In this blog, we will cover going through credit repair during FHA loan process. Credit repair can do more damage than good. It is best to talk to a loan officer before you start a program for credit repair during FHA loan process. There are strict mortgage guidelines on credit disputes during the mortgage process. In many instances, credit disputes can backfire on your getting a mortgage loan approved and we will cover that topic in this guide. In the following sections of this guide, we will cover the dos and don’ts of credit repair during FHA loan process.

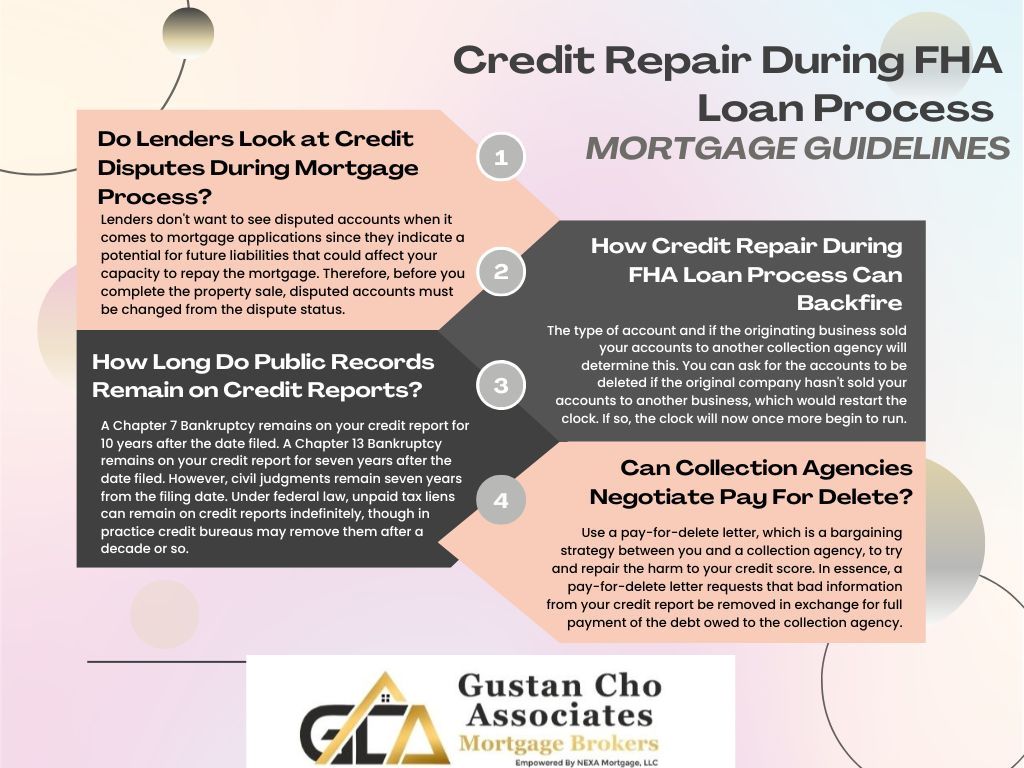

Do Lenders Look at Credit Disputes During Mortgage Process?

Many people don’t understand how this works. This article is designed to give you some basic information to help those who are ready to purchase a home, especially first-time home buyers. Credit repair is not necessary. Credit repair can often do more damage than good during the mortgage process.

Credit Repair During FHA Loan Process can often delay or disqualify borrowers. With a credit repair regimen, consumers need to realize the impact it can do if they are doing credit repair during FHA Loan Process. In this article, we will discuss and cover Credit Repair During FHA Loan Process Mortgage Guidelines.

Talk To a Loan Officer Click Here

Case Scenarios Where Credit Repair May Work To Qualify For Home Loans

There is no guarantee that credit repair companies can delete derogatory tradelines. Here are situations and case scenarios where credit repair to qualify for FHA Loan works:

Deletions of late payments:

- Late payments on credit reports are not public records

- Nobody can find out whether or not the late payment tradeline has been removed from credit reports

Collections and charge off accounts:

- Collection accounts and charge off accounts are not public records

- Nobody can find out if these items have been removed from credit reports

How Credit Repair During FHA Loan Process Can Backfire

Whenever you look at the credit report, look at the age of the delinquent accounts. Did you know that if it’s seven-year-old, you can get it removed by yourself? This depends on what type of account it is and if the original company has sold your accounts to another collection agency. If the original company hasn’t sold your accounts to another company that starts the clock running again, then you can request that the accounts be removed. If this is the case, then the clock starts ticking again.

Things To Consider Prior To Credit Repair Prior To Loan Process

Borrowers need to keep several things in mind when Credit Repair To Qualify For FHA Loan . Those who have bad credit and are thinking of Credit Repair To Qualify For FHA Loan because they want to qualify for a mortgage need to consider several important things about credit repair. Deletions of public records such as bankruptcy, foreclosures, judgments are discovered by lenders during third party public records search. Mortgage applicants cannot have credit disputes during mortgage process on non-medical collections and charge off accounts.

Is Credit Repair To Qualify For FHA Loan Recommended?

A credit repair client needs to really do research and pick an honest, reputable, reasonable credit repair company that places the client first and the results of their credit repair services before the amount of money they charge.

- There are many credit repair companies and consumers can never be too careful

- Never hire a credit repair company that guarantees that they will remove bankruptcies, foreclosures, judgments, and tax liens because there are no guarantees

Can public records be deleted?

- Maybe

Many consumers who dispute their bankruptcies, judgments, foreclosures, collections, charge offs, and tax liens can have them deleted from their credit reports:

- It is not because the credit repair company has a magic dispute letter formula but it is mainly because of errors or inaccuracies or technicalities

- Bankruptcies, judgments, tax liens, and foreclosures are public records and can easily be verified electronically and in the majority of the cases it stays on the credit report

Only a small percentage of those disputes get the items deleted from credit bureaus.

Deletions Of Public Records Off Credit Reports

Another important thing home buyers need to be aware of is that deleting bankruptcy, foreclosure, tax liens, and judgments will not help them in getting a mortgage loan. Deleting those items might help them improve their credit scores. Borrowers cannot lie on a mortgage application that they have never filed bankruptcy, had a foreclosure, has or had a tax lien, or has an unsatisfied judgment. Lenders will do a third party national public records search through Lexis Nexis, Data Verify, or other third-party vendors. As the bankruptcies, foreclosure, judgment, and tax lien ages, they will have less and less impact on credit scores as it ages. Be careful with credit repair companies that want high fees for removal of the above items. Consumers should not be asked for a large payment prior to any services. If the credit repair company suggests that they want to create a new identity with a new social security number, that is a total scam. You might also be committing a crime so stay away from them.

How Do I Check My Credit Report For Mistakes Before Applying For a Mortgage?

The first step is you need to get a copy of your credit report from all three credit bureaus which are TransUnion, Experian, and Equifax. Next, look at your collections or charge-offs.

Look at the dates reported. If the accounts are seven years, you can write a letter to each credit bureau requesting them to be removed:

Write to:

TransUnion

P.O. Box 6790

Fullerton, CA 92834

Experian

P.O. Box 9530

Allen, TX 75013

Equifax

P.O. Box 740241

Atlanta, GA 30374

Whenever consumers do credit repair, they will be disputing derogatory information. When applying for a mortgage, lenders do not allow credit disputes (there are certain exemptions) during the mortgage process. We will discuss this topic in this blog. Retracting credit disputes often drops credit scores. It is very dangerous and risky to do credit repair during the mortgage process.

How Long Do Public Records Remain on Credit Reports?

A Chapter 7 Bankruptcy remains on your credit report for 10 years after the date filed. A Chapter 13 Bankruptcy remains on your credit report for seven years after the date filed. However, civil judgments remain seven years from the filing date. Under federal law, unpaid tax liens can remain on credit reports indefinitely, though in practice credit bureaus may remove them after a decade or so.

Can Collection Agencies Negotiate Pay For Delete?

(Once paid and released, a tax lien must be removed seven years from the date it was filed.). Did you also know that if you owe for delinquent charges-off or collections, you can negotiate with the companies to take a lesser payoff than what you owe?

All you have to do is call the company and ask them if they will take a lesser pay-off than what is on your credit report. Just because you owe them a certain amount doesn’t mean that you have to pay the full amount.

How Lenders View Medical Collection Accounts on Credit Reports

Now, let’s talk about something that I have been experiencing while talking to borrowers about medical collections. After reviewing the credit report, I call the client to review it with them just to make sure the bureaus are reporting correctly and there are no errors in it.

Do Medical Collection Accounts Affect Getting Mortgage?

There have been some times when the borrower states their insurance company should have paid a medical collection that is being reported. If this is your case, call the insurance company and have the account number ready and once the information is verified, the delinquent account should be removed.

Qualifying For FHA Loans With Collection And Charge Off Accounts

HUD, the parent of FHA, does not require borrowers to pay off outstanding collections and charge off accounts. Borrowers can qualify for FHA Loans with Collections and Charge Off Accounts. Borrowers do not have to pay off outstanding unpaid collections and/or charge-offs.

Many of my borrowers go to their local bank or mortgage company to be told that they do not qualify for an FHA Loan because they have outstanding unsettled collection accounts. Borrowers are often told they do not qualify for an FHA loan until they have paid off the outstanding collection accounts by lenders.

Can You Buy a House If You Have Collection Accounts?

Having outstanding collection accounts is not a disqualifier for getting an FHA loan. If a lender tells borrowers to pay off outstanding collections and charge-off accounts, it is not HUD guidelines. Being told to remove collection accounts and charge-offs is a requirement by the individual lender.

The lender can have their own requirements which are called lender overlays. Overlays on collections and charged-off accounts are when lenders will request that the borrower still pay off outstanding collection accounts. This holds true even though FHA does not require it.

Credit Disputes During Mortgage Loan Process

Borrowers cannot have credit disputes during mortgage on non-medical credit items if the total amount of the outstanding unpaid collection items goes over $1,000 or on any charge-off accounts.

Borrowers can have credit disputes on medical collection accounts or non-medical collection accounts with zero balances. Credit repair during FHA Loan Process where the borrower has active disputes on charge-off accounts is not allowed. Credit disputes on non-medical collections with zero balance are exempt from retraction.

Can You Get a Mortgage With Disputes on Your Credit Reports?

Consumers can have credit disputes on non-medical collections that are at least 24 months old. Consumers can have credit disputes on late payments on revolving accounts as long as the outstanding balance is below $1,000.

If the outstanding balance is over $1,000 on late payment disputes, pay down the balance below $1,000 to have the credit disputes exempt. This way the late payment credit dispute does not have to be retracted.

Credit Disputes Needs To Be Retracted During Mortgage Process

The reason for credit disputes not being allowed by lenders is because of the following reasons:

- When a consumer disputes a derogatory credit item, the credit bureaus will automatically take that derogatory credit item off the credit scoring model

- Therefore, that derogatory item is not counted as a derogatory

- Consumer credit scores go up

- When retracting a credit dispute, consumer credit scores will drop

This is because the derogatory credit item is now factored back in to the credit scoring formula.

How Credit Repair To Qualify For FHA Loan Is Helpful

Credit Repair can become very helpful for borrowers who have large outstanding collection balances because of the 5% rule.

- As mentioned earlier in this article, borrowers of FHA Loans can qualify for a mortgage without having to pay off outstanding collections and/or charge off accounts

However, FHA has FHA Guidelines On Non-Medical Collection accounts.

HUD Guidelines On Collections

Here are the FHA Guidelines On Non-Medical Collection Accounts:

HUD requires that lenders take 5% of the outstanding non-medical collection account balance on collections over $2,000:

- use it as a hypothetical monthly debt when calculating debt to income ratios

The borrower does not have to pay the 5% of the outstanding collection account balance:

- but that figure is a paper figure that must be calculated as a hypothetical debt

If 5% of the outstanding non-medical collection account will disqualify Borrower, then borrowers can enter into a written payment agreement with the collection agency and/or creditor:

- whatever the figure agreed upon can be used in lieu of the 5%

Charge off accounts and medical collections are exempt from this rule:

- There is no payment seasoning requirement if the borrower enters into a written payment agreement with the creditor and/or collection agency

- If the borrower gets collection account deleted off credit report through credit repair due to errors or inaccuracies, lenders will not use the 5% in the calculation of debt to income ratios

- This holds true since there is no way of finding out