In this blog, we will cover and discuss the agency mortgage guidelines from the U.S. Department of Veterans Affairs for qualifying for VA loans during Chapter 7 versus 13 Bankruptcy. For those who fell victim to our country’s economic collapse and lost their jobs, chances are that they are overwhelmed with debts. There are major differences in qualifying for VA loans during Chapter 7 versus Chapter 13 Bankruptcy which we will discuss throughout this article. All government and conventional mortgages have waiting period requirements after bankruptcy or foreclose on mortgage loan programs. This includes FHA 203k loans and VA construction loans.

Getting a VA Loan After Filing Bankruptcy

Yes, it is possible to get approved for a VA (Department of Veterans Affairs) loan after bankruptcy, but there are certain requirements and waiting periods you need to be aware of. The specific guidelines can vary, and it’s essential to consult with a VA-approved lender for the most accurate and up-to-date information. In this guide, we will cover some general guidelines. Many have lost high-paying jobs and compromised with lower-paying jobs with little or no benefits. In the meantime, they are struggling with making minimum payments on high-interest credit cards. Other consumers had issues paying other debts where they cannot get ahead and do not see the light at the end of the tunnel.

VA Loan After Chapter 7 Bankruptcy

For Chapter 7 bankruptcy, you may need to wait at least two years from the discharge date before you can be eligible for a VA loan. Lenders will assess your overall financial stability, including your income, employment history, and debt-to-income ratio. It’s crucial to note that these guidelines can change, and different lenders may have their own requirements. Therefore, it’s advisable to contact a VA-approved lender who can assess your specific situation and guide you through the process.

In Chapter 13? You May Still Qualify for a VA Loan

Apply Online And Get recommendations From Loan ExpertsVA Loan After Chapter 13 Bankruptcy

For Chapter 13 bankruptcy, you may be eligible for a VA loan during the repayment period if you have been making on-time payments for at least one year and have permission from the bankruptcy court to take on new debt. Even after the waiting period, you will still need to meet the VA’s credit requirements. Lenders may have their own credit score requirements as well. You must still have VA loan entitlement available. The VA loan entitlement is the portion of the loan amount that the VA guarantees. Additionally, it’s important to stay informed about any updates or changes in VA loan guidelines that may have occurred.

Filing Bankruptcy Can Give People a Fresh Financial Start in Life

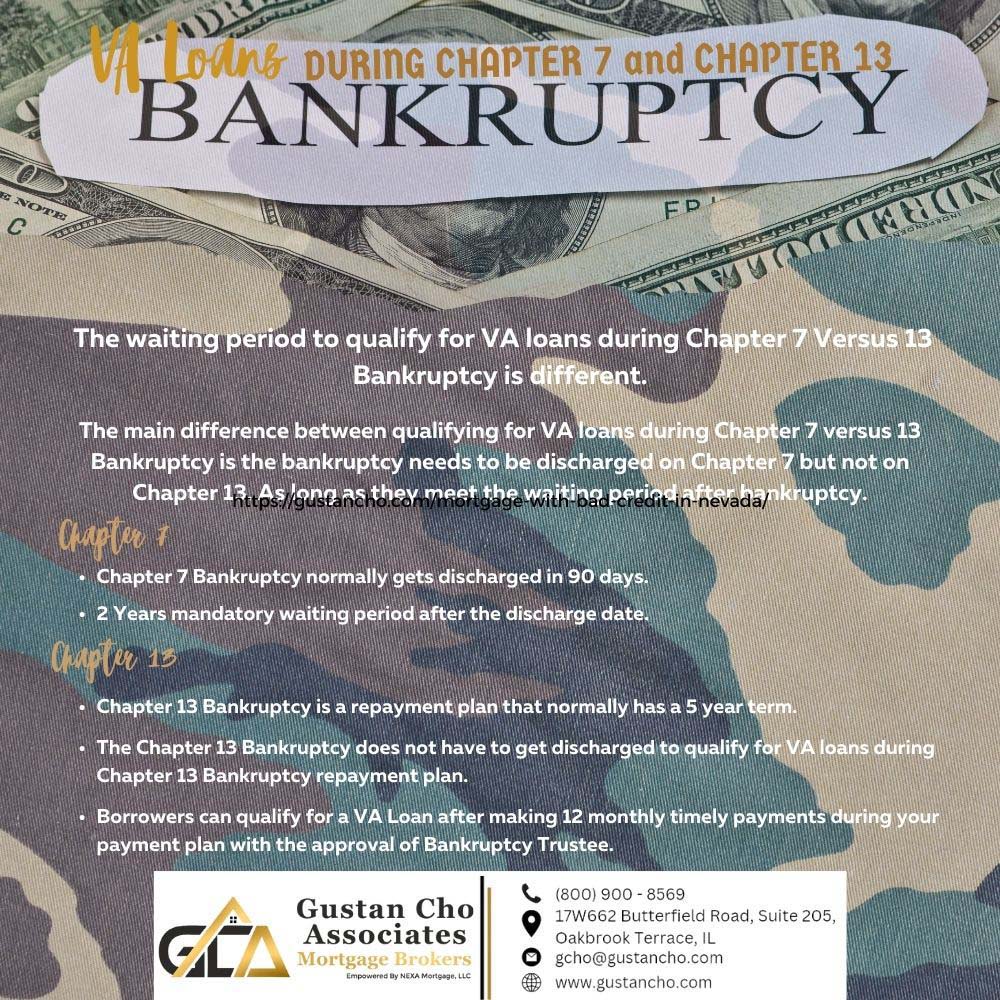

Maybe the best solution for those who cannot seem to get ahead is to consider filing Chapter 7 bankruptcy. Chapter 7 Bankruptcy can get discharged 90 days from the filing date and give people have a fresh start. Borrowers can now qualify for VA loans after Chapter 7 Bankruptcy. This holds true as long as they meet the waiting period after bankruptcy on government and conventional loans. The waiting period to qualify for VA loans during Chapter 7 Versus 13 Bankruptcy is different.

Eligibility Requirements on VA Loans During Chapter 7 Versus 13 Bankruptcy

You cannot qualify for VA loans during Chapter 7 Bankruptcy until the Chapter 7 Bankruptcy has been discharged. The main difference between qualifying for VA loans during Chapter 7 versus 13 Bankruptcy is the bankruptcy needs to be discharged on Chapter 7 but not on Chapter 13 Bankruptcy to qualify for VA loans. Chapter 7 Bankruptcy normally gets discharged in 90 days.

What Is Chapter 13 Bankruptcy?

Chapter 13 Bankruptcy is a repayment plan that normally has a 5 year term. However, you can qualify for VA loans during Chapter 13 Bankruptcy after making 12 monthly timely payments during your payment plan. The Chapter 13 Bankruptcy does not have to get discharged to qualify for VA loans during Chapter 13 Bankruptcy repayment plan. This is the main difference between qualifying for VA loans during Chapter 7 versus Chapter 13 Bankruptcy.

Qualifying For VA Loans During Chapter 7 Versus 13 Bankruptcy

The minute an individual files for Chapter 7 bankruptcy, creditors cannot make contact and demand payment on past due bills from consumers. Petitioners of bankruptcy need to make a list of all creditors that want the bankruptcy court to relieve the debts owed to creditors. Petitioners can keep the auto loan and exclude it from bankruptcy and other credit items. Once Chapter 7 bankruptcy is discharged by the bankruptcy court, all of the debts get wiped out and consumers can have a fresh financial start.

How To Reestablish Credit in Qualifying on VA Loans During Chapter 7 Versus 13 Bankruptcy

Filing bankruptcy can plummet credit scores by more than 200 plus points. However, that drop is a temporary drop. Credit scores will gradually increase as bankruptcy ages. Consumers should start re-establishing credit as soon as Chapter 7 Bankruptcy discharge.

Using Secured Credit Cards to Boost Credit

The easiest and fastest way to re-establish credit after filing bankruptcy is by getting three to five secured credit cards with at least $500 credit limits. Each one of those secured credit cards will boost credit scores by a minimum of 20 or more points. Consumer credit scores will gradually increase as time passes. There are many cases where people’s credit scores are in the 700’s after a year of bankruptcy discharge with the use of secured credit cards.

Recently Discharged from Chapter 7? See When You Can Qualify for a VA Loan

Find Out When You Can Use Your VA Loan Benefit After Chapter 7Tips In Qualifying For VA Loans During Chapter 7 Versus 13 Bankruptcy

There is a minimum of a 2 year waiting period after filing bankruptcy in order to qualify for FHA home loans after Chapter 7 bankruptcy. Just waiting out the 2 years mandatory waiting period does not guarantee a mortgage loan approval. Lenders do not want to see any late payments after Chapter 7 Bankruptcy. Lenders want to see the mortgage loan borrower has re-established credit.

Credit Score Requirements on VA Loans During Chapter 7 Versus 13 Bankruptcy

Most lenders like to see a minimum of three credit trade lines and no late payments after filing bankruptcy. Lenders also do not want to see any overdrafts in the borrower’s checking accounts in the past 12 months. Mortgage lenders want to see rental verification. It is very important that when paying monthly rent pay it with a check. Canceled checks are how lenders document rental verification.

FHA and VA Loans During Versus Chapter 7 Versus 13 Bankruptcy

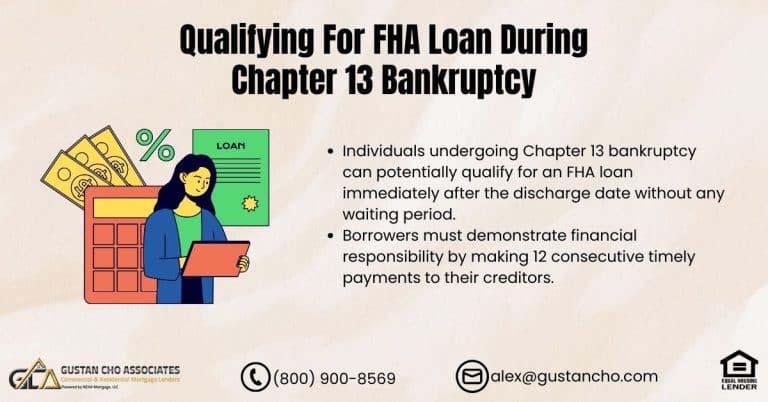

Homebuyers can qualify for VA And FHA loans during and after Chapter 13 Bankruptcy. Homebuyers can qualify for VA and FHA Loans one year into a Chapter 13 Bankruptcy Repayment Plan with the approval of their Chapter 13 Bankruptcy Trustee. Most Trustees will approve a home purchase.

Trustee Approval on VA Loans During Chapter 7 Versus 13 Bankruptcy

Out of the countless VA and FHA loans during and after Chapter 13 Bankruptcy I have originated and funded, I did not have a single Trustee not approve Borrower from a VA or FHA Loan during a Chapter 13 Bankruptcy Repayment Plan. There is no waiting period to qualify for FHA loans after a Chapter 13 Bankruptcy discharged date. However, if the Chapter 13 Bankruptcy discharge has been seasoned less than two years, it needs to be a manual underwrite. Gustan Cho Associates does manual underwriting and is a direct lender with overlays.

VA Loans During Chapter 7 Versus 13 Bankruptcy Versus Other Government Loans

Government loans are owner-occupant home loans guaranteed by FHA, USDA, VA. Here is the waiting period to qualify for government loan programs after bankruptcy. Homebuyers should have no problem qualifying for FHA loans after two years of bankruptcy discharge date with re-established credit and no late payments after bankruptcy. Veteran homebuyers can qualify for VA loans after two years of their Chapter 7 Bankruptcy discharge date.

USDA Guidelines on Bankruptcy

USDA Guidelines on qualifying for USDA loans after Chapter 7 Bankruptcy is 3 years. With FHA & VA loans, homebuyers can qualify for home loans after one year into a Chapter 13 Bankruptcy Repayment Plan with the approval of Bankruptcy Trustee. There is no waiting period to qualify for FHA and VA loans after the Chapter 13 Bankruptcy discharge date. However, if the Chapter 13 Bankruptcy discharge is seasoned less than two years after the discharge date, it needs to be a manual underwrite.

Conventional Mortgage Loan After a Bankruptcy

There is a mandatory four-year waiting period to qualify for a conventional mortgage loan after a Chapter 7 Bankruptcy discharge date.

- 2 years after the Chapter 13 discharge date

- 4 years after the Chapter 13 dismissal date

Re-established credit and no late payments after the Chapter 7 bankruptcy is normally required to get an approve/eligible per Automated Underwriting System.

Credit Score Guidelines on Conventional Loans

Fannie Mae and Freddie Mac sets mortgage guidelines for conventional loans. Fannie and Freddie sets guidelines on conventional loans not because they insure conventional loans but rather they set it on loan they will purchase.

The secondary mortgage markets will not purchase any mortgage loans that do not conform to its guidelines. This is why conventional loans are often referred to as conforming loans.

Conventional loans are not backed by a government agency like HUD, USDA, and the Veterans Affairs. A minimum credit score of 620 FICO is required on conventional loans. The four-year waiting period starts from the discharge date of the Chapter 7 bankruptcy. New Fannie Mae Guidelines for consumers who had a mortgage as part of their bankruptcy that came into effect last August 2014.

Chapter 7 vs. Chapter 13 – Which One Affects VA Loans More?

Apply Online And Talk to an Expert TodayFannie Mae Guidelines on Mortgage Included in Bankruptcy

For conventional mortgage borrowers who had a mortgage part of Chapter 7 bankruptcy, the waiting period start date starts from Chapter 7 bankruptcy discharge date and not the recorded date of the foreclosure. That is great news for mortgage loan borrowers seeking a conventional loan or those whose foreclosures got recorded at a later date. Homebuyers who had a prior Chapter 7 or Chapter 13 Bankruptcy can now qualify for Home Loans After Bankruptcy with Gustan Cho Associates. For more information or to qualify, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays.

- Related> Waiting Period After Bankruptcy And Foreclosure

- Related> Approval Prior To Waiting Period After Bankruptcy

Hi Gustan, what an informative article! Each part was very well explained and with enough details to guide you properly through the difficult times that someone declaring bankruptcy must go through. I have always thought that bankruptcy is not the end, thanks to this site, and it is good to have more information to be able to meet my financial goals. Thank you so much.

I went through bankruptcy myself. I had such a hard time prior to filing Chapter 7 bankruptcy. For example, I could not get my NMLS license in 90% of the states. After my Cha[ter 7 bankruptcy, I got licensed in 100% of all the states. I got my credit scores over 700 FICO in less than one year after my Chapter 7 bankruptcy discharged date. I got a brand new $70,000 truck with an $70,000 truck with Ally Credit Union at a 5.0% down payment. I have over 12 credit tradelines. I got a $7,000 unsecured credit card with Discover. Go to my website and scroll down to the footer and click on the link that says HOW TO REBUILD YOUR CREDIT AFTER BANKRUPTCY. You do not have to hire a credit repair company. jUST FOLLOW MY STEP BY STEP INSTRUCTIONS. I have helped thousands of people rebuild credit to qualify for mortgages and just maximize credit scores. Victoria, I want thank you for posting. Please let me and our followers know how you are doing.