This guide covers buying home with real estate purchase land contracts or seller financing. Real estate purchase land contracts is where the home buyer agrees to purchase the home from the seller. Real estate purchase land contracts is buying a home without financing from a mortgage lender. The agreement is made between the home buyer and seller with real estate purchase land contracts. Real estate purchase land contracts is often referred to as contracts for deed.

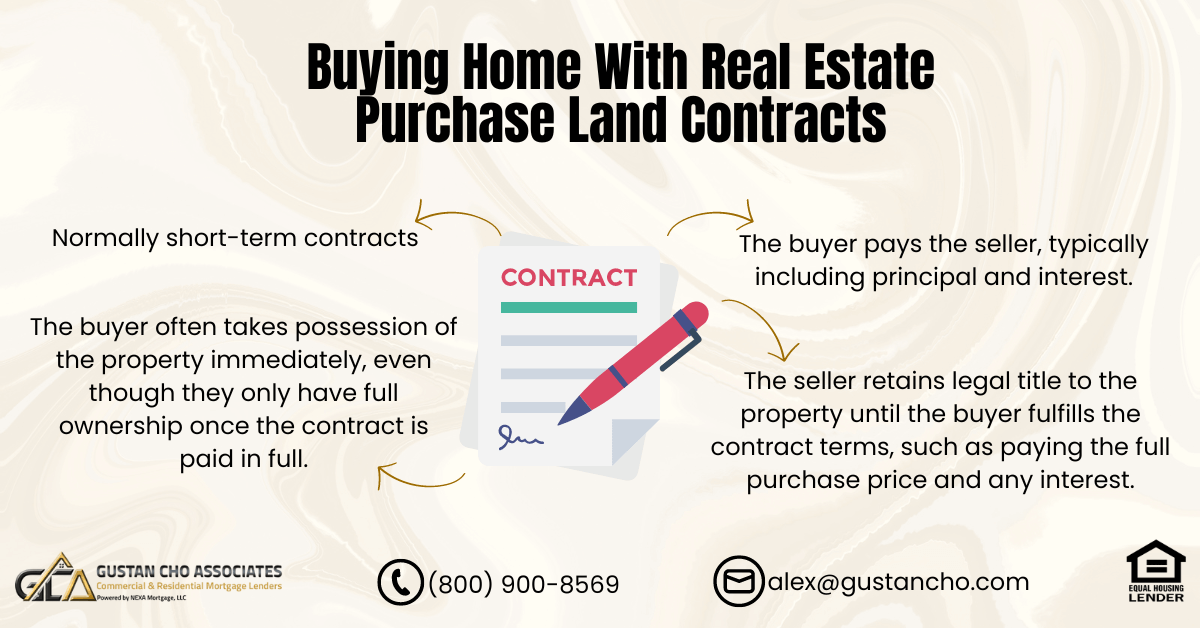

Terms of the land contract such as interest rates, terms, deposit, escrows, are made between the home buyer and seller. The seller acts as the bank. Land contracts are normally short term contracts.

Real estate purchase land contracts can offer many benefits for both the home buyer and sellers. The home buyer may not quite qualify for a traditional home loan from a mortgage lender. This may be due to not being able to prove income or due to the fact that he or she might have had a recent bankruptcy or foreclosure. In this article, we will discuss and cover buying home with real estate purchase land contracts.

Waiting Period After Bankruptcy and Housing Event

Until recently, there were no loan programs without waiting period requirements after foreclosure and bankruptcy. Gustan Cho Associates offers NON-QM loans. NON-QM loans have no waiting period after housing events and bankruptcy. Prior to the launch on non-QM mortgages, homebuyers had to meet minimum waiting period requirements after foreclosure or bankruptcy on government and conventional loans.

Waiting Period After Bankruptcy or a Housing Event on Government and Conventional Loans

There are mandatory waiting periods after a bankruptcy or foreclosure to qualify for government and conventional loans. There is a mandatory two year waiting after the date of Chapter 7 bankruptcy discharge to qualify for FHA, VA, USDA loans. There is a four-year waiting period after Chapter 7 bankruptcy discharged date for a home buyer to qualify for conventional loans. There is a seven-year waiting period for a home buyer to qualify for a conventional loan after a regular foreclosure.

There is a three year waiting period after a foreclosure, deed-in-lieu of foreclosure, or short sale for a buyer to qualify for an FHA and USDA loans. Waiting periods for conventional loans after a bankruptcy or foreclosure is much longer.

A home buyer can qualify to purchase a home via a conventional loan after four years of a deed-in-lieu of foreclosure or short sale with 5% down payment. There is a two-year waiting period to qualify for VA loans after foreclosure, deed in lieu of foreclosure, short sale. Again, there is no waiting period to qualify for NON-QM loans after a housing event or bankruptcy. If the buyer fails to make payments as per the contract, the seller may have the right to terminate the contract and potentially repossess the property, depending on the terms of the agreement.

Speak With Our Loan Officer for Getting Mortgage Loans

Terms of Real Estate Purchase Land Contracts

It’s essential to understand that land contracts vary widely in terms and conditions. Buyers and sellers should carefully review and negotiate the contract terms, including interest rates, payment schedules, and default provisions. Additionally, it’s advisable to consult with legal and financial professionals to ensure the contract is fair and compliant with local laws.

The buyer pays the seller, typically including principal and interest. These payments continue until the contract term is completed.

Buyers should also be aware that because they only have legal title once the contract is paid off, they may only be able to use the property as collateral for other loans or easily transfer ownership once the contract is fulfilled. Before entering a land contract, it’s crucial to do thorough research, seek legal advice, and consider whether this arrangement aligns with your financial goals and circumstances.

Advantages of Real Estate Purchase Land Contracts

The advantage for sellers in offering real estate purchase land contracts is that they can normally get a higher sales price for their home. Sellers can just charge interest only until the home buyer can qualify for traditional financing. Since home buyers on real estate purchase land contracts have limited financing sources, home sellers can normally get the full amount of the asking price of their home.

Unlike a traditional mortgage, the buyer often takes possession of the property immediately, even though they only have full ownership once the contract is paid in full.

Sellers who have homes in dire need of repair can have real estate purchase land contracts home buyer do the repairs. Homes in dire need of repairs are difficult to get financing. So no home buyer with a traditional mortgage loan approval will not qualify for the subject property financing. The buyer and seller enter into a contract outlining the sale terms and conditions. This contract includes the purchase price, the down payment (if any), the interest rate (if applicable), the payment schedule, and the contract duration.

What Are Real Estate Purchase Land Contracts?

Buying a home through a real estate purchase land contract, also known as a land contract or a contract for deed, is a unique way of purchasing property. In a real estate purchase land contract, the buyer agrees to pay the seller over a specified period, typically several years, in exchange for the right to possess and use the property. Here’s how it generally works:

Real estate purchase land contracts are often referred as contracts for deed. Real estate purchase land contracts are security agreements between a home seller and a home buyer.

The seller can have an existing lien on his or her home. Or have the property free and clear of any mortgages. Once the home buyer can secure traditional financing or have the cash to pay the sales agreement of the land contract, the seller then pays off any liens that the seller may have on the property and the balance in equity goes to the home seller.

Click here to qualify for real estate purchase

All-Inclusive Land Contracts Also Known As Wrap Around Land Contracts

If the seller has an existing mortgage from a lender and offers the home buyer a real estate purchase land contracts, it is also known as wrap-around sale land contract. The home buyer of the land contract makes one payment to the home seller. The seller accepts full payment. Upon receipt of payment, the seller makes the payment to the seller’s mortgage company for the lien of the property and may keep the overage. If the payment agreement is less the existing mortgage payment to the seller’s lender, then the seller needs to cough up the difference and pay the mortgage company.

Pros and Cons of Real Estate Purchase Land Contracts

Real estate land contracts can be a win-win situation for both home buyers and home sellers if structured the right way and if both parties honor their ends of the bargain. For home buyers who had just had a bankruptcy, foreclosure, deed-in-lieu of foreclosure, or short sale, real estate purchase land contracts gives the home buyer the opportunity to become homeowners again.

The seller retains legal title to the property until the buyer fulfills the contract terms, such as paying the full purchase price and any interest. Once the contract is paid in full, the seller transfers the title to the buyer.

Home buyers can become homeowners again without going through the mandatory two or three year waiting periods mandated to qualify for government and conventional loans. Home buyers can qualify for NON-QM loans with no waiting period after housing event or bankruptcy. However, a 10% to 20% down payment is required.

Real Estate Purchase Land Contracts Are Used as Temporary Bridge Loans

For those homebuyers who have really bad credit and who cannot qualify due to recent late payments, charge offs, tax liens, judgments, or other recent derogatory credit, it gives the opportunity for the home buyer to have some time to re-establish their credit so they can qualify for a residential mortgage loan.

For those who just opened up a business or those self-employed individuals who took major write-offs and cannot qualify for income, it gives them the opportunity to declare income and establish their income and financial profile.

For sellers, offering a real estate purchase land contract will normally give them the opportunity to sell their home for a higher sales price. If the home has major repairs to be done and does not qualify for residential financing, the new land contract home buyer can do the major repairs until it is financeable.

Structuring Real Estate Purchase Land Contracts

Most land contract home sellers will require a down payment from the real estate land contract buyer. The larger the down payment, the less risk the sellers have. Typically, a 5% to 10% down payment is required by most real estate purchase land contracts sellers. In many land contracts, the buyer is responsible for property maintenance and property taxes while they have the property. In some cases, the land contract may be recorded with the local government to protect the buyer’s interest and establish a public record of the agreement.

It is strongly recommended that both parties are represented by real estate attorneys. This is so both parties interests are protected.

The home buyer needs to make sure that there are a clean title and no liens attached to the property. An appraisal is strongly recommended even though the seller will not require it since the seller is not a mortgage lender. Real estate purchase land contracts is when the seller agrees to sell their home via owner financing to the home buyer. The seller holds legal title. The home buyer receives equitable title.

Qualify For Mortgage Loans, Click Here

Home Inspection Versus Home Appraisal

A home inspection should be done as well to make sure that there are no major defects with the subject property. The attorney should make sure that there are no potential risks involved such as the seller not making their mortgage payments on an existing first lien on the property.

Part or all of the down payment should be escrowed until the home buyer refinances out of the land contract with a traditional mortgage loan. Every state has different laws and regulations governing real estate land contract.

Make sure when entering into a real estate purchase land contract to make all payments with checks. When it comes to refinancing to an end mortgage, lenders want to see canceled checks or bank statements. Verification of mortgage or rent can be sourced and documented by providing 12 months of canceled checks or bank statements. Paying by checks also includes homeowner’s insurance payments, utilities, and any other payments associated with housing expenses.

Retaining Attorneys on Land Contracts

For home sellers, make sure to retain a real estate attorney as well. Every homebuyer has good intent on making their monthly payments but makes sure real estate attorney has an exit strategy in the event if the land contract home buyer defaults in their payments or are no longer interested in purchasing or paying off the land contract. Depending on the state, foreclosure and eviction laws can be extremely costly and time-consuming.

The seller who is also the lender of the land contract, should do their own underwriting by asking them for their credit report, income documentation, and most importantly, make sure they are able to afford the payment agreement.

Make sure to fully understand and know their exit strategy. If structured the right way with the right home buyer, selling a home via land contract can be a win-win situation for both parties. With any other private party sales contracts, there are risks associated with both parties when entering into a real estate purchase land contract. Contact here for get quote about real estate purchase