This guide covers refinancing with low(bad) credit scores and bad credit. Homeowners considering refinancing with low credit scores on their home loans must know that credit scores determine mortgage rates. The higher the credit scores, the lower the mortgage rates.

Refinancing with low credit scores can be done. However homeowners thinking about refinancing with low credit scores should carefully examine their options.

They may be waiting to improve and maximize their credit scores before starting the refinancing process. The minimum credit score required to qualify for FHA loans is 580. The minimum credit score required for conventional loans is 620. Homeowners refinancing with low credit scores need to see if they can maximize their credit scores to qualify for the lowest available credit scores.

Understand Your Credit Score

Refinancing with low credit scores can be challenging, but it’s not impossible. Here are some tips to help you navigate the process: Obtain a copy of your credit report before you start the refinancing process. Understand the factors affecting your credit score and address any errors or discrepancies. Take steps to improve your credit score before applying for refinancing. This may include paying off outstanding debts, making timely payments, and reducing credit card balances.

Refinancing With Low Credit Score, Click Here

Shop For Lenders When Refinancing With Low Credit Scores

Lenders have different criteria and may be more lenient or strict regarding credit scores. Shop around to find lenders who specialize in working with borrowers with lower credit scores. Remember that each financial situation is unique, and the success of refinancing with a low credit score can vary. It’s essential to carefully consider your options and consult financial professionals to make informed decisions.

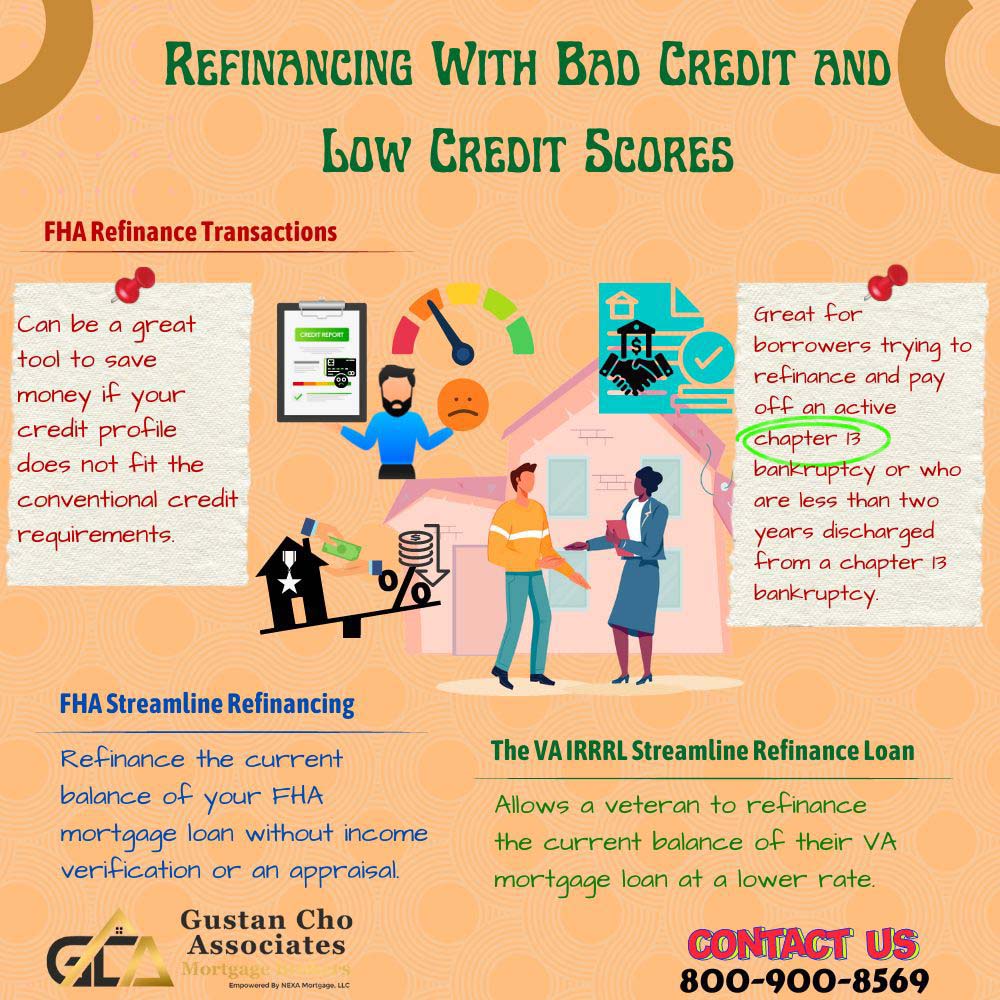

If you’re refinancing a mortgage, consider government-backed loans like FHA (Federal Housing Administration) or VA (Veterans Affairs).

These programs may have more flexible requirements for credit scores. If possible, consider getting a co-signer with a higher credit score. A co-signer agrees to be responsible for the loan if you default, providing additional security for the lender.

Speak With Our Loan Officer for Get Loan With Low Credit Score

Shop For Different Types of Lenders When Refinancing With Low Credit Scores

Subprime lenders specialize in working with borrowers with lower credit scores. However, be cautious with these lenders, as they may charge higher interest rates and fees.

If you’re refinancing a mortgage, offering a higher down payment may make you a more attractive candidate to lenders, potentially offsetting the impact of a lower credit score.

Some lenders may be willing to consider other aspects of your financial situation, such as income stability and employment history. Be prepared to provide additional documentation to support your application. With a lower credit score, you may be offered a higher interest rate. Be realistic about what you can afford and whether the refinancing terms are in your long-term financial interests.

Reasons For Refinancing With Low Credit Scores

There are other reasons why homeowners need refinancing with low credit scores. They may need to take out a co-borrower. Homeowners going through a divorce often need to refinance to take the ex-spouse off the loan. This article will discuss refinancing with low and bad credit scores. The loan originator will review mortgage rates with borrowers with on their current credit scores. They will review mortgage rates and see if credit scores can be improved. Credit scores should be 740 or higher to get the best mortgage rates.

Consult With a Mortgage Consultant

Consulting with a licensed mortgage loan consultant does not cost a homeowner anything. If a mortgage lender asks for an upfront fee to run a credit report, go elsewhere.

If you’re refinancing a mortgage, having more equity in your home can be an advantage. Lenders may be more willing to work with borrowers with lower credit scores if they have substantial equity in their property.

A mortgage loan consultant should not charge anything upfront except for a home appraisal. A licensed mortgage loan originator will take a few minutes to run a credit. A professional loan originator will review the credit report and see if there is room to improve and increase credit scores.

Ways of Improving Credit Scores

There are some quick tips on maximizing credit scores easily and quickly. Just paying down your credit cards can quickly improve your credit scores. This works because if consumers have high credit card balances, the credit reporting agencies will lower their credit scores. Many of my refinance borrowers are asked to pay off their credit card balances. By paying down credit card balances to a 10% or less utilization ratio, they can get a 100-point boost in their credit scores.

How To Improve Credit Scores To Get Lower Mortgage Rates

Another way of improving credit scores is by adding more credit. For homeowners refinancing with low credit scores, they need to see the reason why they have low credit scores. Many homeowners may not have enough credit or no credit.

Some homeowners have closed out their active credit accounts, so they have no active tradelines. Having no credit, little credit, and no active tradelines will hurt consumer credit scores.

Adding new credit, such as opening several secured credit cards, can improve credit scores. Three to five secured credit cards with a $500 credit limit on each secured credit card are strongly recommended.

Errors on Credit Report

Homeowners seeking refinancing with low credit scores should carefully review their credit reports and see if there are any errors. Credit reporting agencies often report errors on consumers’ credit reports, which affect consumer credit scores. One derogatory error on one’s credit report can mean a major drop in credit score. A 30 to 40-point decrease in credit scores can mean a 0.25% difference in mortgage rates. This translates into tens of thousands of dollars worth of mortgage interest expense over the loan term.

Refinancing Costs Money

Homeowners with alternative financing can refinance with low credit scores and may save money. But with higher credit scores, it would have saved you more money. There are closing costs every time homeowners refinance a home loan. Many mortgage companies advertise that there are no closing costs.

There is no such thing. Borrowers may not have to pay any closing costs, but there are closing costs with every refinance mortgage loan.

Homeowners do not understand that the closing costs are built into the rate. When refinancing with low credit scores, weigh options and whether it makes sense to wait a few months to see if you can improve your credit and credit scores. This way, you can get the best available mortgage rates. Do not have to refinance home loans again at a later date after credit improves.