BREAKING NEWS: Illinois Progressive Income Tax Hike Could Bankrupt Businesses

Illinois Progressive Income Tax Hike proposed by Governor JB Pritzker may end up backfiring.

- The U.S. economy was booming prior to the COVID-19 pandemic

- Most states were thriving and raking in billions of dollars in revenues

- However, Illinois was financially struggling and mounting in pension and other debts due to mismanagement and financial irresponsibility

- JB Pritzker, the new rookie freshman governor elected in 2018, was a brand newcomer to politics

- Many Illinoisans had very high hopes for Pritzker due to him being a billionaire and an heir to the Hyatt Hotel Family

However, all Pritzker has come up with to solving the state’s financial crisis is raising taxes and creating new taxes.

The Dangers Of Increasing Taxes

Raising taxes is a very dangerous thing to do for government.

- Raising taxes may work balancing budget deficits but it needs to be done with reducing spending

- However, Pritzker has no intention in drastically cutting spending

- For example, Pritzker has doubled the state’s gas taxes, increased vehicle sticker fees among increasing dozens of other taxes

- At the same time, Pritzker proposed wage increases for state lawmakers

- Pritzker also approved salary increases to high-level state employees

- No matter how much taxes Pritzker raises, it does not make a dent in the budget deficit due to the broken pension system

- In the meantime, countless Illinois businesses and individual taxpayers are fleeing to other lower-taxed taxes

- Now, JB Pritzker is lobbying in changing the state’s flat tax to a progressive income tax system

- This will backfire on the governor and may be the biggest mistake for Illinois

- Most experts believe an Illinois Progressive Income Tax Hike could be the straw that broke the camel’s back in bankruptcy the state

- Hundreds of Chicago businesses are moving to neighboring Indiana daily due to lower taxes

In this breaking news article, we will discuss and cover Illinois Progressive Income Tax Hike Could Bankrupt Businesses.

Illinois Progressive Income Tax Hike Could Backfire On Pritzker

[

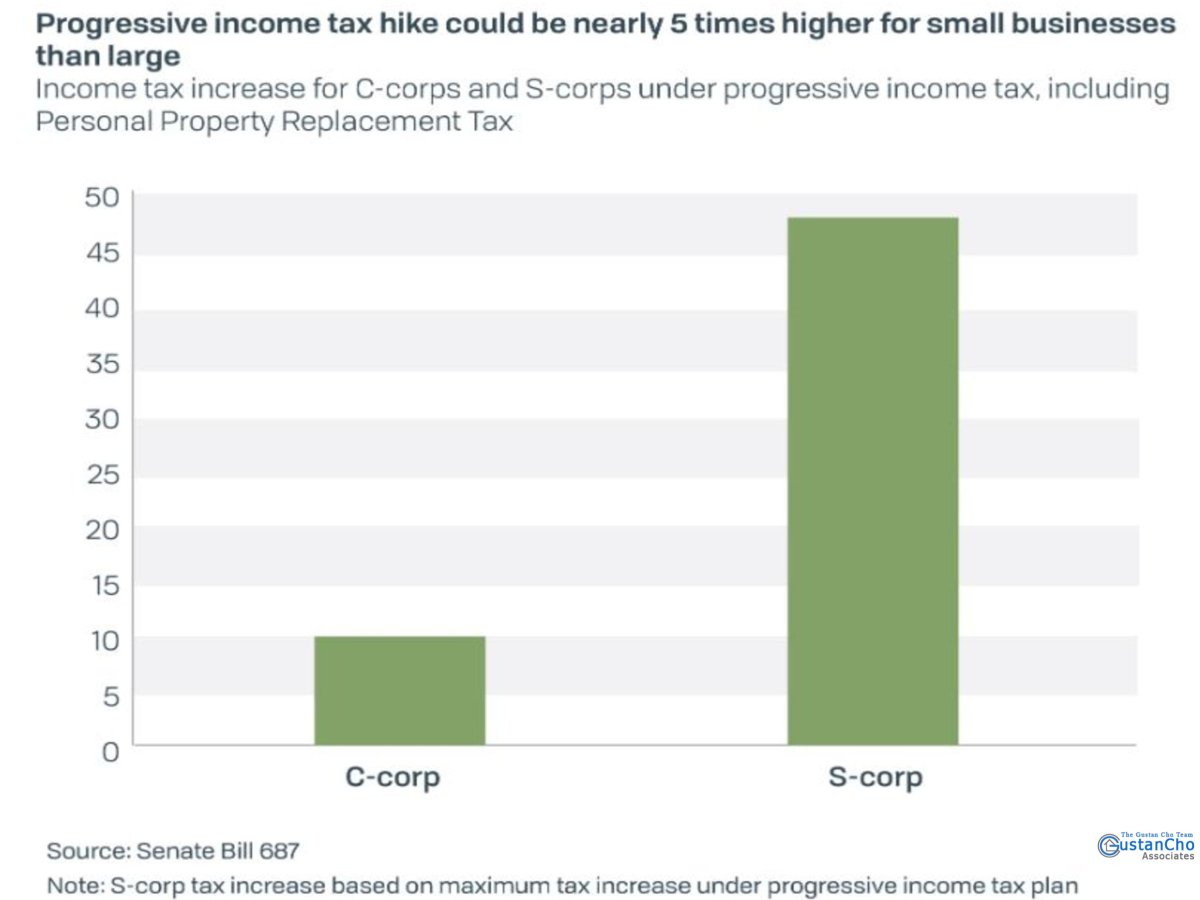

With JB Pritzker’s Illinois Progressive Income Tax Hike, small business owners could face an income tax hike five times larger than corporations in the state.

- Small business owners are in a major financial crisis due to not being at maximum capacity since March due to the pandemic

- Pritzker extended the stay at home order multiple times while other states have reopened

- As time passes and these small businesses do not reopen, the chances of survival greatly reduces

- Many experts and economists told Pritzker that he should delay his Fair Tax proposal until businesses and wealthy wage earners recover from the economic damage due to the pandemic

- On the contrary said Pritzker

- The rookie freshman governor said the progressive tax is needed now more than ever

- Pritzker wants to change the current flat tax to a progressive income tax hike

- This change is expected to take $3.7 billion a year from the Illinois economy

Critics of the progressive tax said by changing the flat tax to a progressive tax system, you will see countless Illinoisans and businesses flee the state. Changing the tax system to a progressive tax is playing with fire and can be the demise of Illinois.

Pritzker Is Lobbying Hard To Get Middle Class Voters To Support His Fair Tax Plan

Pritzker’s progressive tax plan needs voter support in November 3rd, 2020.

- Pritzker’s pitch is lower and middle class wage earners will see their state income tax rate drop while higher level wage earners will pay slightly more

- This is not true and misleading

- Dentists, Doctors, small business owners, professionals, and even civil service workers will all get penalized and pay much more with Pritzker’s progressive income tax

Look at the chart below:

What Experts And Economists Say

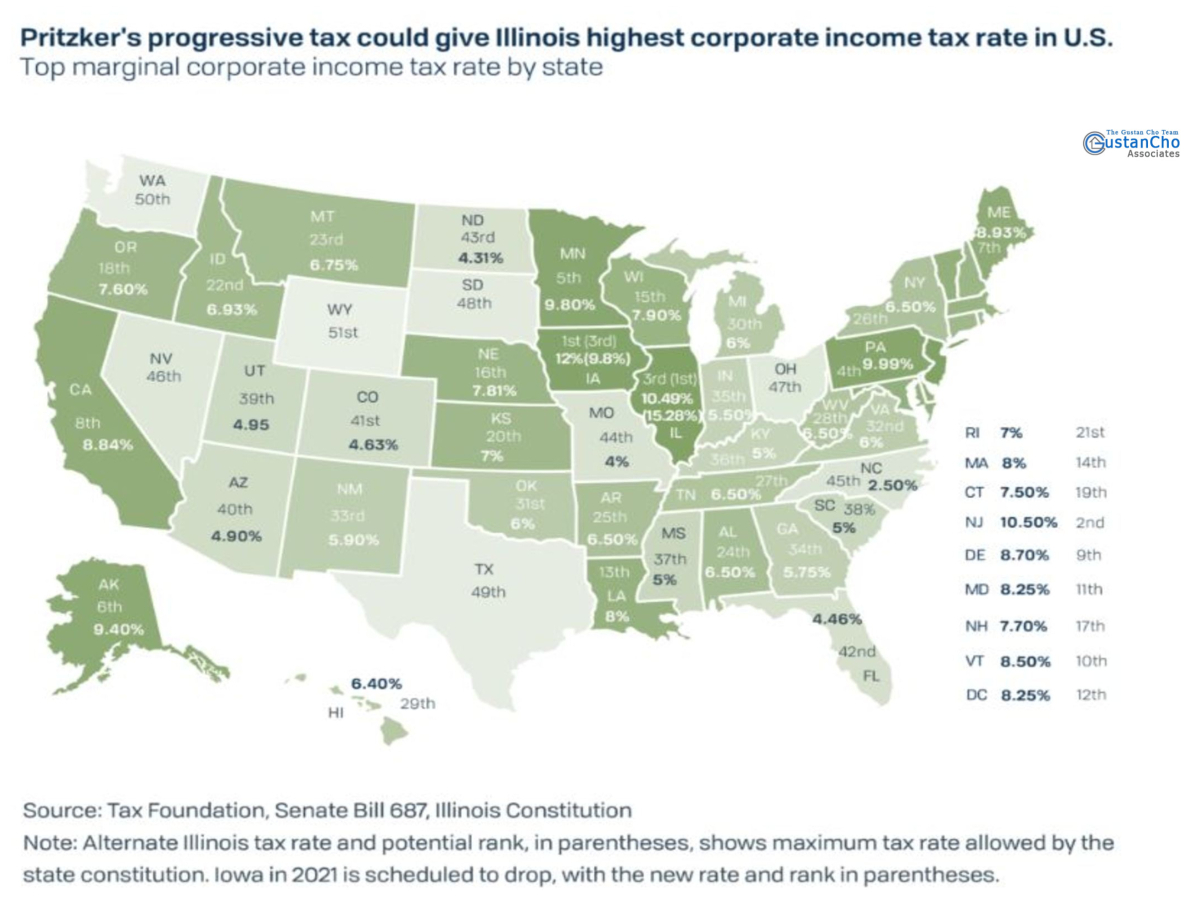

Look at the image below:

Illinois is in dire financial crisis and near collapse. Recently, Pritzker and Democrat state lawmakers requested a nearly $50 billion federal bailout. Senate Majority Leader Mitch O’Connell and President Trump both laughed at Pritzker and told him why the federal government should bail out financially mismanaged and irresponsible states like Illinois. Illinois has a long history of financial mismanagement and irresponsibility. Illinois needs a competent leader who knows and understands finances and how to run a business. It is not how much you make or take in. It is how much you spend. Pritzker seems clueless and lost when it comes to business 101. He wants to bring more revenues by increasing existing taxes and creating new taxes while not cutting spending. Major changes need to be made in Illinois before the state collapses. Pritzker is doing absolutely nothing to attract new businesses and residents to Illinois. He sure is doing a great job in having businesses and individual taxpayers flee the state in droves.