This guide covers companies leaving Chicago to Indiana due to high taxes. Many real estate analysts and experts have predicted that if city, county, and state government kept on increasing taxes in Illinois, businesses and individual taxpayers will be fleeing Illinois. Governor J.B. Pritzker disagreed. Pritzker has told Illinoisans that businesses and residents will not move out of Illinois because the state has too much to offer.

Great universities, great healthcare, transportation, and all the amenities the state has to offer will attract businesses and taxpayers. Illinois has the nation’s second-highest property tax.

New Jersey holds the first position on having the highest property tax in the U.S. Illinois keeps on increasing property taxes with no cap in sight. Experts believe Illinois will surpass New Jersey as the state with the highest property taxes in the nation by mid-2020. In this article, we will discuss how companies leaving Chicago to Indiana due to high taxes. Companies are quitting Chicago and heading to Indiana to dodge expensive taxes and rules. In the following paragraphs, we will cover a a close look at why the flow from Illinois to Indiana keeps speeding up.

Why Companies Leaving Chicago to Indiana

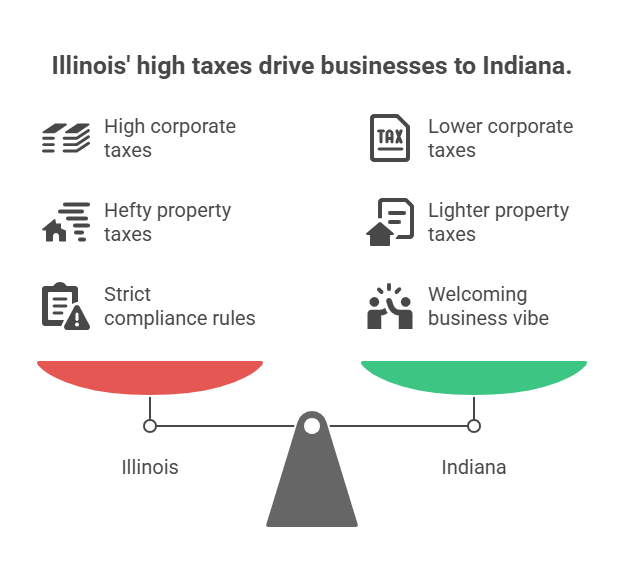

The Chicago business pull-out has sped up lately as firms hunt for a break from Illinois’ sky-high taxes and strict rules. Executives report that the price of operating in the city has shot past the breaking point, thanks to climbing corporate taxes, hefty property tax bills, and endless compliance headaches. On the flip side, Indiana’s cut-rate corporate tax, lighter property taxes, and welcoming business vibe pull them in. The Illinois-to-Indiana shift isn’t confined to one trade. It runs through manufacturing, logistics, tech, and service companies—each eager to cut expenses while keeping a close link to Chicago’s consumer base.

Chicago Businesses Flee High Taxes for Indiana

Explore how companies are saving millions by relocating to Indiana’s low-tax environment and what it means for your bottom line

Companies Leaving Chicago to Indiana: The Impact of High Taxes in Illinois

Illinois ranks among the states with the heaviest overall tax load when you combine what the state and local governments charge. Several Chicago firms are packing up for Indiana, and they repeatedly mention soaring Cook County property taxes, surprise tax hikes, and some of the Midwest’s highest workers’ compensation bills. Over the long run, these burdens chop into profits, discourage fresh investment, and make owners seriously weigh the cost of crossing the state border to stay in the game.

Why Indiana Is Attracting Chicago Businesses

Indiana’s business tax perks are drawing firms across the border. The state’s flat corporate tax is much lower than Illinois’s, and property taxes are much friendlier. Indiana also rolls out migration grants and funding for infrastructure upgrades and keeps regulations slim and clear.

Companies can set up close to the Illinois line and reap the benefits of smaller operating costs, lower prices for commercial space, and a courthouse culture that favors business-friendly law.

Examples of Companies Leaving Chicago to Indiana

The Illinois to Indiana migration scene is broad, including everything from mom-and-pop manufacturers to Fortune 500 headquarters. Logistics firms are drawn by Indiana’s direct interstate access and the chance to ditch Illinois toll fees. Tech firms like the lower overhead, faster incentive timelines, and accessible talent from Midwestern universities. The short drive from Chicago means many employees cross the border to keep the team intact.

The Economic Impact on Both States

When a company moves from Chicago to Indiana, Illinois loses income, payroll, and property tax dollars. At the same time, Indiana gets a ready tax base, new payrolls, and lease income. Small moves by several firms add up. Over the years, this piecemeal shift can lift Indiana’s status to the premier Midwest business address. Illinois must act. Business outflow will continue until tax, compliance, and pension headaches ease.

Future Outlook for Corporate Relocation Trends

If the current path sticks, Indiana will keep fielding Chicago departures for the next ten years. The widening gaps in tax structure, red tape, and living costs tip the scales further.

Owners weighing a shift will focus on bottom-line savings, keeping talent, and long-term predictability—all of which Indiana offers competitively.

Illinois High Taxes Forcing Companies Leaving Chicago.

J.B. Pritzker has not just been raising existing taxes but creating new taxes in the state. The state is broke but the city of Chicago is in worse shape. Countless Companies Leaving Chicago due to high taxes. Pritzker recently doubled the state’s gas tax infuriating taxpayers.

Raising taxes is fine and normally works with a combination of cutting spending. However, this governor does not want to cut spending. He recently approved wage increases to state lawmakers.

The governor is not marketing nor offering incentives to attract new businesses nor residents. Pritzker thinks the state has name recognition and will naturally attract businesses and residents to Illinois. The governor has been proven wrong. Countless taxpayers and companies are fleeing Illinois in droves.

Indiana vs. Chicago: Who Wins?

Get our side-by-side analysis of corporate taxes, incentives, and labor costs.

Companies Leaving Chicago to Indiana: Economy of Chicago

Chicago is the nation’s second-largest city. Chicago is home to many companies and businesses. However, many businesses and taxpayers of the city are fleeing to other lower-taxed cities with lower taxes. Chicago is the highest taxed city in the nation. The city is facing financial collapse and is on the verge of bankruptcy unless politicians fix the financial crisis.

The city imposes its own city tax on just about everything. The city pension debt crisis is out of control. Former Mayor Rahm Emmanuel raises $7 billion in property taxes to balance the city’s pension debt.

However, the pension debt has gotten worse. Newly elected Mayor Lori Lightfoot seems clueless and lost over the city’s financial mess and is asking the state for help. The state has its own problems and does not have any solutions to fix the state’s budget deficits except to keep on raising taxes. Corruption in the city and state is among the nation’s highest. Without a solid budget plan and cutting spending, taxpayers are due for more property and other tax increases. The financial state of Chicago and Illinois are forcing many companies and taxpayers leaving the city of Chicago and Illinois to other tax-friendly states.

Companies Leaving Chicago To Indiana Due To High Taxes

Midland Metal Products is leaving Chicago to Indiana due to the high taxes in Chicago and Illinois. Midland Metal Products has been in Chicago for the past 98 years. The company decided to pull the trigger to make its move to Hammond, Indiana due to the high taxes in Illinois, especially Chicago.

The mayor of Hammond, Indiana, Thomas McDermott, Jr. and city officials are celebrating Midland Metal Products move to their city

The company is scheduled to base its business in the former Lear Building in Lake County City. The mayor, city officials, representatives of the company, and taxpayers will attend the public ceremony and the welcoming event.

Why Indiana Is Thriving and Raking In Billions and Illinois on the Verge of Bankruptcy

Chicago and Illinois politicians need to think about how to attract businesses and taxpayers to Illinois. Just raising taxes without cutting spending will backfire on them. You need to operate and run government like a business. It is not how much money you make but rather what you spend.

There is no reason why any government entity should be broke. It is mismanagement. We need politicians with basic business knowledge to lead and not big-mouths politicians who talk out of their asses.

Both J.B. Pritzker and Lori Lightfoot should reach out to politicians on other states that are raking in billions and growing. Chicago and the state of Illinois are losing businesses and taxpayers in droves. The combination of high and increasing taxes, high property taxes, creating new taxes, corruption, and incompetent politicians is the roadmap for bankruptcy.

Why Smart Companies Are Leaving Chicago for Indiana

Get the inside scoop on high-tax pitfalls in Chicago and how Indiana’s competitive tax climate can boost your growth.

Great post. I was checking constantly this blog and I am impressed! Very useful info specifically the last part 🙂 I care for such info a lot. I was seeking this particular info for a very long time. Thank you and good luck.