Easy Online Mortgage Pre Approval Letter For Home Buyers

This Article Is About The Easy Online Mortgage Pre Approval Letter For Home Buyers The mortgage industry has changed drastically…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This Article Is About The Easy Online Mortgage Pre Approval Letter For Home Buyers The mortgage industry has changed drastically…

This Article Is About A Pre-Approval Versus Loan Commitment During Mortgage Process Many first-time home buyers often ask What Is…

This Article Is About Accelerated Buyer Mortgage Program Pre-Approvals The Accelerated Buyer Mortgage Program is a special mortgage loan program…

This Breaking News Article Is About 10-Year Treasury Yield Surges To A 12-Month High Rising Rates The 10-Year Treasury Yield…

The Gustan Cho Associates are experts in down payment assistance (DPA) programs. We are proud to offer Colorado Housing and Finance Authority ( CHFA) down payment assistance programs. In this blog we will detail the advantages and disadvantages of using down payment assistance as well as how to apply for a mortgage with a Gustan Cho Associates when receiving Colorado down payment assistance.

This ARTICLE Is About COVID-19 Mortgage Guidelines Changes On Home Loans COVID-19 Mortgage Guidelines Changes have created stress for borrowers…

This Article Is About Non-QM Mortgages Versus Government And Government Mortgages If you are in the market for a mortgage…

This Article Is About Homeowners Who Bailed On Mortgage During Mortgage Collapse Residential home sales have been steadily increased and…

This Article Is About Mortgage Guidelines On Down Payment With the exception of VA and USDA loans, most mortgage loan…

This Article On Mistakes When Refinancing Mortgage To Be Avoided By Homeowners Avoiding These 5 Mistakes When Refinancing Home Loan…

This Breaking News Article Is About Illinois Passes Three New Laws For 2021 Due To COVID-19 Pandemic Illinois was the…

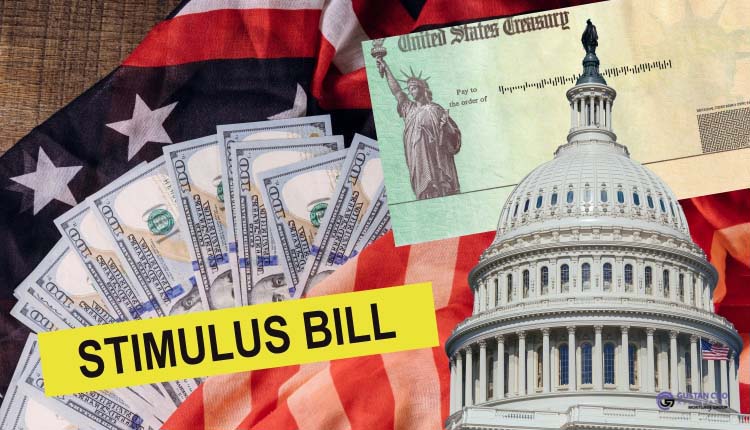

In this article, we will discuss and cover the coronavirus stimulus bill passed by the House. The House passed the…

This BREAKING NEWS ARTICLE Is About How The Coronavirus Outbreak Devastate Chicago Housing Market The COVID-19 Pandemic has affected Chicago…

This BREAKING NEWS ARTICLE Is About Illinois Mass Exodus Due To Jobs, Housing, Tax Policy Economic recovery from the coronavirus…

This Article Is About Using Second Home As A Rental And Vacation Home Using Second Home As A Rental and…

BREAKING NEWS: Illinois Leads Nation With Highest Unemployment Numbers More bad news with the Illinois economy. Illinois Leads Nation With…

This Article Is On Discouraged Mortgage Loan Borrowers Due To Lender Overlays There are many mortgage loan programs available today…

BREAKING NEWS: FHFA Increases 2021 Conforming Loan Limit To $548,250 And High-Balance Ceiling To $822,375 As expected, the FHFA Increases…

This Article Is About What Do Underwriters Look On Credit Report Besides Credit Scores Credit scores is the biggest factor…

BREAKING NEWS: How Presidential Election Uncertainty Affects The Housing Market How Presidential Election Uncertainty Affects The Housing Market: As of…

This Article Is About Tax Cut And Jobs Act And How It Affects Mortgage Guidelines Well, we all survived the…

This Article Is About Chris LaRocco Endeavor America Wholesale Lender I like to introduce my fellow mortgage brokers to Chris…