What Is the Best Mortgage Loan for Buying a House?

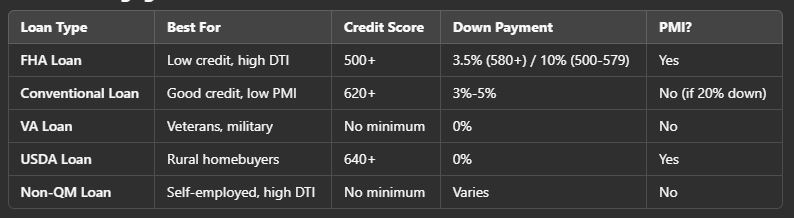

If you plan to buy a house, you probably wonder: What’s the best mortgage loan for me? With so many options, it can feel overwhelming. The good news? The right mortgage loan depends on your credit score, income, down payment, and financial goals.

In this guide, we’ll break down the best mortgage loan for buying a house—covering FHA, Conventional, VA, USDA, and non-QM loans. By the end, you’ll know exactly which loan is right for you and how to start with Gustan Cho Associates.

How Much Money Do I Need to Buy a House?

The cost of buying a home goes beyond just the down payment. You should include closing costs, property taxes, and moving expenses in your budget. As a first-time home buyer, we strongly encourage you to take a homebuyer education course offered by Fannie Mae. But here’s what to expect:

Down payment:

FHA Loan

Here’s what you should know if you’re considering getting an FHA Loan. If you have a 580 credit score or higher, you only need to pay 3.5% of the home’s price. That’s great for first-time buyers who might not have a lot saved up. But if your credit score is 579 below, you’ll need to make a bigger down payment of 10%. This option can help you if you’re looking for the best mortgage loan for buying a house.

Conventional Loan

For those looking at Conventional Loans, first-time homebuyers can get away with a 3% down payment, making things easier if you’re trying to buy your first house. Standard buyers usually have a slightly higher requirement, needing 5%.

VA Loan

Veterans have some great options, too! With a VA Loan, eligible veterans can buy a home with no money down, which can really open up the door for many who have served.

USDA Loan

Lastly, if you’re eyeing a home in a rural area, the USDA Loan can be a fantastic choice as well. This loan also requires no down payment, but you do need to meet certain income limits and live in a qualifying location.

When exploring the best mortgage loan for buying a house, consider how much you can afford to put down. Each type of loan has its perks, and understanding these requirements can help you make the right decision for your home purchase!

Closing Costs

These costs usually range from 2% to 5% of the price of the home you’re looking to purchase, but this can vary depending on the state where the house is located.

For example, if you’re buying a home for $300,000, you might have to pay anywhere from $6,000 to $15,000 in closing costs. These costs include loan fees, appraisal fees, and title insurance. Budgeting for these expenses is a good idea so you’re not caught off guard when it’s time to finalize the deal.

Finding the best mortgage loan for buying a house can also help you better manage these costs. Some lenders may offer programs that help reduce closing costs or guide you through what to expect, making the home-buying process smoother.

Reserves & Moving Expenses

When looking for the best mortgage loan for buying a house, it’s important to remember that some lenders have specific requirements. For example, they may ask you to have 2-3 months’ worth of mortgage payments set aside in reserves. This means you’ll need to show you can cover your payments for a few months, even if something unexpected happens. It’s always a good idea to check with different lenders to see what they require, as it can vary from one to another.

Pro tip: If you’re short on cash, down payment assistance programs and seller credits can help!

Worried About Credit or Down Payment? See What First-Time Buyer Programs Are Available

Apply Online And Get recommendations From Loan Experts

Best Mortgage Loan for Buying a House as a First-Time Homebuyer

FHA and Conventional loans rank among the top choices for individuals buying their first home. If you’re wondering about the best mortgage loan for buying a house, these two options frequently come up.

FHA Loans

Best for low credit scores and small down payments

- 3.5% down payment (580+ credit score)

- Flexible credit guidelines (can qualify with late payments & collections)

- Allows gifted funds for down payment & closing costs

- Higher DTI ratios allowed (up to 56.9%)

Conventional Loans

Conventional loans are a great option for people with good credit. If you have a good credit score, this loan might be the best mortgage loan for buying a house.

- 3% down payment for first-time buyers

- No upfront mortgage insurance (PMI drops at 80% LTV)

- Best rates for 740+ credit scores

Not sure which loan is right for you? Get pre-approved with Gustan Cho Associates to explore your options.

Is a Conventional Loan Better Than FHA?

Choose FHA if:

If you’re considering an FHA loan, it may be a suitable option if your credit score is under 680, you have a high debt-to-income ratio (DTI), or you are looking for a lower down payment. This type of loan is designed to accommodate borrowers who may face challenges in meeting the more stringent requirements of conventional loans.

Choose Conventional if:

If you’re trying to find the best mortgage loan for buying a house, consider choosing a conventional loan if your credit is good to excellent, with a score of at least 680, and if you wish to bypass lifetime mortgage insurance. If you plan to make a 20% down payment or more, you can avoid paying private mortgage insurance (PMI) altogether. Additionally, PMI can drop once you reach an 80% loan-to-value (LTV) ratio, making this choice even more appealing for those who meet these criteria.

Still deciding? A loan officer at Gustan Cho Associates can help compare your options.

Having Prior Mortgage Included in Chapter 7 Bankruptcy

Conventional Home Loans are generally for better credit and income profile borrowers. However, there are cases where borrowers will not qualify for FHA loans but will qualify for Conventional loans. When a prior homeowner had a mortgage part of Chapter 7 Bankruptcy, the Difference Between Conventional Versus FHA Loans is the waiting period.

On Conventional Guidelines On Mortgage Part Of Bankruptcy, there is a four-year waiting period from the discharged date of Chapter 7 if there was a mortgage part of Chapter 7. Cannot reaffirm the mortgage. The housing event needs to have been finalized.

There is no waiting period on housing events, whether it was a foreclosure, deed in lieu, or short sale, but needs to have been completed. With FHA Loans, the waiting period is three years from the date of the finalized housing event (foreclosure, deed in lieu, short sale). Even though the mortgage was included in Chapter 7, the waiting period start date is the recorded date of the foreclosure, deed in lieu, or the short sale date.

Best Mortgage Loan for Buying a House with Bad Credit

If you’re looking for the best mortgage loan for buying a house but have bad credit, don’t worry—there are still good options out there for you.

FHA Loans:

- 500-579 credit score: Requires 10% down

- 580+ credit score: Only 3.5% down required

- No credit score? FHA allows alternative credit (rental history, utility bills)

Non-QM Loans:

- No strict credit score requirements

- Great for self-employed, recent bankruptcies, or high DTI borrowers

- Programs like bank statement loans (for business owners)

Need help qualifying? Credit repair and debt reduction strategies can improve your score fast!

Best Mortgage Loan for Buying a House with No Down Payment

When looking for the best mortgage loan for buying a house, you’ll find that two options let you buy without needing to save up for a down payment: VA loans and USDA loans.

VA Loans:

- 0% down for eligible veterans, active duty, and surviving spouses

- No mortgage insurance required

- Flexible credit guidelines

USDA Loans:

- 0% down for rural area homebuyers

- Income limits apply (household income must meet USDA limits)

Not sure if you qualify? Check your VA or USDA eligibility with Gustan Cho Associates.

Best Mortgage Loan for High DTI Borrowers

If your debt-to-income ratio (DTI) is high, several options exist. One of the best choices is an FHA loan, which allows for a maximum DTI of up to 56.9% and offers more flexibility than conventional loans. Additionally, non-QM loans can be a great fit, as they do not have strict DTI requirements. This is particularly beneficial for high-income borrowers who may have significant tax deductions.

Pro tip: Lower your DTI by paying down debt or adding a co-signer.

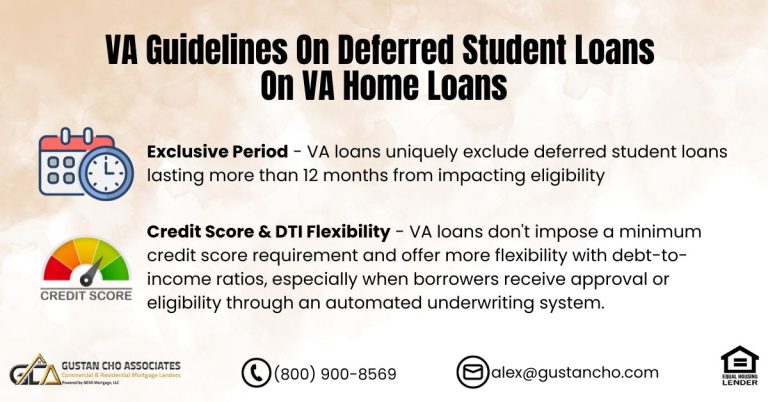

Best Mortgage Loan for Buying a House with Student Loans

If you have student loans, here’s how lenders calculate your monthly payment:

FHA Loans: FHA loans might be a great option if you’re looking for the best mortgage loan for buying a house. They’ve recently made it easier by allowing certain repayment plans, like Income-Based Repayment (IBR), to be counted when figuring out your debt-to-income ratio. This means you may have a better chance of getting approved, even if your payments are tied to your income.

Conventional Loans: When seeking a conventional loan, lenders will consider your monthly income-driven repayment (IBR) payments if they are reflected on your credit report. This means that even if you’re paying less now because of IBR, it counts when they’re figuring out how much you can borrow. It’s important to know that these payments count when calculating your debt-to-income ratio.

Non-QM Loans: When looking for the best mortgage loan for buying a house, one thing you might find interesting is non-QM loans. These loans can be a good choice because they sometimes allow you to overlook certain debts, like student loans, in specific situations.

Call a loan officer at Gustan Cho Associates to see which loan works best for you!

Best Mortgage Loan For Buying a Multi-Family Property With Little Money Down

Multi-unit properties:

- For buyers purchasing a 2-unit to a 4-unit residential multi-family unit, conventional mortgage loans require a 15% down payment

- However, FHA only allows a 3.5% down payment on 2 to 4-unit multi-family residential properties

- This holds true as long as one of the units is the owner-occupant unit

Which Mortgage Loan Is Best for You?

Get Pre-Approved Today!

Selecting the best mortgage loan for buying a house doesn’t need to be overwhelming. Regardless of whether you are a first-time homebuyer, a self-employed individual, or a veteran, Gustan Cho Associates is here to assist you in discovering the perfect loan option.

📞 Call or text us at 800-900-8569

📧 Email us at gcho@gustancho.com

💻 Apply online at GustanCho.com

Start your homeownership journey today with a lender that approves loans that others won’t!

First-Time Buyer? Learn About FHA, Conventional & No Money Down Loan Options

Apply Online And Get recommendations From Loan Experts

Frequently Asked Questions About the Best Mortgage Loan for Buying a House:

Q: What is the Best Mortgage Loan for Buying a House?

A: The best mortgage loan for buying a house varies based on your credit score, earnings, and the amount of your down payment. FHA loans are great for low credit scores, Conventional loans work well for good credit, VA loans are perfect for veterans, and USDA loans are great for rural homebuyers.

Q: Can I Buy a House with no Down Payment?

A: Yes! VA loans (for veterans) and USDA loans (for rural areas) allow you to buy a home with a 0% down payment. If you aren’t eligible for these, FHA loans need a 3.5% down payment for those with a credit score of 580 or higher.

Q: What Credit Score do I Need to Get the Best Mortgage Loan for Buying a House?

A: These are the credit score requirements:

- 500-579: FHA loan (10% down)

- 580+: FHA loan (3.5% down)

- 620+: Conventional loan (3-5% down)

- 640+: USDA loan

- No minimum: VA loan (lenders set their own requirements)

Q: Which Mortgage Loan has the Lowest Interest Rates?

A: VA and Conventional loans usually offer the lowest rates, but FHA loans also have competitive rates. Your rate depends on your credit score, loan type, and market conditions.

Q: What is the Best Mortgage Loan for Buying a House with Bad Credit?

A: FHA loans are a great choice for people with low credit scores. You are eligible if your credit score is 500, but you must put down 10%. If your score is 580 or higher, you can qualify with just a 3.5% down payment. Non-QM loans also help borrowers with recent bankruptcies, self-employment, or high debt-to-income ratios.

Q: How Much are Closing Costs When Buying a Home?

A: Closing costs typically range from 2% to 5% of the home price. For example, buying a $300,000 home might pay $6,000 to $15,000 in closing costs. Some lenders offer credits or assistance to help reduce this cost.

Q: Is it Possible for me to Obtain a Mortgage if I have Student Debt?

A: Yes! FHA and Conventional loans now allow Income-Based Repayment (IBR) plans to be used in debt calculations, making qualifying easier. In some cases, non-QM loans may also exclude student loan payments.

Q: What is the Best Mortgage Loan for Buying a House as a First-Time Homebuyer?

A: The best mortgage loans for first-time buyers are:

- FHA Loan: 3.5% down, low credit scores allowed

- Conventional Loan: 3% down for first-time buyers

- VA Loan: 0% down for veterans

- USDA Loan: 0% down for rural buyers

Q: How Can I Lower My Monthly Mortgage Payments?

A: These tips will help you get a lower monthly mortgage payment:

- Try to improve your credit rating to be eligible for lower interest rates.

- Make a larger down payment to reduce your loan balance

- Choose a longer loan term (30 years vs. 15 years)

- Refinance later if interest rates drop

Q: How do I Get Pre-Approved for the Best Mortgage Loan for Buying a House?

A: Getting pre-approved is easy! Gustan Cho Associates can help you find the best mortgage loan. Call 800-900-8569, email gcho@gustancho.com, or apply online at GustanCho.com today!

This blog about “What Is The Best Mortgage Loan For Buying a House” was updated on February 10th, 2025.

Not Sure Where to Start? Get Expert Guidance for First-Time Homebuyers

Apply Online And Get recommendations From Loan Experts