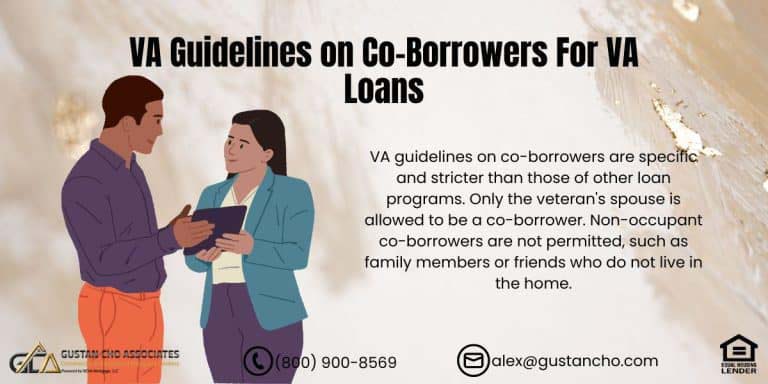

This blog will cover Fannie Mae and Freddie Mac guidelines on qualifying for a conventional loan with non-occupant co-borrower. Non-Occupant Co-Borrowers can be added to Conventional and FHA loans. The United States Department of Veteran Affairs does not allow non-occupant co-borrowers on VA home loans. Only married spouses of veteran borrowers can be added as co-borrower. USDA does not allow non-occupant co-borrowers.

When Are Co-Borrowers Needed

Homebuyers who cannot provide enough documented income cannot qualify for a mortgage loan, no matter how high their credit scores are. Borrowers can get a mortgage loan with sufficient documented income and lower credit scores. But borrowers cannot qualify for home loans with perfect credit but not enough documented income. Many home buyers who are self-employed or write off a lot of expenses on their tax returns normally have issues with providing documented income and qualifying for a mortgage.

Conventional Loan With Non-Occupant Co-Borrower Debt-To-Income Ratios

There are caps on debt-to-income ratios depending on the mortgage program. For example, conventional loan programs’ debt-to-income ratio caps are generally capped at 50%. HUD debt-to-income ratios on FHA loans are capped at 56.9% to get an approved/eligible per Automated Underwriting System Approval. USDA loan programs are capped at 41%. VA loans have no credit score requirements and no debt-to-income ratio caps.

Government and conventional loans have their own debt-to-income ratio agency guidelines. Non-prime loans debt-to-income ratio guidelines depends on the individual lender.

I have gotten AUS FINDINGS Approval on VA Loans with higher than 60% DTI. Jumbo mortgage loan programs cap the debt-to-income ratios between 40% and 45%, depending on the lender. A non-occupant co-borrower is a person who is related to the main borrower. A non-occupant co-borrower income can be used to qualify for conforming loans.

Conventional Loan With Non-Occupant Co-Borrower Versus FHA Loans

HUD, the parent of FHA, allows non-occupant co-borrowers that are related to marriage, blood, or law to be added as non-occupant co-borrowers to the main borrower buying a house or refinancing with a 3.5% down payment or 96.5% loan-to-value. HUD allows close friends who are not related to marriage, law, or blood to be non-occupant co-borrowers but the main borrower need to put 25% down payment or have 75% loan-to-value.

Fannie Mae and Freddie Mac allow borrowers to qualify for a conventional loan with non-occupant co-borrower that is not related to blood, marriage, or blood like HUD.

Conventional loan with non-occupant co-borrower guidelines allows co-borrowers unrelated by blood, marriage, or blood to be added to the main borrower. Both borrowers and co-borrowers need to meet mortgage guidelines. The middle credit score of the lower borrower/non-occupant co-borrowers is used for credit score qualification. This article will cover and discuss Fannie Mae and Freddie Mac Non-Occupant Co-Borrower Guidelines.

Buying your first home? A non-occupant co-borrower can strengthen your application

Get pre-approved today!

FHA loan programs allow non-occupant co-borrowers for homebuyers who have little or no income for income qualification so they can meet the necessary debt-to-income ratios. HUD will allow more than one non-occupant co-borrowers. The main borrower can have zero income and use non-occupant co-borrowers income. Non-occupant co-borrowers normally need to be relatives who are related by blood, marriage, or law. The following folks can qualify to be non-occupant co-borrowers:

- son

- parent

- uncle

- aunt

- grandchild

- son in law

- daughter in law

- father in law

- mother in law

- brother in law

- sister in law can all be non-occupant co-borrowers

If non-occupant co-borrowers are not related to the main borrower by blood, marriage, or law, then a 25% down payment is required.

Can I Get a Conventional Loan With Non-Occupant Co-Borrower?

Many home buyers with excellent credit but insufficient income to qualify for a mortgage loan prefer a conventional rather than an FHA loan due to the hefty pricey FHA MIP. Fannie Mae did not allow non-occupant co-borrowers, but now it does. Both Fannie Mae and Freddie Mac allow non-occupant co-borrowers. Non-Occupant Co-Borrowers do not have to be relatives related by law, marriage, or blood on conforming loans.

Freddie Mac does allow zero income by the main borrower, and the non-occupant co-borrowers income can be used. The answer to whether or not you can get a conventional loan with non-occupant co-borrower is yes with a Freddie Mac and Freddie Mac.

Both main borrower and all non-occupant co-borrowers must meet Fannie Mae and Freddie Mac’s mortgage lending guidelines about credit, income, and debt-to-income ratios. The main borrower and non-occupant co-borrower must get approved/eligible per DU or LP FINDINGS. Not all mortgage lenders are Freddie Mac-approved lenders.

Conventional Loan With Non-Occupant Co-Borrower With More Than One Co-Borrower Guidelines

There can be multiple non-occupant co-borrowers on conventional loans. Fannie Mae does not allow the main borrower with zero income and only has a non-occupant borrower’s income. The main borrower must show some qualified income and cannot have zero income. The non-occupant co-borrower will go on the mortgage note, but the non-occupant co-borrower will not go on title to the property.

Homebuyers who make cash and do not declare income or self-employed borrowers who write off a lot of expenses normally need non-occupant co-borrowers to qualify for mortgages.

Conventional home buyers or homeowners who need to qualify for a conventional loan with non-occupant co-borrower with no mortgage overlays on government or conventional loans, please get in touch with us at Gustan Cho Associates Mortgage Group at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com.

Need help qualifying for a mortgage?

A non-occupant co-borrower can boost your approval! Apply now for a conventional loan