Understanding FHA 203k Rehab Loans After Bankruptcy

Securing a home loan after experiencing bankruptcy can be challenging. Still, the FHA 203k Rehab Loan provides a viable path for home buyers looking to purchase and renovate a property. This type of loan is particularly beneficial for those who have faced financial hardships but are ready to rebuild their lives and invest in a home. In this article, we will cover everything you need to know about qualifying for an FHA 203k Rehab Loan After Bankruptcy, addressing common concerns and providing updated guidelines for 2024.

What is an FHA 203k Rehab Loan?

An FHA 203k Rehab Loan combines the cost of purchasing a property with the expenses of renovating it into a single mortgage. This loan is perfect for home buyers looking to buy fixer-upper homes that require significant repairs or renovations. The FHA 203k loan covers a wide range of improvements, including:

- Kitchen and bathroom remodels

- Roof and gutter replacements

- New flooring

- HVAC system upgrades

- Basement and attic renovations

- Room additions

Transform your fixer-upper into your dream home

apply now for an FHA 203k Rehab Loan and finance renovations!

Understanding Bankruptcy: Chapter 7 vs. Chapter 13

When considering an FHA 203k Rehab Loan after bankruptcy, it’s essential to understand the types of bankruptcy most commonly filed by individuals: Chapter 7 and Chapter 13. Each type of bankruptcy holds specific implications for obtaining an FHA 203k Rehab Loan after bankruptcy.

**Chapter 7 Bankruptcy and FHA 203k Rehab Loan Eligibility**

Chapter 7 Bankruptcy, also called liquidation bankruptcy, typically facilitates the discharge of most unsecured debts, including credit card obligations and personal loans. Key aspects of Chapter 7 concerning the FHA 203k Rehab Loan after bankruptcy include:

- It eliminates most consumer debts, except for government-related obligations such as student loans, tax liens, and child support.

- Filing for Chapter 7 results in an immediate halt to wage garnishments and creditor actions.

- Individuals must wait two years from the discharge date of Chapter 7 before they are eligible for an FHA 203k Rehab Loan.

**Chapter 13 Bankruptcy and FHA 203k Rehab Loan Eligibility**

On the other hand, Chapter 13 Bankruptcy, known as reorganization bankruptcy, allows debtors to repay their debts over a set period, generally ranging from three to five years. Critical considerations for Chapter 13 in the context of obtaining an FHA 203k Rehab Loan after bankruptcy include:

- Approval for an FHA 203k Rehab Loan is possible two years after the Chapter 13 discharge date.

- Suppose the bankruptcy was discharged less than two years ago. In that case, borrowers might still be eligible for FHA loans without a waiting period, provided the loan undergoes manual underwriting.

- For Chapter 13, automated approval by the Automated Underwriting System (AUS) is needed two years post-discharge for FHA 203k loans.

It’s important to know the differences between Chapter 7 and Chapter 13 bankruptcies because they affect your ability to get an FHA 203k Rehab Loan after bankruptcy, including how long you have to wait.

Qualifying for an FHA 203k Rehab Loan After Bankruptcy

Getting approved for an FHA 203k Rehab Loan After Bankruptcy can feel like a fresh start for your dreams of owning a home. Here’s a straightforward guide to what you need to know:

Waiting Periods and Credit Requirements

After going through bankruptcy, you have to play the waiting game before you can apply for an FHA 203k Rehab Loan:

- If you’ve been through Chapter 7 bankruptcy, hang tight for two years once it’s been cleared.

- Chapter 13 also has a two-year wait if you’re going for automatic approval. But, if you prefer a manual check and it’s been less than two years since your Chapter 13 was sorted out, you might not have to wait.

Now, let’s talk credit and cash:

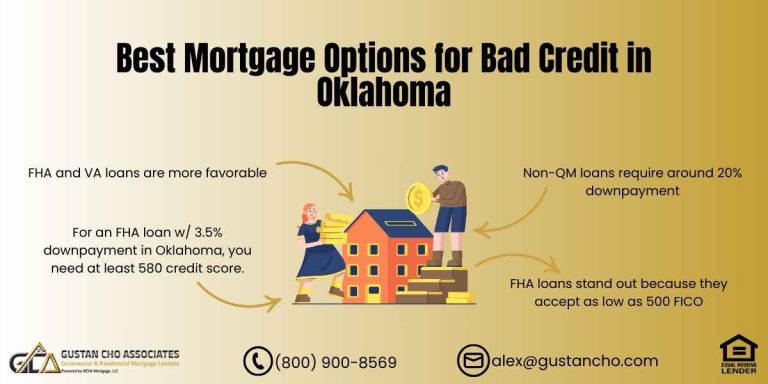

- Credit Wise: You’ll need a FICO score 580 to get your foot in the door.

- Down Payment: Be ready to put down at least 3.5% of the home’s worth after it’s fixed.

Qualifying for an FHA 203k Rehab Loan After Bankruptcy

Apply Online And Get recommendations From Loan Experts

Handling Your Debt

When considering the debt-to-income (DTI) ratio, it’s important to view it as the comparison between the amount of money you owe and the amount you earn. The FHA has some caps to keep in mind:

- If your credit score shines at 620 or more, your DTI can be up to 46.9% on the front end (this is all about your housing expenses) and 56.9% on the back end (this includes all your monthly debt payments).

- Dipped below 620? The maximum DTI allowed is 43%.

What Else You Need to Know:

- Are those nagging debts in collections or charge-offs? There is no need to clear them before applying.

- Got a family member who wants to co-sign? That’s cool, especially if they’re connected to you by law, marriage, or blood.

- The home you’re eyeing must be one you plan to live in and can have up to four units.

Using an FHA 203k Rehab Loan After Bankruptcy is a solid step toward homeownership, even if your credit history hits a rough patch. Remember these pointers, and you’ll navigate the process like a pro.

Benefits and Challenges of FHA 203k Rehab Loans

Getting back on your feet after bankruptcy can feel like a steep climb. Still, the FHA 203k Rehab Loan might be the helping hand you need when dreaming of homeownership and renovations. This unique loan weaves the cash required to buy and refurbish your future home into a single package but comes with its hurdles.

Pros

All-in-One Financing: The beauty of the FHA 203k Rehab Loan is its ability to wrap up the purchase price and the money needed for home improvements into one neat loan. This takes away the hassle of juggling multiple loans at once.

Minimal Down Payment: With just 3.5% down of the home’s future value after improvements, the FHA 203k Rehab Loan after bankruptcy appears more accessible than many expect.

Easier Credit Score Requirements: This loan is known for its flexibility with credit histories, making it a go-to choice for those who’ve faced financial struggles, like bankruptcy, in the past.

Cons:

Higher Rates: Interest rates on an FHA 203k Rehab Loan tend to be about 0.50% higher than the standard FHA loans. This can add a significant amount to your monthly payments over time.

Tougher Loan Approval: If you’ve discharged a Chapter 13 bankruptcy recently (less than two years ago), the loan demands an automated approval from the Automated Underwriting System (AUS), which can be a tricky hurdle.

Must Live in the Property: The FHA 203k Rehab Loan is strictly for those who plan to live in the property. So, if you’re considering fixing a place up to rent out or as a secondary vacation home, you will need a different loan won’t.

Overall, the FHA 203k Rehab Loan after bankruptcy could be a fantastic resource for folks looking to dive back into homeownership while also wanting to put their personal touch on their new home. However, weighing the benefits against the higher costs and stricter requirements is essential. Conversation with a financial advisor or a loan specialist can provide personalized insights and help navigate the complexities of securing an FHA 203k Rehab Loan after bankruptcy.

Steps to Apply for an FHA 203k Rehab Loan After Bankruptcy

If you’re considering an FHA 203k Rehab Loan After Bankruptcy, follow these steps to improve your chances of approval:

- Review Your Credit Report: Ensure your credit report is accurate and dispute any errors.

- Rebuild Your Credit: Concentrate on improving your credit score by making timely bill payments and cutting down on debt.

- Save for a Down Payment: Ensure you have at least 3.5% of the after-improved value for a down payment.

- Gather Documentation: Prepare necessary documents, including proof of income, employment history, and bankruptcy discharge papers.

- Consult a Lender: Contact lenders specializing in FHA 203k loans to discuss your options and get pre-approved.

Working with a Specialist

Getting through the FHA 203k Rehab Loan process can feel like a maze, especially if you’ve gone through bankruptcy before. The good thing is that seeking a pro can make a big difference. Down at Gustan Cho Associates, we’re all about guiding folks who need an FHA 203k loan after hitting a rough patch with bankruptcy.

We know the ropes and are here to walk you through every step, ensuring everything’s in line for a better shot at getting that approval.

So, here’s the deal on landing an FHA 203k Rehab Loan after bankruptcy: it’s definitely within reach when you’re armed with the right know-how and a solid plan. This article highlights key moves to boost your odds of getting your hands on this super helpful loan. If the goal is to snag a place that needs some TLC or give your current digs a facelift, the FHA 203k loan is your ticket to making that investment in your future home dreams come true.

Do you have questions, or have you hit a snag with your FHA 203k Rehab Loan application? The crew at Gustan Cho Associates has got your back. We’re here round the clock – evenings, weekends, and even holidays- ready to chat and smooth out any hiccups. Just give us a ring at 800-900-8569, text us quickly for speedy answers, or drop us an email at gcho@gustancho.com. We’re your go-to for navigating the FHA 203k Rehab Loan after bankruptcy maze, simplifying the process.

Additional Tips for Success

- Stay Organized: Organize your financial documents to help speed up the application process.

- Seek Pre-Approval: Getting pre-approved can give you a better idea of your budget and improve your bargaining power with sellers.

- Choose the Right Property: Focus on properties that need renovations within your budget and can increase in value post-repair.

- Work with Trusted Contractors: Ensure you hire reputable contractors for your renovation projects to avoid delays and additional costs.

Clarify Your Doubts With Our Loan Officers And Finalize Your Mortgage Loans

Apply Online And Get recommendations From Loan Experts

FAQs: FHA 203k Rehab Loan After Bankruptcy Mortgage Guidelines

- 1. What is an FHA 203k Rehab Loan? An FHA 203k Rehab Loan merges the purchase cost of a property with the expenses for renovating it into one convenient mortgage. It’s ideal for individuals aiming to purchase fixer-upper homes requiring substantial repairs or upgrades. This type of loan encompasses various improvements, including kitchen and bathroom remodels, roof and gutter replacements, new flooring, HVAC system upgrades, basement and attic renovations, and even room additions.

- 2. How Does Bankruptcy Affect My Ability to Get an FHA 203k Rehab Loan? If you file for bankruptcy, it may affect your ability to get a loan, but it doesn’t necessarily make it impossible. It’s important to understand the types of bankruptcy and the waiting periods required.

- 3. What Are the Waiting Periods for an FHA 203k Rehab Loan After Bankruptcy? After bankruptcy, you must wait two years to be eligible for an FHA 203k Rehab Loan for Chapter 7, and you can qualify for Chapter 13 after two years. If the Chapter 13 bankruptcy was discharged less than two years ago, you may still qualify for FHA loans but will require manual underwriting.

- 4. What Credit Score Do I Need for an FHA 203k Rehab Loan After Bankruptcy? To qualify for an FHA 203k Rehab Loan After Bankruptcy, you need a minimum credit score of 580. This rule helps you handle the mortgage payments and renovation costs.

- 5. What Down Payment is Required for an FHA 203k Rehab Loan After Bankruptcy? The FHA 203k Rehab Loan requires a minimum down payment of 3.5% of the property’s after-improved value. This means you need to put down 3.5% of what the home will be worth once all renovations are completed.

- 6. What Are the Debt-to-Income (DTI) Ratio Requirements? Understanding how much debt you can have about your income is important when applying for an FHA 203k Rehab Loan after bankruptcy. If your credit score is 620 or higher, your front-end debt-to-income ratio can be up to 46.9%, and your back-end ratio can be up to 56.9%. If your credit score is below 620, the maximum allowed ratio is 43%.

- 7. Can I Use a Co-Borrower for an FHA 203k Rehab Loan After Bankruptcy? You can use a non-occupant co-borrower to help you qualify for an FHA 203k Rehab Loan After Bankruptcy. The co-borrower must be related to you by law, marriage, or blood.

- 8. What Properties Are Eligible for an FHA 203k Rehab Loan After Bankruptcy? The FHA 203k Rehab Loan is available for owner-occupied properties only. This means you must live in the home, which can have up to four units. The loan is not available for second homes or investment properties.

- 9. Are There Any Benefits to Getting an FHA 203k Rehab Loan After Bankruptcy? Yes, there are several benefits to getting an FHA 203k Rehab Loan after bankruptcy. It offers all-in-one financing, requires a low down payment of 3.5%, and has flexible credit requirements.

- 10. What Challenges Should I Expect with an FHA 203k Rehab Loan After Bankruptcy? When considering an FHA 203k Rehab Loan after bankruptcy, expect higher interest rates, stricter underwriting, and a requirement for the property to be your primary residence.

- 11. How Can I Improve My Chances of Getting an FHA 203k Rehab Loan After Bankruptcy? To improve your chances of getting an FHA 203k Rehab Loan after bankruptcy, review your credit report, rebuild your credit, save for a down payment, gather necessary documentation, and consult a lender specializing in FHA 203k loans.

- 12. Why Should I Work with a Specialist for an FHA 203k Rehab Loan After Bankruptcy? Navigating the FHA 203k Rehab Loan process after bankruptcy can be complicated. A specialist can help you understand the requirements, prepare your application, and increase your chances of approval. At Gustan Cho Associates, we have extensive experience helping borrowers secure FHA 203k loans after bankruptcy. We are here to guide you every step of the way.

Final Thoughts

While bankruptcy can be a significant setback, it doesn’t have to prevent you from achieving your dream of homeownership. The FHA 203k Rehab Loan After Bankruptcy provides a viable solution for those ready to rebuild their credit and invest in a home. By understanding the guidelines and preparing accordingly, you can take advantage of this program and turn a distressed property into your dream home.

For more information and personalized assistance, contact Gustan Cho Associates. We are here to support you every step of the way and ensure you have the best possible experience with your FHA 203k Rehab Loan After Bankruptcy.

This blog about FHA 203k Rehab Loan After Bankruptcy Mortgage Guidelines was updated on July 22th, 2024.

I am trying to do a 203k loan for a house we want to buy. I had my bankruptcy discharged last June. I filed due to having cancer. We did not give up our current home. We are still making monthly payments on time and we have built our credit and we do not have alot of debt. Is it possible for us to do this? I am so nervous and anxious.

If you had a Chapter 7 bankruptcy, you need to wait a two year waiting period after discharged date.

HI Gustan,

I will have fulfilled my Chapter 13 by Dec31 2022. I have made consistent payments for the entire 5-year program. I have had steady employment for more than 2 years and by the time of the discharge, my goal is to have saved up 40k. My question for you is after the discharge can I apply or even qualify for the 203k loan using a manual underwrite like a read above, I’d rather not wait the 2 year period if I don’t have to. Thank you sir for any advice in the matter.

We found that our property is commercial zoned for 4 units (was doctor’s office and home) and paid the house off couple months ago. November 2021 will be 4 years since Chapter 7 bankruptcy, can we still get a 203k loan to fix up all 4 units? It will be our personal residency with 3 units for rent, generating approximately $3800 a month. Will the lenders consider the extra rental income after it’s fixed?

Yes, it will be taken into consideration.