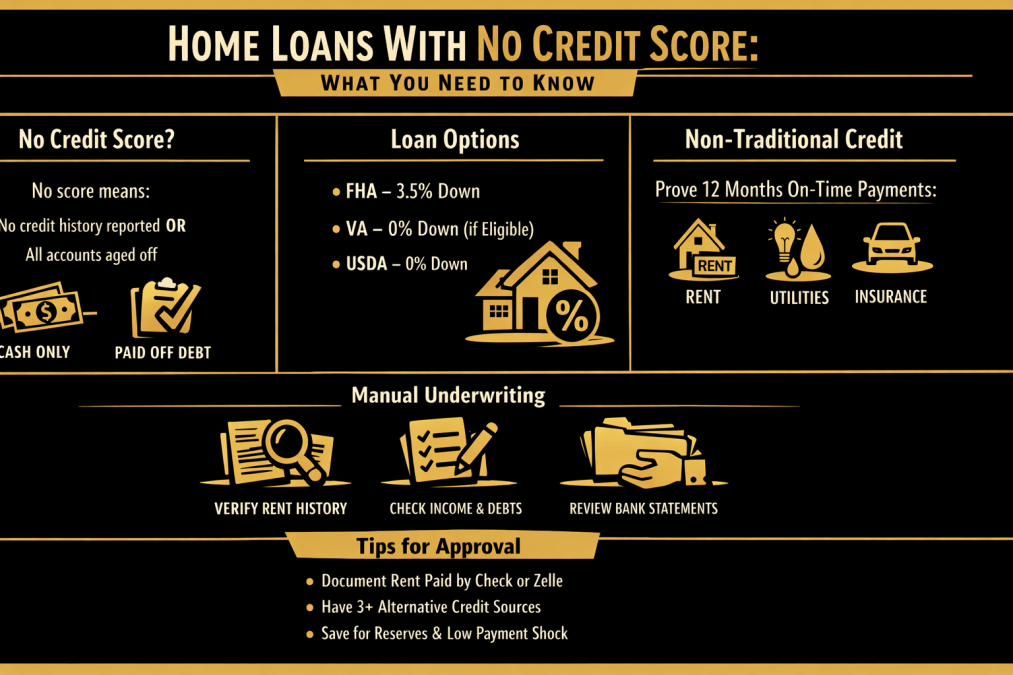

If you’re trying to buy home loans with no credit score, you’re not alone. First-time buyers, cash-only savers, new immigrants, and people who paid off all their debt often have no score—and that can confuse automated mortgage systems.

Here’s the good news: you can still qualify for a mortgage with no credit score, as long as you choose the right loan program and document a strong payment history using non-traditional credit (like rent, utilities, and insurance). In many cases, the loan is reviewed through manual underwriting, where a real underwriter evaluates your full financial picture—not just a three-bureau score.

In this guide, you’ll learn:

- Which loan programs work best with no credit score

- How manual underwriting works (and what underwriters look for)

- What counts as non-traditional credit, and how to document it

- A simple checklist to get approved without scrambling for paperwork

- An optional 60–90 day plan to build a score (if you want better pricing)

Fast help: If you’re not sure whether you’re “no score” or “low score,” we can review your scenario and map the fastest path to approval.

What “No Credit Score” Really Means (Not the Same as Bad Credit)

No credit score means the credit bureaus (Experian, Equifax, TransUnion) don’t have enough recent, reportable account history to generate a score. This commonly happens when you:

- Pay bills with cash or debit only

- Have no open credit cards or loans

- Haven’t used credit in years (accounts aged off)

- Are new to the U.S. credit system

Bad credit means you do have a score, but it’s lower due to late payments, collections, high balances, or other negative items.

These two situations are evaluated differently. With no score, lenders focus on what you’ve done recently—especially your rent history, on-time bill payments, savings patterns, and job stability.

Can You Get Home Loans With No Credit Score?

Yes. Many buyers qualify for a mortgage with no credit score by using:

- FHA loans (most flexible for no-score borrowers)

- VA loans (if eligible; manual underwriting can work well)

- USDA loans (for eligible rural areas; also accepts non-traditional credit)

Conventional loans (Fannie Mae/Freddie Mac) typically require at least one credit score. They are much harder to approve with a true “no score” profile.

What You Typically Need to Qualify with no Score:

- 12 months of verified rent (best if paid by check/ACH/Zelle)

- 3+ non-traditional tradelines with 12 months of on-time payments

- (utilities, insurance, phone/internet, childcare/tuition, etc.)

- A stable income history and manageable monthly debts

- Extra “strength” like reserves, low payment shock, and clean bank statements

If you can document those, a no-credit-score mortgage becomes a checklist, not a mystery.

Explore FHA and VA options for thin credit

Flexible programs that consider more than just a three-bureau score

Which Loan Programs Work Best?

FHA: Most Flexible for No-Score Borrowers

The FHA is the most flexible option for borrowers without a credit score, allowing for manual assessment in these cases. Typically, they look for a debt-to-income (DTI) ratio around 31% for your housing costs and 43% for total monthly debts. However, they may approve higher ratios—up to 37% for housing and 47% for overall debt—if your financial situation shows strong positives. When it comes to collections, FHA usually doesn’t require borrowers to pay them off to get the loan approved.

However, if you have large non-medical collections, they might add a monthly payment assumption to see if your budget can handle it. This makes FHA loans a great choice for those without a traditional credit history, as it allows for non-traditional credit options.

VA: Outstanding If You Have VA Eligibility

If you can get a VA loan, it’s a solid option for you. VA loans are pretty flexible, especially if you don’t have a credit score. The folks who handle these loans look closely at how much money you have left after covering all your monthly bills. If you qualify, a VA loan could be the best way to snag a home, and you might not even need a down payment!

USDA: For Rural/Eligible Areas

The USDA program is ideal for individuals seeking to purchase a home in designated rural areas. It lets you get a loan even if you don’t have traditional credit by using other forms of credit history. To qualify, the property must be located in an area that the USDA considers eligible, and your income must meet specific limits. This is an excellent option for individuals with no credit history looking to purchase a home in a desirable location where they can live happily.

Conventional (Fannie Mae/Freddie Mac)

Conventional loans, such as those from Fannie Mae and Freddie Mac, typically require a minimum credit score. It’s pretty rare to get approved for these loans without a score, and if you do, there will be a lot more conditions to meet. If you can work on building your credit score in about 60 to 90 days, you might get better rates on a conventional loan later on. However, for most people today seeking home loans with no credit score, options such as FHA, VA, or USDA loans are likely a better choice.

Minimum Down Payment With No Credit Score (FHA, VA, USDA)

You don’t need a credit score to know your down payment options—but the loan program matters.

- FHA: Often 3.5% down if you meet FHA eligibility and your manual-underwrite file is strong (rent history + non-traditional credit + stable income).

- VA (if eligible): Often 0% down. Manual underwriting can still work without a score if the rest of the file supports repayment ability.

- USDA (eligible rural areas + income limits): Often 0% down, using non-traditional credit when needed.

Important: Down payment is only one piece. With no score, underwriters place extra weight on 12-month rent history (VOR), non-traditional tradelines, and bank statement patterns.

Can I Buy a House With No Credit Score If I Have Income?

Yes—income is the starting point, not the whole story.

When you have steady, documentable income but no credit score, the lender focuses on whether you’ve shown consistent responsibility in other ways, such as:

- 12 months of on-time rent (strongest proof)

- 3+ non-traditional tradelines paid on time for 12 months (utilities/insurance/phone, etc.)

- Clean bank statements showing stable deposits, reasonable spending, and savings/reserves

- A manageable monthly debt load (DTI) and low payment shock

If you can document those, a no-score mortgage becomes very doable—especially with FHA, VA, or USDA.

No Credit vs Thin Credit vs “Insufficient Credit” (What Lenders Mean)

These terms sound similar, but they’re not the same—and the wording matters.

- No credit score / No score: The bureaus can’t generate a score because there isn’t enough recent, reportable credit activity.

- Thin credit: You do have some credit history, but it’s limited (for example, one small account or very new accounts).

- Insufficient credit: A common lender/AUS phrase that usually means the file doesn’t meet automated scoring requirements—so the loan may need manual underwriting and non-traditional credit.

Why this matters: Someone with a thin file might still get automated approval. In contrast, someone with no score usually triggers a manual review. Either way, the solution is often the same: strong rent history + strong non-traditional credit + clean bank proof.

How Long Does Manual Underwriting Take?

Manual underwriting can take longer than a standard “computer-approved” file because the underwriter must verify more documents and may request additional proof.

What affects the timeline most:

- Whether you can document 12 months of rent and 12 months of non-traditional tradelines quickly

- How complete your initial submission is (missing pages of bank statements is a common delay)

- How fast you respond to conditions (same-day responses keep timelines tight)

Rule of thumb: A clean, well-organized no-score file can move fast. A disorganized file with gaps (cash rent with no proof, missing statements, unclear deposits) slows down.

Pro tip: Bring a complete package on day one (income, assets, ID, VOR proof, and 3+ non-traditional tradelines). That’s the difference between “smooth” and “stuck.”

Manual Underwriting 101 (What to Expect)

When automated systems can’t issue an approval (because there’s no score), the file gets manually underwritten. A human underwriter reviews your income, assets, payment history, and overall risk.

What the Underwriter Looks for:

- 12 months of on-time rent (Verification of Rent, also called VOR). If you pay a landlord by check/Zelle, great. If you pay cash, be ready to document consistently—cash is hard to verify.

- 3+ non-traditional tradelines paid on time for 12 months (utilities, phone, internet, auto insurance, tuition, childcare, gym contract, etc.).

- Conservative DTI ratios (as noted above).

- Compensating factors that lower risk:

- 2+ months of reserves (money left in the bank after closing)

- Low payment shock (your new mortgage is close to your current rent)

- Stable job history and rising income

- Residual income (especially for VA)

- Minimal consumer debt and strong savings habits

If your file checks these boxes, home loans with no credit are very doable.

If You Pay Rent in Cash

Paying rent in cash is common—but it’s also the hardest to use for Verification of Rent (VOR) because there’s usually no clear paper trail. If you’re planning to apply for a mortgage with no credit score, start building rent documentation now so underwriting doesn’t stall later.

Best Move (starting next month): Switch to a Trackable Payment Method

- Pay rent by Zelle, ACH, check, money order, or cashier’s check

- Put the address in the memo (example: “March rent – 123 Main St”)

- Keep the same payment day each month if possible

If you can’t switch immediately, build a “cash rent” paper trail.

Underwriters want to see consistency and proof that the landlord actually received the money. Depending on the lender, here’s what can help:

- Written lease (or renew one) showing the rent amount and due date

- Landlord letter confirming:

- your move-in date

- monthly rent amount

- that you paid on time for the last 12 months

- landlord’s name, phone, address, and signature

- Receipts for each month (signed and dated by the landlord)

- Bank withdrawals timed to rent (same amount, near the due date)

- Example: cash withdrawal for $1,800 on the 1st–3rd of every month

- Optional support (if available):

- text/email confirmations from the landlord acknowledging receipt

- property management ledger (if they use one)

Important: Cash rent documentation rules vary by lender and program. Some lenders won’t give full credit for “cash only” VOR unless there’s a strong supporting trail.

“Start Now” Plan (Simple 60–90 Day Upgrade)

If you’re currently paying cash and want to buy soon:

Week 1

- Ask your landlord if you can pay via Zelle/ACH from now on

- If not, ask if they’ll accept money orders/cashier’s checks and sign receipts

Month 1

- Start paying with a trackable method and save proof (screenshots + bank record)

- Get a written lease (or updated lease) if you don’t already have one

Months 2–3

- Keep payments consistent (same amount, same time each month)

- Save everything in one folder: receipts, bank statements, landlord letter, and lease

If You Need to Close S12 months of statements or letters from providersooner

- Use FHA/VA/USDA options + strengthen the file with:

- 3–4 non-traditional tradelines (12-month history)

- reserves in the bank

- low payment shock documentation

Non-Traditional Credit: What Counts and How to Document It

The goal is to demonstrate at least three solid accounts that you’ve paid on time for 12 consecutive months. Good examples:

- Rent (VOR) – the most powerful non-traditional tradeline

- Electric, gas, water/sewer, trash

- Internet, cell phone, landline, cable/satellite

- Auto insurance, renter’s insurance, life insurance (monthly)

- Tuition or childcare (documented monthly payments)

- Rent-to-own accounts

- Personal loans with formal agreements and cancelled checks

Documentation That Works (Best vs Good vs Risky)

When you’re using non-traditional credit (utilities, insurance, phone, etc.), underwriting is not just looking for “a letter.” They want proof that the account exists and proof that you actually paid it on time for 12 months.

Best (Strongest / Most Lender-Friendly)

Use this whenever possible:

- 12 months of provider statements or billing history showing your name, account number, and monthly amount due

- PLUS

- Bank proof of payment (bank statements showing the matching payment each month)

Why it’s best: It shows both the billing record and the money leaving your account consistently.

Good (Often Acceptable)

Use this when statements aren’t available:

- Provider letter on letterhead confirming 12 months of on-time payments (include dates, amount, and account details)

- PLUS

- Bank proof of payment for the same 12 months

Tip: Letters should include the provider’s contact info so underwriting can verify.

Risky (May Get Rejected or Heavily Questioned)

Try to avoid relying on these as your main proof:

- Screenshots from apps without your name/account details

- Cash receipts with no bank trail

- Informal landlord/provider notes (not on letterhead)

- Payments made by someone else (no clear link to your bank account)

- Large cash deposits are used to “show” payment history (looks unsupported)

Rule of thumb: If it doesn’t show a consistent paper trail from provider → your bank → paid each month, it’s weaker.

Quick Tip: What Counts as a “Non-Traditional Tradeline”?

Aim for 3–4 accounts with 12 straight months of on-time history (rent is strongest if you have it). Utilities and insurance are usually the easiest to document.

Build a manual-underwrite friendly file

We’ll map documents and compensating factors that work without a score

The Paperwork Checklist (So You’re Not Scrambling Later)

For home loans with no credit, expect to provide more documentation upfront. Gather:

- Income: last 30 days’ pay stubs, last 2 years W-2s (or full tax returns if self-employed)

- Assets: bank statements from the past two months (entire document).

- ID: driver’s license/ID, Social Security card, or proof of legal residency as applicable

- Housing: 12 months VOR (rent) with proof of payment

- Non-traditional credit: 12 months on-time for 3+ accounts (utilities/insurance/phone/etc.)

- Letters of Explanation: brief, clear notes on anything unusual (gaps in work, address changes, etc.)

Bring all of this to the first call. A complete file speeds up the underwriting process for home loans with no credit history.

Pricing Expectations: Will Your Rate Be Higher?

Sometimes, yes. Manual-underwrite files can price a bit higher because the lender cannot rely on a strong score and automated approval. The exact impact varies depending on the lender, product, and market. You can improve pricing by:

- Adding reserves

- Lowering DTI (more down payment or paying off small debt)

- Showing rock-solid VOR and clean non-traditional credit

- Building a quick score (see the 60–90 day plan below)

Even with a small pricing bump, home loans with no credit can still be affordable—especially if the rest of your profile is strong.

60–90 Day “Fast Track” Plan to Build a Score (Optional but Helpful)

Even though you can qualify for home loans with no credit, some buyers choose to build a score quickly to widen options or improve pricing. Here’s a simple plan:

- Open 3 secured credit cards (each with $300–$500 limit).

- Set autopay for the statement balance or pay it down to under 10% of the limit before the statement cuts.

- Consider one small credit-builder installment loan (or a shared-secure loan at a credit union).

- Ask a trusted family member with a perfect payment history and low utilization to add you as an authorized user on one long-standing card (with no late payments and a balance under 10–20% is ideal).

- Avoid new lates, overdrafts, or large cash deposits with no paper trail.

- Keep balances tiny and let 2–3 statements cycle. Many people see a score populate within 60– to 90 days (sometimes sooner).

You don’t have to do this to get home loans with no credit, but it can help.

Common Pitfalls That Derail No-Score Mortgage Files

- Cash rent with no paper trail. Try to pay rent by check, ACH, or Zelle for 12 months before applying.

- Authorized user on a maxed-out card. An AU slot is helpful only if the primary card is clean and has low utilization.

- Thin file vs. no file confusion. One small medical collection and nothing else isn’t better—it can be worse. Build tradelines or document strong non-traditional credit.

- Large non-medical collections and capacity tests. Even if a payoff isn’t required, a calculated monthly “hit” can push DTI over the limit.

- Gaps in employment without explanation. Short, honest letters are fine—don’t over-explain, just state facts.

Trying conventional first with no score, then losing time. If you need to close soon, start with FHA/VA/USDA for home loans with no credit.

No Score, Pays Rent by Zelle

We have a candidate who does not possess a formal credit score but demonstrates financial reliability through their payment history. This individual has been employed steadily for 24 months, showcasing a consistent income. Additionally, they have provided a verification of rent (VOR) for the past year through Zelle, along with three timely utility payments, reflecting responsible financial behavior despite the lack of traditional credit metrics.

Given these circumstances, the FHA manual permits approval with a down payment as low as 3.5%. The applicant’s debt-to-income (DTI) ratio stands at 40/49, which is manageable within FHA guidelines. Moreover, this candidate benefits from strong financial reserves and exhibits minimal payment shock, which bolsters their case for approval, as these factors suggest they can handle the new financial responsibilities associated with homeownership.

Step-By-Step: Your Path to Approval

- Free consultation with a loan officer who does manual underwriting and home loans with no credit regularly. (Not all lenders do this well.)

- Map your program: FHA vs VA vs USDA (or plan to build a score for conventional).

- Collect documents: income, assets, ID, VOR, and three or more non-traditional lines with 12 months of on-time payments.

- Tighten DTI: reduce other payments and consider a slightly smaller purchase price if necessary.

- Strengthen compensating factors: add reserves, keep payment shock low, document stability.

- Underwriting: respond to any conditions quickly and precisely.

- Clear to close: review the final numbers, wire funds safely, and sign.

Follow these steps, and home loans with no credit stop feeling scary—they become a checklist.

Get approved even with no credit score

Learn how lenders use non-traditional credit and other factors to qualify you

Final Checklist (Print This)

- I’m applying for home loans with no credit, so I’ve lined up:

- ☐ 12 months of verified rent payments

- ☐ Three non-traditional tradelines with 12 months on-time

- ☐ Income docs: pay stubs + W-2s (or tax returns if self-employed)

- ☐ Asset docs: two months of full bank statements

- ☐ ID documents (and status docs if applicable)

- ☐ A few compensating factors: reserves, low payment shock, stable job

- Optional score-build (60–90 days):

- ☐ 3 secured cards, keep balances <10%

- ☐ Consider a small credit-builder loan

- ☐ Authorized user (only on a clean, low-utilization, long-aged card)

Stick to this list and you’ll be in great shape for home loans with no credit.

Why Work With Gustan Cho Associates?

Manual underwriting is a specialized skill. Our team does it every day, and we’re known for tackling complex files—including home loans with no credit—with clear steps, fast communication, and zero lender overlays on government and conventional loans.

- Talk to a human who knows manual underwriting.

- Get a document checklist on day one.

- Close with confidence.

Borrowers who need a five-star national mortgage company licensed in 50 states with no overlays and who are experts on home loans with no credit, call Gustan Cho Associates at 800-900-8569 or email alex@gustancho.com. We’re available evenings, weekends, and holidays—because real life doesn’t stick to banker’s hours.

Closing Thought

You don’t need a score to buy a home. With the right plan, clean non-traditional credit, and a lender that understands manual underwriting, home loans for bad credit are absolutely within reach. Let’s map your path and get you the keys.

Frequently Asked Questions About Home Loans with no Credit:

Can You Get Home Loans with no Credit Score?

Yes. Many borrowers qualify without a credit score through FHA, VA (if eligible), or USDA, provided they can document strong rent history (VOR) and non-traditional credit (utilities, insurance, phone, etc.). This often requires manual underwriting instead of automated approval.

What is “Insufficient Credit,” and is it the Same as no Credit?

“Insufficient credit” usually means the credit report can’t produce a score (or the file is too limited to support automated underwriting). It’s related to “no score,” but it can also include thin files. Lenders then verify identity/report accuracy and may use non-traditional credit to evaluate risk.

How Much Down do You Need with no Credit Score?

It depends on the program:

- FHA: commonly 3.5% down (manual underwriting can be used for no-score borrowers).

- VA/USDA: often allow 0% down if you meet eligibility rules, and manual underwriting may still be possible without a score.

- Down payment is only one piece—VOR + non-traditional credit + income stability usually matter more when there’s no score.

Can I Buy a House with no Credit Score if I have Income?

Yes—steady, documentable income helps a lot, but lenders also want proof you pay obligations on time. That’s why rent verification and non-traditional tradelines matter so much for no-score approvals.

How Long Does Manual Underwriting Take?

Manual underwriting often takes longer than automated approval because the underwriter needs additional documentation (rental history, non-traditional credit, explanations, etc.). The most common delays are missing bank statement pages, unclear deposits, and incomplete VOR documentation.

Will My Interest Rate be Higher Without a Credit Score?

Sometimes. A no-score file can be priced differently because the lender can’t rely on traditional scores or automated findings. The best ways to improve outcomes are strong reserves, low payment shock, clean VOR, and well-documented non-traditional credit, or building a score if you have time.

This article about “Home Loans With No Credit: Simple Guide to Getting Approved” was updated on March 4th, 2026.

Turn your bank history into strength

Show stable income deposits, savings patterns, and reserves for confidence

The Gustan Cho Team at Nationalwide Mortgage & Realty LLC is managed by Gustan Cho NMLS 873293. The Gustan Cho Team at Gustan Cho Associates is a premier mortgage banking corporation headquartered in Oak Brook, Illinois and licensed in multiple. Our goal at Gustan Cho Associates is to be the number one mortgage banking institution and be the Best of the very BEST under the leadership of Gustan Cho and his managers, loan officers, and support staff nationwide. Gustan Cho Associates Mortgage and Real Estate Information Center, http://www.gustancho.com is a nationally recognized mortgage and real estate informational website created and launched by Gustan Cho NMLS 873293 and his partner, Peter Bieda with a mission to provide the latest mortgage information to home buyers, homeowners, real estate investors, attorneys, real estate agents, home builders, and insurance agents. The Gustan Cho Team has loan officers and branches located nationally and all loan officers and Gustan Cho himself is available 7 days a week to answer your questions and ensure you are comfortable with the financing decisions you make.

Gustan Cho NMLS 873293

Senior Vice President

The Gustan Cho Team

Nationwide Mortgage & Realty LLC