- Arizona

- California

- Louisiana

- Texas

- Idaho

- Wisconsin

- Washington

- Nevada

- New Mexico

Fannie Mae Guidelines on Community Property States: What Is Community Property

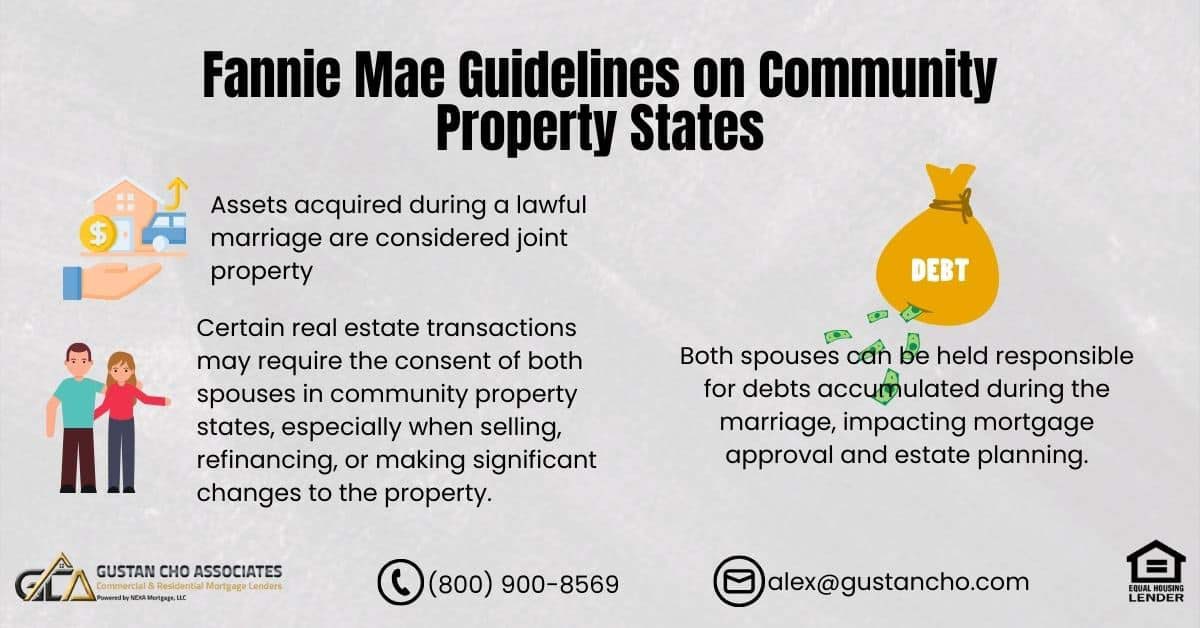

This legal concept made its way into Spanish law and subsequently influenced the financial community system in Mexico. Consequently, many community property states are concentrated in the southwestern region of the United States due to the historical and legal ties to this tradition.The essence of the Fannie Mae Guidelines on community property states underscores that assets acquired during a legal marriage are subject to joint ownership by both partners. This foundational principle draws its roots from a civil law system rooted in Roman law, with subsequent influences in Spanish and Mexican legal traditions. The prevalence of community property states, as defined by Fannie Mae guidelines, is notably concentrated in the southwestern region of the United States, reflecting the historical and legal development of this concept in the region’s financial systems.

Are you navigating mortgage options in a community property state?

Apply Now And Get recommendations From Loan ExpertsHow Homebuyers Are Affected Qualifying For Mortgage in Community Property States

Laws in Community Property States: When you purchase a house during marriage, both you and your spouse share ownership of the property equally, with a 50/50 split. While this might not present an immediate concern, it can become challenging to resolve this community property matter if the marriage ends in the future. If the house is sold, dividing the proceeds is a straightforward 50/50 split. However, complications arise when one spouse wishes to retain ownership of the property. In such cases, addressing the community property issue becomes crucial. Typically, after the finalization of the divorce, a refinance is necessary. The spouse retaining the property compensates the other spouse with the equity in the house. Naturally, specific arrangements can be negotiated case by case through the divorce courts.Community Property Laws

Community property states generally consider property acquired during the marriage to be community property owned equally by both spouses. This includes income, assets, and debts. The community property states in the United States are Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. Alaska is an opt-in community property state, where spouses can treat their property as community property.Ownership Structure in Community Property States

When purchasing a house in a community property state, it’s important to understand the ownership structure. The title may be community property, joint tenancy, or separate property.Spousal Consent

In community property states, certain real estate transactions may require both spouses’ consent. This is particularly relevant when selling, refinancing, or making significant changes to the property.Credit and Liability in Community Property States

Both partners may be responsible for debts incurred during the marriage, even if only one partner’s name is on the loan. This is especially important for mortgages. Community property laws can also affect estate planning. It’s important to understand how property is handled when one spouse dies. In some cases, the surviving spouse may automatically inherit the deceased spouse’s share of community property.Prenuptial and Postnuptial Agreements

In states such as California and Texas, assets obtained throughout the marriage are generally divided equally between the partners. This means that both individuals hold the same rights to those assets, no matter who was responsible for the purchase.If Sarah and John decide to divorce later, the house is treated as shared property. It will be divided equally, even if Sarah paid more for the down payment. However, signing a prenuptial agreement stating the house will belong only to Sarah if they divorce can help avoid arguments later on.A prenuptial or postnuptial agreement in community property states can clarify who owns what and protect each person’s interests. This can help make the divorce or estate process easier. It’s a good idea to get legal advice to make sure these agreements are clear and can be enforced.

Separate Property Declarations

Spouses can sometimes choose to keep certain property separate instead of making it community property. This helps them maintain sole ownership of specific assets. Talking to a legal expert who understands the laws in your community property state before buying property is important. They can guide you based on your situation and help you understand what owning property in a community property state means.Fannie Mae Guidelines on Community Property States Versus HUD Guidelines

In community property states, the main challenges involve the debt-to-income ratio. When people apply for a government-backed mortgage, both spouses’ debts are added together to calculate this ratio, even if both are not on the mortgage loan. Government-backed mortgages include FHA, VA, or USDA loans. A common issue occurs when one spouse has a credit score that does not meet the requirements.

See below:

Mark and Jen, a married couple in Texas, are looking to buy their next home after renting for a year. They are not first-time homebuyers, having sold their previous house last year. Mark has a credit score of 620, which allows him to qualify for either a conventional loan or an FHA loan. However, Jen has a credit score of 578, so she can only qualify for an FHA loan with a 10% down payment.

Since they have only saved 5% for a down payment, Jen cannot be included on the mortgage. Mark now faces two options: he can proceed with an FHA loan solely in his name with a 3.5% down payment but will need to include both his and Jen’s debts in his debt-to-income ratio. Alternatively, he could qualify for a conventional loan with a 5% down payment and exclude spousal debts from the overall debt-to-income ratio calculation.

In community property states, the main challenges involve the debt-to-income ratio. When people apply for a government-backed mortgage, both spouses’ debts are added together to calculate this ratio, even if both are not on the mortgage loan. Government-backed mortgages include FHA, VA, or USDA loans. A common issue occurs when one spouse has a credit score that does not meet the requirements.

See below:

Mark and Jen, a married couple in Texas, are looking to buy their next home after renting for a year. They are not first-time homebuyers, having sold their previous house last year. Mark has a credit score of 620, which allows him to qualify for either a conventional loan or an FHA loan. However, Jen has a credit score of 578, so she can only qualify for an FHA loan with a 10% down payment.

Since they have only saved 5% for a down payment, Jen cannot be included on the mortgage. Mark now faces two options: he can proceed with an FHA loan solely in his name with a 3.5% down payment but will need to include both his and Jen’s debts in his debt-to-income ratio. Alternatively, he could qualify for a conventional loan with a 5% down payment and exclude spousal debts from the overall debt-to-income ratio calculation.

Confused about how community property affects your mortgage eligibility?

Contact us today for expert guidance and personalized mortgage solutions!Benefits of Conventional Versus FHA Loans in Community Property States

Conventional loans do not require borrowers to count spousal debt against overall debt to income ratio in community property states. Conventional loans are slightly harder to qualify for than an FHA loan based on credit requirements. The loan officers of Gustan Cho Associates are top-notch. The Gustan Cho Team will be able to explain both loan programs to you. If your combined debt to income ratio is holding you back from buying a house, it is a good idea to contact us and come up with a plan to use a conventional loan!How Does Mortgage Process Work In Community Property States

How to start the process? Gather the following document:- Last 60 Days Bank Statements – to source down payment

- Driver’s License

- Last 30 Days Pay Stubs

- Last Two Years W2’S

- Last Two Years Tax Returns

Frequently Asked Questions (FAQ) – Fannie Mae Guidelines on Community Property States

Why is it important to understand Fannie Mae Guidelines on Community Property States?

Understanding these guidelines is crucial for mortgage seekers, as the nuances in regulations can significantly impact the borrowing process, especially in the nine states in the United States that follow community property laws.

Which states adhere to community property laws?

The following nine states adhere to community property laws: Arizona, California, Louisiana, Texas, Idaho, Wisconsin, Washington, Nevada, and New Mexico.

How does community property impact property ownership in marriage?

In community property states, assets acquired during a legal marriage are considered joint property shared equally by both spouses. This includes income, assets, and debts.

What challenges can arise when purchasing a house in a community property state?

The main challenge is the equal ownership of the property by both spouses (50/50 split), which can complicate matters in case of divorce. Resolving community property matters, especially when one spouse wishes to retain ownership, may require a refinance after divorce.

What types of ownership structures exist in community property states?

When purchasing a house in a community property state, the title may be community property, joint tenancy, or separate property. Understanding these structures is essential for navigating property transactions.

How are debts handled in community property states?

Both partners can be held responsible for debts accumulated during the marriage, even if only one partner’s name appears on the loan. This becomes significant when securing a mortgage, as it affects the debt-to-income ratio.

Can spouses declare certain property as separate in community property states?

Yes, spouses may declare specific property as separate rather than community property through legal means. Consultation with a legal professional familiar with the specific laws of the community property state is advised.

How do Fannie Mae Guidelines on Community Property States differ from HUD Guidelines?

The primary difference lies in the treatment of debts in the debt-to-income ratio calculation for government-backed mortgages in community property states. Both spouses’ debts are considered for loans such as FHA, VA, or USDA, regardless of whether both are listed on the mortgage loan.

What are the benefits of conventional loans versus FHA loans in community property states?

Conventional loans do not require borrowers to count spousal debt against the overall debt-to-income ratio in community property states. However, they may have slightly stricter credit requirements compared to FHA loans.

How can individuals get in touch for mortgage qualification or guidance in community property states?

For mortgage qualification or developing a plan for home qualification, individuals can contact Eric Jeanette from American Dream Home Financing via phone, email, or text. Contact details are provided in the article.

I have a 532 FICO and I am desperately trying to get out of my current living situation. I’ve seen