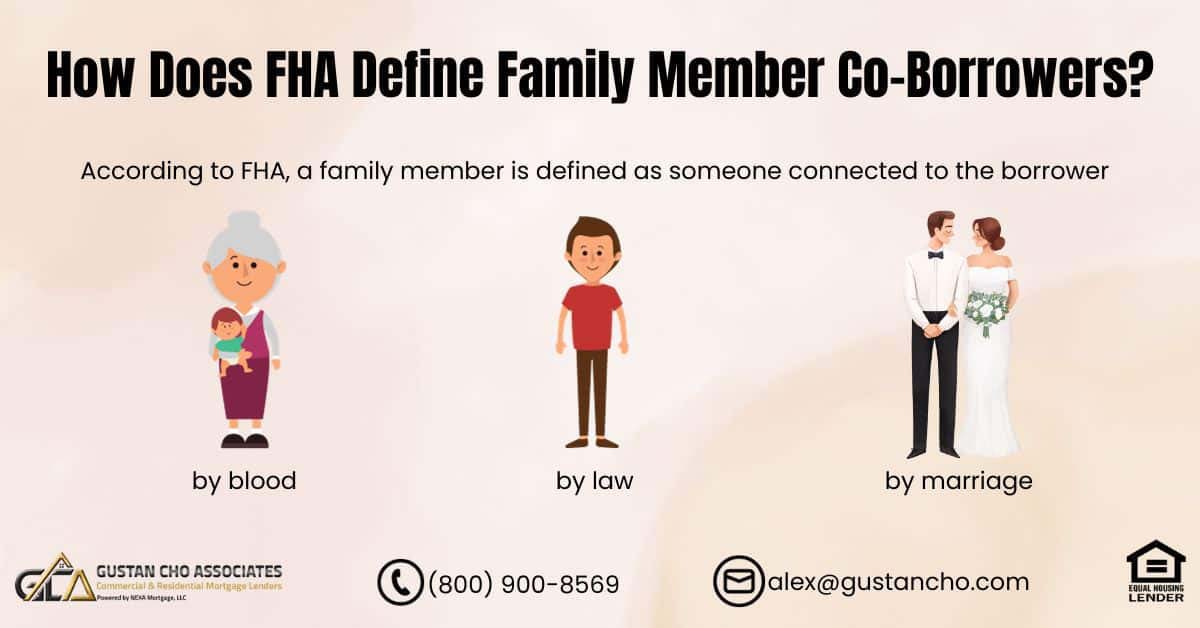

This guide covers how does FHA define family member. In this blog post, we’ll explore FHA’s criteria for defining a family member in the context of non-occupant co-borrowers. HUD, which oversees FHA, enforces guidelines that outline the definition of a family member. This definition becomes significant when considering the inclusion of non-occupant co-borrowers.

According to the HUD 4000.1 Guidelines, non-occupant co-borrowers can be added to an FHA Loan if the primary borrower is unable to qualify independently due to insufficient income, no income, or negative income. Our discussion in this blog will delve into how does FHA defines family member in the context of non-occupant co-borrowers.

How Does FHA Define Family Member For Non-Occupant Borrowers

The Federal Housing Administration (FHA) defines “family member” in its HUD 4000.1 Handbook. While the FHA’s guidelines do not explicitly detail this definition, they provide general guidance regarding using family members regarding down payment assistance and gift funds. Typically, family members eligible for co-borrowing on an FHA-insured mortgage include parents, children, and other close relatives who plan to make the home their primary residence. The following paragraphs will explore how the FHA defines family members when adding non-occupant borrowers and using gift funds.

How Many Non-Occupant Co-Borrowers Are Allowed on FHA Loans

The FHA allows you to include as many non-occupant co-borrowers as you need, but if they aren’t family members, you’ll have to make a larger down payment. If you are considering securing an FHA loan with a 3.5% down payment, ensure that your co-borrowers are relatives, as this will assist you in meeting the requirements and fully benefiting from the advantages of the FHA loan. Knowing how FHA defines family members is important for anyone looking to navigate the home-buying process with the help of non-occupant co-borrowers.

Need to Add a Family Member as a Co-Borrower for Your FHA Loan?

Contact us today to learn how you can qualify with a family member co-borrower.

HUD Gift Funds Guidelines From a Family Member

HUD allows borrowers to receive gifts from family members to help with their down payment and closing costs. Family members typically include parents, grandparents, siblings, and sometimes aunts, uncles, or cousins. Lenders may require a gift letter and documentation to verify the source of the funds and the donor’s relationship with the borrower.

> HUD> also allows non-occupying co-borrowers to help a primary borrower qualify for a mortgage. These co-borrowers are often family members willing to co-sign the loan but do not intend to live on the property.

>It’s important to note that HUD guidelines can change over time, and lending practices may vary from one lender to another. Therefore, if you’re considering an FHA loan and have specific questions about the definition of “family member” or eligibility criteria, it’s best to consult an FHA-approved lender or a housing counselor for the most up-to-date information and guidance that applies to your situation.

HUD Down Payment Guidelines on Home Purchase With Non-Occupant Co-Borrowers

In HUD Guidelines, individuals who are not legally, biologically, or maritally linked to the primary borrower but serve as non-occupant co-borrowers can still qualify. However, in cases where non-family members become co-borrowers in an FHA loan, the principal borrower is obligated to furnish a 25% down payment.

3.5% Down Payment:

- Applicable for non-occupant co-borrowers who are family members (e.g., spouses).

- The primary borrower and co-borrower must share a familial relationship.

15% Down Payment:

- General requirements for borrowers who do not meet the criteria for a lower down payment include investment properties or certain credit situations (specifics depend on lender policies).

25% Down Payment:

- Required when non-family members serve as non-occupant co-borrowers on an FHA loan.

- The primary borrower must provide this higher down payment if the co-borrower is not related to them.

Understanding the types of relationships is important when considering FHA loans. This is particularly significant since only relatives are eligible for the reduced 3.5% down payment option. Moreover, it is important to become familiar with HUD regulations, as this information is important for successfully managing FHA loan eligibility criteria.

Purpose For Adding Non-Occupant Co-Borrowers

Non-Occupant Co-Borrowers are needed if the main borrower has no income, little income, or negative income: If the main borrower cannot qualify for a mortgage loan by themselves due to a higher debt-to-income ratio and them exceeding the maximum FHA DTI Guidelines then adding non-occupant co-borrowers is the solution.

HUD Debt-To-Income Ratio Guidelines on FHA Loans

The way how does FHA define family member is the co-borrower needs to be related to the main borrower by blood, marriage, or law. HUD will allow up to 46.9% front end and 56.9% for borrowers with at least 620 FICO Credit Scores to get an AUS Approval. Maximum DTI limits for borrowers with credit scores under 620 FICO is 43% DTI to get an approve/eligible per automated underwriting system.

Any borrowers that exceed these debt-to-income ratios would need a family member and/or family members to be non-occupant co-borrowers in order for them to qualify.

Borrowers With Non-Occupant Co-Borrowers With FHA Versus Conforming Loans

Home buyers without income, those with minimal income, or individuals experiencing negative income can be eligible for an FHA home purchase mortgage loan by incorporating non-occupant co-borrowers. Nevertheless, non-occupant co-borrowers must meet credit and other FHA Guidelines, not relying solely on income qualifications. In terms of credit scores, the credit qualification will be based on the lower middle credit score among two or more borrowers.

To illustrate, consider a scenario where two non-occupant co-borrowers accompany the primary borrower:

Borrower A:

- 520 FICO TransUnion

- 620 FICO Experian

- 700 FICO Equifax

Middle Credit Score 620 FICO

Co-Borrower B:

- 600 FICO TransUnion

- 700 FICO Experian

- 800 FICO Equifax

Middle Credit Score 700 FICO

Co-Borrower C:

- 500 FICO TransUnion

- 600 FICO Experian

- 750 FICO Equifax

Middle Credit Score 600 FICO

Co-Borrower C has the lowest middle credit of 600 FICO. So the credit scores of Co-Borrower C will be used as the qualifying credit scores for this mortgage loan application.

FHA Family Member Co-Borrowers—What You Need to Know

Contact us today to learn how FHA defines a family member and how it can benefit your mortgage.

How Does FHA Define Family Member Non-Occupant Co-Borrowers

On September 14, 2015, HUD revised the FHA Guidelines, now referred to as the HUD 4000.1 Handbook. According to FHA, a family member is defined as someone connected to the borrower by blood, law, or marriage. FHA categorizes non-occupant co-borrowers related to the main borrowers as family members.

-

- children, parents, or grandparents

- a child is defined as a son, stepson, daughter, or stepdaughter

- parent or grandparent includes a step-parent/grandparent or foster parent/grandparent

- spouse Or Domestic Partner of the main borrower

- legally adopted son or daughter

- including a child who is placed with the borrower by an authorized agency for legal adoption

- Foster Child of the borrower

- brother, Stepbrother of the borrower

- sister, Stepsister of the borrower

- uncle of the borrower

- aunt of the borrower

- son-in-law of the borrower

- daughter-in-law of the borrower

- father-in-law of the borrower

- mother-in-law of the borrower

- brother-in-law of the borrower

- sister-in-law of the borrower

How Does FHA Define Family Member Versus Non-Family Member

Now we covered how does FHA define family member. Under HUD Guidelines on how FHA define family member, non-family members can be added to the loan. However, if the main borrower adds non-family members as non-occupant co-borrowers, then a 15% down payment is required versus a 3.5% down payment.

If you have any questions on how does FHA define family member or borrowers who need to qualify for FHA loans with a lender with no overlays on government or conforming loans, please contact us at Gustan Cho Associates at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

FAQ: How Does FHA Define Family Member Co-Borrowers

- What is the significance of FHA defining family members for non-occupant co-borrowers? FHA’s definition of family members is crucial when considering the inclusion of non-occupant co-borrowers in an FHA loan. These co-borrowers can be added to the loan if the primary borrower cannot qualify independently due to insufficient income, no income, or negative income. Understanding who qualifies as a family member is essential to comply with FHA policies and navigate the home purchase process.

- How many non-occupant co-borrowers are allowed on FHA loans? FHA does not impose restrictions on the number of non-occupant co-borrowers that can be considered alongside the primary borrower. However, it is important to note that a 3.5% down payment is required for FHA loans, and non-occupant co-borrowers must meet the criteria of being family members as defined by FHA guidelines.

- How does FHA define family members for non-occupant borrowers? FHA’s guidelines do not provide a specific definition of “family member.” However, family members typically include parents, children, and other close relatives who intend to live in the home as their primary residence. FHA also allows family members to be co-borrowers on the mortgage loan.

- Can family members provide gift funds for down payments and closing costs? Yes, HUD allows borrowers to receive gift funds from family members to assist with their down payment and closing costs. Family members usually include parents, grandparents, siblings, and sometimes aunts, uncles, or cousins. Lenders may require a gift letter and documentation to verify the source of the funds and the donor’s relationship with the borrower.

- What are the HUD guidelines regarding down payments when non-occupant co-borrowers are involved? HUD stipulates that non-occupant co-borrowers must have a familial relationship with the primary borrower to qualify for a 3.5% down payment FHA loan. If non-family members are added as non-occupant co-borrowers, a 15% down payment is required.

- How do non-occupant co-borrowers affect debt-to-income (DTI) ratios for FHA loans? Non-occupant co-borrowers can help primary borrowers with higher DTI ratios qualify for an FHA loan. FHA allows a maximum DTI of 46.9% front end and 56.9% for borrowers with at least a 620 FICO credit score. Borrowers with credit scores under 620 FICO have a maximum DTI of 43%.

- What happens when multiple non-occupant co-borrowers have different credit scores? In cases where multiple non-occupant co-borrowers are involved, the credit qualification will be based on the lower middle credit score among the co-borrowers. This means the borrower with the lowest middle credit score determines the qualifying credit score for the mortgage loan.

- Where can I get the most up-to-date information on HUD guidelines and FHA loan eligibility? HUD guidelines can change over time, and lending practices may vary among lenders. For the latest information and guidance on FHA loan eligibility, it’s advisable to consult with an FHA-approved lender or a housing counselor who can provide information specific to your situation.

This blog on “How Does FHA Define Family Member Co-Borrowers” was updated on April 21st, 2025.

Add a Family Member as a Co-Borrower and Improve Your FHA Loan Chances

Contact us today to understand how this can help you qualify for a mortgage.