This guide covers identity theft process during mortgage application process. Identity theft process is one of the fastest growing crimes in America and every consumer should always make sure that their personal credit information is not accessible to anyone. Anyone can be a victim of identity theft process.

All the thief needs is the following: Name, Social security number, Date of birth. And the thief can have a field day by opening fraudulent credit accounts.

In the following paragraphs, we will cover identity theft process during mortgage application process. Identity theft process is a serious crime in which someone wrongfully obtains and uses another person’s personal data in a way that involves fraud or deception, typically for economic gain. This can happen in various ways and affect victims by damaging their credit status, causing financial losses, and significantly complicating their personal lives.

Types of Identity Theft Process

Financial Identity Theft Process: The most common form, where the thief uses another person’s identity to access financial resources such as credit cards, bank accounts, or loans. Medical Identity Theft Process: The thief uses someone else’s identity to obtain medical services or make fraudulent claims for medical services, which can affect the victim’s medical records and insurance coverage.

Criminal identity theft process occurs when someone gives another person’s name and personal information during an arrest or investigation, which can lead to wrongful charges or criminal records for the victim.

Child Identity Theft Process: Thieves steal the identity of children, who typically don’t use their Social Security numbers, to open accounts or commit fraud, which can go undetected for years. Tax Identity Theft Process: Someone uses another person’s social security number to falsely file tax returns with the Internal Revenue Service or state government to receive a fraudulent tax refund.

Concerned About Theft or Fraud During Your Mortgage Process? Let Us Help You Stay Protected!

Contact us today to understand the steps you can take to prevent theft and keep your home purchase on track.

Common Ways Identity Theft Process Occurs

Phishing: Fraudulent emails or websites that deceive individuals into divulging personal, financial, or security information. Data Breaches: Unauthorized access to corporate or personal data databases. Physical Theft: Stealing wallets, purses, mail, or documents from homes. Social Media Scams: Social media platforms are used to gather personal data that is often shared freely by individuals.

Protecting Yourself from Identity Theft Process

Monitor Your Accounts: Regularly check your bank statements, credit card statements, and credit reports for unauthorized transactions or changes. Use Strong Passwords and Two-Factor Authentication: This adds an extra layer of security to your online accounts. Secure Your Documents: Keep sensitive documents safe and shred any unneeded papers containing personal information. Be Wary of Phishing Scams: Do not click on links or open attachments from unknown sources. Verify the authenticity of any communication claiming to be from your bank or any official source. Freeze Your Credit: This prevents creditors from accessing your credit report entirely, which stops new credit accounts from being opened in your name.

If You Are a Victim of Identity Theft Process

Alert Your Financial Institutions: Contact your bank, credit card companies, and credit bureaus to report the theft and discuss the next steps, like locking or closing affected accounts. File a Report with the Federal Trade Commission (FTC): You can do this online at the FTC’s identity theft process reporting website, IdentityTheft.gov. File a Police Report: This can help legally establish that you have been a victim of identity theft process. Notify the Social Security Administration If your Social Security number has been compromised. Change Passwords: Immediately change all passwords linked to financial and personal accounts. Taking these steps can help mitigate the damage caused by identity theft processs and protect your identity in the future.

Damage and Outcome of Identity Theft Process

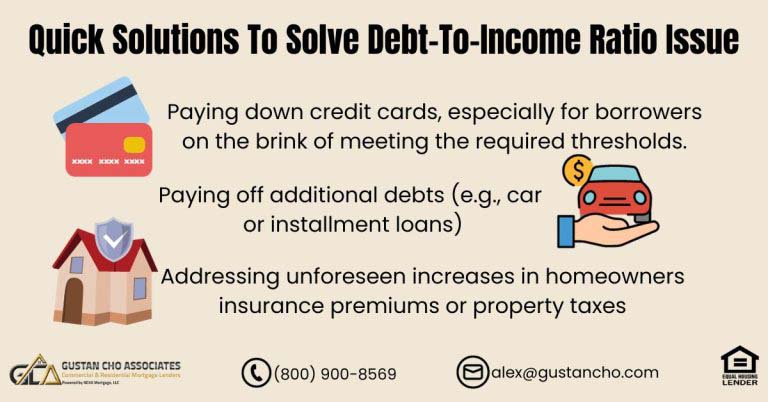

Victims of identity theft process often get the erroneous items corrected but comes with a price. The outcome on the victim can be devastating and can plummet the victim’s credit scores. Worse yet, if the identity theft process victim is in the process of purchasing a home, it will delay the victim’s mortgage application process for weeks and beyond

It is almost impossible for a borrower to get the loan approval if they are a victim of identity theft process until the credit report has been sorted out and resolved.

Mortgage underwriters do not know what is fraudulent and what is legitimate. On another note, the true credit scores of the identity theft process victim cannot be determined due to the drop in credit scores from the perpetrators’ fraudulent use of the victim’s credit.

Discovering Being Victim of Identity Theft

Victims of identity theft process do not find out that they have been victimized until weeks or months after they have been the target of the thief. Many do not find out until they apply for credit. The creditor tell them that they have not been paying their bills or that their credit scores are super low. The first thing you need to do if you are a victim of identity theft is to contact the local police department and file a police report. Make sure to make multiple copies of a police report. Keep the original in a safe place because police report will be the ticket in solving identity issues. It may take days, weeks or months

Many victims of identity can have credit issues pop up years later. The only proof that victims have been victimized will be the police report. Victims need to get a copy of credit report from the three credit reporting agencies and review their credit.

All of the fraudulent credit items need to be noted and need to write a letter to each of the three credit reporting agencies along with a copy of credit report and tell them of being a victim of theft. Victims also need to demand to the credit bureaus to immediately remove all the credit items that do not belong to the victim including the late payments. I would also strongly recommend requesting the three credit bureaus to place a fraud alert on credit reports which notify creditors to verify the credit applicant’s identification prior to extending new credit.

Worried About Fraud During the Mortgage Process? We’re Here to Help You Protect Your Loan!

Mortgage fraud can delay your closing, but we’ll help you spot and prevent issues early. Reach out today to ensure your mortgage process stays secure.

How To Avoid Being a Victim of Identity Theft: Safeguard Personal Information

To avoid being a victim of identity, consumers need to safeguard personal information containing their name, social security number, date of birth, and address. Never give out personal information out unless it is absolutely necessary such as applying for an automobile loan or mortgage loan application. Beware of ridiculous internet offers from the internet where they offer instant credit and need to provide credit information. Unless it is a lender, never provide anyone copies of your tax returns, W-2s, bank statements, copies of credit reports or paycheck stubs. Never throw out paperwork containing personal financial information unless being shredded. Identity thieves usually go dumpster diving: Going through garbage looking for paperwork containing people’s financial papers.

Identity Victim: Important Contact Information

Those who have been a victim need to file a complaint with the Federal Trade Commission after you get a police report from your local police department or Sheriff’s department. If you live in a rural area, contact your local state police district. Here is the Federal Trade Commission contact information: Toll-free phone at 1-877-438-4338

Identity Theft Clearinghouse

Federal Trade Commission

600 Pennsylvania Avenue, N.W.

Washington D.C. 20580

Credit Reporting Agencies: Experian, Equifax, Transunion

Also, contact the three credit reporting agencies and request that fraud alerts be placed on your credit profile. A fraud alert will alert the creditor you are applying for credit to contact you prior to granting credit.

- Experian, PO Box 1017, Allen, TX 75013; 1888-397-3742

- Equifax, P.O. Box 740250, Atlanta, GA 30374; 1-800-525-6285

- TransUnion, P.O. Box 6790, Fullerton, CA 92634; 1-800-680-7289

Mail the three credit reporting agencies copies of your police reports and copies of your credit report containing the fraudulent credit items. Circle the items that do not belong to you and demand to have them removed.

Identity Theft Process During The Mortgage Application Process

Identity theft process during the mortgage application process is a serious concern, as it involves potentially misusing highly sensitive personal information that could have long-term financial repercussions. Here’s how to recognize, prevent, and handle identity theft process during this crucial time:

Recognizing Potential Identity Theft Process

Unexplained Credit Inquiries: If you notice unauthorized or unexplained inquiries on your credit report, it might indicate that someone is attempting to use your identity to secure a loan. Unfamiliar Accounts: Discovering mortgage or loan accounts that you should have opened listed on your credit report. Inconsistencies in Personal Information: Receiving mortgage documents or communications with incorrect personal information, like a wrong address, can be a red flag. Alerts from Financial Institutions: Banks or financial service providers might notify you of suspicious activities, such as attempts to access your accounts or set up new ones.

Preventing Identity Theft During Mortgage Applications

Secure Your Personal Information: Only provide your personal information to trusted, verified entities through secure channels. Avoid sharing sensitive information over the phone or online unless you initiated the contact and know the recipient’s identity. Monitor Your Credit: For unauthorized activities, check your credit reports from all three major credit bureaus (Equifax, TransUnion, and Experian). You can get a free report once a year from each bureau at AnnualCreditReport.com. Use Strong, Unique Passwords: Use strong and unique passwords for all financial accounts, especially those related to the mortgage process. Consider using a password manager to keep track of them. Enable Alerts: Set up alerts with your financial institutions to notify you of any transactions or changes to your account settings.

Don’t Let Fraud Impact Your Mortgage! Let Us Help You Navigate the Theft Process!

Mortgage fraud can be overwhelming, but you don’t have to face it alone. Contact us now for guidance on how to handle theft and protect your loan.

Steps to Take if You Suspect Identity Theft

Contact the Lender: Immediately inform your mortgage lender or broker if you suspect your personal information has been compromised during the application process. Place a Fraud Alert: Contact one of the three major credit bureaus to request a fraud alert on your credit reports. This alert warns creditors that you may be a victim of identity theft and that they should take extra steps to verify your identity. Freeze Your Credit: Consider placing a credit freeze on your reports, which prevents creditors from accessing your credit report entirely. This makes it more difficult for identity thieves to open new accounts in your name. File a Report with the FTC: Report the identity theft to the Federal Trade Commission at IdentityTheft.gov. You’ll receive a personalized recovery plan. File a Police Report: A police report can help establish a legal record of the theft, which can be useful in disputing fraudulent transactions or accounts.

Long-term Measures

Follow Up: Keep detailed records of your communications regarding the theft, and monitor your credit and accounts long-term. Identity theft can have lingering effects that take time to surface. Educate Yourself: Stay informed about the latest identity theft tactics and protective measures. Regular updates can help you stay a step ahead of potential thieves. Protecting yourself from identity theft during the mortgage application process requires vigilance and proactive management of your personal and financial information. Taking these steps helps secure your current mortgage transaction and safeguards your overall financial health.

Identity Theft During The Mortgage Process FAQs:

- What is identity theft, and why is it a concern during mortgage applications? Identity theft involves someone illegally obtaining and using your personal information, often for economic gain. During mortgage applications, this can result in fraudulent loans, unauthorized accounts, and a significant impact on your credit and personal finances.

- What types of identity theft processes are most common? Financial identity theft involves accessing someone else’s credit cards, bank accounts, or loans. Medical identity theft occurs when someone receives medical services using another person’s identity. In cases of criminal identity theft, an individual might provide another person’s information during arrests or investigations. Child identity theft entails using a child’s social security number to open accounts. Lastly, tax identity theft happens when someone files false tax returns to obtain fraudulent refunds.

- How does identity theft occur in the mortgage process? Thieves can use your stolen personal information to apply for loans or open accounts in your name. They may also misrepresent your financial situation or creditworthiness, potentially damaging your ability to secure a legitimate mortgage.

- What are the signs of potential identity theft during mortgage applications? It’s important to take action if you notice unauthorized credit inquiries or unfamiliar accounts on your credit report, receive mortgage-related documents with incorrect personal information, or receive alerts from financial institutions regarding suspicious activities.

- How can I prevent identity theft during a mortgage application? It’s important to only share personal information through secure channels with trusted entities. Additionally, regularly checking credit reports for unauthorized activities, using strong and unique passwords, and being wary of phishing emails and fake websites can all help boost security.

- What should I do if I suspect identity theft? If you suspect unauthorized use of your personal information, act quickly. Inform your mortgage lender, request a fraud alert from a credit bureau, and consider freezing your credit reports. Report the incident to the FTC at IdentityTheft.gov and file a police report to document the theft officially.

- What long-term measures should I take after an identity theft incident? Ensure that detailed records of all communications related to theft are kept. It’s also important to regularly monitor your credit reports and accounts to check for any lingering effects. Additionally, staying updated on the latest identity theft tactics and prevention measures is crucial.

- How can I safeguard personal information to prevent identity theft? Ensure to shred documents with sensitive information before their disposal. It’s important to keep personal data private, and always verify the recipient’s identity. Additionally, requesting fraud alerts on your credit reports can notify creditors of possible identity theft, providing extra protection.

- How do I contact the credit reporting agencies or the FTC for assistance? Experian is at PO Box 1017, Allen, TX 75013, 1-888-397-3742. Equifax can be reached at PO Box 740250, Atlanta, GA 30374, 1-800-525-6285. TransUnion’s address is PO Box 6790, Fullerton, CA 92634, 1-800-680-7289. For the FTC Identity Theft Clearinghouse, you can call toll-free at 1-877-438-4338.

- What impact does identity theft have on the mortgage application process? It can significantly delay or prevent loan approval until the fraudulent items are corrected. Mortgage underwriters may struggle to identify legitimate transactions, and credit scores may be inaccurately low due to the perpetrator’s actions.

Experiencing Theft or Fraud During Your Mortgage Process? We Can Help You Recover!

If theft has impacted your mortgage, we’re here to guide you through the recovery process. Reach out today to ensure you get back on track.