BREAKING NEWS: Illinois COVID-19 Recession Hurt Illinois Homeowners

Illinois COVID-19 Recession is hurting Illinoisans more so than any other homeowner in the nation.

- The U.S. economy was booming prior to the coronavirus pandemic

- Most states were raking in billions in revenues and had billions in reserves

- However, that was not the case with Illinois

- Illinois was in a financial crisis prior to the COVID-19 pandemic

- The pandemic worsened the financial crisis

- It is no secret that Illinois Governor JB Pritzker is not managing the state right

- JB Pritzker seems the only thing he knows in solving the state’s financial mess is to raise taxes

- Pritzker has raised taxes in over two dozen items, doubled the state’s gas tax, and is proposing a progressive tax

Pritzker’s incompetence is forcing a mass exodus of individual taxpayers and businesses to flee Illinois to other lower-taxed states. Never in history have so many taxpayers formed groups to recall a state governor.

Illinois COVID-19 Recession: Pritzker And Illinois Lawmakers Hoping For A Federal Bailout

The governor’s goal seems to take the state into the ground so he can get a federal bailout from the Trump Administration.

- President Trump and his administration said he will not be bailing out financially irresponsible states such as Illinois

- Illinois was one of the first states to shut down due to the coronavirus pandemic and one of the last states to reopen

- The state has not yet fully reopened

- The main reason for the state’s financial mess is due to its pension debt shortage

- No matter how much Pritzker increases taxes, there is no way in the world it will fix the state’s major pension debt

- Pritzker and the Democrat lawmakers do not seem to realize that the pension system in Illinois is broken and has been broken for decades

- It is like running a Ponzi Scheme

The state is on the verge of bankruptcy.

Illinois Financial Crisis Prior To The Pandemic

The only way Illinois will be back in order is to stop the financial bleeding:

- Pritzker is not only raising and creating taxes across the board but is also spending like a drunken sailor

- Many Illinoisans had the highest respect for Pritzker prior to his election because he is an heir to the Hyatt Hotel Family

- However, after getting elected as Illinois governor, JB Pritzker seemed like he never ever ran a business in his life

- Pritzker is often clueless and lost

- Pritzker does have high political hopes

- He always inspired in being a politician but was unsuccessful in his political endeavors

- Now he is eyeing a Democrat Presidential Ticket for 2024

- Unfortunately, Pritzker is becoming more unpopular than any other governor in the Nation

In this breaking news article, we will discuss and cover how Illinois COVID-19 Recession Hurt Illinois Homeowners.

Illinois COVID-19 Recession Hurt Illinois Homeowners More So Than Any Other State In The Nation

It is no secret that Illinois was in a financial mess prior to the coronavirus pandemic.

- While other states were raking in billions in revenues prior to the pandemic, Illinois was on the verge of bankruptcy

- The pension debt was beyond the financial crisis

- No tax increases in the world can fix the state’s pension debt

- Property taxes in Illinois is the nation’s second-highest next to New Jersey

- Despite the financial crisis and big budget deficit, Pritzker has no sign of reducing spending

- Pritzker and his administration are in a state of denial

The high Illinois taxes are stumping the growth of Illinois. Out-migration is at serious levels. Not only are individual taxpayers moving out but so are businesses. The combination of a history of public corruption, high crime rates, high property taxes, and high cost of living is making Illinois a very unattractive state for people and businesses to move to.

Massive Exodus To Neighboring States Due To High Taxes

The high property taxes are forcing Illinois homeowners to sell their homes and seek refuge to nearby neighboring states like Indiana, Tennessee, and Kentucky, where property taxes are a fraction and cost of living, is well below Illinois.

- The only solution Pritzker has is to keep increasing existing taxes and creating new taxes

- This is causing a mass exodus of Illinoisans

- Illinois property values are decreasing instead of increasing due to high property taxes

- The state is in major financial trouble

- The governor is in a state of denial

Pritzker recently approved pay raises to state workers and lawmakers despite the state’s major budget deficit. Illinois COVID-19 Recession is driving the state to the road of bankruptcy at a fast pace.

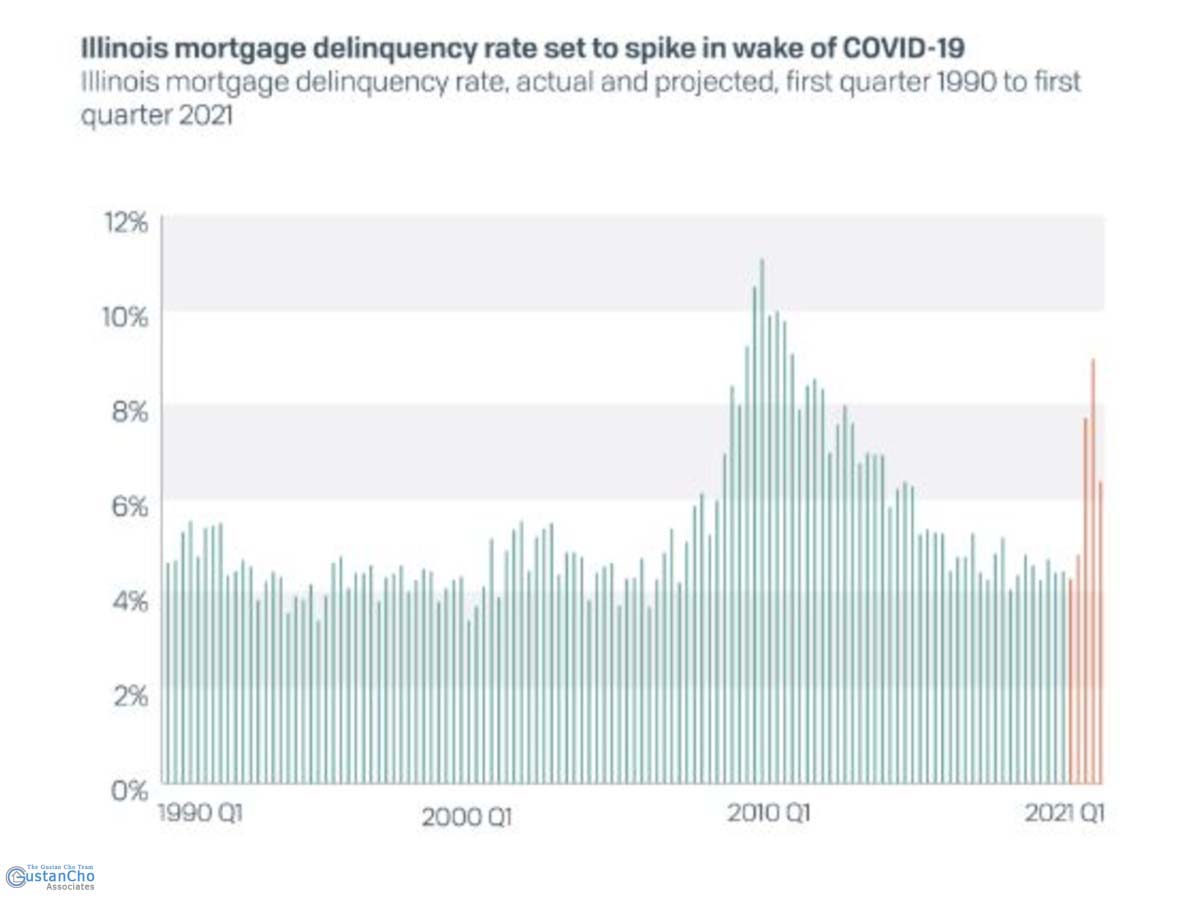

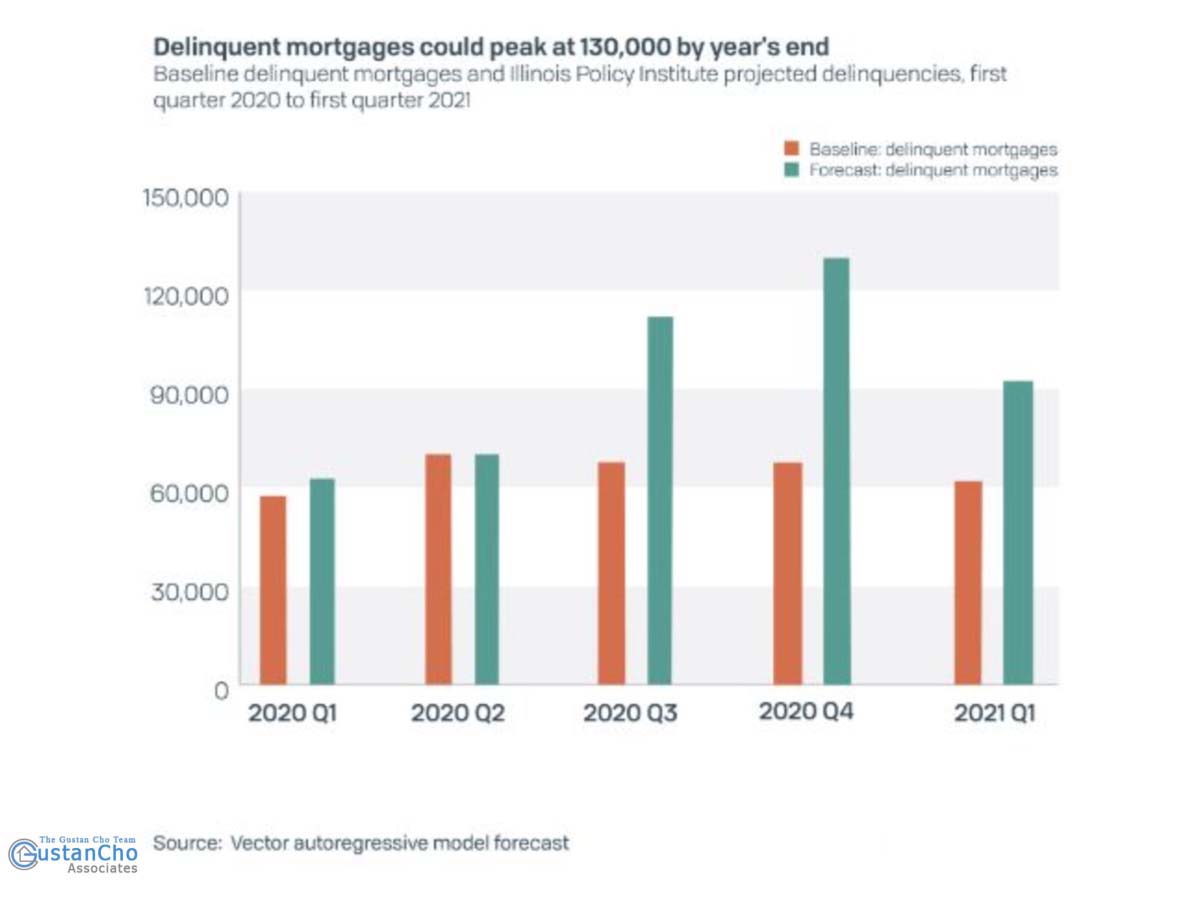

Illinois COVID-19 Recession Driving High Mortgage Delinquency

Analysts expect over 130,000 homeowners in Illinois can default on their mortgage payments if Illinois lawmakers do not provide financial relief. Illinois homeowners have been struggling with a declining housing market prior to the coronavirus pandemic unlike homeowners of other financially stable states. The coronavirus pandemic has brought the U.S. economy to a major halt. Over 1.5 million Illinoisans were left jobless. The pandemic has devastated Illinois homeowners more so than any other homeowners in other states. The governor extended his executive stay at home order. Illinois remained closed while other states started reopening as early as late April. The Illinois crippling economy with the extension of Pritzker’s stay at home order is making tougher for families to make their mortgage payments. Illinois has the harshest lockdown shut down order in the nation. Many experts and economists see the mortgage delinquency rates to double making it the worst mortgage crisis in the past 30 years.

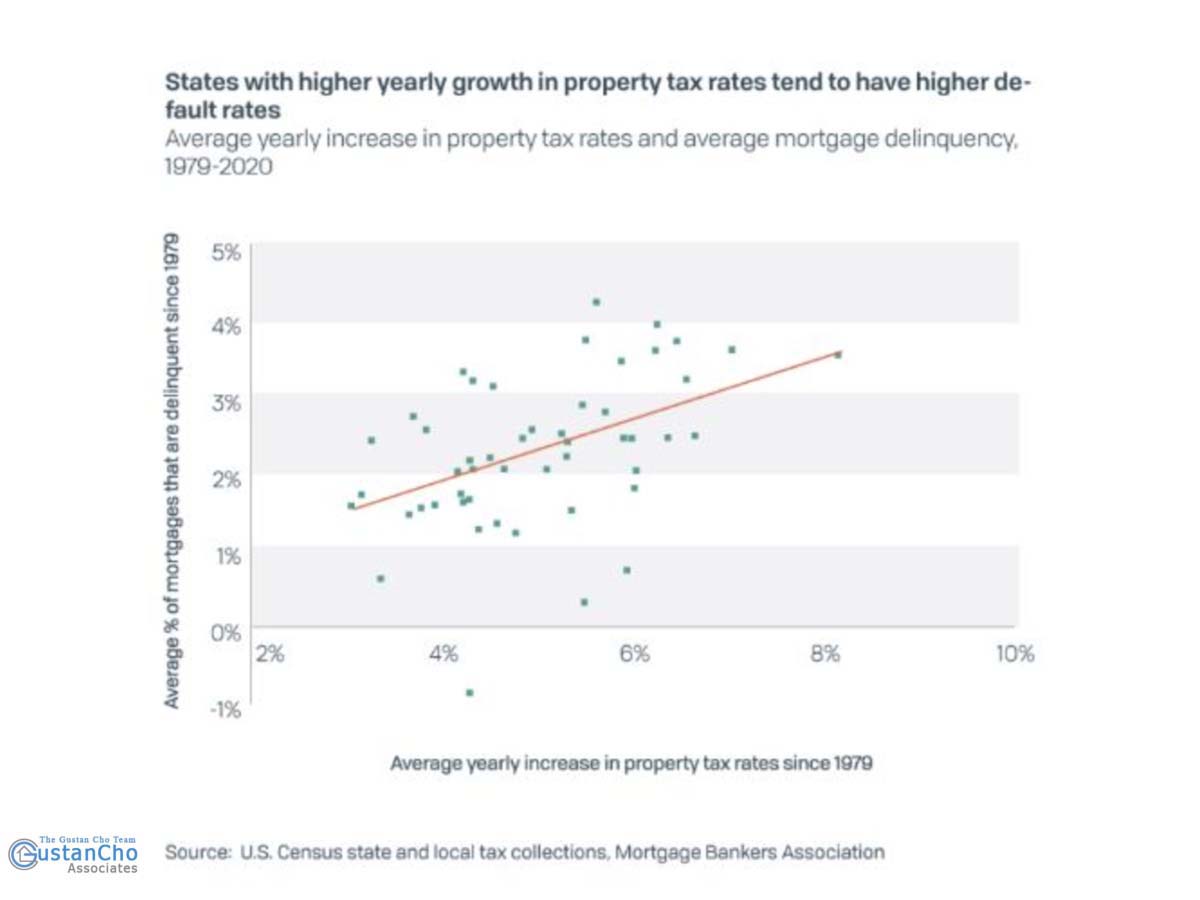

See the graph below:

Businesses Exodus To Other States

Never in history has politics played a major role in business decisions. Many companies have either left or are planning on leaving Illinois to other tax-friendly states. It is not just individual taxpayers who had it with the financial mismanagement by lawmakers, but the number of businesses leaving the state is at a historic pace. This means these companies leaving the state are also taking jobs as well.

See the graph and images below:

Illinois COVID-19 Recession To Skyrocket Illinois Foreclosure Rates

Under the CARES Act, unemployed homeowners are eligible for forbearance.

- Forbearance is not mortgage forgiveness

- Forbearance allows homeowners to skip mortgage payments for a period of time

- The skipped payments need to be paid back

- Lenders will allow borrowers to spread the missed payments after the forbearance period expires

- However, many Illinoisans have lost their jobs permanently due to the extended lockdown by Illinois governor Pritzker

- They may never get another job with equal pay

- Analysts see mortgage delinquency rates to skyrocket in Illinois

- Delinquency on mortgage payments leads to foreclosures, and foreclosures make economic downturns even worse

- One of the things Pritzker and lawmakers can do to avoid an economic collapse and stop skyrocketing foreclosure rates is to offer homeowners property tax relief to Illinoisans

- This would require approval by lawmakers

- However, Illinois lawmakers and politicians are taking a different approach

- For example, Chicago Mayor Lori Lightfoot recently said she plans on increasing Chicago property taxes to cover the city’s $700 million budget shortfall

The average Illinois property homeowner pays annual property tax bills equal to nearly seven months of their mortgage costs.

How To Avoid A Housing Collapse In Illinois

Why are other states thriving and Illinois is drowning in debt? Why does Illinois have one of the highest tax rates in the nation? Why are so many individual taxpayers and businesses leaving Illinois? Why are homes in Illinois depreciating when the housing market is skyrocketing in low-taxed states? Why is Illinois rated as junk bond status while other low-taxed states AAA rated?

Here are the potential solutions for politicians to save the state and avoid a massive housing crisis in Illinois:

- Lower property taxes

- Lower property taxes mean higher home prices

- Lower property taxes means less pressure on sellers, buyers, property owners

- Real estate investors are shying away from investing in Illinois due to high property taxes

- Lower sales taxes and income taxes

- Lower taxes entice families and businesses to locate to Illinois

- Low taxes create new jobs

- Reopen the state as soon as possible

- Elect competent politicians and vote incompetent career politicians out

Pritzker and Democrat lawmakers keep on increasing existing taxes. Not only are they increasing taxes, but they are also creating new taxes. The combination of increasing taxes and not cutting spending is leading Illinois to bankruptcy.

The COVID-19 Pandemic May Trigger Major Housing Meltdown In Illinois

As of February 2020 prior to the coronavirus pandemic, Illinois had the second-highest foreclosure rate in the nation.

- The state has the second-highest property tax rate in the Nation

- New Jersey is the state with the highest property tax rate in the country

- However, Illinois seems like it will surpass New Jersey as the highest property tax state in the Nation in the next 18 to 36 months

- Illinois also has the third-lowest home appreciation rate in the Nation since 2008

- Homes in Illinois are not appreciating due to high property taxes, high city and state taxes, mass out-migration of residents due to high taxes, and more inventory of housing versus demand

- Mortgage delinquencies are expected to skyrocket in Illinois due to Pritzker extending the lockdown

The longer businesses remain close, the higher the chances of never reopening. More and more businesses are going out of business permanently as Pritzker keeps extending the lockdown.

See the graph below:

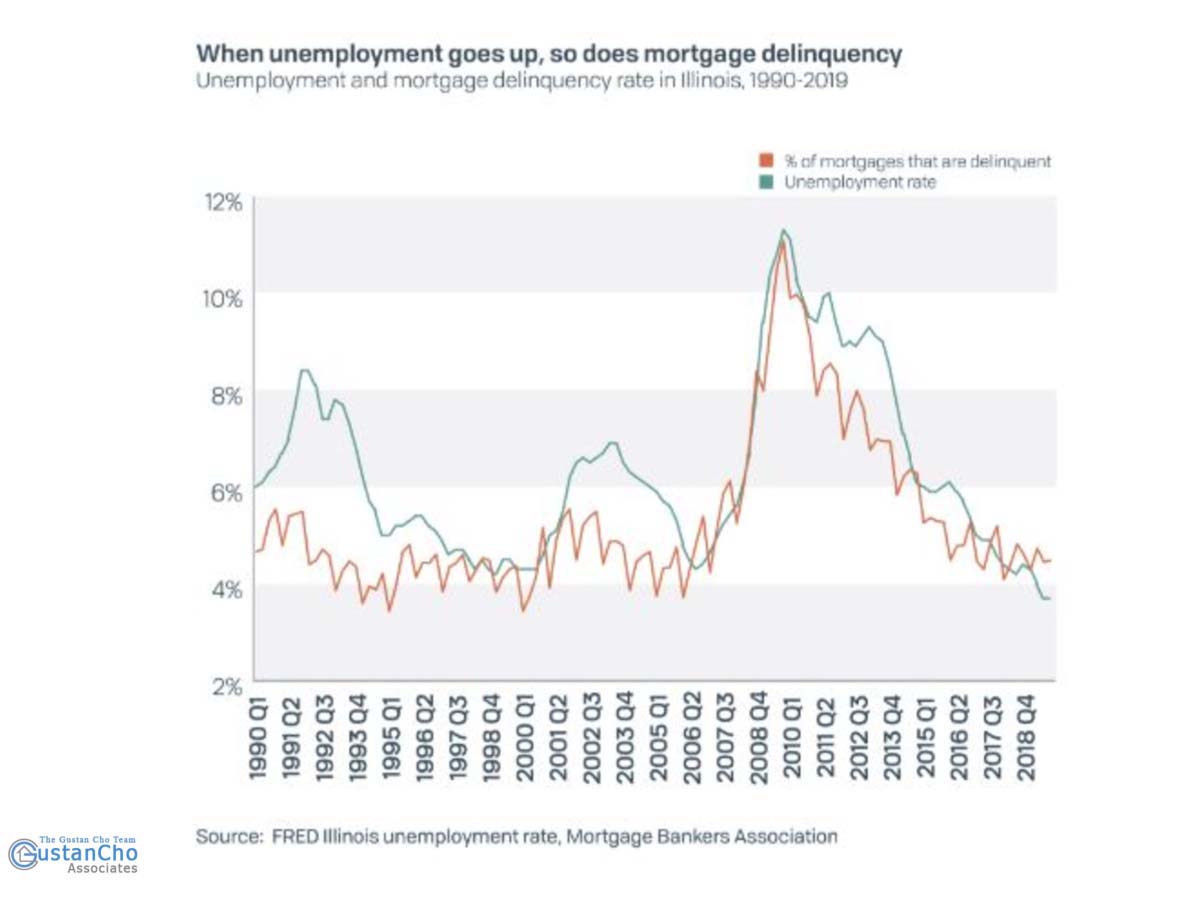

Extended Lockdown Is Bankrupting Businesses And Creating High Unemployment

Illinois ranks as one of the highest unemployment rates during the coronavirus pandemic. Over 1.5 million Illinoisans are unemployed. The state leads as one of the states with the highest unemployment rates. It is no rocket science that unemployed workers fall behind on their mortgage payments. The unemployment numbers and delinquency go hand in hand. The more unemployed, the higher the mortgage delinquency rates which are explained by the chart below. High employment translates into fewer mortgage delinquency rates. More and more homeowners are facing financial problems due to high property taxes. This holds true for elderly homeowners with fixed incomes. Many homeowner’s property taxes are higher than their mortgage payments. As property taxes keep on increasing, many Illinoisans are faced with relocating to other lower-taxed states such as neighboring Indiana or Wisconsin.

See the graph below:

Politicians To Increase Taxes

One of the ways to avoid an economic meltdown due to a national emergency such as the COVID-19 pandemic is to lower taxes. This holds especially true by providing property tax relief for homeowners. Property taxes are hands down a person’s highest expense besides their mortgage. However, lawmakers are not lower property taxes. They keep on increasing property taxes instead of seeking other solutions to fix the state’s financial crisis.

See the graph below:

However, JB Pritzker recently was asked if he would postpone the state’s new progressive tax proposal. Pritzker replied that this is the best time to change the state’s flat tax to a progressive tax system. He calls his new progressive tax proposal the FAIR TAX. Changing the state’s flat tax to a progressive tax system will penalize the middle-class and upper-class wage earners. More than 100,000 businesses are expected to get affected by the new FAIR TAX. Economists expect a mass exodus of individual taxpayers and businesses if Pritzker’s Fair Tax becomes law. Pritzker plans on increasing more taxes as well as property taxes. Chicago Mayor Lori Lightfoot recently announced she will increase property taxes to cover the $700 million budget shortfall facing the city. Chicago is the highest taxed city in the nation. Having the highest tax in the nation still does not solve the financial crisis in the city due to financial mismanagement by incompetent politicians.

Illinois is a great state. It is such a beautiful state. Downtown Chicago is probably the most beautiful downtown in the world. The state is home to Chicago and other great metropolitan cities. Home of top colleges and universities, the city is home to many immigrants and world leaders. However, the state, run by Democrats for decades, is on its last leg financially. The state has always had financial issues due to its broken pension system which is run like a Ponzi Scheme. No matter how much you pump money into the pension system, it is still short. The first step in fixing the state’s financial crisis is to get rid of the incompetent politicians who do not know what they are doing. In any business and/or organization, it is not about how much money you take in but rather how much you spend. However, the governor and lawmakers are increasing revenues by increasing taxes and not cutting spending. No matter how much taxes you increase, it will not solve the broken pension system and the state’s financial crisis. The state is on the road to bankruptcy unless politicians get out of their state of denial mode and get working on pension reform. The state need to cut taxes, especially property taxes to promote people and businesses to move into the state. The state is headed to become a ghost town if the out-migration continues. Many closed businesses is not expected to reopen due to Pritzker’s extended stay at home order.