

- Sales taxes are going up

- Many cities such as Chicago are implementing high city taxes

- Peoria Illinois recently has created a separate property fee tax to meet its police and fire pension debt shortage

In general, when property taxes increase, home values depreciate. What this means is Illinoisans are losing hard earned equity in their homes.

Home Values In Illinois Versus Other States

The housing market is hot. In most states, home values have been appreciating since 2011.

- HUD, the parent of FHA, has been increasing FHA Loan Limits for the past three years due to rising home prices

- The FHFA has followed HUD’s lead in increasing conforming loan limit for the past three years due to skyrocketing home prices

- FHA Loan Limits for 2019 has been increased to $314,827

- 2019 Conventional Loan Limits is now capped at $484,350

- President Trump signed legislation exempting VA Loan Limits

- There is no longer a maximum loan limit on VA Loans due to rising home prices

- Unfortunately, Illinoisans has not enjoyed rising home prices due to the high property taxes in the state

- Homes in Illinois have not increased like other states. Recent data show falling home prices in Illinois

Illinois is one of the very few states that still have home prices that are at the Great Recession levels. However, local, county, and state government keeps on increasing property taxes as well as other taxes in the state.

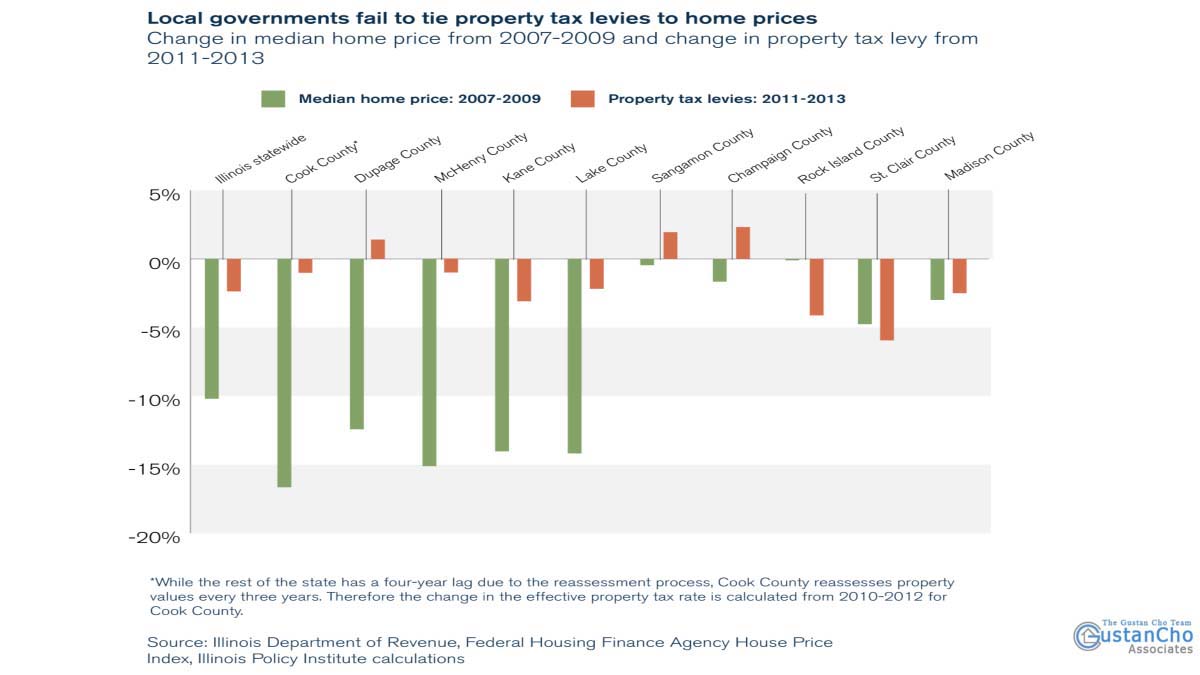

Look at the chart below:

In many towns of Illinois, property taxes went up despite falling home values. In Dupage County, home prices dropped 24% while property taxes increased by 7% since the 2008 Housing Meltdown. DuPage County is one of the best areas in Chicago and surrounding suburbs.

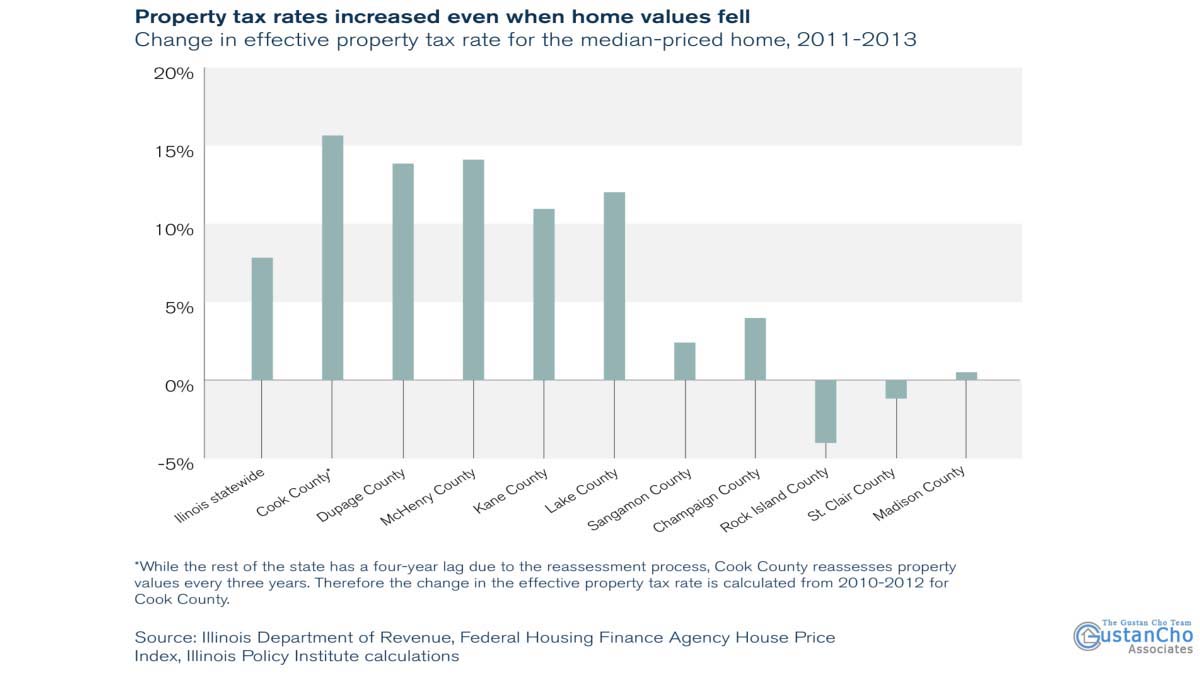

Look at the chart below:

Declining property values takes away equity from homeowners. Politicians realize this. However, despite falling home prices, lawmakers increased property taxes putting a strain on homeowners and their families to make ends meet.

Affordable Home Prices But Increasing Home Values

There are two reasons why Illinoisans are fleeing the state to other states.

- High property taxes and other state taxes

- Massive corruption in the state for years

Illinois is one of the highest taxed states in the U.S. However, one great aspect is Illinois home prices are reasonable. Homebuyers can purchase a lot of home for the money. The housing market in Illinois is fair at best. Homebuyers fear how much more property taxes will go up. Politicians keep on hiking property taxes despite falling housing prices. Housing prices are decreasing due to high property taxes.

Economic Outlook

Even though the state is losing countless of taxpayers, Illinois does have hope. Experts predict Illinois will be the highest property tax state by late 2020 surpassing New Jersey’s first position. However, home prices in Illinois is substantially lower than other states in the nation. Property tax reform is absolutely necessary. Raising taxes works but you need to drastically cut spending. Lower housing values means homeowners losing equity in their homes which means they are losing their net worth. If home values increase and appreciate, naturally property taxes should increase. However, this is not the case in Illinois. The state need competent experienced politicians who can run the government like a business. It is not what you make but rather how much you spend. Gustan Cho Associates Mortgage News will keep our viewers updated on developments to this story.