FHA Loans with Child Support Payments: How to Qualify in 2025

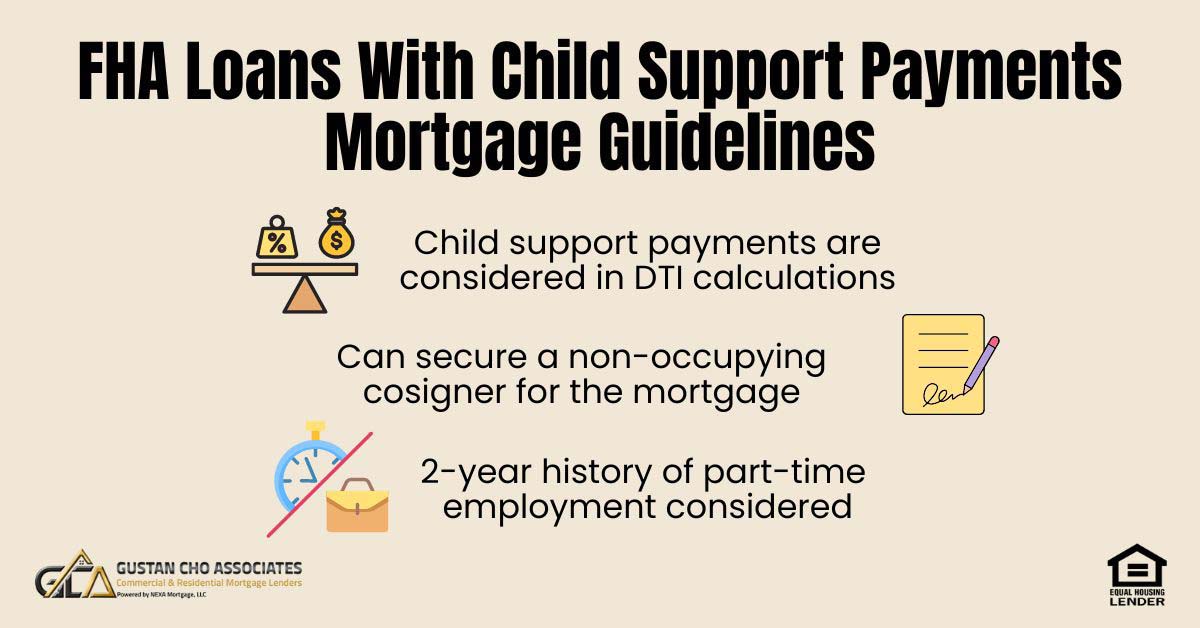

Child support payments can significantly affect your ability to qualify for an FHA loan. Whether you pay or receive child support, lenders consider it when calculating your debt-to-income ratio (DTI), which can determine your eligibility.

The good news is that FHA loans with child support payments are possible, and with the right approach, you can still achieve homeownership.

In this guide, we’ll cover everything you need to know about how child support affects FHA loans, how to qualify, and solutions if you have a high DTI or outstanding child support obligations. Let’s dive in!

Can You Get an FHA Loan If You Pay or Receive Child Support?

Yes! FHA loans with child support payments are possible, whether you are paying or receiving child support. But here’s what you need to know: child support can impact your debt-to-income ratio (DTI), which affects whether you qualify for a mortgage.

If you pay child support, lenders count it as a monthly debt, just like a car payment or credit card bill. This means it can increase your DTI and limit the loan amount you qualify for. On the other hand, receiving child support can be used as qualifying income—helping you afford a house.

Understanding how child support affects FHA loans is crucial before you apply. Let’s break it down so you can prepare for FHA loans with child support payments and get approved with Gustan Cho Associates.

Buying a Home While Paying or Receiving Child Support? Learn How to Qualify for FHA!

Apply Online And Get recommendations From Loan Experts

Does Child Support Count as Income for an FHA Loan?

Regarding FHA loans with child support payments, it’s important to know that child support can be counted as income. However, there are some guidelines from the FHA that you need to keep in mind:

- You must receive payments consistently for at least 6 months.

- Payments must continue for at least 3 more years.

- Provide proof of income using:

- A court order or divorce decree showing the payment terms.

- Bank statements or canceled checks proving regular deposits.

- Tax returns if the child support is reported as income.

Lenders want stability in your income before counting it toward your mortgage application. If the payments are irregular or unofficial, they won’t be considered.

✅ Pro tip: When looking to qualify for FHA loans with child support payments, paying close attention to how child support is handled is important. A helpful tip is to always make sure that all your child support payments are made on time. You should also keep a clear record of these payments, whether it’s through bank statements or receipts.

Can You Qualify for a Mortgage with Child Support?

Yes, you can qualify for a mortgage while paying or receiving child support. The key factor is how child support affects your debt-to-income ratio (DTI). If you receive child support, it can boost your qualifying income, making it easier to meet FHA’s DTI requirements.

When applying for FHA loans with child support payments, it’s important to understand how child support can affect your borrowing capacity. Lenders will look at what you pay in child support as part of your monthly expenses, which could reduce the amount of money they are willing to lend you.

If you find that this is limiting your options, there are a few solutions you might consider to improve your situation.

- Increasing your income: This may include taking on a part-time job, requesting a salary increase at the current position, or even launching a side hustle to generate extra funds.

- Using a non-occupying co-signer: This means someone willing to help you by signing the loan with you, even if they won’t be living in the home. A co-signer with good credit can make lenders more comfortable with the loan.

- Working with a lender that allows higher DTI ratios: Work with a lender that is known for being flexible, like Gustan Cho Associates. They understand situations like yours and may allow for higher debt-to-income (DTI) ratios, meaning they might still approve your loan even with child support payments factored in.

✅ Key takeaway: You can still qualify for FHA loans with child support payments, but proper planning is essential.

Who Is Not Eligible for an FHA Loan?

FHA loans are designed for many types of borrowers, but some individuals may not qualify, including:

❌ Borrowers with delinquent federal debt (including unpaid federal taxes or student loans in default)

❌ Individuals with insufficient income or employment history

❌ Those with recent foreclosures or bankruptcies without meeting waiting periods

❌Applicants with severe credit issues and no effort to rebuild credit

❌ Borrowers with excessive debt that exceeds FHA’s DTI limits

If you are in a situation where you might think you can’t qualify for a loan, don’t worry! Even if you fall into one of those categories, there are still ways to improve your financial situation and qualify for FHA loans with child support payments. Our dedicated team at Gustan Cho Associates knows how tough things can get, and we specialize in assisting borrowers who face challenges.

FHA Loan Approval with Child Support – See What’s Possible!

Apply For A Mortgage Loan Today!

Does Child Support Count Against Your Debt-to-Income Ratio?

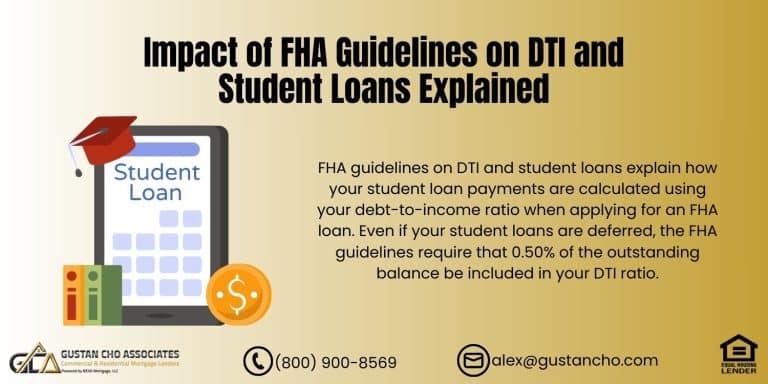

Yes, paying child support counts as a debt in your DTI calculation, just like credit card payments or auto loans.

FHA DTI Limits in 2025

According to the guidelines outlined in the HUD 4001 FHA Handbook, there are specific thresholds for both front-end and back-end debt-to-income ratios when seeking approval for a mortgage loan.

- Front-end DTI (housing expenses only): 46.9%

- Back-end DTI (all debts, including child support): 56.9%

Imagine you have a steady monthly income of $5,000. Out of that amount, you’re allocating $800 each month toward child support. In that case, that payment can impact the mortgage you qualify for. So, when looking into FHA loans with child support payments, remember that those payments are taken into account. Essentially, the more you have in monthly obligations, the less you can borrow for your home.

✅ Key takeaway: Child support payments are considered part of your financial responsibilities and can affect your debt-to-income ratio (DTI). Before applying for FHA loans with child support payments, closely examine your overall finances. It’s wise to keep track of all your income and expenses so you know where you stand and can present a strong application when the time comes.

What If You Owe Back Child Support?

FHA lenders will check public records to see if you have unpaid or delinquent child support. If you’re behind on payments, it can hurt your chances of getting approved. If you’re considering FHA loans with child support payments, be sure to get your finances in order.

💡 Solutions if you owe back child support:

- Set up a repayment plan and make at least three consecutive payments before applying for a loan.

- Pay off the past-due amount if possible.

- Work with a lender like Gustan Cho Associates, who understands FHA loan guidelines and can help you find solutions.

✅ Good news: You can still qualify for FHA loans with child support payments—as long as you show a repayment plan in place.

Case Scenario – A Dedicated Father

Bryan was committed to providing for his children through monthly child support payments. Eager to purchase a home, he was concerned that these obligations might hinder his mortgage approval.

Bryan connected with John Strange and Angie Torres at Gustan Cho Associates, seeking guidance. They meticulously assessed his financial situation, including his child support commitments, and provided clear, honest advice.

With their expertise, Bryan navigated FHA loans with child support payments smoothly, leading to the purchase of his dream home. He praised the team’s professionalism and dedication, noting that they were always available to address his concerns, even on weekends.

John’s experience shows that securing an FHA loan while managing child support payments is achievable with the right support and guidance.

Final Thoughts: Get Approved for FHA Loans with Child Support Payments

FHA loans with child support payments are possible—even if you have a high DTI.

💡 Key Takeaways:

- Child support affects your debt-to-income ratio.

- If you pay child support, it counts as a monthly debt.

- If you receive child support, you can use it as income (if properly documented).

- Owing back child support? You can still qualify if you’re on a repayment plan.

- High DTI? Use a co-signer, increase income, or work with a lender with no overlays.

🚀 Get Pre-Approved Today! At Gustan Cho Associates, we specialize in helping borrowers qualify, even with child support payments. We offer FHA loans with no lender overlays and can guide you through the process.

📞 Call us today at 800-900-8569 or email alex@gustancho.com for a free consultation!

✅ Fast approvals. No overlays. We close loans others can’t!

Frequently Asked Questions About FHA Loans with Child SUpport Payments:

Q: Can I Qualify for FHA loans with Child Support Payments if I Pay Child Support?

A: Yes! Paying child support doesn’t automatically disqualify you. Lenders consider child support payments as a form of debt. This impacts your debt-to-income ratio (DTI). If your DTI is elevated, you have a few options. You can aim to increase your income, secure a co-signer, or collaborate with a lender such as Gustan Cho Associates, known for accommodating higher DTI limits.

Q: Can I Use Child Support Income to Qualify for an FHA Loan?

A: Yes, but the payments must be consistent and expected to continue for at least three more years. You’ll need proof of payments, such as bank statements, a divorce decree, or court-ordered documentation.

Q: Does Child Support Count Against my Debt-to-Income Ratio?

A: Yes. If you pay child support, it’s considered a monthly debt obligation. It will be factored into your DTI, which can limit how much you qualify for. If your DTI is too high, you may need to explore solutions like increasing your income or getting a co-signer.

Q: Can I Still Get FHA Loans with Child Support Payments if I Owe Back Child Support?

A: Yes, but you must have a repayment plan in place. FHA lenders check public records for unpaid child support, which could impact your loan approval if you’re behind. Making at least three consecutive payments on a repayment plan can help improve your chances.

Q: How do I Prove my Child Support Income for an FHA Loan?

A: Lenders will typically require:

- Court order or divorce decree outlining the payments.

- Bank statements or canceled checks showing regular deposits.

- Tax returns if child support is reported as income.

- Consistent payment history is crucial for it to be counted as income.

Q: Can I Increase my FHA Loan Approval Amount if I Pay Child Support?

A: Yes! If your child support payments push your DTI too high, you can:

- Increase your income through a part-time job, raise, or side business.

- Use a non-occupying co-signer to help offset your DTI.

- Work with a lender that allows higher DTI ratios, like Gustan Cho Associates.

Q: Will my Child Support Payments Make it Harder to Get an FHA Loan?

A: It depends on your overall financial situation. If your child support payments push your DTI above 56.9%, you may need to explore options like increasing your income or using a lender with no overlays on DTI requirements.

Q: Can I Get FHA Loans with Child Support Payments if Payments are Inconsistent?

A: No. For child support to count as qualifying income, you must show at least six months of consistent payments, and the payments must be expected to continue for at least three more years.

Q: What Happens if my Child Support Obligation Ends Soon?

A: If your court-ordered child support will end within three years, lenders won’t count it as a debt in your DTI calculation. This could help improve your mortgage approval chances.

Q: What are the Best Lenders for FHA Loans with Child Support Payments?

A: Not all lenders treat child support the same way. Gustan Cho Associates assists borrowers with high debt-to-income ratios, those who have child support responsibilities, or those who rely on non-traditional income sources. We have no lender overlays, meaning we follow FHA guidelines without adding extra restrictions.

Don’t Let Child Support Impact Your Homeownership Dreams – Check Your FHA Eligibility!

Apply For A Loan That Fits Your Goals

This blog about “FHA Loans With Child Support Payments Mortgage Guidelines” was updated on February 6th, 2025.

I have applied for an FHA loan. I need the child support to make my DTI work. My son turns 18 during his senior year. The loan person says that since his Birthday is in August and is 16 now we can’t get 3 years. The state of TN has child support continue till he is out of high school. Does FHA allow child support to be counted if he is still in school?

If you have documentation that the child support will continue for the next three years, you are in good shape. It needs to be a court document and/or some other official paperwork that state the child will get child support past 18 years of age. We are licensed in Tennessee. We are very creative in working debt to income ratios out. If you need help, please call and/or text us at 262-716-8151 or email us at gcho@loancabin.com. Thank you.

I guess i just dont understand why its considered debt. I have been working post bankruptcy for four years to get my credit score up to 620 because i was told that was the only thing i needed for my VA loan. After four years i get it to 651 and now im being denied by the VA because my child support puts my DTI too high. Heres what i dont understand though in Illinois child support is taken out of my check before taxes and before i receive it so while it is technically a debt its not actually coming out of your earnings if if my net pay for the year is 88k my child support isnt a factor in that number because it is removed prior to even getting it. Too me it seems more like my employer is actually paying the debt and im working X ammount of hours for free to pay it back if that makes sense. I have 14 years of child support left im not waiting that long too buy a house please help there has to be away around this at 88k a year i have a hard time beliving i cant afford a 125k mortgage . Is there anything i can do. Thank you.

Absolutely. There is no debt to income ratio requirements on VA loans. We are lenders with no lender overlays so we can help you. Please call us at 262-716-81515 or text us for a faster response. Or email us at gcho@gustancho.com. Looking forward to working with you and your family.

What are the FHA guidelines for past due child support payments? One large box lender has told us that you can’t past due payments for the last 24 months. I’ve read elsewhere that it is 12 months. Can you please clarify?

As long as you have a written payment agreement and are paying it timely, you are fine. In general, there is no seasoning requirements but if you have been timely for the past 12 months, you are all set. If you need a lender with no lender overlays, please call and/or text us at 262-716-8151 or email us at gcho@gustancho.com.

At what point does child support payments no longer get factored into the debt to income ratio? If we have only two years left of paying child support, is this factored in the debt to income ratios?

Child support payment is factored in debt to income ratios until paperwork and documents show you are no longer liable.

I have a court order to pay child support, but they don’t take it out of my paycheck I personally drop the money to the office . Do I have to the lender know that I pay child support ?

Proof of payment may be required through canceled checks and/or bank statements.

How can the mortgage lender know if u pay child-support. How can they fine out ? If is not on ur paychecks oh credit ?

Child support is a public record so it will be recovered and asked. Unpaid child support will get recovered through public records when we do a national third party public records search

What stage in the loan process is that 3rd party search done? In the beginning, or end, if they never said anything, as of yet. My clients file is in underwriting process now.

Normally during the initial underwriting process.

What if I have 12 months left to pay for child support as my child be be 18 soon. What is the threshold for lenders to include this as a debt since it will be over in less than a year.

If the payment is nine payments or less, we may be able to request it be exempt from your debt to income ratio. Please reach out to us at gcho@gustancho.cho. Or call us at 262-716-8151 or text us for a faster response. What state are you in?

Im currently in a chapter 13 and need to refinance

It looks like you’ve misspelled the word “atleast” on your website. I thought you would like to know :). Silly mistakes can ruin your site’s credibility. I’ve used a tool called SpellScan.com in the past to keep mistakes off of my website.

-Robert

It has been foreclosed on but I was leasing it and now the bank wants to sell. Need a loan.

100% owner of LLC with title of 3 unit MFH in Philly; property is owned free and clear worth somewhere between 275 & 300, however I’m looking to cash-out. Currently unemployed, with indecent credit; not much liquid assets. Last year wasn’t a great year. As of this month, April, we have 2 of 3 leases; property has a positive cash flow of 525 a month.. The total income is 1625 a month & the expenses including maintenance, repairs, insurance, utilities and taxes total about 1100 a month. I’ve recently watched a lot of the great videos you provide through the forum about non-QM loans, however, I’m unsure if I am eligible for financing. Any guidance or advice would be appreciated. Thank you.

I currently own 15 acres outright with no liens. Appraisal value by the county 130,000

I am in the market to purchase a home price up to a 2.4Million. I have a 20% down payment and have a co-borrower also. Both our credit scores are 700+ but need a lender who can finance us since we did a loan modification 3 years ago. Also, our DTI is low < 10%. Let me know if you can help. I am looking for a pre-approval to start shopping.

I’m a independent contractor and would like further info on qualifying for a non QM mortgage loan.

Hello

My name is Gerri Cash, I live in Va. I have been trying for 3 yrs to refinance the home that was deeded to me when my father passed.

Due to the fact I missed a payment over 2 yrs ago and have not been able to make that payment up, I am considered late every month with every payment made. Which will not allow me to refinance. After the passing of my father I struggled very hard to get back in the swing of things. I was his caregiver round the clock 24/7 so to say it was hard is an understatement.

He was my best friend, my hero and my sound half…….until he wasn’t !!!! He was diagnosed with advanced dementia and a little over a year later he was gone.

The current mortgage is in his name but I make the payments and the home is deeded to me!!!

The home appraised at $315,000 and the mortgage balance is only $55,000. There has to been something I can do to obtain some of the equity that is in this home.

I have been reading online different articles on how to get this done and come across an article about you!! Can u help me? If I can obtain $50,000 from the equity in the home and pay if the mortgage balance that pays off all of my debt and I finally get to start fresh.

In my current situation I can’t help but think I should just sell the home and obtain all of the equity and walk away. Then I remember the promise I made my dad who had walking horses and his only wish was I take care of them and keep them on the property until they pass. I have gone with out to assure I keep that promise completely on my own!!! I can’t help but think there has to be a better way. I am sitting on so much equity and can’t access it? This money could turn my whole world that went into a tail spin into a breath of fresh air.

What if any are my options?

Hi, I am interesting to refinance my condo, I bought for cash, and second one want to refinance, my annual income for last year 130.000 with my wife, now I am unemployed, it’s possible to refinance for new apartment?